Summary:

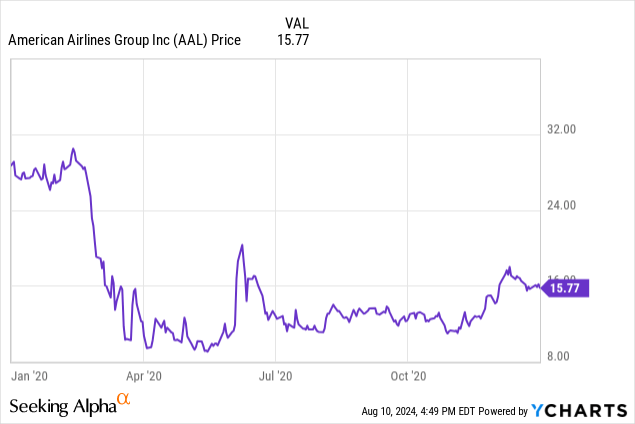

- American Airlines stock underperformed the index by over 75% since my Strong Sell rating last year.

- Company fundamentals remain weak with flat revenues and a challenged balance sheet.

- If this is how the performance and the financials look in a “good” environment I hate to think how this will turn out if we actually realize a recession.

- At its present levels the valuation is fair and rating the stock as a Hold.

Eder Paisan/iStock via Getty Images

I first covered American Airlines (NASDAQ:AAL) in March of 2023 with a Strong Sell Rating. My thesis rested plainly on the fact that Airlines have historically been a bad investment and American Airlines was a prime example of where not to be invested in an airline. Since then, the stock has underperformed the index (SPY) by more than 75%, underscoring my argument that airlines are value destroyers for investors. My thesis also rested on weak company fundamentals and weak macro. Unsurprisingly, neither has changed more than a year after my coverage.

SA

I thought it prudent to revisit this company and my rating. To be succinct, I am upgrading my rating to Hold as the drop in the stock price has brought down the valuation to a great degree, and over the short term, the stock could see a bounce buoyed by technicals.

Fundamentals that continue to be weak

Revenues have remained flat for four quarters now and while net income showed positive trends for 2022 and 2023, trailing 12 months it has again turned negative.

Given the significant debt the company has, American Airlines management’s focus has been on reducing debt where it has made progress. The goal is to reduce debt by $15B by 2025 and the company is close to getting there. But holistically, the picture is still grim.

- The company shows negative shareholders equity and the debt-to-equity ratio profile has remained unchanged from my last coverage.

- Interest expenses for TTM are approximately $2B and net interest expenses are around $1.5B. Comparing this with the TTM Operational Cash Flow of $2B does not give me enough confidence in the company’s ability to meet its debt obligation if we see any downturn in the company.

- Over the long term, I have already made my thoughts very clear on why airlines are bad investments in my last coverage (Competition, Differentiation mostly by price, extreme dependence on oil prices, high operational costs, lack of innovation). But what about the medium-term? For that, the answer lies in the economy as the airline sector is strongly tied to the economic fortunes of the country.

Economic signs are discouraging

We are currently in the middle of one war related to Russia and Ukraine and a high risk of escalation into another war related to the Israel-Palestine conflict. There is also the looming threat of China finally making its advance on Taiwan, all of which can affect markets and have a disproportionate effect on airline stocks which are highly correlated to the markets. But these are known threats and in my opinion, what is going on under the hood in the current US economy or the uncertainty in the economy poses a much bigger danger.

The Weakening labor market is considered the canary for a recession to follow. The current weakness even though small is considered material due to Sahm rule. The rule suggests that when the three-month moving average of the unemployment rate increases by 0.5% or more from its lowest point in the past 12 months, it signals the start of a recession in the U.S. economy.

This threshold was crossed when the unemployment rate in the July jobs report rose to 4.3%. This increase brought the average unemployment rate for May, June, and July to 4.1%, which is 0.6% higher than the low of 3.5% reported in the July 2023 labor market report. A review of the past 50 years of economic data reveals that the rule has consistently proven accurate, with unemployment surging at the onset of each downturn.

Bloomberg and Bureau of Labor Statistics

Additionally, the Conference Board’s LEI for the U.S. has been declining, with a 0.2% drop in June 2024 following a 0.4% decline in May. Over the first half of 2024, the LEI fell by 1.9%, indicating a continued downward trend. This decline is driven by factors such as gloomy consumer expectations, weak new orders, negative interest rate spreads, and increased unemployment claims.

Now an argument can be made that indicators that turned red last year also indicated a recession but was never realized. It is usually countered with the argument that the U.S. has been on a historic spending spree which has largely supported the GDP growth, and this is unsustainable. Eventually, this will have to be reined in, which will weigh on the economy.

But here comes the big question which I am scared to answer. If we saw the stock drop when a recession was forecasted but never materialized (the reason for this being immaterial), what would we see in the stock price performance if a forecasted recession this year actually materializes?

In bull markets the future gets a premium, in bear markets, reality gets a discount

– Jim Chanos

Seeking Alpha’s quant rating for American Airlines shows a big decline

The quant rating for American Airlines stock has shown a big decline since my last coverage. The stock was rated a Strong Buy and scored 4.81 at that time and now is rated a hold and has dropped to 2.85.

One of the factors that could have possibly contributed to the lower score could be analyst revisions which is an important component in the score. For the upcoming year, there have been no up revisions and there have been 13 down revisions for EPS and 15 down revisions for revenues which does not bode well for the stock.

American Airlines valuation is fair even after accounting for risks

Valuing American Airlines through the PE ratio is not possible as the Net Income is negative. Even then I hesitate to use the ratio for airlines due to the cyclical nature of the industry and the high fixed costs. Instead, let’s look at this company through the lens of EV/EBITDA. From Seeking Alpha’s valuation page for American Airlines, the Current EV/EBITDA is at 7.1x and the forward ratio is at 6.3x both more than 40% below the sector median. Given the risks in the short and medium term, this seems fair. Also, under uncertainty, I prefer scenario-based valuation, and here too the results seem fair.

As the company continues to pay down its debt an improvement in EBITDA would start pushing the ratio lower. However, a drop in EBITDA by up to 40% would only push the ratio to the current sector median levels indicating the stock is trading at fair prices even after accounting for risks in the overall economy.

Short-term the stock’s direction could mislead investors

While over the long and medium timeframes, I am bearish on the stock the short term is quite tricky. Short term, the price action could be dictated by technicals and the drop in valuation. Case in point, even Oracle of Omaha could not escape the criticism he took after he sold his airline holdings at the onset of COVID-19 in 2020 and the airlines rebounded sharply thereafter. Between May and June of that year, the stock doubled in price even as the news related to Covid-19 continued to get grim. As I mentioned the current valuation plus any short-term good news related to the stock or the economy might give reasons for the investors to pile into the stock sending it sharply higher from here.

American Airlines is a hold

The stock has weak fundamentals, operating in an uncertain environment and the outlook is grim heading into a possible recession. But the stock is trading at 10-year lows and valuation-wise seems fair in light of the risks involved. I prefer to remain on the sidelines and believe there are better uses of one’s capital.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.