Summary:

- American Tower is a long-term, dividend growth opportunity, but challenges in India and plans to reduce debt are impacting growth expectations.

- The company’s recurring revenue and long-term contracts provide stability, with minimal disruptions expected from new tech or carrier dynamics.

- Built-in rate increases in AMT’s contracts help protect returns from inflation, adding potential value for long-term investors.

Ivelin Denev

Investment Thesis

American Tower Corporation (NYSE:AMT) is a company that owns and operates communication towers. These towers are the tall poles and structures that help phones, radios, and other devices connect and communicate. Think of them as the middleman of our calls, texts, and internet browsing.

AMT rents out space on these towers to different companies, mostly mobile network operators “MNOs,” who must put their equipment up to send and receive signals. This is how AMT makes money. The company has a bunch of towers not just in the United States but also in other parts of the world, like Latin America, Europe, Africa, and Asia.

In 2022, AMT made more money than the previous year, mainly because tenants rented more space on their towers. The company added thousands of towers last year through development and acquisition. Management did a good job controlling expenses, which helped them make a sizable profit last year. However, in Asia-Pacific, they faced some challenges with a company Called Vodafone Idea Limited, “VIL,” that didn’t pay AMT as much as they expected. The rapid rise in interest rates also meant that AMT had to spend more on loan payments, and many say that because of the high costs of borrowing, and the huge amounts of capital needed to expand the telecommunication network, this environment will make it hard for AMT and its customers to engage in growth initiatives. The immediate effect, however, was a decline in net income from 2021 levels.

On February 23, the company reported profits that fell below estimates and guided for lower results in 2023. Overall, despite these challenges, I believe AMT is doing well. Although results may have disappointed some due to unforeseen challenges, it is well-set to make the most of the 5G revolution, smart gadgets, and all those cool new tech trends that need better connections.

AMT is a more attractive option for investors looking to benefit from the growth of 5G technology compared to investing in mobile network providers who face high expenses and don’t have a clear strategy to profit from their investments in 5G. Customers expect quality 5G service, but carriers can’t easily raise their prices due to the competitive market. As a result, AMT appears to be a market investment choice in this context.

5G Rollout and FY 2022 Growth

When it comes to 5G, the radio waves used are shorter than the ones used for older tech, like 4G. Because of this, 5G signals don’t travel as far, so we need more towers closer together to keep our devices connected. This is called densification, and it is like adding more dots on a grid to fill the gaps.

When it comes to AMT adding new tower sites, there isn’t a clear pattern or trend. Building or acquiring these towers is a big deal and costs a lot of money, so it is not like they can just crank them out one after the other. Mobile operators’ capital expenditure decisions also increase the complexity of the matter. Because of this, the pace at which they put up new towers can be a bit unpredictable and depends on various factors. In 2022, AMT added 7,405 new towers across its five primary geographic areas.

With more towers popping up, it makes sense for different companies to share the same tower space instead of renting their own separate towers. This is called colocation, and it is like roommates sharing an apartment to save on rent.

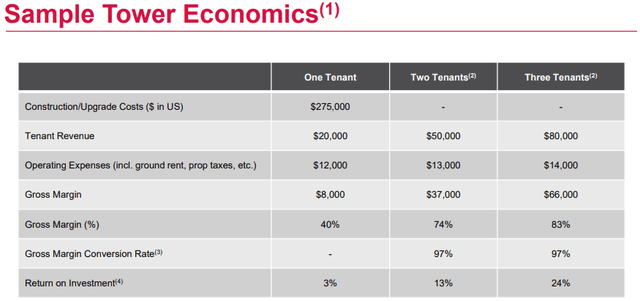

Colocation is important for AMT. Think about it this way: imagine you have an apartment building (the tower), and you’re trying to find tenants (the companies) to rent the apartments. When you get your first tenant in, it is great because you start making money, but the cost of building and maintaining the apartment is still pretty high, so you don’t make huge profits just yet.

Now when you start adding more tenants (colocation) to the same apartment building, it becomes way more profitable. That’s because the cost of the building itself doesn’t really change, but you’re making more money from the extra tenants.

