Summary:

- American Tower Corporation reported solid quarterly results.

- The company’s underlying business growth remains strong, with organic tenant billings growing by more than 6% for two consecutive quarters.

- Despite temporary headwinds from higher interest rates, American Tower offers a buying opportunity with a below-average valuation and above-average dividend yield.

BackyardProduction

Article Thesis

American Tower Corporation (NYSE:AMT) has reported quarterly results that were very solid. Underlying business momentum is positive, and thanks to a weak share price performance over the last year, American Tower now offers an above-average dividend yield and trades at a below-average valuation, making for a nice buying opportunity in this reliable income real estate investment trust (“REIT”).

What Happened?

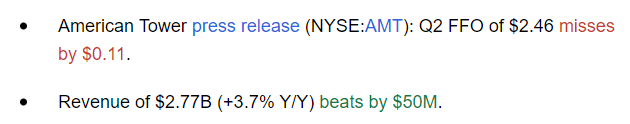

American Tower Corporation reported its second-quarter earnings results on Thursday morning. The headline numbers that the company generated can be seen in the following screencap:

Seeking Alpha

While revenues beat estimates slightly, the company showcased a small miss on the bottom line — funds from operations (“FFO”) per share came in around 4% below what was expected. Overall, the performance was more or less in line with expectations, and the results looked pretty solid. Let’s delve into the details.

American Tower: Solid Underlying Growth

American Tower Corporation is a real estate investment trust that primarily owns cell towers. The company leases these cell towers to companies such as AT&T (T) and Verizon Communications (VZ), which use them to build out their wireless networks across the country.

For the telecom companies, this has the advantage that they don’t have to build these towers themselves — they are already debt-ridden and it suits them well to forego the additional capital expenditures that would be required if they wanted to build these towers themselves. For American Tower (and its peers), this business is attractive as well, as the returns on investment can be quite attractive. That does especially hold true when several companies use the same tower — in that case, AMT spends the capital expenditures to build the tower once, but receives checks from multiple companies every month.

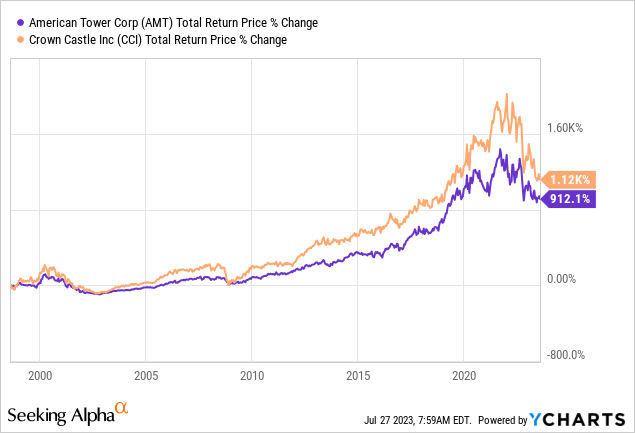

American Tower and its competitor Crown Castle Inc. (CCI) have delivered total returns of around 1,000% over the last 25 years, which pencils out to a total return of 10% per year. For a low-risk income stock, that’s a pretty nice result, I believe. And this does not yet account for the fact that long-term investors could have locked in a much higher return if they had sold their investment during the peak of the pandemic when the valuation on both of these tower REITs was pretty high. Since then, the valuation has come down a lot, but more on that later.

The good news is that underlying business growth remains solid. During the second quarter, American Tower has grown its revenue by a little less than 4%, while property revenue grew by a little more than 4%. Rising lease rates play a major role when it comes to growing revenues over time. During the second quarter, American Tower managed to generate organic tenant billings growth of 6.2%, which was the second quarter in a row during which AMT managed to grow its organic tenant billings by more than 6%. This indicates that momentum is healthy, as AMT is able to push for rate increases that will ultimately flow through to the bottom line.

