Summary:

- American Airlines guidance was a boost, but missed analyst expectations.

- I would argue that expectations were too high and it’s not so much that American Airlines did not perform badly.

- Longer-term concerns are boiling up, bringing American Airlines and other airline stocks down.

Jetlinerimages

American Airlines (NASDAQ:AAL) stock tumbled more than 9% after issuing preliminary results that disappointed analysts and investors. While the guidance is better than the guidance that American Airlines issued, the stock is still tanking. In this report, I will be looking at what I believe are the reason for this sharp downturn in the stock price.

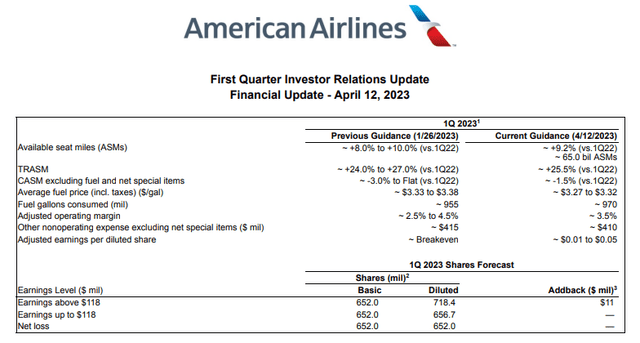

American Airlines Boosts Earnings Forecast

Looking at the guidance itself, there seems to be little justification for the sharply lower stock prices. At 9.2% year-over-year, the capacity expansion falls almost at the midpoint of the range and the same actually holds TRASM (Total Revenue Per Available Seat-Mile). Suggesting that on the top line, American Airlines should be doing as planned. Unit costs excluding fuel also are at the midpoint of the guided range from flat to 3% lower with a 1.5% decline expected. So, far we haven’t seen anything bad in the guidance and really we’re not going to see anything bad if you go further into the guidance line by line. Unit fuel prices have been shifted down around five cents per gallon which will improve the margins. The consumption during the quarter came in 1.6% higher than expected which really also is not a dealbreaker, in my view. In fact, some of it could possibly be attributed to flying more than the mid-point guided capacity.

Overall, adjusted operating margin will come in at roughly 3.5% compared to a range of 2.5% to 3.5% guided for while adjusted earnings per share have been increased from break-even to $0.01 to $0.05. That’s really where things might have disappointed investors. Adjusted margins will be at the mid point, whereas the market likely was waiting for an indication that margins would be somewhat stronger.

Why Is American Airlines Stock Down?

To be fair if you would ask me that and just give me the updated guidance, I would see no reason for the market to react the way it did as lower fuel prices are providing some very small profits. I think that we should also view things in the bigger picture. I think there are two reasons specifically to American Airlines that might have caused some worries among investors. The first worry might be that the boosted guidance only came from lower fuel prices and actually nothing else and that might make investors wonder how lean the cost structure of American Airlines really is for sustained profits that are not a function of fuel prices. Furthermore, it also makes one wonder how American Airlines will cope if demand will not remain as robust. Most likely fuel prices will fall in that case but will that be enough to run a profitable business? A quick glimpse on the Q1 preliminary results would suggest that is not the case.

In the comparable pre-pandemic quarter, operating margin was 3.9% so the 3.5% for Q1 2023 might not be satisfactory with 97% of the capacity recovered. It really makes one wonder whether this is the best that American Airlines can do. The margin of around 3.5% does not compare favorably to the 4% to 6% margin that Delta Air Lines expects. I think in some way, investors might have maybe had too high expectations from American Airlines. That does not discount the fact that, United Airlines (UAL) earlier this year had to drop its adjusted pre-tax margin expectations from 3% to a two to three percent loss margin.

Maybe that really boils back to the robustness in pricing and the old-school capacity pile up that airlines did years ago at the expense of strength in unit prices. United Airlines boosted its capacity guidance, but units revenues came down. It can be seen as an indicator that prices will not hold if much more capacity is added which means that if American Airlines adds capacity it could see start seeing unit revenue pressure as well and similarly if the competition does it they will face pressure as well. So, American Airlines seems to be trapped in the case unit revenue weakens.

So the concern is really more oriented toward Q2 and beyond. Bank of America said that since mid-March bookings have softened and year-over-year numbers could actually decline. Ideally, you would like to see strong booking trends but one should also keep in mind that last year Q1 was still impacted by the pandemic and from Q2 onwards we saw stronger bookings making it more difficult to achieve year-over-year growth in booking numbers. I wouldn’t say the market is saturated but we are still dealing with elevated inflation that pushes discretionary income down.

What’s also not helping are views from comment that shift the position of premium travel classes from a growth opportunity to protection mechanism for financial results in case air fares do soften. That might be an accurate view, but it basically takes one growth driver from airlines as recovery in the premium travel classes are now seen as a padding for airfare softening in economy. It leaves airline relying on international travel for growth.

What might also not have helped stock prices is the fact that CPI data was published today. The market already was a bit nervous and with some concerns on longer-term robustness in booking trends, it really created an easy justification to dump American Airlines stock.

One thing that I have not addressed yet is what the market was hoping to see. For the quarter, the consensus was $0.04 per share which means that American Airlines would need to exceed its mid-point of the guidance. However, I also want to address one thing about consensus numbers and that’s that sometimes it’s not the performance that is off but the consensus. If you take Delta as a pinnacle of performance, the consensus would suggest that American Airlines should be performing almost as well which I don’t think is a realistic expectation if you consider that Delta Air Lines did not get to where they are now overnight. Looking deeper into the consensus, we have 16 analysts coming up with their EPS estimate and the low was a 14 cents loss and the high was an 18 cents profit per share. Those estimates are not really realistic in my view and then you could really wonder what kind of analyst estimates go into the consensus and skew the numbers unrealistically. So, investors should not just look at consensus numbers but also look at what the consensus is composed of if possible. The earning whisper is 3 cents per share, which I think is somewhat more fitting and also fits in the midpoint of the guided range.

Is American Airlines Stock A Buy Or Sell?

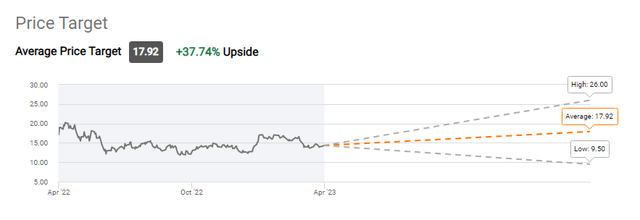

The current rating for American Airlines stock is a hold with a $17.92 price target representing 37.7% upside from current price levels. I had a buy rating on the stock, but think that if we view the uncertainty ahead, a hold might be more appropriate.

Conclusion: Risk Ahead For Airline Stocks

I think if you look at the updated guidance, you won’t easily find anything that justifies a 9% drop or at least not in the guidance. I think the more concerning element to investors is that we saw United Airlines basically throwing in capacity at the expense of unit revenue growth and bookings trends are strong but there are uncertainties ahead while Delta seemed to imply that premium recovery can absorb price weaknesses depriving airlines from one growth driver for earnings and if that is the case then you can really wonder how strong margins will be this year. Perhaps publishing a guidance today on a day with macroeconomic data was also not the best thing to do for stability of the stock.

What needs to be said is that Q1 is the weaker quarter of the year, but the question remains whether that’s enough for airlines. If they will continue with the old pre-pandemic habit of throwing in capacity in excess of demand just to get a bigger piece of the pie regardless of the price that will be paid for that then it’s going to be a tough situation for airlines with higher labor costs locked in.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.