Summary:

- American Tower reported strong 2023 Q1 results, beating consensus estimates on both the top and bottom lines.

- What is more important to me are the updates it provided for its 2023 full-year outlook.

- The updates were a bit mixed. However, my interpretation is quite optimistic as it points to continued expansion.

- In terms of valuation, the stock is currently trading at attractive multiples both in terms of FFO and dividends.

Jaiz Anuar

Investment thesis

American Tower (NYSE:AMT) recently released its 2023 Q1 earnings report (“ER”). The results were strong, beating estimates on both lines. To wit, its Q1 AFFO dialed in at $2.54 per share, beating consensus by $0.08. And its revenues dialed in at $2767.2M, beating consensus by $27.2M and representing a healthy 4.0% YoY growth.

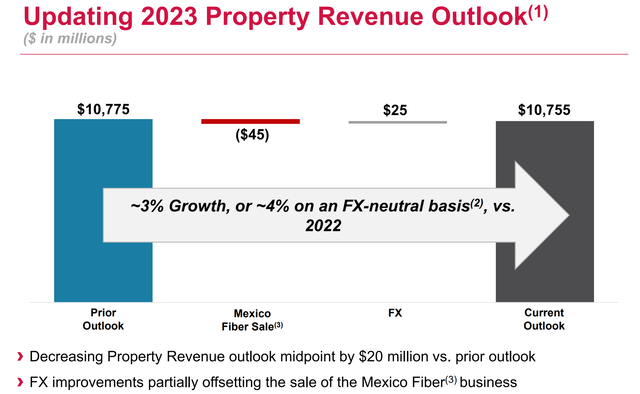

It also updated its 2023 full-year outlook, which should be of more importance to investors. The updates were a bit mixed. On the one hand, AMT is lowering its 2023 property revenue outlook and also net income outlook. The property revenue outlook was reduced by $20M to a range of $10,665M-$10,845M, and the net income outlook was reduced by $130M. The main reasons for the reduction are the currency losses and the sale of Mexico Fiber. Although, on the other hand, it raised its guidance for AFFO by $20M (translating into a $0.05 raise on a per share basis to $9.53-$9.76).

The focus of the remainder of this article is to explain why my interpretation of the above updates is bullish. Despite the lower revenue guidance, the updated outlook still implies a robust 4% YOY growth (see the chart below) when exchange rates are adjusted for. Furthermore, I will explain why AMT is best poised to continue such a healthy expansion. And finally, I will also analyze what the updated guidance means for its valuation and expected returns.

Strong profitability and strong growth potential

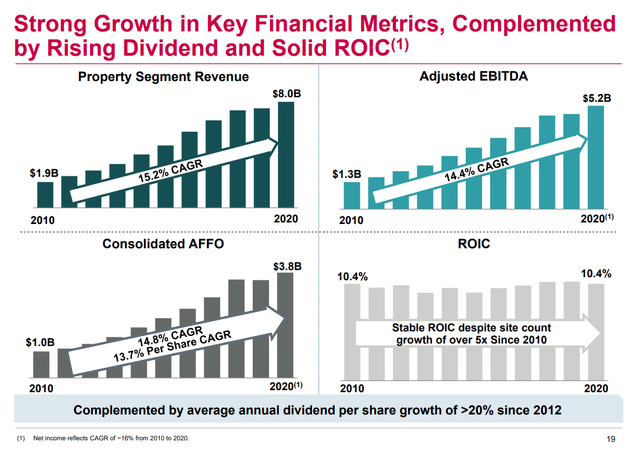

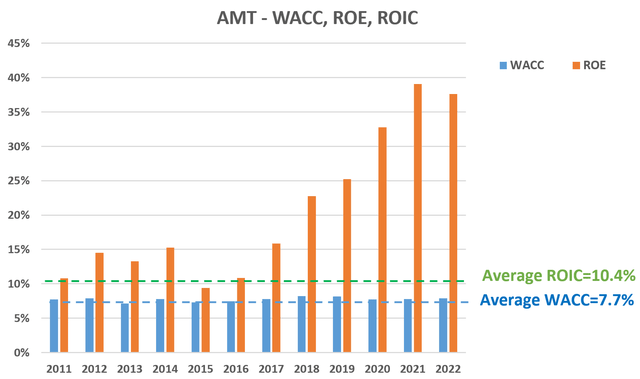

AMT is a scale leader in the tower space. It owns, operates, and develops wireless communications infrastructure both in the U.S. and also other countries. The company has a strong track record of profitability thanks to its leading scale and the secular trend of data usage. As seen in the chart below, its revenue and earnings have grown steadily at an impressive CAGR in the mid-teens over the past decade. More impressively, its profitability remained remarkably consistent and competitive despite the rapid growth in its site counts. As shown in the chart below, its ROIC (Return on Invested Capital) has consistently stayed in the 10% range with little fluctuations. And its profitability measured in ROE (Return on Equity) is equally strong, as seen in the second chart below.

To put these profitability metrics in perspective, the second chart also analyzed its cost of capital using the WACC (Weighted Average Cost of Capital) model. As seen, its WACC has been fluctuating in a range of 7.1% to 8.2%, consistently below its ROIC and ROE by a good margin. Its average WACC in the past decade was only 7.7%.

Looking ahead, I see plenty of reasons for it to continue such profitability and maintain a healthy pace of growth. The top catalyst in my mind involves its opportunities overseas. AME has created a significant presence overseas, and I expect this activity to continue and be a key driver for its future growth. I further expect AMT to enter into additional long-term leasing arrangements in its overseas markets, leading to higher revenue in the next few years. In my opinion, a fundamental advantage that AMT has over its competitors is its real estate is strategically situated to support its customer base in many of these markets. A second key catalyst involves the ongoing rolling out of 5G. I view it as an unstoppable secular trend that more mobile data will be consumed through a growing number of devices. As the 5G environment further matures, I expect the trend to accelerate and AMT to further benefit from cost efficiencies due to the larger scale of the economy.

