Summary:

- AMT and CCI are two of the main tower REITs, though they’ve been venturing into other business lines.

- Both are quite popular with income-focused investors as they’ve grown their payouts to shareholders over the years.

- AMT has been the faster grower, but CCI potentially represents more upside due to cheaper valuation.

- Having one or the other or both in a portfolio can be worthwhile for long-term investors.

Ivelin Denev/iStock via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on December 30th, 2022.

The tower REITs are often popular ways to invest in the growing demand for more connected devices and 5G. More connected devices and 5G requires more towers. That’s where American Tower Corp (NYSE:AMT) and Crown Castle Inc (NYSE:CCI) can come in. They are two of the largest and most popular tower REIT plays.

Both are worthwhile investments, but AMT presents better historical growth – while CCI appears to be the better value. Investing in either or both could provide investors with long-term success either way. That would be through continued growth in their dividends and potential appreciation.

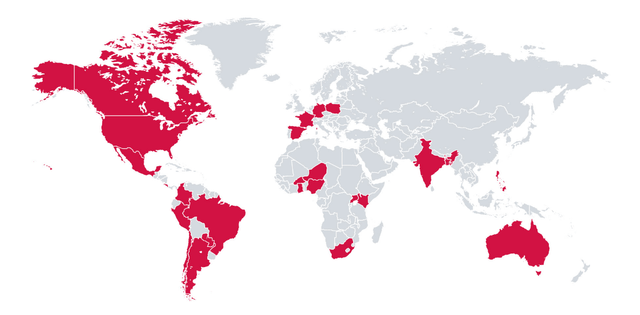

American Tower has operations around the globe, with approximately 223k sites. AMT has also been making a push into data centers.

AMT Global Presence (American Tower)

CCI is the smaller of the two operations, with around 40k towers. However, they’ve been acquiring fiber operators to diversify their business as they push into small-cell communication sites.

So there are certainly differences in the direction that these two tower REITs are going. AMT seems to be focusing on its global tilt along with data centers and pushing into more of those efforts. CCI might not be expanding internationally but is pushing into other areas of the connectivity market through acquisitions.

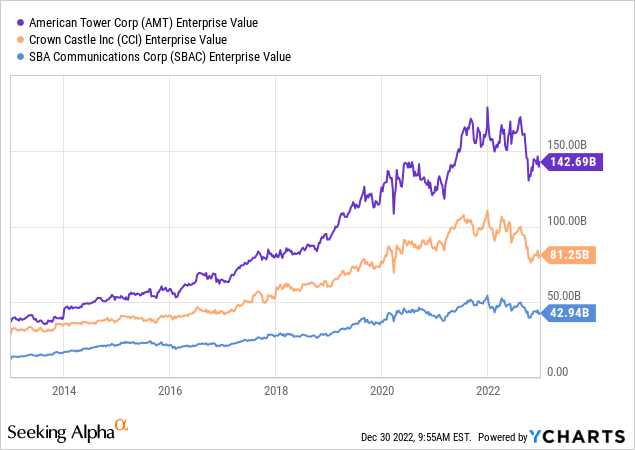

Below highlights the enterprise value of each of these two. I’ve also included SBA Communications (SBAC) for some more context to highlight that AMT and CCI are the two largest in this space by a fairly wide margin.

Ycharts

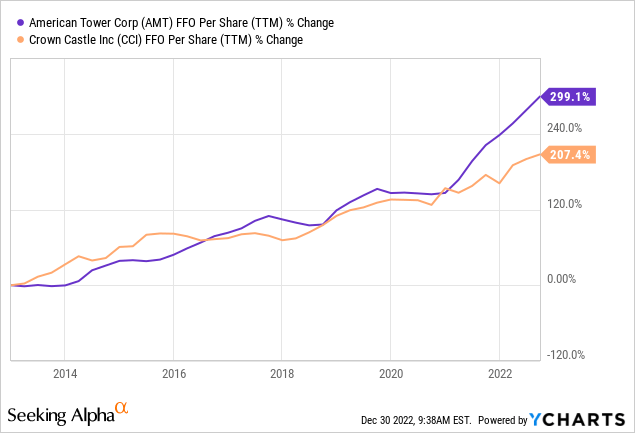

Earnings Growth And Expectations

AMT has provided higher historical growth, especially during the last couple of years. It looks like their funds from operations have really taken off relative to CCI. Demand for 5G has been the main driver for both, providing some substantial FFO growth over the years, which is great to see as it provides the funds for those growing payouts to investors.

