Summary:

- American Tower Corporation is currently the second-largest stock in the Real Estate sector (although it switches off for first between Prologis, Inc. often) and has a resilient business model.

- Unlike some key competitors, American Tower has a lot of international business and benefits from a catch-up effect in less-developed markets and a declining dollar.

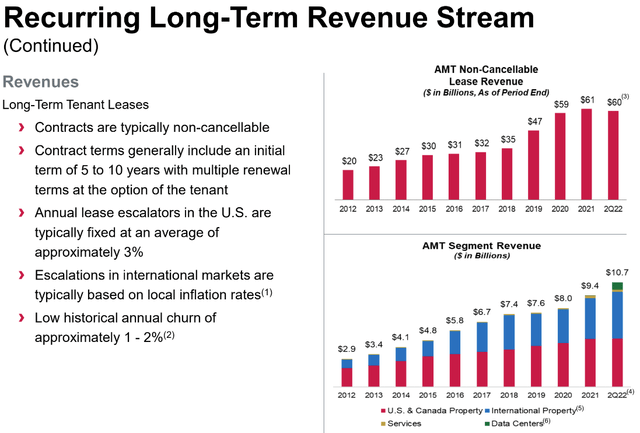

- The company’s model differs from many Real Estate firms and has a resilient and highly profitable multi-tenant property model with iron-clad contracts and stable cash flows.

- American Tower Corporation has a strong competitive position, a demonstrated track record of prioritizing shareholders, and counter-cyclical characteristics.

- The consistency and visibility of American Tower’s cash flows make it a great investment for a year fraught with risks like 2023.

bjdlzx

Stand firm as the tower that never shakes its top whatever wind may blow. -Dante Alighieri

American Tower Corporation (NYSE:AMT) is not your average Real Estate Investment Trust (“REIT”), although it is one of the largest in the S&P 500 Index (SP500). The company has an incredibly stolid business model that mixes high visibility earnings marked by a lot of non-cancellable revenue with high growth potential and exposure to some of the most exciting technological trends occurring in the economy.

The company also enjoys a strong competitive position and is the leader of an effective oligopoly for essential digital economy infrastructure, the need for which will likely only increase over the foreseeable future. The firm had a tough year in 2022, but new growth initiatives like the data-center segment and continuing “densification” at its sites from the ongoing 5G upgrade cycle are enticing reasons to own this stock for the long term.

American Tower Investor Materials

In a very literal way, there is high earnings visibility into American Tower Corporation. High earnings visibility which helps mitigate the fog of uncertainty hanging over 2023. Much of the firm’s revenue is from huge wireless carriers that cannot provide their services without paying American Tower rent.

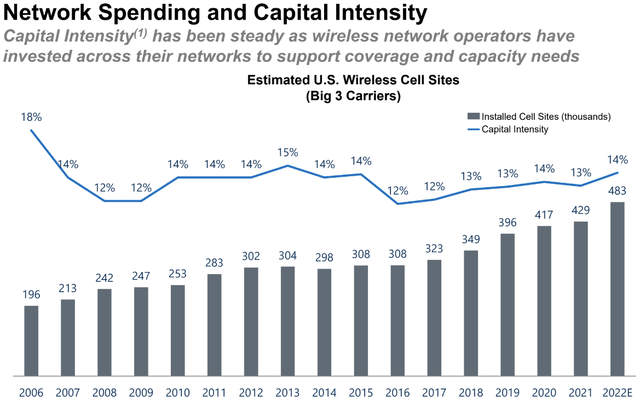

Owning land as your core asset is not only a natural hedge against inflation, but in the tower business placement and geography is incredibly strategic, and this company has the best portfolio in the business. Furthermore, the 5G upgrade cycle will serve as a continuous source of earnings support for this name for the next decade.

One source of safety is that until 2026, there’s a pretty small percentage of lease renewal that will be subject to change. So, like another company I recently recommended that has stable demand from the U.S. Government and sits in the upper echelon of an oligopoly, Raytheon Technologies (RTX), American Tower’s cashflows are not exposed to a lot of economic cyclicality but rather benefit from the consistent and growing demand of its core customers. It had a great recent earnings report that showed how strong demand globally is supporting its financial goals.

