Summary:

- American Tower Corporation is a highly respected REIT, and as the price has been declining I decided to look more into it as a possible investment.

- AMT has done a great job at growing its top and bottom line, but its yield is too low for me and the valuation is too rich at this point.

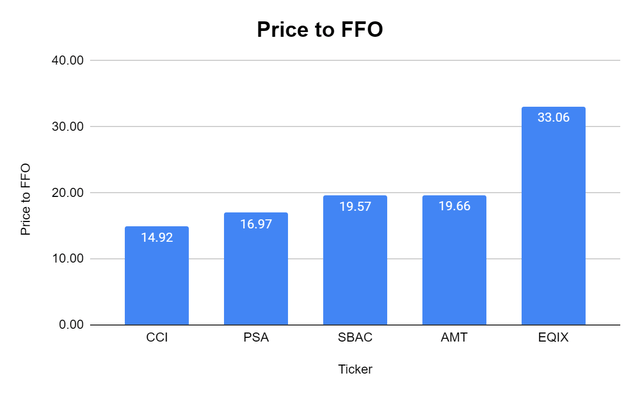

- I think there are better opportunities for yield in the REIT sector and paying 19.66x for AMT’s FFO when its yield is 3.23% isn’t a good trade-off for me.

Sakorn Sukkasemsakorn

There hasn’t been a negative article on American Tower Corporation (NYSE:AMT) since October of 2022, and you would need to go back to December 2021 to find another. I am having difficulty understanding why so many contributors are intrigued by AMT. I am not saying AMT isn’t a good company, as they have a global stranglehold on wireless infrastructure. AMT operates across 6 continents and has 226,000 sites in 26 countries. I actually love the business as AMT is an owner, operator, and developer of multitenant communications real estate and generates over 98% of its revenue from leasing its properties, fiber, telecommunication assets, and data centers. We live in a world where communication is as second nature as breathing, and AMT helps construct the backbone of the industry. I have several problems with AMT as an investment, as the dividend yield is 3.23%, its book value is a small fraction of the share price, and it’s overly expensive compared to other REITs I would rather invest in. AMT would need to decline a great deal for me to consider adding it to my income portfolio.

Why would you take on equity risk looking for yield in this environment if the yield is anything less than 5%?

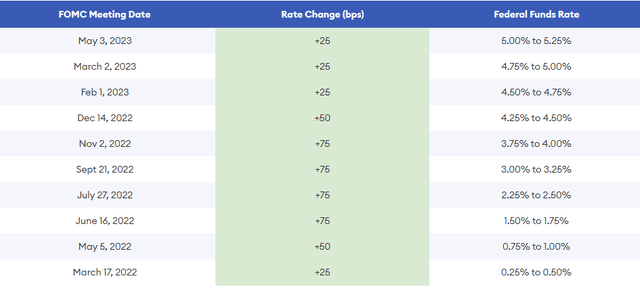

Since March of 2022, the Fed has delivered 10 consecutive rate hikes, increasing rates from 0.25% to 5.25%. Jerome Powell has been clear that the Fed will do what is necessary to tame inflation and ensure that it is eradicated from the system. The Fed’s only lever is to increase or decrease the Fed Funds Rate. The next FOMC meeting will commence on June 14th, and the CME FedWatch Tool indicates that there is a 25.7% chance the Fed will take rates to 5.5%.

As rates rise, the yield-starved market we were accustomed to vanished. The days of 2-3% being considered by some as high-yield are gone. Today, with the Fed Funds Rate at 5.25%, cash is no longer trash, and generating a healthy return from non-risk assets is a dime a dozen. There are many CDs that are offering 4.75% – 5.2% on a 1-year APY and as much as 4.5% on a 5-year APY. You could buy 2-year Treasury Notes at 4.308%, or a 10-year at 3.712%.

If you’re looking for yield in 2023, there is no shortage, and if you’re not looking for yield, I doubt investing in REITs is a popular option. So, sticking with the premise of investing in REITs to generate passive income and produce a larger yield than you could find from non-risk assets, why would AMT be an interesting choice? AMT has a current yield of 3.23% and is stuck in a downtrend. Back in January of 2023, AMT traded for around $220, which placed its yield at the beginning of the year at 2.84%. Looking at AMT through the lens of an underappreciated asset and making an investment with the premise that it will increase and generate capital appreciation while throwing off a modest dividend is one thing, but that’s not why I invest in REITs. There are many companies that I feel are undervalued. If I were looking for a capital appreciation investment, I would allocate capital to Amazon (AMZN), Truist Financial Corporation (TFC), or Palantir (PLTR) well before AMT. It’s hard for me to get excited about dividend yields that are under 5% when I can get 5% on a CD.

I went through the financials and compared AMT to its peer group and to REITs I am invested in and came to the conclusion that if I am going to allocate more capital to REITs, AMT isn’t making the cut.

