Summary:

- The demand for global travel is rebounding to pre-pandemic levels, driven by economic stability and increased business travel.

- American’s robust financials led to a $9.4 billion drop in total debt, thus making the management close to their target of a $15 billion decline in total debt by 2025.

- American Airlines is undervalued and has the potential to reach $19 per share, based on its financial performance and market outlook.

Alvin Man/iStock Editorial via Getty Images

Introduction

Together with their regional airline subsidiaries and third-party carriers operating as American Eagle, American Airlines (NASDAQ:AAL) is one of the world’s largest airlines that provide scheduled air transportation for passengers and cargo. During 2021, the airline experienced high costs due to the decline in the demand for air travel due to the COVID-19 outbreak. The shortage in the demand side remained due to higher inflation rates and modest worldwide economic growth. Now, due to the higher economic stability and more business travel, the demand for global travel is rebounding to its level in 2019. In this thorough analysis, I have investigated American’s financials and market outlook. Also, based on my valuation result, American is undervalued and has the potential to reach $19 per share.

The travel market is rebounding

After a few years of struggling with COVID-19 consequences, now we are seeing that the demand for travel is accelerating to its 2019 level in both tourism and business travel segments. After the removal of the zero-COVID public health policies in China a few months ago, China’s domestic revenue passenger kilometers ((RPKs)) surged. It is expected that their domestic RPKs will boost considerably and recover to their 2019 monthly level by the end of summer 2023. RPK is an airline traffic statistic and an efficient metric that shows traffic volume.

It is worth noting that worldwide economic circumstances have a great impact on this recovery. As the second-largest economy in the world, with a GDP of over $17 trillion, it is expected that China’s international markets will likely fully recover to the 2019 annual levels by 2025. China has been number one in the business travel market since 2014. However, longer quarantines pushed the country to the second business travel market in the world. With the economic reopening, it is expected that China again reaches first place by the end of 2023. Global business travel spending has accelerated astonishingly. It also is expected to surpass its pre-pandemic spending level of $1.4 trillion in 2024 while reaching $1.8 trillion by the end of 2027. In comparison with other giant airlines, American Airlines had the highest growth and rose 1.4% by the recent report published by the Global Business Travel Association, while Delta Air Lines (DAL) and United Airlines Holdings (UAL) were up by 0.14% and 0.23%, respectively.

Furthermore, as I disgusted in my recent article about United American Airlines,

“U.S. inflation rates are on a decreasing path, and after reaching the Federal Reserve’s target of 2%, there is no need for keeping interest rates high. It is worth mentioning that in July 2023, the annual inflation rate in the U.S. accelerated to 3.2% versus 3% in June, albeit remaining below the forecast of 3.3%. A year earlier, the inflation rate started to fall from its peak level of over 9%. Recently, energy costs fell by 12.5%, albeit less than a 16.7% fall in June. Overall, the inflation rates are heading to their previous levels leading to a solid demand environment and thus bringing more opportunities for Airline giants like American, United, Delta Airlines, and Southwest (LUV)”.

American Airlines’ business and financial outlook

After embarking on recovery, American could pave the way very successfully and gain its fifth consecutive quarterly profit by reaching $1.8 billion of adjusted pre-tax earnings or $1.92 of adjusted earnings per diluted share at the end of 2Q 2023. These earnings hit the high end of their EPS guidance range. Moreover, it is worth noting that they reached the highest quarterly revenue in their history of approximately $14 billion at the end of the second quarter of 2023. Again, this revenue indicates how strongly the demand for both international and domestic travel has surged this summer.

One of the main advantages of Airline is related to its young fleet. The management started refleeting in 2014 and kept going during the pandemic time. This plan was very cost-efficient for American, as they improved their fleet before global supply chain constraints and with lower interest rates. Additionally, the young fleet cater to low capital expenditures in the near future, and thus the airline’s operating cash flow will be translated to an ample amount of free cash flow. The management can use this free cash flow for more investments and balance sheet strengthening. In the last six months ended June 2023, Airline’s load factor reached 83.2%, which was slightly higher than 81% for the same time in 2022. The load factor is a profitability factor in the airline industry that shows how effective an airline is in selling seats and generating revenues.

During the recent quarter, American generated circa $1.8 billion of operating cash flow, which was translated to $1.2 billion of free cash flow. They are likely to generate $3 billion of FCF by the year-end. The management plans to use free cash flow and a well-generated amount of $14.9 billion of total liquidity for the balance sheet strength. After the downturn period in 2021 and reaching peak debt levels, the management set a goal of reducing total debt by $15 billion by the end of 2025. It is worth noting that based on the $9.4 billion reduction in total debt at the end of 2Q 2023, they only require circa $5.5 billion reduction to reach their target.

