Summary:

- American tower was a REIT on my no-no-list for several years after starting to write as a contributor. While others considered it undervalued back in 2019 and 2020, I didn’t.

- I did not become interested in AMT until mid-2022, bought a few shares, and am now more interested in slowly expanding my position.

- Why? That’s what we’ll look at here, and establish my first “BUY” thesis for AMT.

Ivelin Denev

Author’s Note: Please note that this article was published on iREIT on Alpha in early March, and prior to the crisis in banking of 2023.

Dear subscribers,

You probably know at this point that I’m a huge investor in telecommunications infrastructure, at least insofar as my portfolio goes. I own businesses that help people communicate to a degree of over 18% of my total portfolio value, spread out over companies like Deutsche Telekom (OTCQX:DTEGY), Telenor (OTCPK:TELNY), Telia (OTCPK:TLSNF), Tele2 (OTCPK:TLTZF), Orange (ORAN), AT&T (T) and Verizon (VZ) – as well as others. These companies provide high dividends with high, relative margins of safety while not providing us with that much overall growth.

However, when bought at a discount, these companies can not only give us outperformance, but they can also combine capital appreciation with massive dividends to market outperformance over time. Deutsche Telekom since my first “BUY” article is a very good example of this.

Another trend I’ve noticed is for these companies to either spin off or carve out their tower operations, the infrastructure. Not everyone has or is doing it, but a majority of the companies I mentioned are in some way looking at their tower operations.

In this article, I’ll be going through the core operations and considerations of tower businesses with American Tower (NYSE:AMT) in particular, and show you why I’m interested in owning this as well.

Let’s get going.

Tower Businesses and American Tower

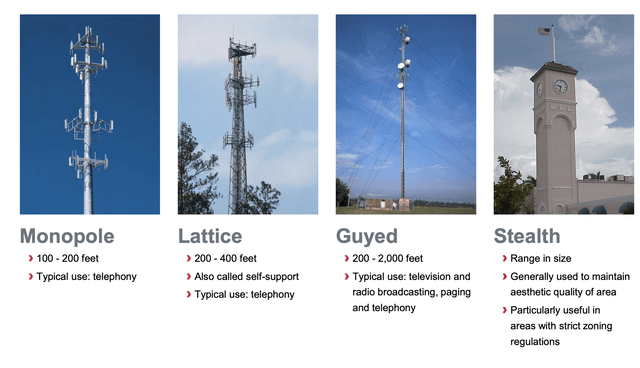

Cell phone or communications towers/wireless towers is a fairly basic concept – from a high level. You’re building a structure on a small parcel of land that’s designed to hold communications equipment from one or sometimes several providers. These providers use the structure’s verticality to deliver technologies including but not limited to telephony, mobile data, broadcast, television, and radio.

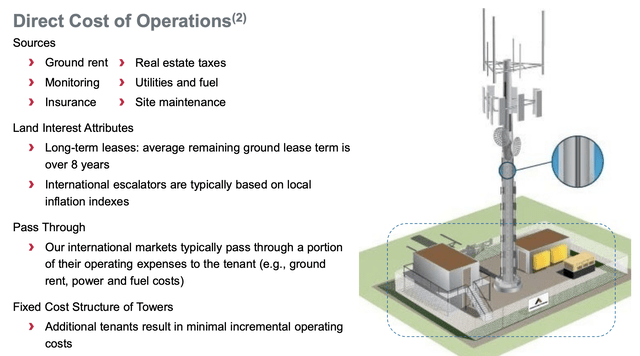

The lease that the company pays, lest they own the tower and land itself (as some do), accounts both for their space on the structure, i.e., the tower, but also for the land.

A tower company, like AMT, typically owns or leases the land where the structure is located on extremely long-term leases (or ownership), while the tenant in turn owns the equipment (like Antennas, arrays, cables, and base stations) as well as equipment shelters found on the land.

You’ll find different types of towers all across the world.