American Tower does, like most other REITs, use considerable leverage. Building out its towers is capital intensive, thus AMT utilizes debt to finance some of these capital expenditures. While debt levels are not threatening at all — net leverage (net debt to EBITDA) stands at a solid 5.3x — the company still is impacted when interest rates are rising. That is what has been happening over the last one and a half years or so, and AMT has felt some profit headwinds from these higher rates. We see this when we compare the performance of AMT’s EBITDA, where interest expenses are not yet accounted for, to the performance of the company’s funds from operations, where interest expenses are factored in. During the second quarter, EBITDA was up by a nice 5%, while funds from operations (adjusted), unfortunately, were flat compared to the previous year’s quarter, at $1.15 billion. We can thus say that underlying business growth remains solid, but this is not visible in AMT’s bottom line today, as higher interest rates have a negative impact on the company’s earnings growth rate.

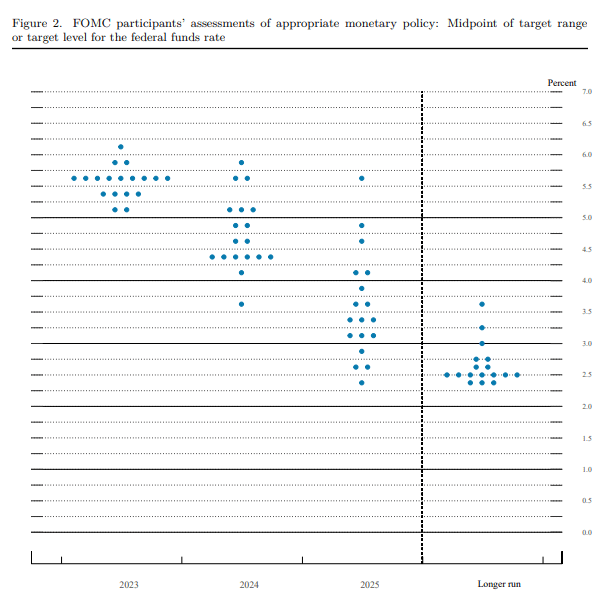

The good news is that interest rates will not climb forever. While the interest rate increases over the last 18 months were needed in order to fight inflation that was running well ahead of the 2% target, inflation has come down, and most analysts and investors expect that the Fed will be done raising rates soon. In fact, the market anticipates that interest rates will decline in the not-too-distant future. Even the Federal Reserve itself is expecting interest rates to head lower over the next couple of years, as indicated by the famous “dot plot”:

Federal Reserve

FOMC participants mainly see interest rates lower in 2024, relative to 2023, with more declines being expected for 2025. In the long run, rates are seen settling at a way lower level compared to where they are today.

This means that the current profitability headwinds that American Tower is experiencing will wane in the not-too-distant future. When the company keeps its underlying business growth rate intact, its FFO growth should pick up again, when interest rate headwinds will no longer be a factor. I thus believe that the current profit performance with no meaningful growth is not very telling when it comes to how AMT will perform in the long run. Instead, I believe that it is likely that AMT will get back to meaningful growth not too long from now.

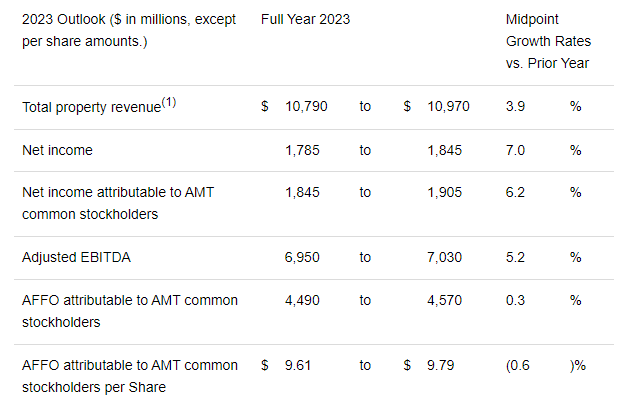

American Tower’s solid underlying performance has also made the company revise its guidance for the current year to the upside. The company’s updated guidance can be seen in the following chart:

