Summary:

- American Airlines pre-announced very strong Q4’22 results.

- The legacy airline forecasts earning an amazing $1.15 profit in the December quarter.

- The stock only trades at 5x normalized EPS targets that might be low based on these numbers.

OntheRunPhoto

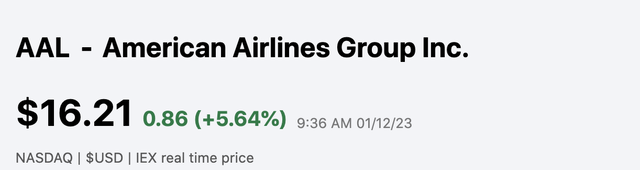

In no huge surprise to people following the research here, American Airlines Group (NASDAQ:AAL) pre-announced a strong quarter as the earnings season starts to ramp up. The airline remains priced for the next Covid shutdown while profits are booming. My investment thesis remains ultra Bullish on the airline stock due to the vast disconnect with the stock price and the current EPS in just Q4 alone.

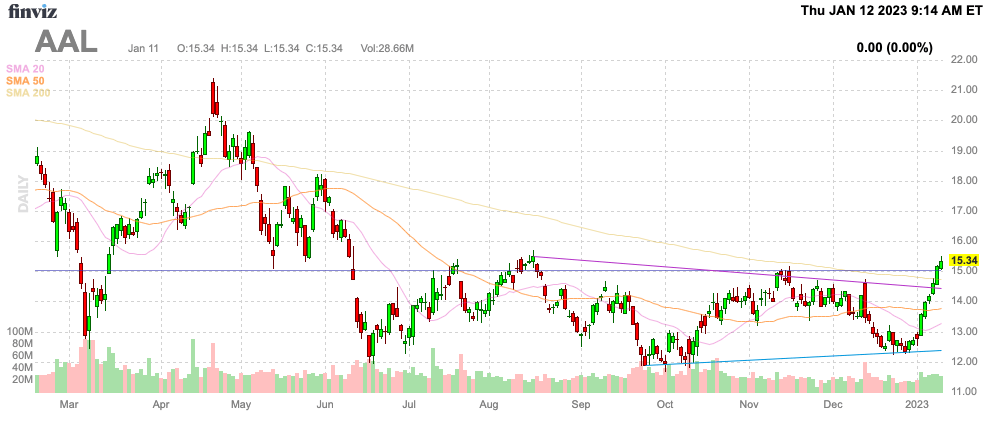

Source: FinViz

No Surprise

The market is likely surprised that American Airlines reported a blockbuster quarter, but investors shouldn’t be surprised. Delta Air Lines (DAL) has recently discussed topping 2019 financial results and Southwest Airlines (LUV) just reinstated a big dividend. The sector keeps telling the market that boom times are ahead, but the market keeps ignoring these strong results.

Prior to the open on Thursday, American Airlines provided the following strong updated financial results for Q4’22:

- Revenue: 16% to 17% as compared to Q4 2019, up from 11% to 13% in previous forecasts

- Adjusted EPS: range from $1.12 to $1.17, about double the prior forecast of $0.50 to $0.70 and well above the consensus of $0.58

- Adjusted operating margin: guidance was also hiked from a range of 5.5% to 7.5% to a 10.25% to 10.5% expectation

The stock was recently trading in the $12s, yet American Airlines just reported a quarter of ~$1.15 per share in earnings, roughly equivalent to 10x where the stock traded. In early trading, the stock is only barely topping $16.

The typical excuse for not investing in airlines are the higher debt levels and share dilution from trying to survive Covid. American Airlines had to issue a ton of shares to survive in order for the company to now thrive.

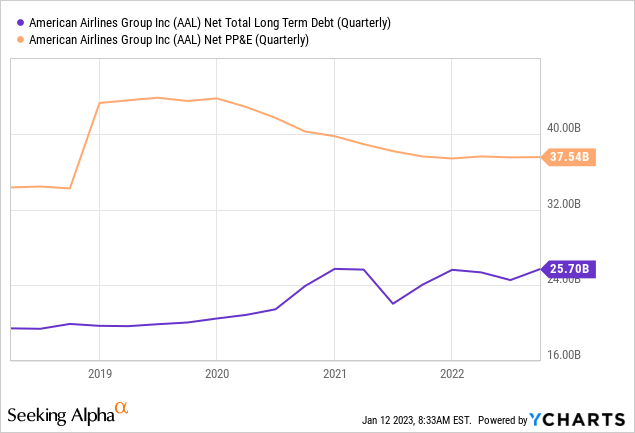

The airline ended Q3’22 with a net debt position of $25.7 billion. While the number is still much higher than pre-Covid, investors don’t always understand that American Airlines has a PP&E balance in excess of net debt by $11.8 billion.

In essence, the legacy airline has a large debt level due in part to purchasing a ton of airplanes prior to Covid shutdowns. American Airlines already has met half of their goal of reducing total debt levels by $15 billion by the end of 2025.

With 716 million diluted shares outstanding, the airline is forecasting to earn ~$823 million in the holiday quarter. Remember, the December quarter isn’t even close to the best quarter for the airline and American Airlines only earned a similar $1.15 in Q4’19 in a sign of the massive rebound by the airline already. The airline has completely recovered from the shutdowns despite higher interest expenses and the increased share counts.

Huge Hikes Ahead

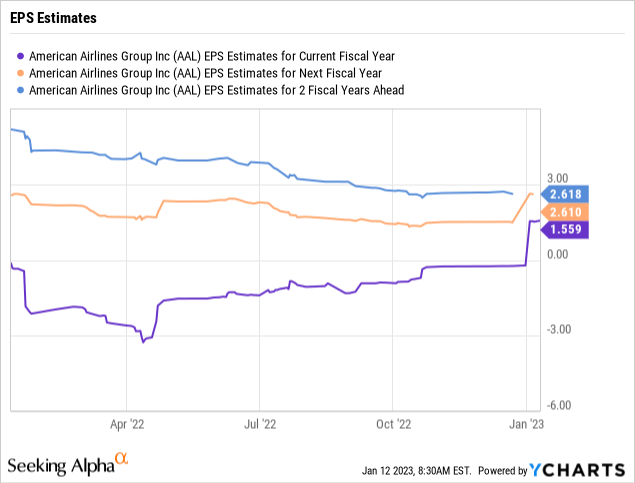

The crazy part of the investment story is that analysts only forecast American Airlines generating a 2023 EPS of $1.56. The consensus target only jumps up to $2.60 in the following years.

As mentioned in prior research, American Airlines has earnings power of $3 to $4 per share. The ability of the airline to survive and thrive despite a tough year where fuel costs soared should provide more confidence to investors.

The market will correctly question whether the Q4’22 numbers are repeatable next year. The airline likely benefitted somewhat from the network issues of competitor Southwest Airlines.

While this number isn’t likely repeatable next year, analysts only have the airline earning $1.56 in 2023 with the Q4 estimate at just a meager $0.30. The more income American Airlines makes now, the more cash flow the airline will generate to repay debt to lower interest expenses and boost profits in the future.

Takeaway

The key investor takeaway is that American Airlines is ridiculously priced with the profits now being generated. The airline is executing far better than most market participants expected, but the stock still gets no respect.

Investors should use the current stock price to buy a stock trading at 5x normalized profits of $3+ per share.

Disclosure: I/we have a beneficial long position in the shares of AAL, UAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.