In Sweden and where I am currently, most of the towers are Guyed due to the massive distances involved here and the coverage necessary.

Now, as mentioned, many telcos own their own infrastructure. But in case they do not, the tower company like AMT, typically owns the structure itself, which can support -5 tenants, as well as the land parcel (typically), as well as a backup generator in case of power loss.

The business idea is simple. Tenants pay for the vertical space/access and the rent is, as with all RE, dependent on location, the square footage, and the weight placed.

This sort of revenue is extremely long-term, and these contracts are typically not cancellable. Terms are typically 5-10 years as an initial period, with a 2-4% escalator, which means that they typically outperform inflation, but lately have not done so.

Churn is almost non-existent. Operating costs are very low, and the structure of the costs is that they are mostly fixed. The way this works is also that additional tenants can be added at extremely limited operating costs. In the US, AMT doesn’t have the ability to pass through certain expenses to tenants, which is why the international segment is more interesting and appealing in the longer term.

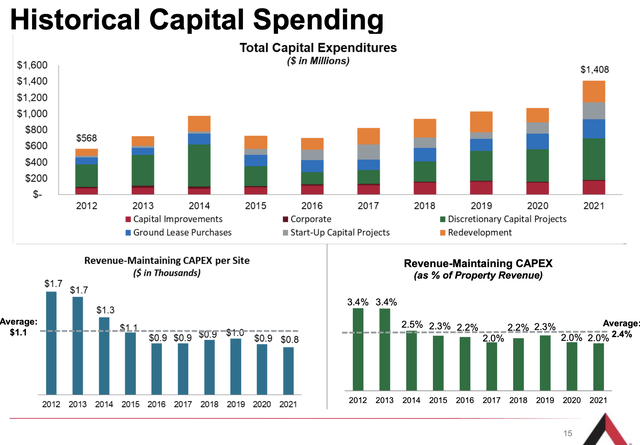

Capital requirements for upkeep are extremely low, which leaves tower companies with the ability to deploy CapEx for expansion rather than maintenance.

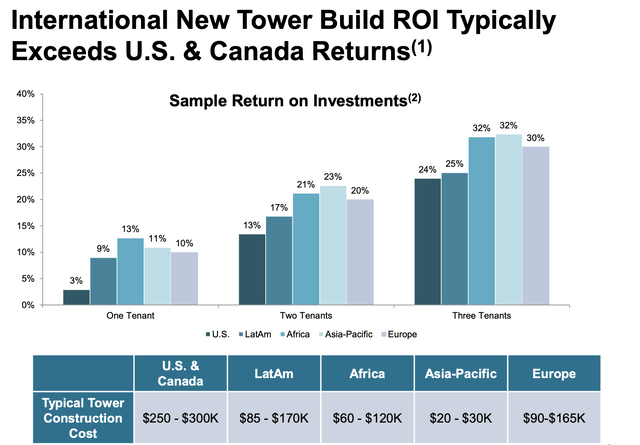

The business model is extremely sound. The construction cost for a tower can be calculated at around $275,000, which means that at three tenants, there is an 83% gross margin, and a conversion of 97%, to an ROI of 24%. And for international locations, those even exceed these US numbers, because construction costs everywhere are far lower than the US.

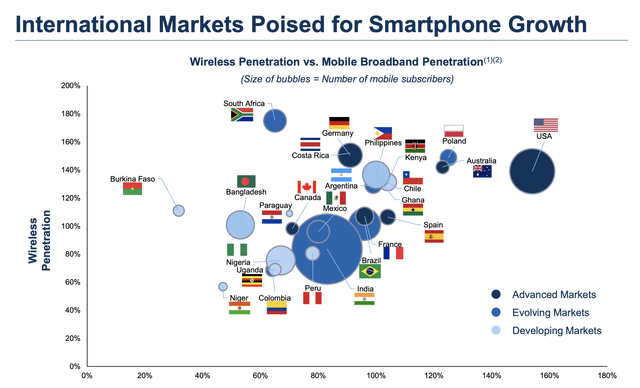

Now, if you think this sounds attractive, you’re obviously not the only one. This is the epitome of an attractive business model, and it’s also why the company’s international operations are very important – they’re more profitable. The company is active in countries like Australia, Bangladesh, India, Philippines, Many nations in Africa, the attractive EU nations of Germany, Spain, France and Poland, and pretty much over entire south America. Plenty of international appeal here, and it’s growing.

