Summary:

- American Tower offers a discounted valuation compared to its historical average and has a sustainable dividend.

- The company has positive growth prospects in the telecommunications infrastructure sector, particularly in international markets.

- American Tower’s financial performance has improved, with strong revenue growth and increased profitability, despite a decline in net income due to a goodwill impairment charge.

Bill Oxford

American Tower (NYSE:AMT) currently offers a discounted valuation compared to its history and has a sustainable dividend, making it an interesting play within the REIT sector.

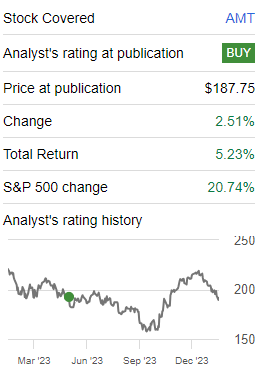

As I’ve covered in a previous article, American Tower is a good long-term income investment due to strong fundamentals and a sustainable dividend. However, its relatively weak growth prospects have been a drag on its share price performance, and since my previous article its shares are up by ~5%, clearly underperforming the market during the same period, as shown in the next graph.

Article performance (Seeking Alpha)

In this article, I analyze American Tower’s most recent financial performance and update its investment case, to see if it remains an interesting income option or not in the REIT sector.

Financial Overview

American Tower is one of the largest REITs in the world, measured by its market value of about $88 billion. Despite its large size, it still has some positive growth prospects over the medium to long term, as the REIT is focused on telecommunications infrastructure, which is expected to gradually expand due to increased data usage over the next few years.

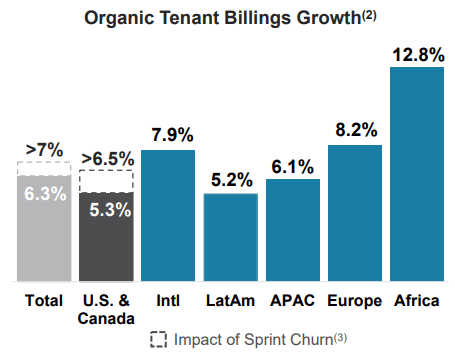

This is a supportive backdrop for American Tower both in developed and emerging markets, and the company is well positioned to benefit from this structural trend, given that it has operations across the globe. In the last quarter, American Tower was able report strong revenue growth across the group, even though, not surprisingly, the company is reporting higher revenue growth in international markets, namely in Africa and Europe, showing that demand for infrastructure assets remains strong across the world.

Organic growth (American Tower)

Property revenue in Q3 2023 amounted to nearly $2.8 billion, up by 7% YoY, even though growth was impacted negatively by forex during this period.

Due to its business model that has relatively low operating expenses, given that American Tower usually owns the real estate and the tower structure, while its tenants usually own the remaining tower equipment, American Tower has been able to report a positive operating leverage. This means that higher revenues don’t necessarily lead to higher operating expenses, thus American Tower increasing top-line has led to higher margins over the past few quarters. This happens because it has long-term leases with contractual rent escalators, high renewal rates and low vacancy, plus relatively low maintenance expenditures.

Therefore, during a period of rising inflation, its business benefits from these types of contracts, if the company can maintain good cost control. In the last quarter, this was visible on its property gross margin, which increased by 10.4% YoY to nearly $2 billion (gross margin of 71%), a higher growth rate than compared property revenue, showing its positive operating leverage.

Beyond the fact of having relatively sticky operating expenses, its operations also have positive operating leverage from a higher customer base, given that when it establishes a property and a tower, there are limited additional costs of adding additional tenants, thus its incremental revenue from new tenants flow almost directly into its bottom-line.

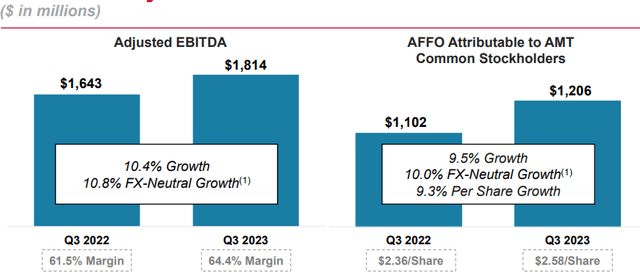

Taking this background into consideration, it’s not surprising to see that American Tower’s profitability has improved significantly in the past few quarters, with EBTDA and Adjusted Funds From Operations (AFFO) both increasing at a higher rate than revenues in Q3, as shown in the next graph.

