Summary:

- American Airlines Group Inc. is poised to fully recover earnings to pre-Covid levels.

- Booming TSA traffic during the July 4th holiday is a positive sign that passenger demand isn’t going to wane.

- American Airlines stock trades at less than 4x ’25 EPS targets that now appear very realistic with debt levels under control.

Bruce Bennett/Getty Images News

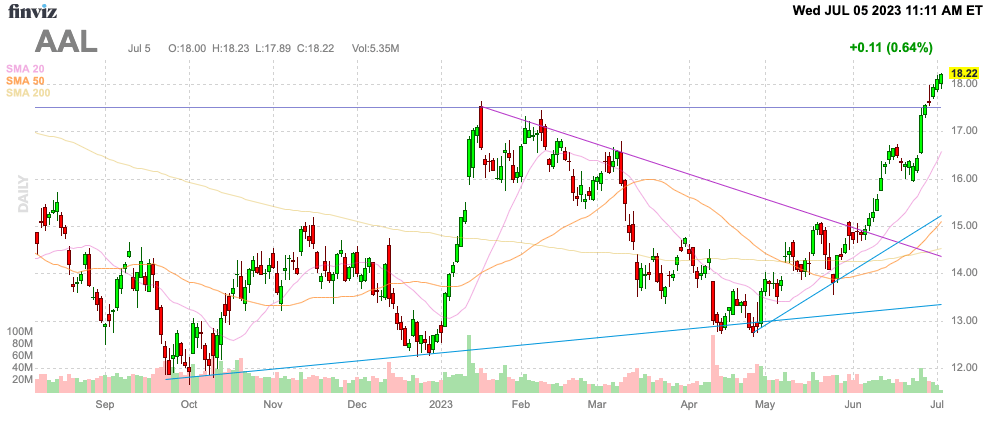

The airline sector is poised to break records this holiday period while the stock market is still mostly ignoring the surging demand in passenger travel. American Airlines Group Inc. (NASDAQ:AAL) remains a vastly overlooked airline stock due to unfounded fears on debt that have mostly been resolved already. My investment thesis remains ultra Bullish on the stock with it only trading at $18 with EPS potential of $4+.

Source: Finviz

Booming TSA Traffic

Prior to Independence Day, TSA already proclaimed the expectation for a booming holiday travel period. The government organization forecasts 17.7 million in passengers during the 7-day period through July 5 as follows:

TSA anticipates the busiest travel days will occur from June 29 through July 5. The peak travel day of the holiday weekend is expected to be Friday, with TSA screening an estimated 2.82 million individuals and approximately 17.7 million during the seven-day travel period. Friday’s travel figure would surpass our current single day travel record since Friday, June 16, where TSA screened nearly 2.8 million passengers. The peak Independence Day holiday travel day in 2019 was Sunday, July 7, where TSA screened 2.79 million passengers.

The holiday period started off with a bang with both days prior to the weekend showing traffic up 30% over the 2019 levels as follows:

- 6/30/2023 2,884,683 132.1%

- 6/29/2023 2,751,137 131.7%

The June 30 traffic on Friday reached nearly 2.9 million passengers in a sign of the booming demand with weekly traffic now running above 2019 levels. Clearly, passenger demand isn’t the issue once expected when Covid was shutting down the airlines.

Earnings Recovery

The amazing story about American Airlines and really any of the airlines is the lack of conviction that earnings will soar back to prior levels. Delta Air Lines, Inc. (DAL) is already forecasting the 2025 EPS matches pre-Covid levels, yet the stock still hasn’t regained the $60 level from back in 2019.

American Airlines is another stock where the market appears stuck in disbelief whether the airline will hit the $2.50 to $3.50 EPS target for the year, while the real story is how much higher earnings can recover. The airline was hitting a $4+ EPS pre-Covid, but debt levels and additional shares outstanding impact the ability for an immediate EPS recovery to those levels.

