Summary:

- One of them was in a better place to recover after the pandemic but now the new growth phase favors the other major carrier.

- American Airlines reported good first quarter results while Southwest’s first quarter results were a miss due to the holiday disruption compensations.

- Despite the elevated airfares and inflation most organization’s travel expenses have returned to pre-COVID levels and will keep increasing.

- Which airline would you choose to invest in right now?

frankpeters/iStock via Getty Images

Investment thesis

American Airlines Group Inc. (NASDAQ:AAL) and Southwest Airlines Co. (NYSE:LUV) both reported their first-quarter earnings. The last time I made a comparison article was back in September 2022. In that comparison, one of them was in a better place to recover after the pandemic but now that phase is over and the new growth phase favors the other major carrier in my opinion. Which airline could profit more from the current trend and where should investors allocate money if thinking about getting exposure to the airline industry? Let’s have a look.

American Airlines First Quarter Results

Approximately 2 weeks ago AAL in its 8-K projected its Q1 numbers. According to the management, its projected capacity for the first quarter of 2023 will be 9.2% higher than the midpoint of its prior guidance of 8% to 10% compared to Q1 2022. The total revenue, cost, and operating margin for every available seat mile matched the midpoints previously established in the guidance given in January. But the market was expecting stronger Q1 forecasts and figures so the stock plummeted and could not recover despite positive first-quarter earnings. American Airlines exceeded first-quarter profit estimates and revealed an optimistic outlook for the current quarter due to the elevated demand. The company reported adjusted earnings per share of 5 cents on revenue of $12.19 billion (up 37% year-over-year), which was higher than analysts’ estimates of 4 cents a share on revenue of $12.2 billion. According to current market trends and fuel price projections, while ignoring special circumstances, the corporation anticipates its 2023 second-quarter adjusted earnings per share to be between $1.20 and $1.40 which is 15-25% higher than the current market consensus.

Future plans

The changing demand and consumer behavior and the mix of trips are changing AAL as well. The management is making some changes to adjust to the new era after the pandemic recovery phase. In the past, over 50% of the trips were solely for business. However, now there is less than 40% of purely business trips. This shift of 10-15 points has gone almost entirely to blended-style air travel trips. According to these changes, the management has started to shift the business and has undertaken a reallocation of the network to reduce flights in shorter routes, such as New York to Chicago, or move into newer markets like New York to Tulsa. The travel reward system is changing as well, AAdvantage travel rewards program makes it easier to go and earn miles for things that aren’t just taking business trips.

The fleet has been streamlined and unified to offer greater flexibility in AAL’s network, allowing American Airlines to be more agile and concentrate on the most financially viable flights. AAL’s Sunbelt hubs are also well-poised to capitalize on the current population shifts taking place within the United States. AAL was one of the most in debt companies following the first year of the pandemic without almost any revenue but huge ongoing expenses. As the management laid out the plan previously in 2022 to reduce the debt and leverage, they are on route. They anticipate that the free cash flow will be around $3 billion this year. This sum includes the potential of bonus pay, which is linked to the labor agreements they have in place. AAL anticipates that next year it will be able to report an impressive free cash flow, despite a slight spike in aircraft capital expenditures. They have managed to reduce the total debt from around $10 – $11 billion at its peak in the summer of 2021 down to approximately $3 billion by this year. The debt burden is expected to be higher in 2025, so the management has already taken some measures against it in the first quarter. Depending on AAL’s available resources, they plan to either pay off or refinance a part of the remaining debt in subsequent years making the balance sheet stronger and more sustainable in the long term.