Ycharts

Despite this continued growth from both, AMT has fallen around 25.5% for the year, and CCI is off just over 34%. To be fair, though, both had quite strong runs heading into this year. They experienced a similar trajectory to growth and tech names over the last few years. So some of that is naturally deflation in the higher valuations. I think that’s primarily why both are now more compelling overall. Not only have their share prices fallen, but it has come down meaningfully enough to make them attractively valued now.

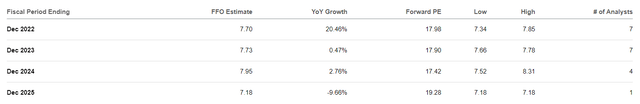

One thing that might be interesting to note is that going forward, analysts expect CCI to show higher growth compared to AMT. For 2022, both are showing high expected FFO growth, but the ~20% for CCI overtakes the ~15% for AMT. It is generally harder for larger REITs or companies, in general, to put up higher growth. That could be some of what is at play here.

Also, to be fair, neither have a lot of analysts covering them. With a smaller number covering them, we don’t always get a clear picture of expectations. In this case, one or two outliers can sway a figure materially.

CCI FFO Outlook (Seeking Alpha)

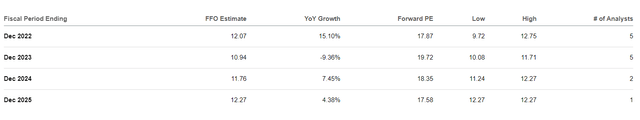

Analysts are expecting for fiscal 2023, AMT will show a decline in FFO before rising again.

AMT FFO Estimates (Seeking Alpha)

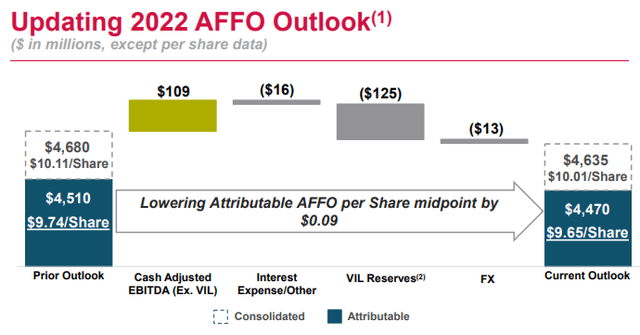

AMT has an outlook of $10.01 consolidated AFFO that they provided themselves. That was reduced from their prior guidance, but

AMT AFFO Outlook (American Tower)

They cite VIL-related reserves, interest expense and FX headwinds as being the factors. Here’s more on the topic of VIL from their last earnings call.

In Q3, collections from Vodafone Idea or VIL, fell short of our billings. And the customer has also communicated an expectation for that trend to continue through the balance of this year. As a result, we found it prudent to take certain reserves associated with VIL in Q3 and against the anticipated Q4 billing shortfall in our revised guidance.

Consequently, our full year expectations now include approximately $95 million in additional revenue reserves, about half of which was booked in Q3. It also includes the removal of a $30 million bad debt reversal that was assumed in our prior guidance. Together, these result in a reduction in adjusted EBITDA and attributable AFFO of $125 million.

Valuation Comparison

AMT is currently trading at a P/FFO of 17.87. This is quite similar to CCI with its 17.98 P/FFO. When looking at P/AFFO, AMT comes in at 21.70, and CCI is at 18.80.

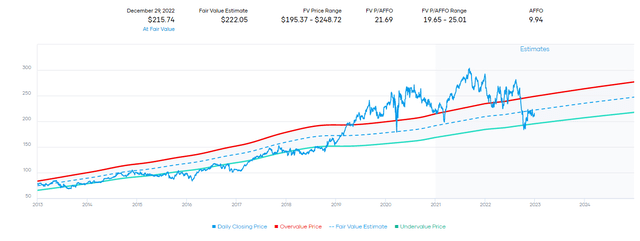

Based on the longer-term average P/AFFO range, AMT is right in the middle of its range. There could be some upside from here, with a fair value estimate coming in at $222.05 at the mid-point. That would be around a 3% upside potential from the last close to that estimate price.

AMT P/AFFO Estimate Range (Portfolio Insight)

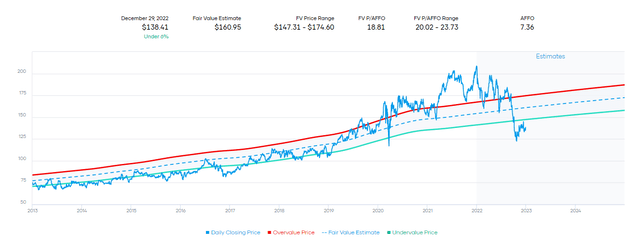

That’s where CCI looks like a better relative value. With the last closing price of $138.41 and an estimated fair value of $160.95, that could see shares rise 16.3% before hitting that mid-point estimated level.