AMT has been a growth machine, and I can see why people were excited about it. This is a company that has increased its revenue by 221.98% over the past decade as its revenue grew from $3.29 billion to $10.58 billion. In the TTM, AMT has generated $4.96 billion in funds from operations (FFO) and $6.6 billion in EBITDA. AMT has strong margins as it produces a 46.89% FFO margin and a 62.55% EBITDA margin. Many have probably heard Charlie Munger discuss his disdain for when people use EBITDA as a measure of profitability, but in the world of REITs, it’s an important metric. Credit rating agencies determine a REITs leverage ratio by looking at a REITs debt to EBITDA. The other main metric is FFO which is determined by taking GAAP net income and, adding depreciation and amortization, then deducting gains from property sales. When it comes to REITs, FFO is more important than traditional earnings because, under GAAP accounting standards, depreciation, and amortization are deducted from net income. For REITs where properties appreciate in value over time, depreciation and amortization charges decrease EPS artificially and can make the dividend payout ratios look artificially high if you’re using traditional valuation methods. This is why FFO is a more common metric to determine operating cash flow for REITs and look at the safety of the dividend. AMT has done a tremendous job at driving its bottom line higher as its FFO has increased 294.75% to $4.54 billion since 2013, and its EBITDA has grown 217.58% to $6.62 billion in the same period.

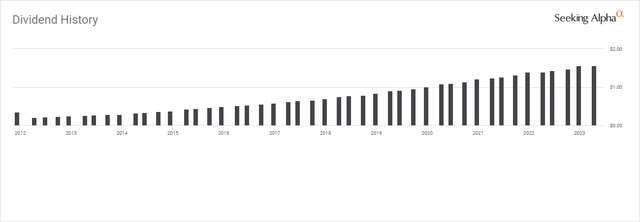

Investors have been rewarded with a growing dividend as AMT has provided 10 years of consecutive dividend growth. Over the previous 5-years, AMT has had an average annual dividend growth rate of 16.96%. The quarterly dividend has grown 500% from $0.26 to $1.56. AMT has a forward FFO of $9.84, which places its $6.24 annualized dividend at a 63.41% payout ratio. From a dividend growth perspective, AMT has been phenomenal, and its track record of growing its top and bottom lines indicates future dividend growth is on the horizon.

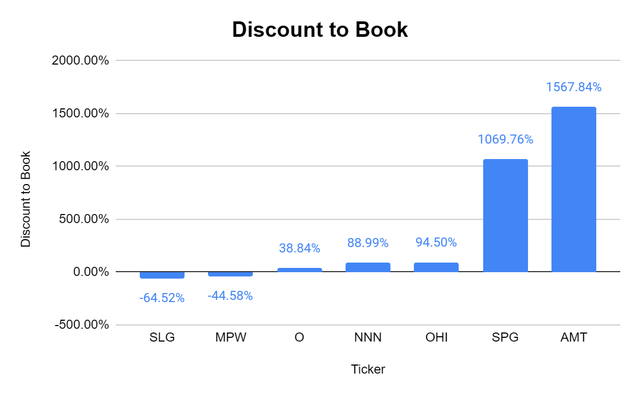

So if I think its growth is good on the top and bottom line, and the dividend growth is strong, why don’t I like AMT as an investment? For starters, AMT has a dividend yield of 3.23% which isn’t attractive to me for a REIT. AMT also has $46.9 billion of debt on the balance sheet, and while its EBITDA places its debt-to-EBITDA ratio in an acceptable range for me, the amount of debt has impacted AMT’s book value. Some people don’t care about book and tangible book value, but I do. AMT has a book value of $11.60 and a tangible book value of -$54.13. It’s hard for me to get excited about AMT when it trades at a 1,567.84% premium to its book value, and when you strip away the intangible assets, its tangible book value is negative.

Seeking Alpha has AMT’s peer group listed as:

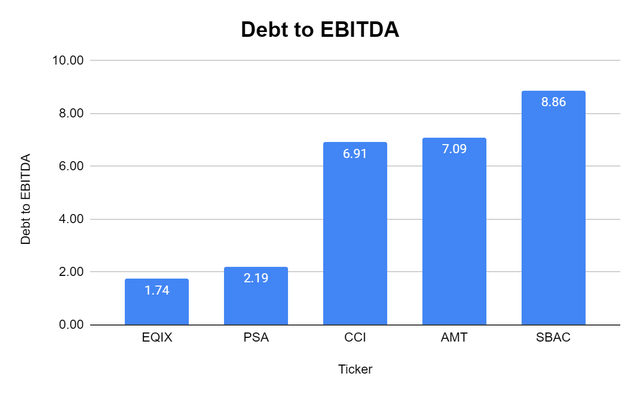

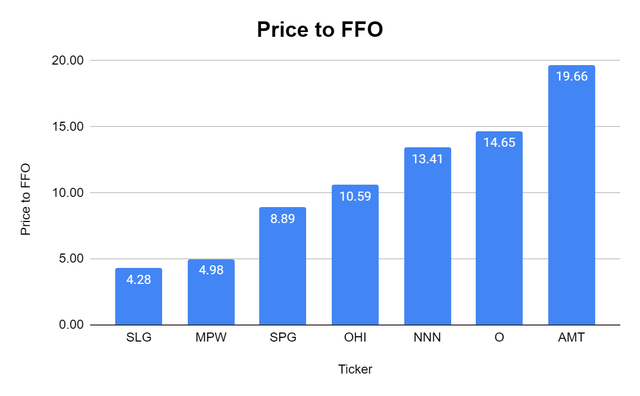

In addition to the low dividend yield and large premium on its book value, AMT has the 2nd largest price-to-FFO ratio at 19.66x and the 2md largest debt-to-EBITDA ratio at 7.09x. I am cheap, and I want to pay a low price for a REITs FFO, and if I am going to take on a debt to ratio of more than 7, it needs to make sense.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

I compared AMT to 6 REITs that I am invested in to see how it looked. I compared it to:

- Realty Income (O)

- NNN REIT (NNN)

- Simon Property Group (SPG)

- SL Green Realty (SLG)

- Medical Properties Trust (MPW)

- Omega Healthcare Inc (OHI)

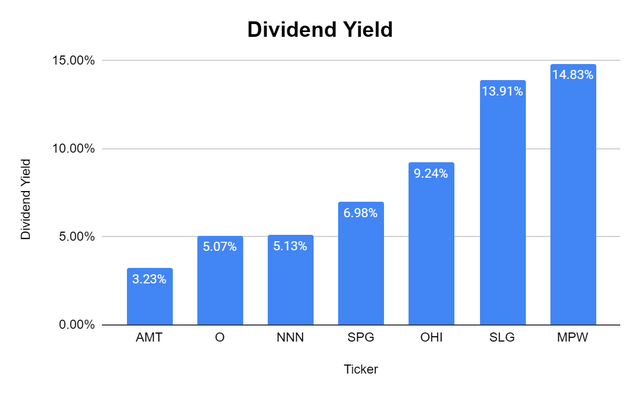

The 6 REITs I compared AMT to have a dividend yield range of 5.07% up to 14.83%, while AMT is at 3.23%. From an income perspective, AMT isn’t enticing. I am not a yield chaser, and I do my due diligence, and after a lot of research, I am ok with the risk from owning MPW and SLG.

Steven Fiorillo, Seeking Alpha

AMT has the largest price-to-FFO ratio of these companies at 19.66x, while O is the next largest at 14.65x. SLG, MPW, and SPG all have single-digit price-to-FFO ratios. In addition to the lowest yield, I would be paying the largest price to FFO for AMT, which doesn’t sit well with me.

Steven Fiorillo, Seeking Alpha

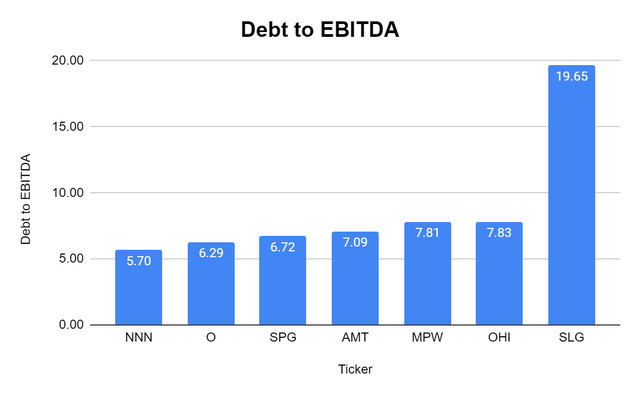

From a debt to EBITDA perspective, AMT looks fine compared to the REITs I selected. Yes, SLG has a sky-high debt-to-EBITDA ratio. I am not worried because it should be lowered considerably this year as they are selling some non-core assets and allocating a substantial amount of money to deleverage its balance sheet.

Steven Fiorillo, Seeking Alpha

From a discount-to-book perspective, SLG and MPW trade significantly under book value. Even if their assets are re-rated and take a 30% haircut, they would still trade under book value. It’s also very hard for me to consider AMT’s valuation when I can pay 38.84% over book for O, which is arguably the gold standard in REITs.

Steven Fiorillo, Seeking Alpha

Conclusion

Would I like to own a REIT that is the backbone of the communication sector? Absolutely, but not at this yield or valuation. I need at least a 5% yield to get excited about a REIT, especially when I can get 5% from a risk-free investment. I think AMT is a strong company, but the numbers don’t work for me today to allocate capital toward it. I am neutral on AMT because there is no doubt it can grow its top and bottom line while increasing the dividend, but from a value perspective, I would rather invest in other RIETs that have more compelling valuations and significantly larger yields. An investment in AMT could do well, but it’s not for me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, TFC, PLTR, O, NNN, SPG, MPW, OHI, SLG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.