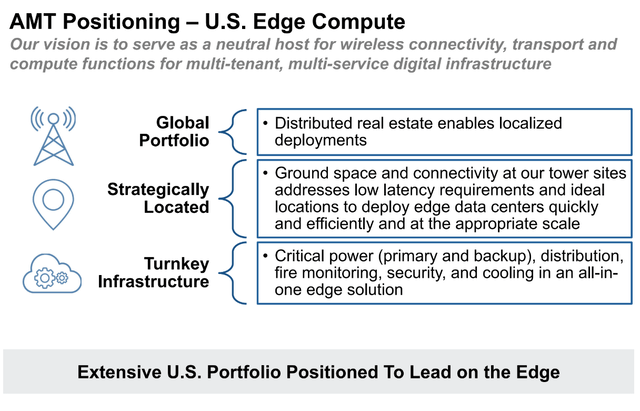

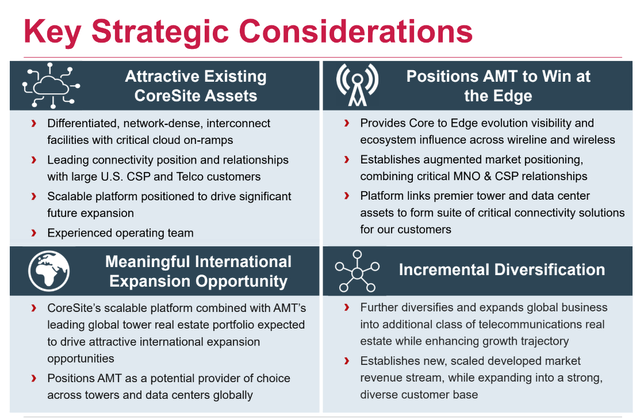

The data center business is nascent but has a lot of potential, particularly for expanding data needs from the Industrial Internet of Things (IIoT). Here the company made some wise strategic acquisitions to fuel growth, but it is also able to leverage its extensive physical footprint to synergize with CoreSite, which was acquired in late 2021. Revenue is already flowing from this addition.

American Tower Investor Materials

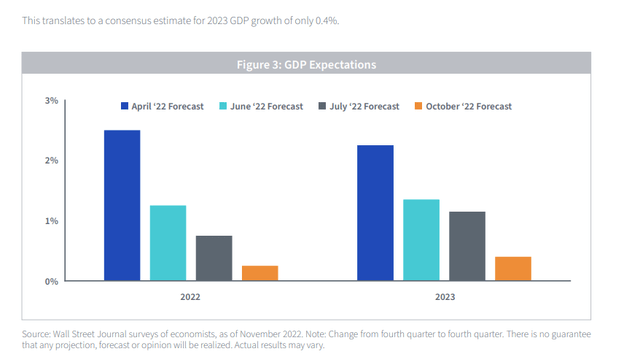

As we start off 2023, there is a pall of uncertainty over the stock market and there is a lot of divergence in the views of market strategists. Yes, 2022 was a historically bad year and back-to-back losses are rare, but there is still a lot of uncertainty about core market drivers, namely the U.S. Federal Reserve. For my part, in my 2023 Outlook I do tend to lean on the side of those who think the bond market is correct and that the Fed’s current dot plot will likely end up being too hawkish. Expectations for GDP growth have continued coming down throughout 2022, and many fear a recession in the coming year.

Here, I also fall into the more optimistic camp. The American consumer has shown resilience and has remaining resources to continue driving economic activity. I think a recession, if one occurs, will be of a mild variety supported by robust financial stability. But, even if there is a bad recession that diminishes economic demand on a wide scale, the demand for data will continue to increase. Only in a worst-case scenario would the seemingly inexorable digital revolution abruptly reverse.