Of course, as you might expect, this is not an easy market to play in, because what legacy operators have been doing is forming JVs and cooperations with one another to spin off or manage their own tower businesses. You’ll notice there is no northern-European exposure, and there is a reason for that. To play in this market, you need scale, incredible expertise, and no doubt a fair amount of Vitamin C (“connections”).

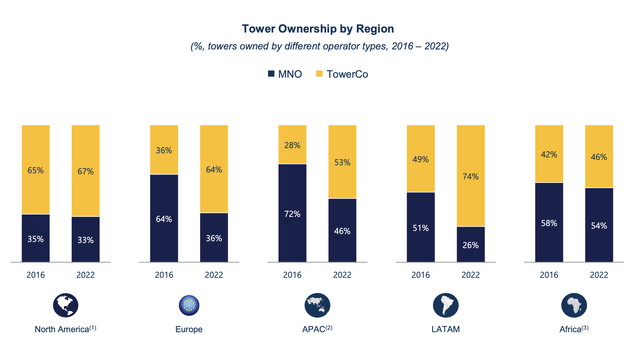

Still, the tower model is growing, and AMT has been growing significantly with it. The trends I am speaking about where ownership moves to TowerCo’s are global.

AMT itself is a REIT with a market capitalization of over $90B. However, much of its growth has been debt-funded, which has left the company with a debt/cap of almost 80% at current state. This has also impaired the company’s credit rating, which is now at a BBB-. This does not bother me that much in this case, because the underlying assets and revenue streams are as safe as they are.

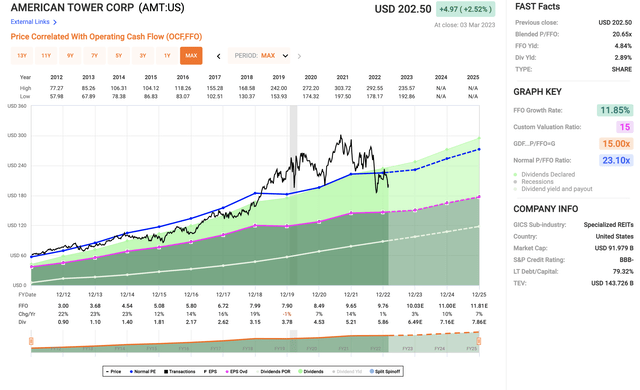

However, like all REITs and companies that have the appearance of having found revenue streams that are essentially immune or very resilient to disruption, the company is very prone to trading at a massive premium. Take a look at the recent history.

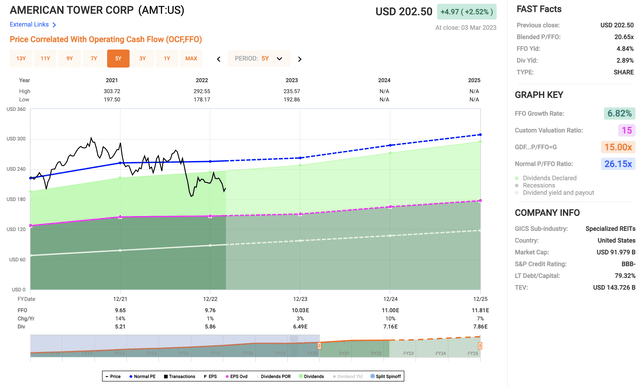

F.A.S.T graphs AMT (F.A.S.T graphs)

I don’t really care what you do, I’m not paying 30x+ P/FFO for a sub-6.8% 5-year FFO growth rate at that sort of credit safety. So you may notice why AMT has been such a “No-go” for me up until they essentially crashed to earth back in 2022 – though even that decline didn’t really turn the REIT “cheap” as such, merely acceptably valued.