AMT earnings report

As we can see, sales and EBITDA are seen growing substantially. Net income is expected to grow as well, but that’s not really an important metric for a REIT, due to high depreciation charges that make the net income metric more or less meaningless. As explained earlier, funds from operations (the better profit metric for REITs compared to net income) growth is not meaningful right now, due to headwinds from higher interest expenses. It is worth noting that American Tower’s management has upped the FFO guidance midpoint by $25 million versus the previous guidance midpoint while the EBITDA forecast has been lifted as well, indicating that underlying business growth is better compared to what management had expected before.

Temporary Headwinds Make For A Buying Opportunity

In the long run, American Tower has a good chance of getting back to meaningful profit growth. Its infrastructure is needed for our modern world, and interest rate headwinds should eventually wane, while AMT’s existing assets should generate higher and higher revenues.

What we see now thus can be described as a temporary headwind. These aren’t great, but they aren’t terrible, either — and when the market reacts negatively to them, that can make for nice buying opportunities.

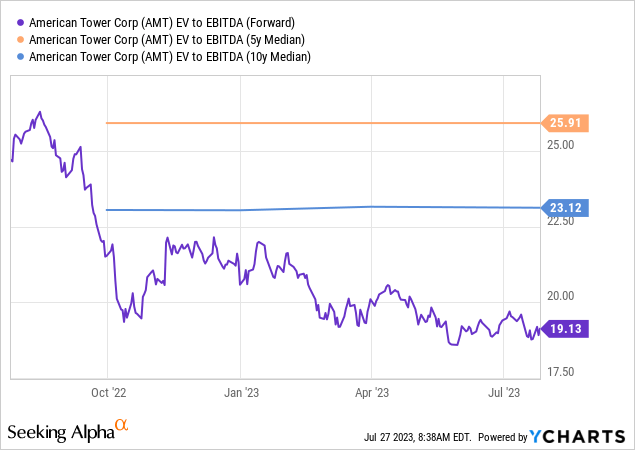

This holds true for American Tower, I believe. In the following chart, we see its enterprise value to EBITDA multiple for 2023 as well as the longer-term averages for this valuation metric over the last five and ten years:

We see that American Tower trades at a pretty clear discount compared to its historic valuation today — EV could climb by 20% in order to hit the 10-year average, while a 30% EV increase would be needed to hit the 5-year median. Note that a 20% increase in AMT’s enterprise value would require a share price increase of more than 20%, all else equal (since EV also accounts for net debt that does not change when shares climb).

With AMT trading at the lowest valuation over the last year by far, and with shares trading well below the longer-term average — not just the average seen during the peak of the pandemic — it seems reasonable to assume that AMT has substantial potential in the long run. This will not necessarily materialize in the very near term, but between some business growth and multiple expansion upside potential, AMT has ample room to climb over the next couple of years, I believe. Add a dividend yield of 3.3%, which is well above the norm for American Tower, and the total return outlook over a multi-year period is pretty appealing. There is no catalyst (that I see) for immediate upside potential, but it seems likely that investors that enter or expand a position here in American Tower Corporation will do well in the long run.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, AMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

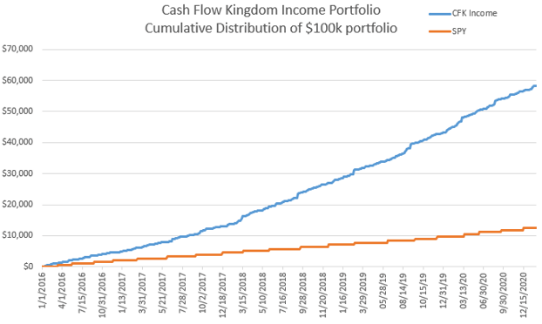

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!