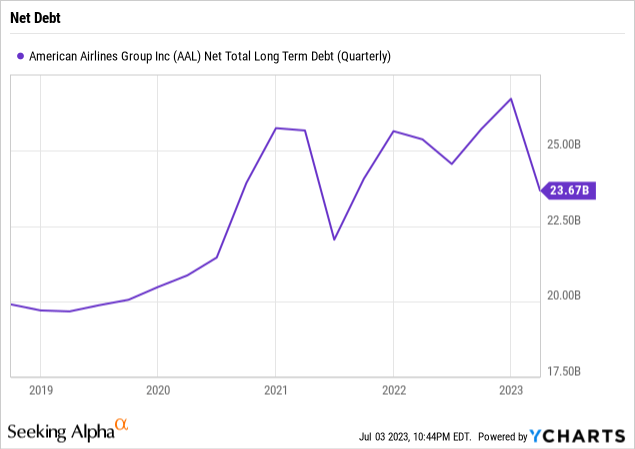

Still, American Airlines trades at only $18 and the airline already produced a massive Q4 EPS of $1.17 topping the Q4’19 level despite the higher debt and share counts. What a lot of investors appear to have already missed is that the airline has drastically reduced net debt levels heading into Q2.

American Airlines ended Q1 with net debt at only $23.7 billion, down massively from the peak levels. The airline isn’t that far away from net debt of around $20.4 billion at the start of 2020.

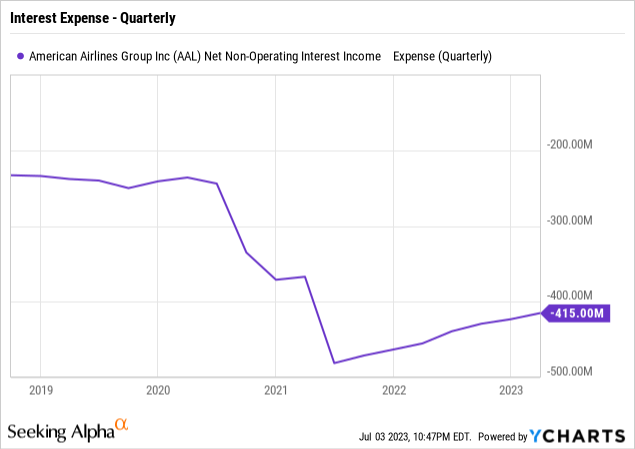

Just as important is that American Airlines has turned the corner on net interest expenses. At the peak, the airline had excessive cash balances in order to avoid any scenario where another shutdown occurred and cash was needed.

The end results was higher total debt levels leading to excessive interest expenses. With the rise in interest rates, the excessive cash started earning sizable income and cash flows have now started repaying debt leading to a combination of where net interest income has fallen from nearly $500 million in mid-2021 to only $415 million in Q1’23.

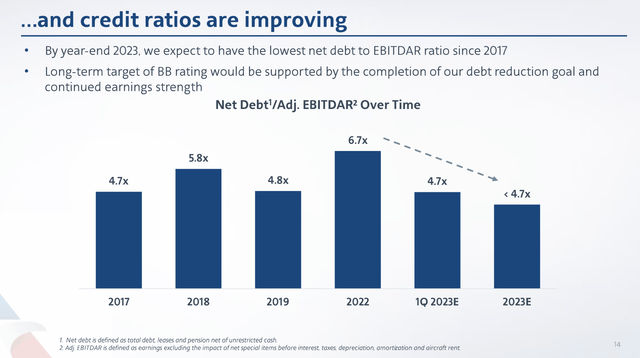

During Q1 alone, American Airlines produced a massive $3 billion in free cash flows. The airline has reduced total debt by an incredible $9 billion during this period and expects to reach up to $11 billion of debt repayments by year-end, leading to a net leverage ratio below the pre-Covid levels.

Source: American Airlines Q1’23 presentation

Even with all of the progress on cash flows, American Airlines is still paying ~$175 million per quarter in higher interest expenses. The company has ~$12.5 billion in total cash providing the opportunity to pay down higher costing debt and overtime cut interest expenses to the tune of boosting EPS by $1 alone.

With the cash flows generated in Q1’23 and booming traffic, investors should no longer question this ultimate outcome. The airline has guided to a $3 EPS for 2023 and the interest expense issue alone boosts this EPS target to $4 in a few years.

Analysts actually forecast a $4.83 EPS in 2025, and investors should probably start considering this number as a very legitimate estimate for a stock only trading at $18.

Takeaway

The key investor takeaway is that American Airlines has already rallied a lot in the last couple of months, but $18 likely is only the start. The airline has debt under control – probably to the shock of most following the stock.

With the case for a $4+ EPS in a few years, American Airlines has far more upside ahead trading below 4x 2025 EPS targets.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.