Profitability (American Tower)

Indeed, its EBITDA margin has increased by 290 basis points over the past year to 64.4%, which is a very good outcome during a period of significant macroeconomic uncertainty, showing that its business has a recurring profile and benefits from higher demand for data usage, a long-term trend that is not expected to change in the foreseeable future.

On the other hand, American Tower’s reported net income declined by 30% YoY to $587 million in the quarter, impacted by a goodwill impairment charge of $322 million related to its India operations. This happened because American Tower put this business for sale and third-party fair values received for the business were lower than its accounting value, which led to a revaluation of the goodwill in its balance sheet. In January 2024, American Tower agreed to sell its India operations to Brookfield for $2.5 billion, exiting the country when the deal is completed.

While India is an emerging market and growth prospects are good for the telecommunications industry in the country, American Tower was heavily reliant on one tenant, namely Vodafone’s (VOD) local unit, while Brookfield is already present in the country and its main tenant is Reliance Industries, thus it may have better operating prospects than American Tower in India.

American Tower is expected to use the proceeds of this sale mainly for balance sheet deleveraging, which seems to be a sensible move and should lead to a more sustainable dividend in the future.

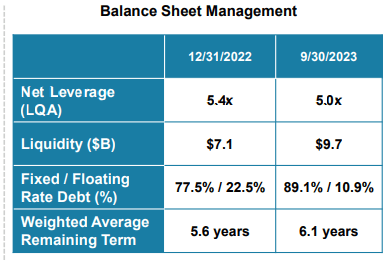

While its acquisition of CoreSite Realty back in 2021 led to an increase in its financial leverage, American Tower’s strategy has been focused since then on balance sheet deleveraging and the recent deal related to its India operations is another step to improve its leverage position. Indeed, its net debt-to-EBITDA ratio was 6.1x at the end of 2021, while this has decreased to 5x at the end of Q3 2023, a much more acceptable position.

Moreover, its liquidity and debt profile have improved over the past few quarters, as the company was able to raise new bonds, increasing the weight of fixed-rate debt and the average maturity of its outstanding debt.

Debt profile (American Tower)

This shows that despite a tough environment for REITs due to the rising interest rate environment, American Tower has been able to maintain good access to capital markets, which is a supportive factor for a sustainable business model over the economic cycle.

While its leverage ratio has declined gradually over the past couple of years, it’s still at the top of its desired range of 3-5x, thus American Tower is still in a deleveraging process and therefore is not likely to enter into large M&A deals or increase aggressively its shareholder remuneration policy.

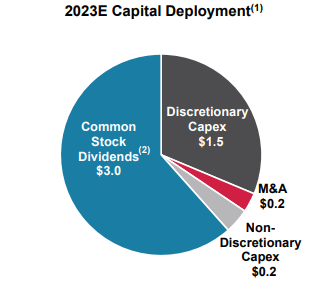

Indeed, while American Tower expects AFFO to be about $4.57 billion in 2023, its capital deployment plan is to allocate this amount toward dividends, capital expenditures, and small M&A operations, thus it’s not expected to retain much cash for deleveraging. This means that its financial leverage ratio should come down mainly from higher EBITDA, while its cash flow generation should not be used to reduce debt in the short term.

Capital deployment plan (American Tower)

Regarding its quarterly dividend, American Tower has increased it gradually over the past few quarters, to a current level of $1.70 per share, or $6.80 per share annually, reflecting annual dividend growth of about 10%. However, for 2024 its guidance is for a flat dividend, thus further increases in the coming quarters are not expected.

This means that, at its current share price, American Tower offers a forward dividend yield of about 3.56%, which is an acceptable level, but much lower than other REITs. Indeed, even compared to its closest peer Crown Castle (CCI) it offers a lower yield, thus American Tower’s income appeal is not fantastic even though its dividend is sustainable and should maintain a growing path over the long term.

While for 2024 its dividend should remain more or less unchanged compared to the mid-point of the previous year, according to analysts’ estimates, its dividend is expected to grow to $8.16 per share by 2026, showing that American Tower’s dividend growth prospects are relatively good over the next few years.

Conclusion

American Tower is a good income investment due to its strong fundamentals and safe dividend, even though its dividend yield is not that high. Nevertheless, its valuation is also quite attractive, given that it’s currently trading at 18.5x FFO, at a significant discount to its own historical average of nearly 25x over the past five years, making it also interesting from a value perspective for long-term investors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.