American Tower Investor Materials

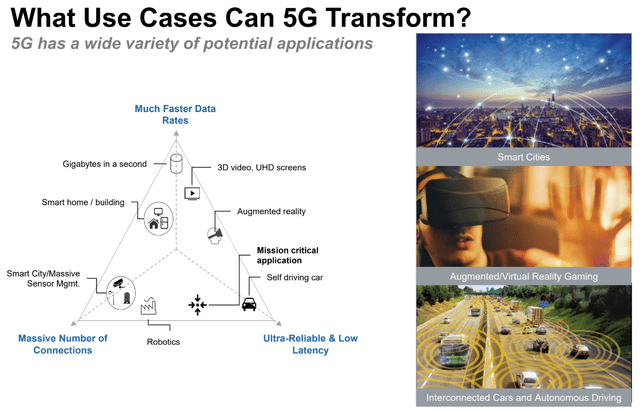

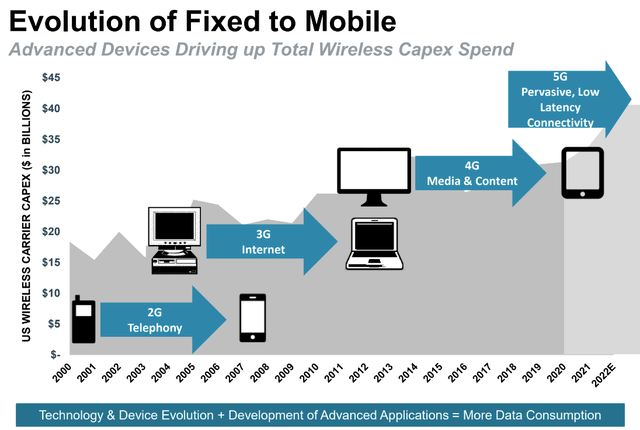

Technological trends like autonomous driving, the Industrial Internet of Things, the rise of Artificial Intelligence, and others ensure that the long-term trend of demand for wireless access to large amounts of data will remain steady and robust, if not more than most currently forecast. Certainly, given the pace of technological progress, the risk seems to be tilted toward the upside rather than downside.

American Tower Investor Materials

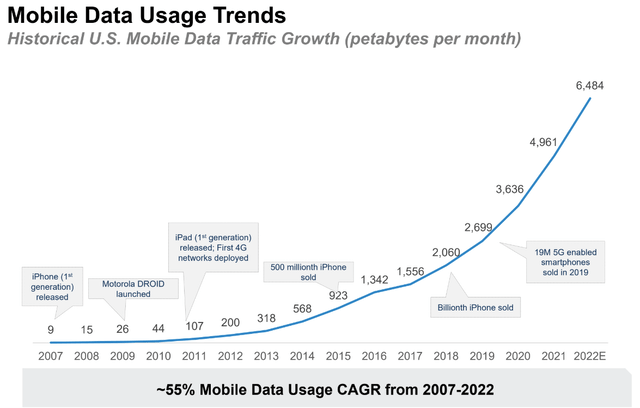

However, you don’t need pie-in-the-ski technological trends to play out in order to achieve growth. Mobile data usage had a CAGR of about 55% from 2007 to 2022, and growth has accelerated over the last 5 years and likely will continue to. American Tower’s growth prospects are tied to some of the highest growth areas of the economy.

American Tower Will Continue to Benefit from 5G Adoption and Increasing Data Demand

American Tower is directly attached to high-growth technological trends. However, as the company’s CEO pointed out, the use cases for 5G have just started to proliferate. Current expectations for carrier demand for tower space is based on current data demand needs, but as more advanced use cases dependent on 5G grow in popularity, so will the pressure on mobile carriers to upgrade their infrastructure to support new data-intensive functionality on a large scale.

American Tower Investor Materials

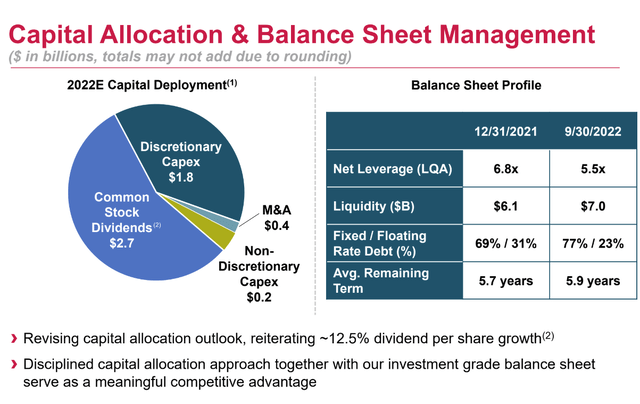

I am humble in the face of so many risks and potential volatility in core inflation drivers, and, therefore, I’m trying to recommend stocks that can keep you alive during a rocky first half to then take advantage of loosening financial conditions that the market will hopefully be looking toward at the end of the year. American Tower does have a high debt load after recent acquisitions, some of which is variable, so it should be able to rally on a better-than-expected outcome from Powell and friends. The balance sheet has been improving and management apparently aims to continue this.