Southwest Airlines First Quarter Results

For the first quarter, LUV had an adjusted operating loss of $284 million, which exceeded the consensus forecast of $192.7 million. Earnings per share came in at -$0.27 vs. the consensus of -$0.23. The first quarter revenue per available seat mile increased by 9.8% but the operating expenses were up 23.6%. The noteworthy surge in expenses came as a result of inflationary pressures, especially about higher wages for all employee types, increased spending on technology, and higher rates of airport and benefits costs. The airline still carrying the holiday-related issues that seriously damaged its reputation. Part of this quarter’s high expenses was due to the outlay for operational disruption-related costs such as customers’ travel expenditure reimbursements and an anticipated higher redemption rate of Rapid Rewards points given as a sign of good customer service. All in all, it resulted in an approximately $380 million pretax revenue hit in the first quarter.

Future plans

LUV has a well-connected network with many direct flights, and the services they provide are great in general. Its on-time performance and overall customer experience are usually improving except for the last 3-4 months due to the massive holiday disruptions. After a bit disappointing Q1, the management is expecting strong summer trends and great Q2 profit. The company has faced excessive cancellations in January and February due to the holiday season issues but in March the bookings were up and it seems that this fiasco was forgotten by most of the customers.

The management needs to solve quite some short-term issues and solve some longer-term problems. They need to modify the fleet in the short term, moderate hiring in the upcoming months, take care of the costs and CASM figures, and in the long term modernize its tech system. It appears that there is a slight inflationary increase which is attributed to the maintenance of its fleet especially to the 800s. This could be because some of the expenses related to engine visits may have been pulled into this financial year and will be substantial in 2024 as well, making it difficult to ascertain the exact cause of inflation. Despite the cost pressures, the management is reducing its CASM expenditure guidance for this year.

The management’s priority for this year is to revive the flight network with fewer aircraft being delivered. This will impact the company’s growth outlook. With fewer aircraft than previously planned, they have been open about where the flights are going and how they are planning for growth. As we move into 2024, their goal is to remain cost-conscious and take advantage of operating leverage. The majority of new routes will be added to locations where there are gaps in service during the day. The past year has been challenging for LUV, with three factors limiting its growth progress: flight instructors, pilots, and aircraft. In the second half of 2023, the focus will shift from having too few pilots to having too few aircraft. They are on course with recruiting and training the number of pilots necessary not to limit the company’s growth. And by the second half of 2024, the right amount of aircraft should be delivered to Southwest by Boeing so this balance might shift back to the staffing issues once again.

Events and trends affecting the carriers’ profit

Oil prices have been quite hectic in April due to OPEC’s surprise cut. Airline fuel hedging is currently lower than it has ever been in the past. Southwest Airlines has hedged around 50% of its fuel needs for 2023, whereas American Airlines and Spirit Airlines (SAVE) have not made any fuel hedge purchases as of yet. It means that AAL investors face more risk in case of jet fuel price increases so they should keep an eye on it. At the same time, LUV’s risks are more concentrated on its workforce and potential strikes. Union representatives have warned of an imminent vote to authorize a strike on May 1 and urged management to approve the terms that were presented. They also iterated their disapproval of the board’s inaction in light of the interruptions caused by faulty internal software systems.