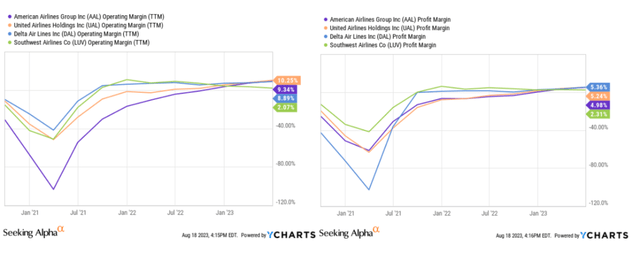

After seeing the airline’s well performance during the recent quarter, it goes with no surprise that its profitability condition has improved considerably. In doing so, I analyzed AAL’s profitability ratios across the board of return and margin ratios in comparison to other peers. As it is indicated in Figure 1, American Airlines’ operating margin has boosted astonishingly since the downturn of 2021 and reached 9.3% in TTM. Compared with its peers, AAL has the second-highest operating margin after United Airlines of 10.2% in TTM. Moreover, the airline generated a profit margin of circa 5%, which was lower than Delta’s and United’s of 5.3% and 5.2%, respectively. Overall, it is well observable that American has been able to recover successfully from deep negative margins during recent years and has been able to convert its generated revenue to investors’ profit.

Figure 1 – AAL’s margin ratios vs. its peers

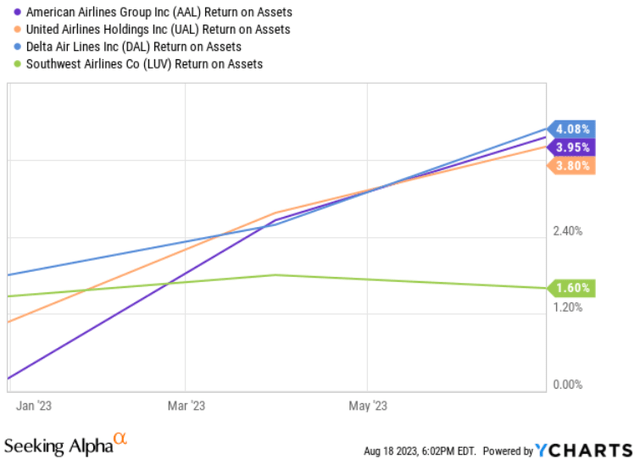

Furthermore, observing the peer group’s return on assets shows that although Delta experienced the deepest plunge in ROA in 2021 due to the COVID-19 outbreak, it could recover successfully, surpass others and reach over 4% of ROA. After Delta, American sat at 3.95% of return on assets, which shows how efficiently the management could earn profit from their economic resources and thus make their balance sheet healthy (see Figure 2).

Figure 2 – AAL’s return on asset vs. its peers

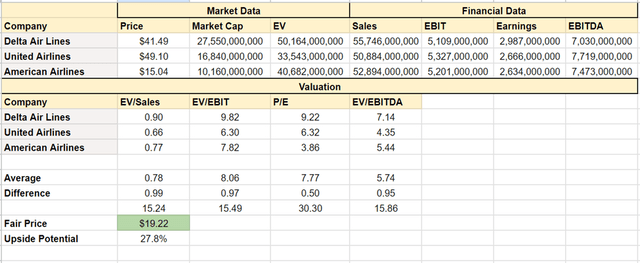

AAL stock valuation

Ultimately, after analyzing American’s recent financial performance and comparing its profitability metrics with its peers, I believe the stock is undervalued, and its well-performance has not been reflected in its market price yet. In doing so, comparing American’s valuation metrics with its peers shows that the airline’s PE ratio is at 3.8x, which is far lower than Delta and United’s PE ratios of 9.2x and 6.3x, respectively. Moreover, the airline has an EV-to-EBITDA of 5.4x, which albeit being in the same line as the average, is higher than United’s EV-to-EBITDA of 4.3x. As a result, AAL’s stock valuation indicates that the airline has an approximately 27% of upside potential to reach around 19$ per share (see Figure 3).

Figure 3 – AAL stock valuation

Conclusion

American Airlines has performed astonishingly to recover after the downturn of 2021. Moreover, economic reopening and improving business travel spending are good news for American because it has a very high portion of both domestic and international travel segments. The management has been successful in strengthening its balance sheet by decreasing total debt by $9.4 billion during the last six months of 2023 and thus become reasonably close to its target of declining total debt by $15 billion versus its level of 2019. When all was said and done, American Airlines’ good financial performance in comparison to its peers indicates that the company has circa 27% of upside potential to reach its Fair value of $19 per share. As a result, I conclude that a buy rating is appropriate for AAL stock.

As always, I welcome your opinions and comments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.