Summary:

- As a contrarian investor, I usually bet against Wall Street.

- But in the case of American Tower, I agree with Wall Street’s bullish sentiment.

- I see strong catalysts both in the near term as communicated in its Q3 earnings report and also in the longer term.

- Despite all the catalysts, the stock now trades around the lowest multiples in a decade.

spxChrome

AMT: where Wall Street meets Main Street

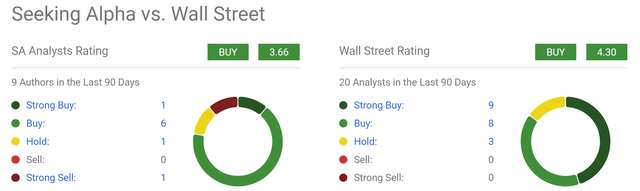

Even if you’re not a contrarian investor, there are good reasons to take Wall Street ratings with a grain of salt. Due to the alignment of interests, their ratings are more focused on the near term, subject to herd thinking and biased toward the bullish end. But in the case of American Tower (NYSE:AMT), my view is that Wall Street’s bullish rating is well placed.

The following chart compares the sentiment from Seeking Alpha authors to Wall Street analysts. As seen, Seeking Alpha authors already are quite bullish on the stock. A total of nine articles were published on the stock in the past month, and seven of them rated the stock as either Buy or Strong Buy. The average score is 3.66. Wall Street ratings are even more bullish and stronger, and their average rating is 4.3.

Seeking Alpha

The remainder of this article will elaborate on reasons why I think the above ratings are well justified. Since AMT just released its Q3 earnings report and raised guidance, I will highlight some of the near-term catalysts communicated in the earnings report. But my key argument is really oriented toward the longer term. Looking past the near-term catalysts, I see a business with a robust return on capital employed, sensible capital allocation policies, and valuations near a secular bottom.

Q3 highlights and near-term catalysts

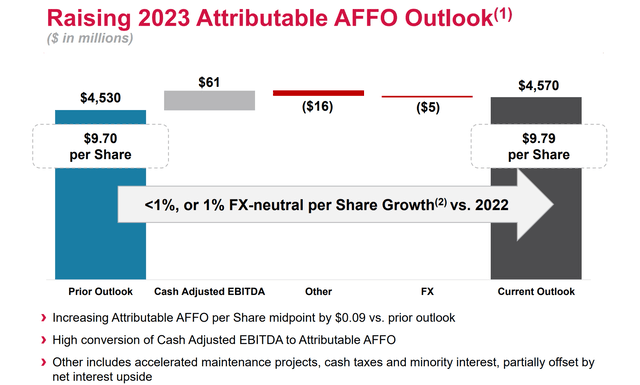

In its Q3 earnings, AMR reported strong results, beating analyst expectations on both revenue and net earnings. I view the growth in its core wireless communications infrastructure business and its CoreSite data center business as the key drivers for such strong performance. Management raised its full-year 2023 Property Revenue midpoint by ~$60 million compared to the prior outlook (from the previous $10. 88 billion to the current $10.94 billion). In terms of the bottom line, the AFFO guidance was raised to $9.79 per share, up from its previous guidance of $9.7.

Next, I will elaborate on the implications of these updates for the long term. Specifically, I will explain A) why I expect the above growth drivers to continue well into the future given the secular demand for mobile data, and B) why the valuation multiples are made even more attractive by the updated guidance.

AMT Q3 earnings report

Long-term prospects

As detailed in my blog article, in the long term, the growth of any business is ultimately governed by two forces: Its return on capital invested and its plow back ratio (aka, the reinvestment rate). I see AMT in a strong position on both fronts.

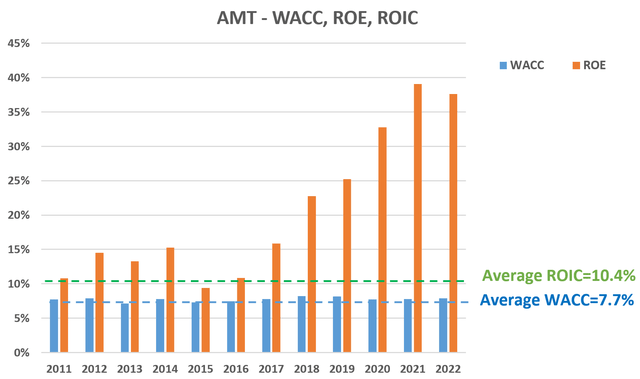

Let’s first look at its long-term return on invested capital as shown by my analysis below. As you can see, its return on invested capital was on average 10.4% in the past decade, well above its cost of capital (approximated by the WACC, Weighted Average Cost of Capital). Also, note that the return on invested capital is different from ROE because the book value is typically not the same as capital actively needed for the operation of the business. In AMT’s case, its ROE has been even higher.