Author based on Seeking Alpha data

Valuation and expected return

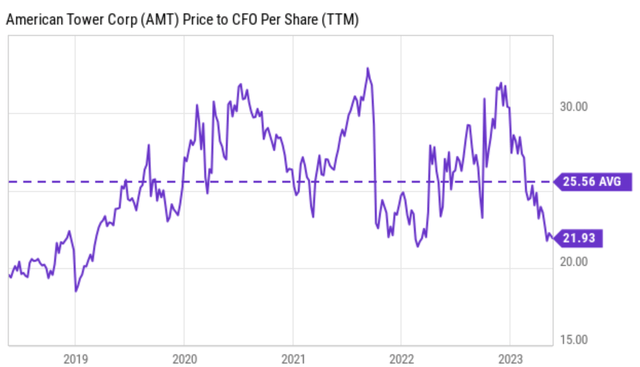

In terms of FFO multiples, AMT has been on average valued at 25.56x FFO historically, as seen in the chart below. The stock is currently valued at about 21.93x FFO, implying a ~15% discount. And as mentioned earlier, its updated AFFO per share for full-year 2023 was in the range of $9.53-$9.76. Taking the midpoint of this range, its 2023 FWD P/FFO multiple is even lower, only 20.01x at the price of this writing ($193) and implying a discount of about 22%.

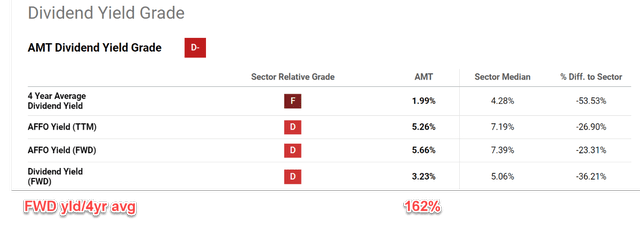

Given its stable dividends and track record of continuous dividend raises, the following chart also assesses its valuation by its dividend yield. Admittedly, AMT’s dividend yield is much lower than the average dividend yield for the sector (more on this in the risk section). However, AMT’s dividend yield is currently much higher than its own historical average. Its FWD yield of 3.25% is a whopping 62% higher than its historical average of 1.99%, implying a substantial valuation discount.

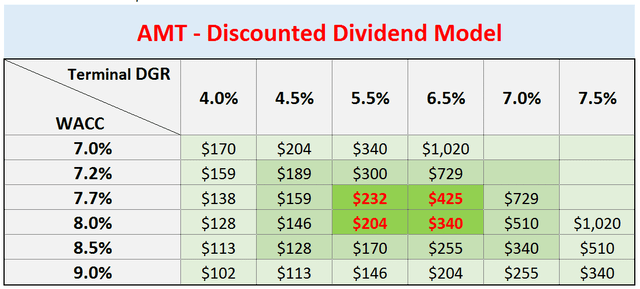

To form a more quantitative projection of its return potential, the second chart below shows my analyses based on the Discounted Dividend Model (“DDM”). I think the application of the DDM is well justified here given its long record of stable dividends and also its consistent WACC established earlier. To wit, my projection for its fair valuation is about $285, assuming an average WACC in line with its history and a terminal growth rate of around 6% (with an inflation escalator of about 2% included. Compared to its current market price of $193, this represents a sizable margin of safety of around 32%.

Seeking Alpha data Author based on Seeking Alpha data

Risks and final thoughts

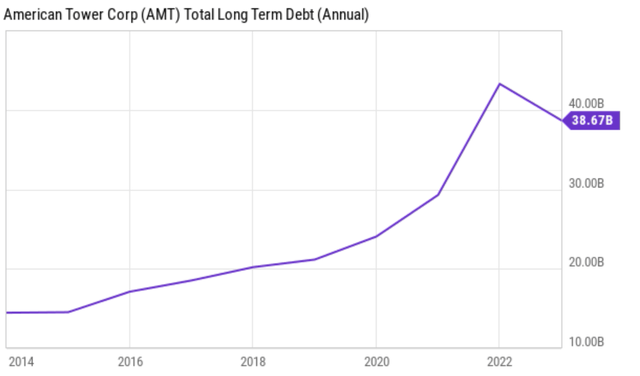

Risks include both macroeconomic uncertainties and operational challenges specific to AMT. As a price for its rapid expansion in the past, its debt has also been rising rapidly (see the chart below). Currently, its total long-term debt hovers around $39 billion. As a result, interest rates represent a major macroeconomic uncertainty. Also, due to its rapid expansion, AMT’s dividend yield is substantially lower than the average dividend in the REIT sector. If you recall from an earlier chart, its FWD yield is about 3.23% and the sector median yield is about 5.06%. Lack of current income could be a potential risk for potential investors. In terms of operational challenges, the sector is highly competitive, with a number of large and well-established companies. As a result, AMT has to commit significant CAPEX expenses to remain competitive. The sector is also subject to regulatory changes, especially in many of the overseas markets the AMT operates. Such changes can also impact its profitability.

Despite these risks, I view the upside catalysts as the dominating forces under current conditions. And to recap, these upsides catalysts include the secular trend of our data consumption, AMT’s robust and consistent profitability, its ongoing expansion plan, and also its attractive valuation caused by recent price corrections.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.