Let me put it in a simple way, as simple as possible. Until there is an alternative, commercially acceptable technology, tower technology is going to be the way for our communication. That makes companies or REITs operating successfully in the field likely to continue to grow. Why? Growing populations, a growing number of mobile units and traffic, and the growing need of infrastructure.

In order for the business idea of tower companies to be replaced in their current form, it would require a significant technological change. SmartCells and MicroCells or Outdoor DAS which are much smaller base stations could not do it.

Tech proponents have long been talking about things like Starlink or balloons to replace these fixed structures on the ground. But guess what? While Starlink may be working at this time, Alphabet (GOOG) shuttered Loon, which was its balloon infrastructure company, due to the idea not being commercially viable. Maybe a company will be able to get costs down low enough, but many people I’ve spoken to vastly underestimate the challenges of having what would essentially be “flying” cell towers. I am no meteorologist, but I see enough challenges to make me grind my teeth in such a scenario. In addition, the expansion of towers has seen construction costs for towers sink rapidly.

It would not be enough for an alternative technology to exist – it must also be cost-effective compared to current tech.

Because of this, I say to you:

1. I view it unlikely that replacement technology for cell tower tech is coming anytime soon.

2. When that technology comes, the likely adopters and operators will be the current cell tower companies, which will be in a position to dominate this market as well.

What this means, in my opinion, is that a company like AMT, as long as it is cheap enough, is a solid and no-nonsense “BUY” with a considerable degree of safety.

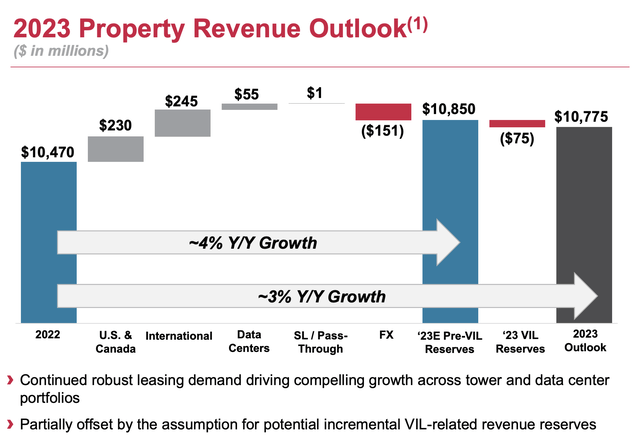

The latest quarterly results from AMT mostly confirm this. 4Q22 was released in late 2022, and we saw property revenue rise nearly 15%, or nearly 18% FX-neutral, with a 7% tenant billings growth. Adjusted EBITDA outperformed inflation at 13% FX-neutral, and the company’s AFFO grew nearly 8% FX-neutral or over 5.5% at actual numbers. AMT continues to drive good returns, and 2023E is unlikely to be different.

By which I mean, growth is likely to continue here. Billings’ growth is expected to be around 5-9% depending on the segment, with Africa almost at double digits. EBITDA margins are likely to remain over 60%, at 62.6% per the company’s official outlook, with more or less flat AFFO due to inflation/macro – maybe a cent or two below. This is due to increases in financing costs. Much of AMT’s debt is at floating rates, which means that once those impacts start going down the balance sheet, the company will have difficulty maintaining historical AFFO growth – at least until rates and these impacts normalize more. Capital allocation is expected to remain at current priorities, with continued dividend growth, leverage moving towards 5x, and increasing the fixed-rate debt even more than the REIT already has.

The perhaps biggest hurdle AMT has at this time is its leverage, and this is why the company is focusing on getting that down. In terms of company performance, there was nothing really negative or impactful that would be considered a risk here, nor do I expect this going forward.

