Summary:

- American Airlines is expecting to see a continued strong demand for the foreseeable future.

- The slowing of the CPI price increase and delinquency rate growth supports the argument for a continued strong travel demand.

- American Airlines operates a young fleet leading to less Capex needs and flexible growth potentials.

Kevin Porter

Introduction

In my previous article covering American Airlines (NASDAQ:AAL), I had a sell rating on the company. The primary reasoning behind this thesis was that I viewed the macroeconomic conditions unfavorably. As it is the case that the travel industry is cyclical and some macroeconomic data points like the rising delinquency rates were pointing towards a potential slowdown in consumer spending, I had a negative view of American Airlines. However, recent data points suggest that this may not be the case. Travel demand continues to be strong while the rate of delinquency growth that has been increasing is showing signs of deceleration.

Beyond a reversal in my views surrounding the macroeconomic conditions, American Airlines is also expected to benefit from relatively low CAPEX rates for the rest of the decade as a result of the company’s young fleet. Therefore, I am upgrading my rating on American Airlines to a buy from a sell.

Macroeconomic Conditions and Strong Demand

Unlike my views of the negative macroeconomic conditions outlined in my previous article, American Airlines has been enjoying a strong demand with no clear evidence that the economic conditions are causing headwinds to current demand.

First, my primary reasoning for arguing that the macroeconomic conditions could be challenging was the continual rise in consumer loan delinquency rates, as I believed it could impact the consumers’ spending on discretionary products like travel. However, it could be the case that the rise in delinquency rates was simply within a normal seasonal pattern.

Capital One (COF), a primary player in the consumer loan and credit card industry, during the 2024Q1 earnings call, acknowledged that “the charge-off rate for [2024Q1] was up 190 basis points year-over-year to 5.94% [, which is] about 18% above its pre-pandemic level in the first quarter of 2019.” Yet, the company’s view remains “that credit is settling out modestly above pre-pandemic levels in 2018 and 2019” as “the pace of year-over-year increases in both the charge-off rate and the delinquency rate have been steadily declining for several quarters and continued to shrink in the first quarter.” As such, despite what I believed to be a potentially risky increase in consumer loan delinquency rates in the past several months, industry players offering credit to consumers have been seeing a decelerating rate of growth in both charge-offs and delinquencies showing that the macroeconomic risks from growing delinquency rates could be minimal. Therefore, it is likely wrong to assume that American Airlines could be negatively affected by the macroeconomic headwinds.

Looking at American Airlines 2024Q1 earnings call, the company is seeing a continued strong demand with an expectation for this to continue. The company’s management team said that “the environment for air travel is very constructive” and that the company is “seeing [the] demand coming back” resulting in an expectation for a strong year.

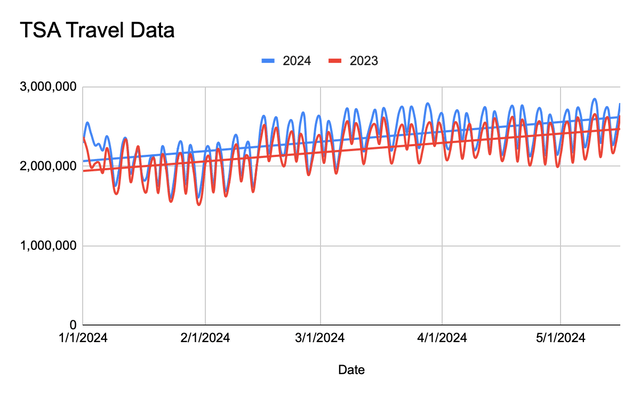

I believe American Airlines’ views are reasonable. First, the travel industry’s growth is expected to surpass that of the GDP growth. According to a McKinsey and Company, through 2032, travel and tourism sector is expected to see about 5.8% yearly growth while the GDP is expected to grow at 2.7% a year during this period. Thus, American Airlines could expect a positive macroeconomic tailwind for the foreseeable future. Second, as the TSA travel data shows that the 2024 air travel demand is strong. As the chart below shows, 2024 air travel demand has been consistently stronger than 2023 demand. Further, the 2024 travel demand trend line implies that the growth in the travel demand is not over.

[Chart created by author using TSA]

Updated Loyalty Program

In 2024, American Airlines updated its AAdvantage Program in hopes of creating a stronger brand, better customer retention, and enticing higher spending or premium customers. Overall, I believe the changes to be positive.