CCI P/AFFO Estimate Range (Portfolio Insight)

Dividend Comparison

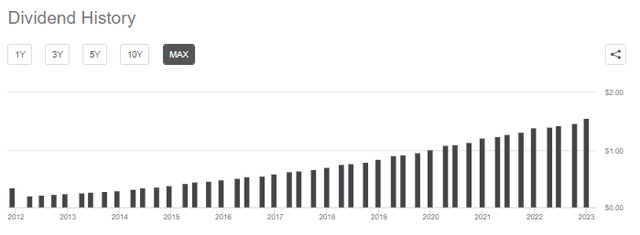

When looking at the dividend history of both, they’ve provided strong and growing payouts to investors. AMT has been able to provide an increase every single quarter for years now. That’s part of what makes AMT a fairly unique income offering for shareholders.

AMT Dividend History (Seeking Alpha)

The last quarter’s increase was a 6.1% increase. That alone is almost enough to cover the change in inflation over the year. However, year-over-year, it was a more substantial 12.23% increase from Q4 to Q4. They’ve managed a 20.61% 10-year CAGR. The 5-year CAGR comes in at a healthy 17.47%.

After these larger increases previously, it would seem they haven’t been as aggressive in the latest year. Given the current economic uncertainty, I think that’s not necessarily a negative.

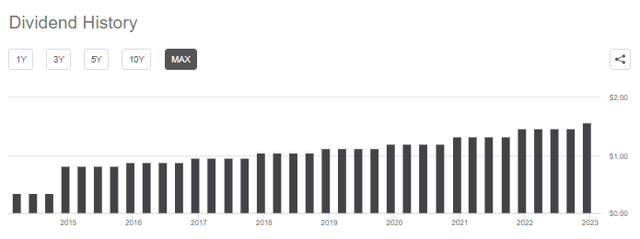

CCI offers the typical annual dividend increases, but that doesn’t make it any less of an income play.

CCI Dividend History (Seeking Alpha)

Their latest increase was good for a boost of 6.5%. Given that is expected to be the increase for the entire year, that is meaningfully lower than AMT’s growth. This is also reflected in the last 5-year CAGR for the dividend coming in at 8.91%.

Both offer quite a low forward FFO payout ratio. AMT is at around 52%, and CCI is around 81%. While CCI’s payout ratio is much higher, it still isn’t really that elevated or at risk, in my opinion. Both should be able to continue to grow their dividends in the future, especially when their earnings are expected to grow over the coming years.

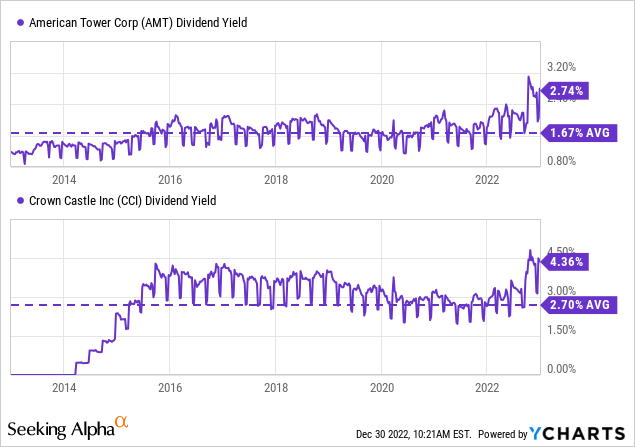

CCI also sports a relatively higher dividend yield too. That can make it a bit more popular upfront, even if the growth going forward is lower. Both these REITs are also trading well above their historical average, which is another metric that could suggest they are undervalued.

Ycharts

However, with higher interest rates, this can be expected. When risk-free rates rise, investors may choose a U.S. Treasury over putting capital to work in a REIT with downside risk. Of course, with the U.S. Treasury, one won’t see a growing dividend over the coming years as we can expect in AMT and CCI.

Conclusion

AMT and CCI are two tower REITs that have taken different paths going forward. However, both represent attractive long-term investment options. AMT has been the stronger grower historically. They can also boast about increasing their dividend every quarter at a much more aggressive pace and with a lower payout ratio. On the other hand, CCI starts with a higher yield out of the gate – and currently looks like the cheaper of the two options. Both should provide investors with strong results over the longer-term for income investors.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SHORT AMT OR CCI PUTS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.