Author based on Seeking Alpha data

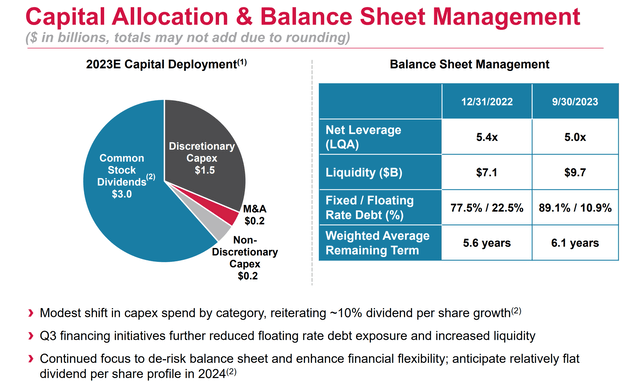

In terms of reinvestment rate, American Tower’s financial position is quite strong. As seen from the chart below, its net leverage has been stable in the range of 5.0x to 5.4x in recent quarters. Most of its debt (77.5% at the end of the third quarter) is fixed rates and won’t be impacted by rising interest rates. Management has quite a bit of flexibility in terms of capital allocation and they have been doing a sensible job. They reiterated the importance of dividend growth and plans to allocate ~2/3 of the earnings on dividends and ~1/3 on capex (with a minimal amount of M&A), a well-balanced approach for investing in new growth opportunities and return capital to shareholders.

AMT Q3 earnings report

I see plenty of growth opportunities for AMT to invest its capital. As aforementioned, I expect strong demand for its wireless communications infrastructure in the years to come. The fundamental drivers include the rollout of 5G networks and our increasing use of mobile data services. I also expect the growth of its CoreSite data center business to remain robust in the years to come. The key driver here involves the strong demand for data center services from cloud computing providers and other enterprise customers.

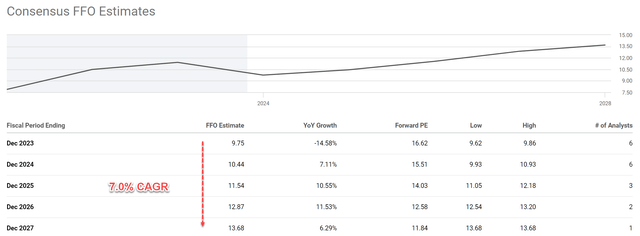

The combination of secular demand, stable profitability, and capital allocation flexibility is a powerful combination for growth. All told, consensus estimates project its FFO to grow at a CAGR of 7% in the next five years.

Seeking Alpha

Other risks and final thoughts

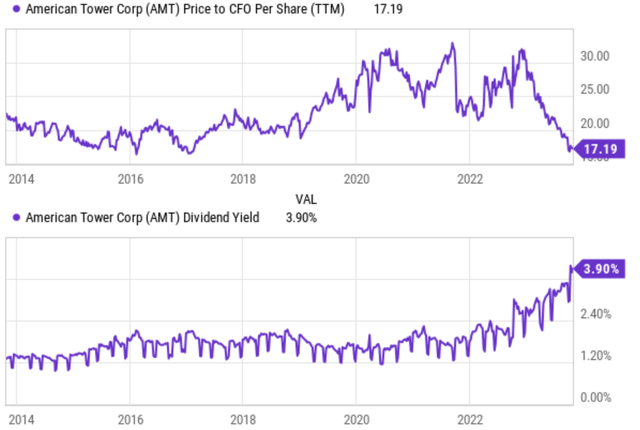

A few additional risks, both upward and downward, are worth mentioning before I close this article. Another key upward risk involves its very compressed valuation. As you can see from the chart below, the stock is currently trading at a price-to-CFO ratio of 17.2x only. With its updated 2023 AFFO guidance of $9.79 per share, the P/CFO ratio is even lower (only 16.5x). These multiples are among the most attractive levels in at least a decade as seen. In terms of dividend yield, its current yield of 3.9% is again among the most attractive levels in at least a decade, far above its average yields in this period. And if you recall from the previous chart, consensus estimates project its FFO to grow at 7% CAGR. As a result, the FY valuation multiple would be even more attractive, only about 11.8x P/FFO in FY5.

Seeking Alpha

On the downside, AMT faces risks too. Some of these risks are common to other tower REIT stocks, and some of them are unique to AMT. The common risks include uncertain macroeconomics and government regulations. Currently, my overall feeling is that governments around the world are supportive of the rollout of 5G networks, which is a positive catalyst for all tower REITs. However, the degree of support can change and even the overall regulatory climate can change. The main risk that’s unique to AMT is its exposure to international markets. American Tower has a significant presence in international markets, which account for about half of the company’s total revenue in recent years. As a result, AMT is more sensitive to currency exchange risks. If you read its earnings report, you will see that every outlook is based on some assumptions on exchange rates. At the same time, such exposure also can make it sensitive to geopolitical risks and different regulatory risks in different countries/regions, many of which are more volatile than in the U.S.

Overall, under current conditions, I see the catalysts in the upward direction outweigh those in the downward direction. In a nutshell, I see a good business for sale at a bargain price. The stock offers highly a skewed return/risk profile, especially for long-term investors. To recap, I expect the key shareholder return drivers to be stable secular demand, robust return on capital, capital allocation flexibility, and compressed valuation multiples.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.