Summary:

- AMT is a major cell tower REIT with a global exposure and a significant allocation to data centers.

- Data usage is expected to grow by 23% per year for at least the next five years giving AMT a long growth runway.

- At the same time, the company trades at a reasonable valuation presenting a buying opportunity.

energyy

I’m quite bullish on technology and find the combination of technology and real estate offered by cell tower REITs very appealing. So an article on a cell tower REIT is long overdue. Today I want to cover a leader in the space – American Tower Corporation (NYSE:AMT) which is one of the largest cell tower tenants in the world with a portfolio of over 200,000 cell towers on 6 continents. This is in contrast to Crown Castle (CCI) which has operations exclusively in the US.

AMT is involved in a fairly simple business. It buys land, builds a cell tower, and then leases space on that tower to major telecommunications providers such as Verizon (VZ) or T-Mobile (TMUS) so that they call to place their own antennas there. This is why the REIT derives the vast majority of its revenue from only three tenants. New revenue is created by either expanding the tower network and building new ones or by adding existing infrastructure on existing towers. What’s great is that the industry is expected to grow quite quickly over the next 5-10 years. In particular, AMT forecasts growth in the number of connected devices as well as usage per device to generate growth in overall traffic of 23% per year. That’s impressive and since this will in large part be driven by 5G, which is a new technology and will require new technology on cell towers, the REIT will almost surely capture a considerable part of this growth.

AMT’s international focus is great because emerging markets are many years behind in terms of 4G adoption, which I believe means that the growth runway is very predictable there and is longer than in the US. Of course, this also comes with some negatives. The main one being harder collections due to less developed policies and laws. For example AMT has struggled quite a bit in India to get rent from Vodafone Idea.

The last thing I want to touch on before looking at their recent results is their asset allocation because unlike CCI, American Tower Corporation is not a cell tower pure play. This is because of their acquisition of data centers from CoreSite. The acquisition has been widely covered here on Seeking Alpha, so I won’t spend too much time on details, but the important thing is that the addition of data centers is great in my opinion because I expect to benefit from the transition to AI which we are currently seeing. Moreover, it’s important, because data centers are quite expensive and trade at high FFO multiples, so it’s important to take this into account when valuing AMT.

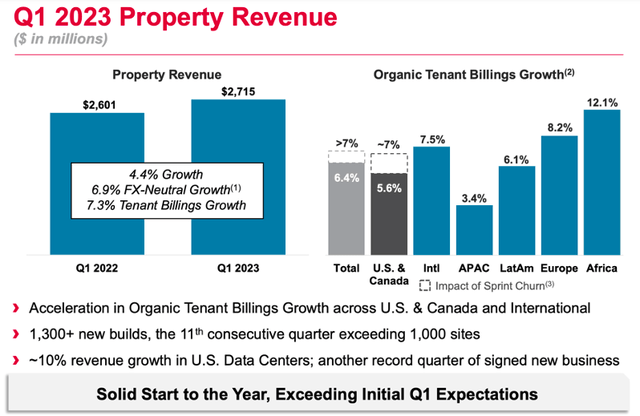

Their Q1 results have been quite good. Property revenue increased by 4.4% on an organic basis while tenant billings increased by 7.3% (or 6.4% including the churn from Sprint, which merged with T-Mobile therefore terminating all of their leases). I also want to point out that growth is much stronger in emerging markets. See Africa for example which posted a 12.1% growth in Q1 2023. This supports my thesis that global exposure will enable AMT to grow quicker. Since results exceeded expectations, management has raised their guidance for the full year from AFFO of $9.60 per share to $9.65 per share. Though not a large increase, it’s indicative of their confidence.

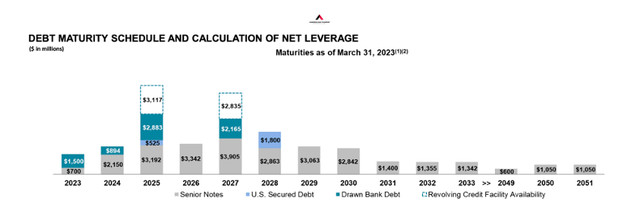

So far all seems well for AMT. While future growth is never certain, I see AMT as very well positioned to capitalize on the inevitable growth in data usage. Of course, no analysis of a REIT would be complete without looking at their balance sheet, especially these days. AMT has a BBB rating and although net debt of $36 Billion seems high, it represents 5.2x EBITDA. AMT’s maturity schedule is good with a lot of very long term debt and manageable scheduled repayments in 2023 and 2024. One thing to keep an eye on is their percentage of fixed debt, which stands at 79%. I consider this to be on the lower end and since their current average interest rate stands below 3%, it’s more than likely that we will see the interest expense higher in the following quarters.

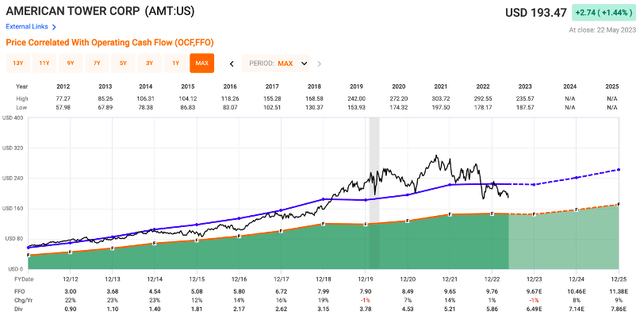

Still, I see AMT as a safe play on cell towers, without any major fundamental red flags. At the same time, it trades at 20x FFO, which is below the historical average of 23x and pays a forward dividend yield of 3.3%. These metrics make it obvious that AMT is more of growth play than a pure income play. Despite this year’s FFO being flat, the consensus calls for 8-9% growth from 2024 onwards. If the company delivers on that and the multiple reverts closer to where it was historically, I see no reason why AMT couldn’t return to $250 per share, which happens to be my price target. As soon as the economic situation stabilizes and telecommunication carriers resume investing into new technology, I expect FFO to grow rather quickly. For those reasons, I’m confident to rate AMT as a BUY here at $193 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.