This takes us to the current valuation, and why AMT is a “BUY” here.

American Tower Corporation – Why there is a “BUY” at this time

AMT has been overvalued for a very long time, all the way until about mid-2022. That’s when I decided that the company had fallen low enough for me to make my first “BUY”. However, it was a small buy, and it really didn’t warrant any massive highlighting – I was just dipping my toe in the water.

It grew, grew more, and then dropped back down in about mid-February, to a level where I once considered it attractive not just to its own trends, but to the broader market and its expected growth rates.

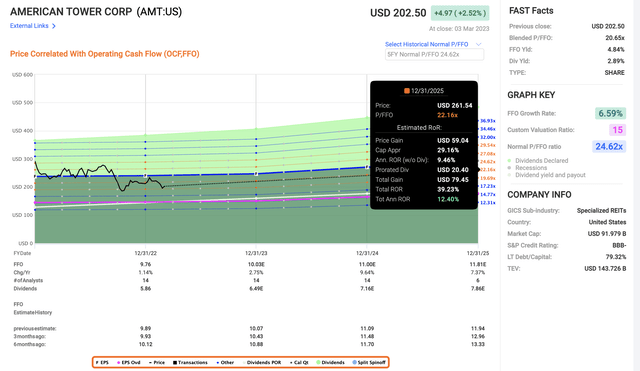

AMT F.A.S.T graphs Valuation (F.A.S.T graphs)

Now, keep in mind that the company itself is guiding negative AFFO for the coming fiscal. We should expect AMT, at least this year, to not really deliver that much growth, which will likely weigh down its valuation, to where we’re able to buy it even cheaper than we’re seeing here.

Don’t expect AMT to deliver massive growth. The point of this investment, as I see it, is that double-digit annual CAGR, from which around 2-3% is dividends, with perhaps the potential for overvaluation to a 30-32x P/FFO, at which time I would rotate that investment for profit and wait for it to decline again.

Forecasting it at 20-22x, we can just about get those double digits, which implies nearly 40% 3-year RoR, which is good enough for me.

F.A.S.T Graphs AMT (F.A.S.T graphs)

The time to really pay attention is if AMT starts yielding more than 3%. This would imply actual undervaluation. I don’t argue that the company deserves a premium, just the degree of that premium.

We forecast AMT at a PT of around $245/share at iREIT, which implies an upside of about 17%. I would personally go somewhat lower than this, and say that the company is only a “BUY” as long as it stays below $210/share. After that, the upside becomes somewhat “Murky”, and you go into potential underperformance. Even better, the first number in the share price should be a “1” – then you’re fairly safe, as I would see it.

S&P Global analysts give the company targets ranging from $220 on the low side, to $275 on the high side, with an average of $248, meaning they’re mostly in agreement with the official iREIT target. I say, once again, that this is calculated with some optimism. The current NAV per share comes to no more than $181/share, which means that we’re already at above 1.1x, for a single-digit growth rate with a BBB-.

It’s a scenario where I am sticking to my conservative price target, knowing fully well the company might do better.

This is my thesis for American Tower, because of this scenario.

Thesis

- American Tower is among the market-leading cell tower/infrastructure REITs. It yields over 2.5%, and it has operations across the world, which I view as an absolute must for investment in this type of company. While leverage remains a concern though one that’s being paid down, this is the only actual risk/Drawback, aside from a single-digit AFFO growth rate, that I see for this REIT.

- I would value AMT at 20-23x P/FFO for a “BUY”. That means that as the valuation stands today, we can actually buy the company.

- There is an upside, and my PT is $210/share or below.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

No, it’s not “cheap”, but it fulfills 4 out of 5. That makes it a “BUY”.

Disclosure: I/we have a beneficial long position in the shares of AMT, TLSNY, TLTZF, TLSNF, T, VZ, DTEGY, ORAN, VOD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company’s domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.