Summary:

- American Airlines is continuously deleveraging its balance sheet.

- High international travel demand likely expected this summer.

- The airline industry is returning to pre-COVID levels of operation.

- Not every day do you see an industry-leading firm trade at a 60-90% discounted price when compared to its competitors.

- I expect AAL to earn the respect it deserves from the market in the coming months and years, which will be reflected in its price, and I rate it a ‘Strong Buy’.

Editor’s note: Seeking Alpha is proud to welcome Brent Buttles as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

smshoot

Introduction

I strongly believe American Airlines (NASDAQ:AAL) is one of the most misunderstood stocks out there, and I initiate my coverage on AAL with a buy recommendation and a price target of $28.81 for FY23. The rate of travel is increasing at rapid rates as our world returns to normalcy, and airline companies are foaming at the mouth. The ending of the pandemic as well as the termination of travel restrictions/protocols have left consumers eager to fly overseas. American Airlines is the top choice for overseas flights from the US, leaving them with much to gain. AAL’s influx of customers is just one reason among several others as to why I’m bullish on their stock. The deleveraging of AAL’s balance sheet, conservative estimates, and the state of its highly discounted price are all indicators of a bright future for AAL.

AAL Investment Thesis

Street Estimates Are Highly Conservative Amidst Resilient Travel Demand

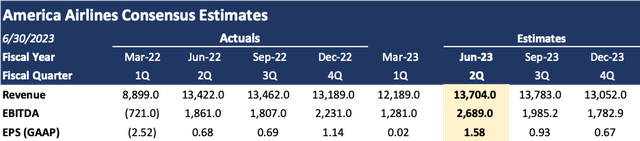

My biggest catalyst for American Airlines outperforming the group this year is future earnings. Below, I have attached the street expectations for AAL’s earnings ($ in millions except EPS):

Taking a look at the upcoming FY23E 2Q estimates, AAL is projected to see $13.7 billion in sales. Looking at 2Q results from FY22, AAL had $13.4 billion in sales. So, with airline demand remaining robust, and airline prices being at all-time highs, why would sales only increase by a few percentage points? Don’t ask me, those are not my estimates, those are the street estimates. So, from my view, I believe they are largely underestimating AAL’s sales.

One of the main reasons I think American Airlines will outperform their street earnings estimates this quarter is the advancement and improved circumstances within the airline industry. To start, it’s important to note this will be the first spring/summer without COVID-related air travel restrictions since they were first put in place. On May 11, 2023, the CDC ended the COVID-19 Public Health Emergency and all regulations that came along with it. The lifting of these restrictions significantly helps international air travel. This benefits all airlines but being the largest airline in the world with a large international presence, American Airlines has more to gain than the rest. These gains will present themselves in what I expect to be an excellent earnings report this July and for growth to come in the subsequent months and years. According to Allianz Partners, this summer travel to Europe will be up by 55% from last summer. Additionally, the airfare prices on flights to Europe are up 12% from last year. These two statistics alone lead me to be extremely optimistic about the upcoming earnings report for AAL on July 20th and indicate the industry is moving in the right direction as a whole.

Although right now all eyes are on Europe in spite of the ending of COVID regulations, China is another important place to look at. This May, the International Air Transport Association (IATA) released a report detailing the impact of China lifting its COVID air travel policy. The data shows the Revenue Passenger- Kilometers (RPK) reached 86.3% of 2019 levels in January, 91.8% in February, and predict this summer these numbers will recover to their 2019 values. At the moment, less than 6% of flights to and from China in 2019 have been resumed. It’s hard to know for certain how the future of travel to China will transpire due to political issues, but I still think it’s almost inevitable it will return to normal levels over time, and as travel to China increases, the airline industry will grow as well.

IATA recently published another report which highlighted some promising data for the industry. One report from June 2023 estimated a 9.7% y/y revenue increase in global commercial airlines and a 2.8% increase in EBIT margin. Taking this into consideration AAL’s forecasted revenue for FQ2 2023 ($13.7 billion) begins to look very conservative when compared to the revenue from FQ2 2022 ($13.42 billion). There are several other impressive metrics to look at regarding the industry. As of June, net profits are estimated at $9.8 billion for 2023 which is over double the $4.7 billion in December 2022 for the industry. Also, the expected total revenues for airlines in FY23 are closing in on those from 2019 as well. $803 billion in total revenues are projected this year, only down 4.1% from $838 billion in 2019. Finally, expenses are expected to be down 1.8% from 2019. All these statistics can be used as evidence that the airline industry is growing, and with AAL being the largest airline in the world, its performance will follow the positive trends of the industry.

Highly Undervalued

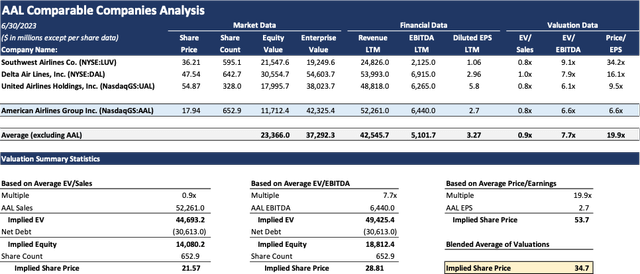

The next core reason I’m bullish on AAL is it’s far undervalued in comparison to its competitors. Below is a chart comparing the valuations of AAL to its largest competitors.