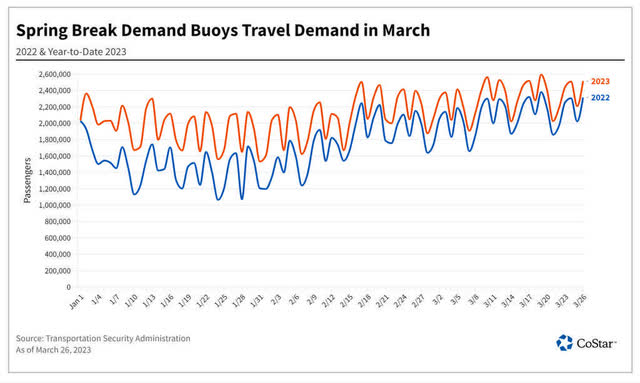

There are some challenges that both carriers face, such as Boeing’s late deliveries. Boeing aircraft delivery delays could impact the summer schedule for both AAL and LUV. LUV even trimmed its capacity growth plans due to the late deliveries. LUV is expecting 70 new aircraft from Boeing (down from the original 90 this year) while AAL has 20 deliveries for the remainder of the year. However, there are many positive signs as well that impact both the carriers and boost profits. The air travel industry had a successful March due to the influx of travelers on spring break, which had set them up for further growth during the summer months. In April, every single day the TSA checkpoint travel numbers were higher than in 2022 sometimes by 10-15%. These numbers are also beating the pre-covid 2019 figures, on some days a bit more, sometimes a bit less but we can confidently say that the travel demand is back. In addition, despite the elevated airfares and inflation, a survey of 100 corporate travel managers around the world revealed that many think their organization’s travel expenses have returned to pre-covid levels and will keep increasing.

TSA travel demand (hospitalitynet.org)

AAL vs LUV – Valuation comparison

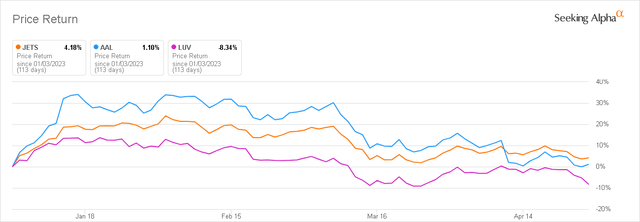

As we have seen above, LUV’s situation is more challenging in the short term than AAL’s. I would refer to Southwest Airlines as a reputation regainer while to American Airlines as a debt reducer. Now, let’s see the valuation of the two. In the last 4 months, they both underperformed one of the largest airline ETFs, LUV by quite a hefty margin.

JETS vs AAL vs LUV (Seeking Alpha)

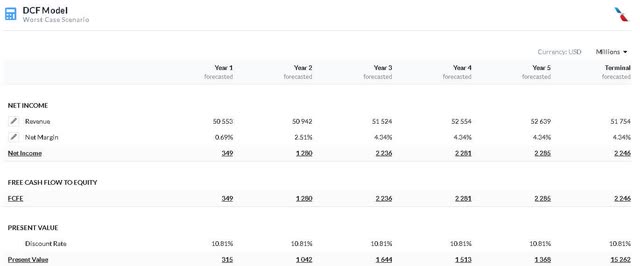

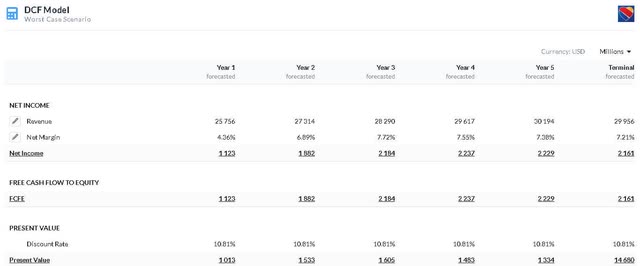

Looking at the CAGR figures for the upcoming years, revenue growth for the next 3 years for AAL is 6.15% and just 4.89% for LUV. Return on assets LUV is the second highest among the 4 major carriers but this is not enough if the reputation is damaged and customers rather choose someone else to fly after a horrific experience. If investors take a look at discounted cash flow models, both of them are undervalued at this point but American Airlines is more undervalued to its fair value than Southwest. I calculated both with a discount rate of 10.8% and a terminal growth of 2%. With these numbers, AAL’s fair price would be $32.46 per share and LUV’s fair price would be $36.43 per share. Seeking Alpha valuation for AAL is an A+ while for LUV is an A- so Seeking Alpha Quant also rates AAL slightly better than LUV.

AAL Discounted Cash Flow (alphaspread.com) LUV Discounted Cash Flow (alphaspread.com)

Summary

The airline industry is heading for a great second quarter and a summer boom in travel demand despite inflationary pressures and high airfares. Both American and Southwest will profit from this trend however I believe that American Airlines will be able to capitalize on this trend more than Southwest Airlines. American Airlines faces fewer internal challenges and reputational issues with better valuations. So my choice for the upcoming months is American Airlines over Southwest Airlines. Which one would be your choice?

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.