American Tower Investor Materials

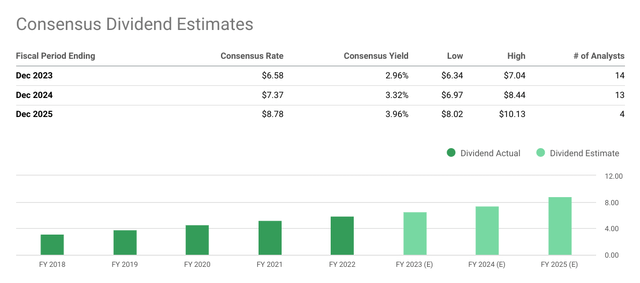

American Tower Corporation has such a solid business, I believe it’s a winner either way. While the dividend yield at American Tower might not be quite that of its main customers like AT&T (T) and Verizon (VZ), I think the yield is attractive and helps mitigate risk. Importantly, it has been growing solidly and consistently and all indications are that it will continue to.

I do believe we will have a new market low in 2023 and a capitulatory selloff. So, picking companies with strong competitive positions, stable cashflows and demand, and a management that can reward shareholders with dividends and buybacks are all ways to insulate yourself from unwelcome adverse surprises.

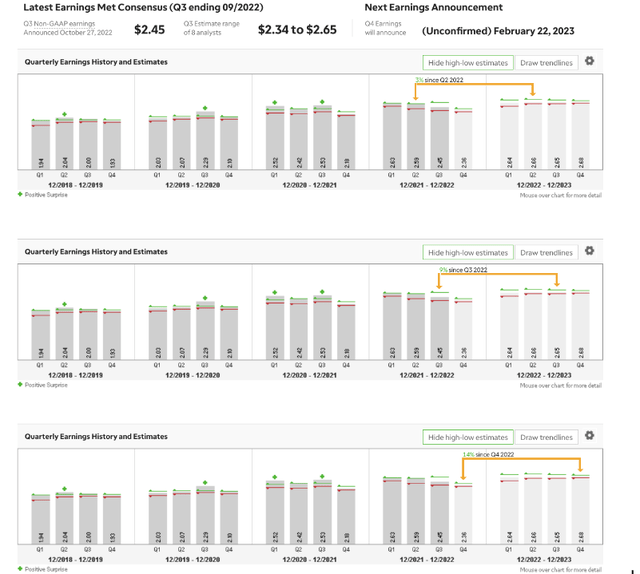

Therefore, when formulating my picks for the first quarter of this year, American Tower Corporation was one of the first stocks that came to mind. I want to own safe stocks that also have an upside kicker in the event of better-than-expected outcomes. I think this company definitely qualifies for that definition, with the added benefit of having a safe and robust dividend and growing prospects for share repurchased over the coming year. I’m also focusing on companies where earnings are currently projected to accelerate throughout 2023 as an added insurance against a market where earnings growth will likely be scarcer.

American Tower is a great mix of defense and offense that I think will be a wise addition to any portfolio in 2023. On the one hand, it has steadier income than even many large old-economy REITs given its unique and growth-exposed business model and the iron-clad contracts it locks in revenue with. It has a concentration in clients, yes, but this concentration of clients is extremely creditworthy and spends voraciously on CAPEX in order to remain competitive, and this directly benefits AMT.

American Tower Investor Materials

Just like some of the other firms I’ve recently recommended, demand for the core revenue driver is stable and relatively insulated from economic cyclicality. This is a key advantage in times of economic uncertainty. There’s very few probable developments that could result in extreme earnings volatility for the company. So, when you see some analysts sitting at one side of the table calling the Fed’s bluff and you see others cowering in fear because of the Fed, know that there are strong companies that can do right by you as a shareholder regardless of who is correct.

Raise the Drawbridge and Get In The (American) Tower

Whenever I think of the oft-used term “moat,” this company comes to mind. Not only do they have high barriers to competition, but they also benefit from an ongoing secular trend that will likely continue to occur regardless of when the Fed tightens and whether there’s an imminent recession, or not. That trend is the insatiable demand that the human race has for data, which is only forecast to continue growing exponentially as the digital revolution progresses.

- First, it is very difficult for companies to switch providers/towers because it’s cumbersome and cost prohibitive.

- Secondly, the company has very certain cash flows (domestically) because of long-term agreements with very creditworthy core customers.

- Thirdly, the core asset here is Real Estate and the company’s extensive portfolio includes strategically located sites with potential for more business as “densification” needs from 5G increase.

- Fourthly, American Tower is the largest and most geographically diversified company with high-growth opportunities in developing markets.

- Finally, the company’s growth is directly tied to increasing data demand and upgrade cycles. 5G will continue to drive demand over next few years.