American Airlines created numerous new policies to entice customers to use the company’s website over other third-party websites to drive loyalty and likely greater margins. As such, from May 1st, consumers will be eligible to receive the bonus miles if and if the paying customers book a flight through the official American Airlines website or their preferred travel agency. American Airlines will not be extending perks and benefits to customers booking from third any party websites.

Although it is too early to tell, I believe these changes to be beneficial. About 60% of customers are already utilizing American Airlines website, and when taking into account the preferred travel agencies, which have not been released yet, it is likely that majority of the consumers will see no changes at all. Meanwhile, American Airlines will have stronger negotiating leverage over these travel agencies and eliminate some loyalty liabilities occurring from other smaller third party travel agencies.

Therefore, as the renewed program is targeting cost cutting measures without heavily impacting the consumers’, I believe the renewed program to be positive.

Young Fleet Advantage

American Airlines could enjoy lower Capex spending throughout the current decade as the company’s fleet is young.

Going back to the 2024Q1 earnings call, the American Airlines management team said that the company expects the “2024 aircraft CAPEX to be approximately $2.2 billion” followed by an “approximately $3 billion to $3.5 billion per year from 2025 through 2030.” On the other hand, United Airlines (UAL) is expecting to incur about $7 to $9 billion in total annual Capex spending from 2025 to 2027 after spending about $6.5 billion in 2024.

American Airlines invested heavily in newer and more efficient planes in the past few years. During the 2023Q4 earnings call, the company’s management team said that the company “have modest aircraft CapEx requirements this decade due to the fleet investments we made over the past decade.” As a result, American Airlines has a young fleet, which allows the company to receive a small number of aircraft deliveries in the current decade creating a downward force on the CASM. The company received a total of 23 planes in 2023.

The advantage American Airlines is expected to see against its competitors reaches beyond the absolute dollar amount. Boeing (BA), due to a multitude of delays and its ongoing effort to stabilize and increase production, is delivering planes at a slower volume, which has led major airlines like United Airlines to cut expansion plans and existing schedules. But, because American Airlines operates a relatively newer fleet, the company is affected at a far less magnitude or by cutting only about 3 routes. This, in my opinion, leaves greater flexibility for American Airlines to expand and capture growth or market share while some of its competitors are tied back.

Therefore, I believe American Airlines will enjoy its young fleet advantage for the foreseeable future.

Risks

Despite the potential tailwinds warranting an upgrade from a sell to a hold, I am still worried about American Airlines for several reasons.

The company’s CASM is up significantly year-over-year as a result of an increased wage cost. Looking at the 2024Q1 earnings report, American Airlines reported a cost per available seat mile, CASM, of 13.49 cents excluding special items and fuel costs, which was a 2.3% increase from the 2023Q1 CASM of 13.18 cents. The majority of this increase came from a sticky salaries and wage increase of 17.8% year-over-year to $3.867 billion from $3.281 billion.

On the surface, the increased cost may not seem significant; however, I would like to argue otherwise. American Airlines reported an operating income of $7 million in 2024 Q1, down about 98.5% year-over-year from $438 million. This came as the total operating expenses increased 6.9% year-over-year from $11.751 billion to $12.563 billion. Beyond the labor costs, other sticky expenses increased, including a 24% increase in maintenance costs, a 15.8% increase in landing and renting costs, and a 5.6% increase in regional operating costs. On top of these cost increases, the current result takes into account favorable oil prices as the fuel expenses declined by 5.9% year-over-year to $2.98 billion from $3.167.

Thus, I believe American Airlines could be exposed to two major risks.

First, American Airlines expects to see a continued elevated travel demand supporting this higher operating cost environment. However, in the case that the travel demand slows, American Airlines could quickly see its operating profits deteriorate.

Second, American Airlines benefited from a lower fuel cost. Unfortunately, the oil prices could appreciate in the coming few quarters creating a further increase in the company’s operating costs. The U.S. Energy Information Administration expects the oil price to increase to a $90 per barrel range by the end of 2024 from the current $82 per barrel range.

Therefore, with a continued significant risk tied to investing in American Airlines, I still do believe that there are some risks involved with investing in American Airlines.

Summary

American Airlines is expected to see a potential macroeconomic tailwind from a continued strong travel demand. Previously, I believed this trend would subside as 2024 progressed; however, with an expectation for a strong travel demand throughout 2024 for the foreseeable future, the macroeconomic condition will likely provide a tailwind instead of a headwind. Further, American Airlines is expected to benefit from a young fleet advantage. The company will be able to invest less while having the flexibility to grow without relying on aircraft manufacturers who are experiencing trouble increasing production at a stable rate. Therefore, I believe American Airlines is a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.