Summary:

- American Tower is a top player in the cell tower REIT space, with a strong portfolio of communication sites and data centers.

- AMT stock has underperformed due to concerns about higher interest rates, but its top-line growth drivers remain solid.

- Investors should be prepared for slower growth in the near-term, but have an opportunity to layer into the stock at a price well below historical valuation.

Daniel Grizelj

In these uncertain times, it’s ever more important to stick with top-players, and when quality names like American Tower (NYSE:AMT) have been beaten down in price. However, it’s also important to be mindful of risks when it comes to investing in REITs in this high interest rate environment.

It’s been a while since I last visited AMT here back in May with a ‘Buy’ rating, noting its attraction on the share price pullback and its fundamental strengths. In this piece, I revisit the stock including its Q3 highlights and discuss whether the stock is currently a buy or hold, so let’s get started.

Why AMT?

American Tower strikes me as being the Realty Income (O) of cell tower REITs, given its positioning as the largest player in the space. It has a moat-worthy portfolio of 225K communications sites globally and highly interconnected U.S. data centers after its acquisition of CoreSite in late 2021.

AMT stock hasn’t been a top-performing stock over the past 12 months, to say the least. Since my last piece in May, the stock has declined by 6.6% (-4.9% total return including dividends), underperforming the 1% rise in the S%P 500 (SPY) over the same timeframe. As shown below, AMT has also underperformed the broader market as well as the Vanguard Real Estate ETF (VNQ) over the past 12 months.

AMT Price Return (Seeking Alpha)

A key reason for why AMT has underperformed is likely due to higher interest rates, which has put a damper on dividend growth companies, as in the case of AMT. Apparently, the market is concerned that AMT wouldn’t be able to grow as fast in a higher for longer rate environment.

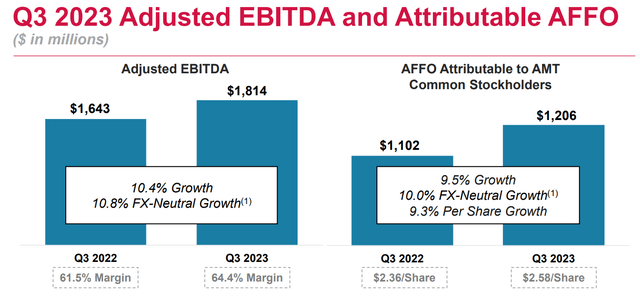

While higher interest rates will result in higher interest expense, thereby putting downward pressure of FFO, AMT’s fundamental growth drivers remain solid. This is reflected by Adjusted EBITDA growing by 10.8% YoY on an FX-neutral basis, and robust AFFO/share growth of 9.3% YoY to $2.58 during the third quarter. Importantly, as shown below, AMT is demonstrating effective cost management and operating leverage in an inflationary environment, with EBITDA margin actually improving by 290 bps YoY to 64.4%.

These results were driven by healthy demand, including consolidated tower business Organic Tenant Billings Growth of over 6% and a second consecutive quarter of record new leasing in U.S. data center business with 9% YoY billings growth. Against the backdrop of strong fundamentals, management raised its full-year AFFO/share estimate by $0.09 to $9.79.

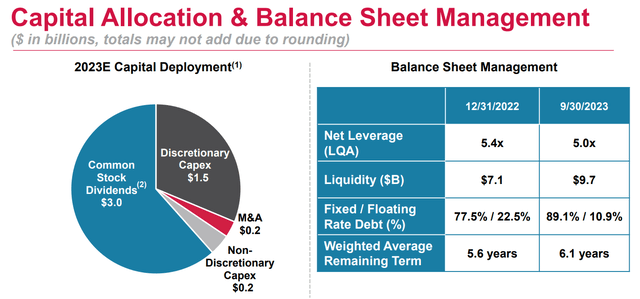

It’s worth considering that AMT ended 2022 with AFFO/share of $9.76, so full-year 2023 AFFO/share growth would only by $0.03 should AMT’s Q4 results meet management’s guidance. This is due in part to higher financing costs as that is estimated to have a 5% downward effect on AFFO/share this year and beyond. Nonetheless, AMT maintains reasonably low leverage with net debt to EBITDA of 5.0x. This actually sits on the high end of management’s stated 3x to 5x range, so I wouldn’t expect AMT to substantially tap debt markets in the near term.

Beyond headwinds from higher interest rates, external growth may be muted in 2024, as management noted a lack of compelling investment opportunities in the market during the recent earnings call. This, combined with lower expected 5G capital spending by U.S. wireless companies next year contributed to management expectations for the 2024 dividend rate to remain the same as the current forward rate of $6.45. Nonetheless, the current dividend rate represents 10% growth over last year, and it’s well covered by an AFFO payout ratio of 66%, leaving plenty of retained capital to either pay down debt or fund opportunistic growth.

Despite near-term headwinds, I see the long-term growth story as being intact, considering the proliferation of data with expanded use cases. This makes the interplay between AMT’s towers, data centers, and distributed edge infrastructure all the more essential. This is supported by the following comments by management during the recent earnings call:

As potential customers increasingly focus on new revenue opportunities and customer experience including through the proliferation of applications like next-generation gaming, AR and devices and wearables that leverage interactive AI, we believe we have a compelling combination of distributed points of presence and interconnection capabilities that can be extended to a broader edge.