Risks to American Tower and My Bullish Thesis

American Tower Corporation is concentrated in customers as we mentioned. So, this risk can have some nasty side-effects. In the case of Sprint’s merger with T-Mobil, the consolidation resulted in less use of the company’s infrastructure being used and proved a headwind. Some of the key customers do have high debt loads, and if there were a downgrade of a major U.S. carrier this could definitely cause very certain cashflows to become less certain, potentially hurting the valuation.

However, in domestic markets further consolidation is unlikely any time soon. Risks from consolidation in foreign markets from additional consolidation may hurt the companies’ earnings over the next few years though. Spain and Germany are two key markets where this is possible, although American Tower’s exposure to Europe is just starting to ramp up. In less advanced wireless markets there are always a lot of risks to doing business. One example would be Vodaphone reneging on commitments and paying the company only 60 cents on the dollar for its 2022 commitments. If there is a global recession, events like these could become more common.

American Tower Investor Materials

One of the largest potential risks is if the year-plus old merger with CoreSite proves to be ill-fated or doesn’t realize the desired synergies. A lot of the ability to outcompete its peers depends on offering a significantly differentiated platform, and if these efforts fall flat, I might re-evaluate my bullish stance on American Tower in favor of a peer. Still, for the time being, I think this company has better growth prospects than its peers and the merger seems to be on track so far.

Of course, while the company is insulated from economic cyclicality, no company is fully immune from it. While the company has been improving the balance sheet, in the event of a higher terminal rate than currently forecast, or a policy error by the Fed that results in a prolonged period of high rates it is possible the financial condition of the company could erode significantly.

Lastly, technological innovation that significantly changes how data is consumed and distributed could obviously upend the resilient business model of this company. However, the regulatory structure and zoning laws do make technological change in this industry somewhat slow. However, like any company with upside from higher-than-average growth from technology, it can be a double-edged sword when creative destruction occurs.

Conclusion

We’ve just come off one of the most difficult years for investing after a long decade of accommodative monetary policy and geopolitical stability. 2023 offers a lot of risks that could de-rail investment strategies. Despite the large losses in many large-cap technology names, the fog of risks and uncertainty makes me prefer stocks that have strong competitive positions, positive projected earnings momentum throughout the year, and stable demand and growth levels that are relatively unaffected by the aforementioned risks.

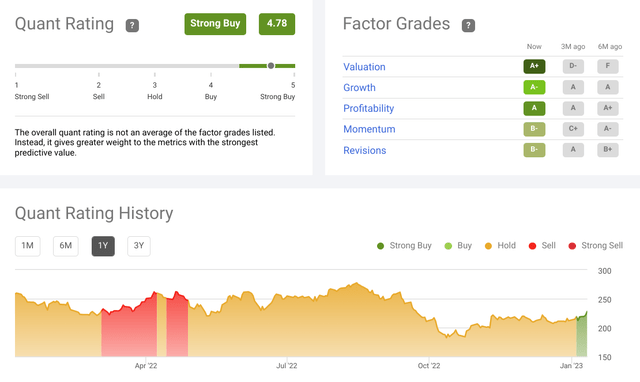

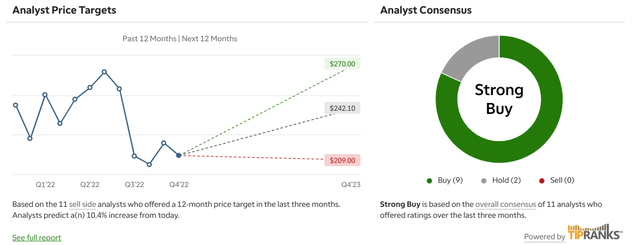

The analyst community is generally positive on American Tower Corporation. I personally prefer the quality of American Tower to peers in today’s market environment. I’m encouraged that the firm just raised the dividend by a healthy 6.1% and that expected domestic organic growth from 2023 to 2027 outpaces chief rivals Crown Castle (CCI) and SBA Communications (SBAC).

American Tower Corporation is an incredibly strong company with a proven and capable management team, a pristine and superior portfolio of assets, and an exciting new growth driver in its data center business. Currently, demand projections suggest that American Tower’s premium valuation is justified, if not on sale. The strong competitive position and resilient business model are complemented by the fact that the company is still digesting a big acquisition, and capital allocation will probably be more focused on buybacks and dividends while the integration occurs. Get in the Tower!

Disclosure: I/we have a beneficial long position in the shares of AMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.