So, with communication towers, it’s a similar deal. Adding more tenants to an existing tower is usually more profitable because you’re getting more money without having to build a whole new tower. This colocation thing is a smart and critical way for AMT to make the most out of those big, expensive tower investments. These dynamics are illustrated in the table below, showing AMT’s tower economics.

So with 5G needing more towers and better coverage, densification and colocation trends are becoming a big deal to make sure we all stay connected and a way for AMT to make more money. Just to give you an idea, colocations brought in an extra $148.4 million in the US, $55.4 million in Africa, $35.8 million in Asia, plus $35.4 million in Latin America during FY 2022. On the other hand, new tower installations added $158.1 million in Europe, $44 million in Africa, $31.7 million in Latin America, and $23.3 million in Asia in the same period.

Challenges

A big chunk of AMT’s revenue comes from just a few customers, namely MNOs, the likes of AT&T (T), Verizon (VZ), and T-Mobile (TMUS). So, if something goes wrong with one of these customers, it can really mess with AMT’s bottom line. For example, AMT has some issues with a company called Vodafone Idea Limited, “VIL.” VIL didn’t pay AMT as much as they expected, and that caused some headaches for AMT. At the Q4 earnings call, AMT bosses noted that VIL didn’t really hold up their end of the deal to start paying full price for using AMT’s towers beginning in January. Because VIL is their largest customer in India, AMT had to lower the value of their Indian assets by $97 million, which was recorded in the income statement. They also had to take a hit of $411 million in Q4 because they weren’t sure if they’d get the money VIL owed them. This whole situation affected the net income in a big way in 2022, dropping it to $1.7 billion, down from a much higher $2.6 billion in 2021.

As the Fed raised interest rates, the average interest expense on AMT’s debt went up. The company’s interest expenses jumped by 30% to $1.2 billion in 2022 compared to $870 million in 2021. And we can’t forget how monetary tightening affects other parts of the economy. With interest rates going up, the dollar gets stronger, and that forced AMT to record a foreign currency adjustment loss of $1.16 billion. It is all connected, and AMT is definitely feeling the effects.

How do we from here?

VIL’s impairment charge is a one-time thing, which means that growth should look better this year both on the top and bottom lines. Still, the Indian segment challenges made management start to think about leaving the market. Losing a major customer like VIL, which is AMT’s third biggest account, makes one wonder about the impact on growth.

AMT hasn’t been cheap, and people have been willing to pay more for it because of the growth it gets from being in emerging markets. Losing that edge is one reason why their stock price has gone down recently.

When it comes to interest rates, I think the most likely scenario is that they’ll stay higher for longer, but looking at it year-over-year next February, one shouldn’t expect a massive jump in interest expenses as we saw last year.

This is especially true given management’s decision to deleverage, which again brings us back to the growth issue, as this rules out platform acquisitions, a primary source of growth for any REIT.

Final Thoughts

AMT is a long-term investment that’s all about growing dividends, which is why it has a high growth premium mirrored in its valuation. But the problem in India and the plan to leave the market kind of put a dent in those growth expectations. Management wants to reduce debt by dealing with their floating notes when they’re due, but that might mean they’re not putting as much into growing the business. Even so, for people who plan to invest for like ten years, it could still be a pretty good deal for income investors.

The way AMT makes money is mostly through steady, recurring revenue supported by long-term contracts (5 – 10 year horizon), and I don’t think any new tech is going to mess with that too much. It’s not like the big US carriers, who don’t really get along, is suddenly going to start sharing networks and hurt the demand for space on AMT’s towers. And stuff like SpaceX’s Starlink satellites probably won’t cause any major disruptions anytime soon, but as a long-term investment, you’ve got to keep an eye on these potential game-changers.

Also, keep in mind that AMT’s contracts usually have built-in rate increases of around 3% in the US and based on inflation abroad (even though some foreign companies had fought against these hikes before and managed to negotiate better deals). That could help protect your returns from long-term inflation and perhaps add some premium.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.