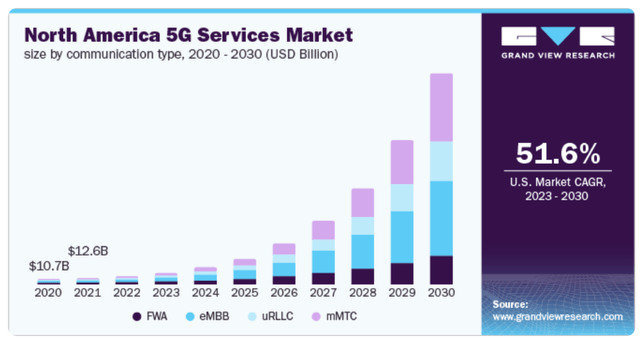

Moreover, 5G is still in its early stages, and it’s expected to grow by 51% between now and the end of this decade. This is to be driven by Fixed Wireless, with which AMT’s tenants Verizon (VZ) and T-Mobile (TMUS) are making good headway, and by 5G’s other use cases, as described below.

-

URLLC: Ultra-Reliable and Low Latency Communications

-

eMBB: Enhanced Mobile Broadband

-

mMTC: Massive Machine-Type Communications

It’s worth considering that 5G rollouts and data centers are not mutually exclusive, but are rather complementary, and that’s a key reason for why AMT acquired CoreSite a couple years ago. That’s because emerging use cases such as autonomous vehicles, industrial robotics, and crowd analytics require edge computing, which means data centers working at the edge of 5G to enable faster speeds and response times. American Tower has deployed edge computing infrastructure in key markets, which could serve its key customers like Verizon (VZ), which is one of the companies that’s spearheading edge computing, and offers the following value proposition for its clients.

Edge Computing Value Proposition (American Tower Website)

Risks to AMT include potential for a higher for longer interest rate environment. This is considering the fact that AMT has a weighted average debt maturity term of 6.1 years, which means that it would have to refinance all of its debt at higher rates should interest rates remain stickily high for an extended number of years.

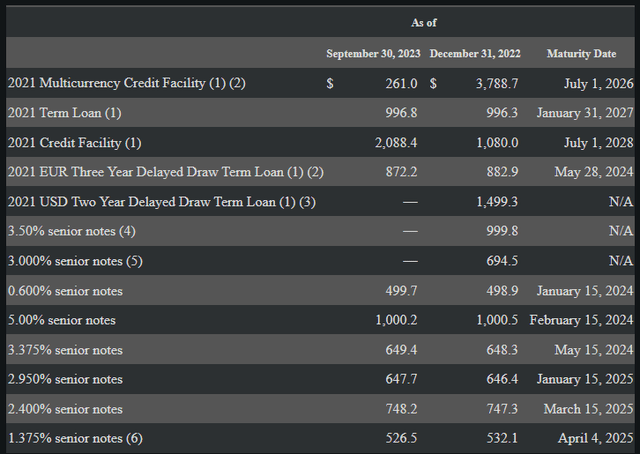

Also, 11% of its debt is held at floating rates, giving AMT more immediate exposure to higher rates. It’s worth noting, however, that AMT has made progress on this front by extending its weighted average debt maturities by 6 months and reducing its floating rate exposure by 11.6 percentage points since the end of 2022, as shown below.

AMT Debt Profile (Investor Presentation)

Also, while management extended the majority of its July 2026 debt maturities to July 2028, as shown below, AMT does have $2.1 billion worth of near-term debt maturing in the first 5 months of this year, as shown below.

AMT Debt Maturities (10-Q Filing)

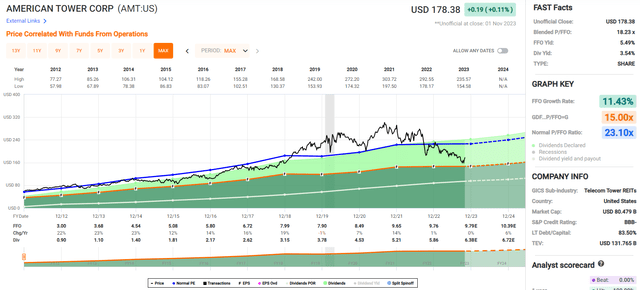

Turning to valuation, I believe many of these headwinds have already been baked into the stock price of $178.38 (as of writing) with a forward P/AFFO of 17.35, sitting well below AMT’s normal P/FFO of 23.10. While growth is expected to be flattish over the next year, analysts expect AMT to resume 8-12% annual FFO/share growth in the 2025-2026 timeframe, which I believe undervalues AMT at the current price should this growth be realized.

Investor Takeaway

AMT’s long-term growth story remains intact, with potential for continued demand from expanding data usage and 5G technologies. While near-term headwinds may impact growth and external investment opportunities, AMT maintains a strong balance sheet and dividend payout ratio. With a current undervaluation compared to historical valuation metrics, AMT may present an opportunity for long-term investors looking to capitalize on the growth of 5G and related use cases.

However, investors should be aware of potential risks such as a higher interest rate environment and near-term debt maturities, which puts pressure on near-term growth. So, it’s worth considering these factors while making investment decisions based on AMT’s current outlook and long-term potential. Maintain ‘Buy’ rating on AMT.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!