If you look at the bottom right of the table above, I arrived at an implied share price of $34.7 (a 90% upside) for AAL. My price target is based on a blended average of 3 valuations: (1) average EV/Sales (LTM), giving me a $21.6 price target; (2) average EV/EBITDA giving me a $28.81 price target; and (3) average P/E giving me a crazy $53.7. Either multiple implies significant upside to today’s prices despite the recent rally in AAL’s shares after Delta (DAL) pointed to strong travel demand last week. Nevertheless, I prefer EV/EBITDA multiple as that takes in net debt and non-cash expenses – unlike EV/Sales and P/E. So, I set a price target of $28.81 for FY23 (60% upside).

Why The Undervaluation Does Not Make Sense

First off, American Airlines is the most iconic brand out there. In my opinion, I would much rather travel on American than Southwest (LUV), Delta, among others. Yet, Southwest trades at 34x earnings and AAL at 6.6x. Additionally, AAL generates the most revenue YoY, and will continue to do so. AAL has the most miles per year and has the largest fleet out there. Put two and two together, you get a well-established, industry-leading company, with the best-in-class moat, trading at a dirt-cheap valuation.

Also, American Airlines operates worldwide. Most companies in the US Airline industry have little to no exposure that AAL has to the global economy. This to me, means that AAL is less at risk from any slowdown in US flight demand and has more upside risk to the global economy continuing to re-open such as China. Put simply, we are seeing the largest airlines company out there, now trading below a $12 million market cap (that is half the equity of Southwest and 1/3 the equity of Delta), with a 90% upside potential to current prices.

Discounters Have More Growth Potential – Not Anymore

You might be wondering, “Why put my money into AAL instead of a budget airline, which could potentially yield bigger returns with less risk if a recession strikes?” It’s true, this perspective once held water in the airline industry, but times have changed. A glance at the past year’s performance of budget/discounter airline stocks like Frontier (ULCC) and Southwest versus the ‘big three’ (Delta, American, United (UAL)) shows a stark contrast. The ‘big three’ are outshining their budget counterparts, with bigger profit margins to boot. This trend doesn’t seem to be a passing phase. Coupled with AAL’s notable strides in operational improvements and balance sheet rectifications, I anticipate this momentum propelling them beyond their rivals in the foreseeable future.

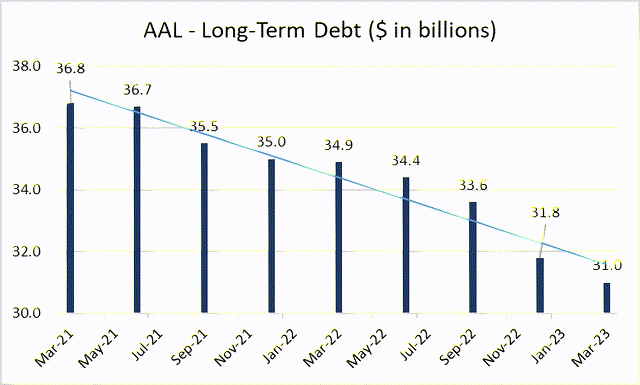

But What About That Balance Sheet! – What About It?

This indeed is a significant concern when analyzing AAL, given its considerable debt – a key reason for its lower market valuation compared to rivals. However, during FQ2 2021 AAL committed to reducing its debt by $15 billion by the end of 2025. Impressively enough as of the end of FQ1 2023 AAL had already reduced its total debt by $9 billion since first setting out to do so in FQ2 2021, placing them well ahead of schedule and 60% of the way to their debt reduction goal for the end of 2025.

See below – AAL is continuously deleveraging its balance sheet:

The airline’s operational performance is also promising, having reported a record Q1 revenue of $12.2 billion in FQ1 2023. If this trajectory continues, I wouldn’t be surprised if AAL exceeds its debt reduction schedule. Overall, AAL’s ongoing improvements bode well for its short and long-term growth prospects. I no longer see its balance sheet as the formidable deterrent it was in 2Q21 when debt levels peaked and shares were 53% higher than current levels. To be clear, though, I anticipate AAL’s margins will continue to trail those of Delta and United, and its higher risk profile – especially regarding the ever-present interest burden – remains a significant consideration for when, not if, market conditions worsen.

Some Concerns Loom On The Horizon

One concern is the demand for higher pay by pilots. Recently, pilots have been expressing dissatisfaction with their compensation, and in response, airlines including Delta and American have agreed to salary increases. Specifically, AAL has committed to a 21% pay raise for its pilots this year – a move that should placate them in the short term but may stir similar issues down the line.

Also, high jet fuel prices, exacerbated by the ongoing Russia-Ukraine conflict, pose a potential challenge. Although the fuel prices are high, they are continuously going down from their peak. In 2022, the average price per barrel was $135.6 and the expected price for 2023 is $98.5. Given AAL’s resilient earnings reports thus far, and my optimistic expectations for its forthcoming one, I believe the airline can weather the high fuel prices without significant harm to its business or profitability.

Recap & Outlook

There’s a lot to be excited about right now when it comes to American Airlines. AAL is doing an excellent job cleaning up its balance sheet and is ahead of schedule in reducing its debt. This is one of the reasons I give AAL a strong buy rating. In the past, its subpar balance sheet has led to it being undervalued but as it continues to be deleveraged, its price will rise and we will see a more accurate valuation for the company. Additionally, increased flight demand as well as the airline industry coming up on pre-pandemic levels of revenue are great reasons to be bullish on AAL and point to a promising future. A recession or a sharp increase in jet fuel prices down the road are things I would look out for in regard to the stock going down, but in the event of those situations coming to fruition, I would be confident the storm will blow over and AAL will continue to succeed. If AAL becomes lackadaisical on its goal of deleveraging its balance sheet, I would become concerned for the future of the company and shift my rating on the stock to neutral or slightly bearish. However, I don’t see that happening, and believe American Airlines is a great company with a lot of potential for growth and would consider its current stock price a steal.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.