Summary:

- REITs have been hit hard recently, but now may be a good time to invest in the sector due to market opportunities.

- American Tower is a global provider of wireless communications infrastructure with a strong presence in India, Mexico, and Brazil.

- The high population and increasing demand for wireless connections in these countries make AMT a promising investment.

- The company has been decreasing leverage since making the $10.1 billion acquisition in CoreSite.

- REITs are expected to outperform in the foreseeable future, as we are closer to rate cuts than continued hikes.

Ivelin Denev

Introduction

It’s no secret that REITs have been hit hard over the last few weeks. Since the last FED meeting, they’ve been hit even harder. I think now the market is pricing in a higher probability for not only for more rate hikes, but higher for longer. Yes, they have been saying this for a while, but now I think it’s started to really settle with investors. And this has caused even more individuals to rotate out of the market into T-bills. And while this strategy may work for some, this is similar to market timing in my opinion. But I’m staying put and looking for sales and the market has been presenting some good ones, especially in the REIT sector (VNQ).

Be greedy when others are fearful, and fearful when others are greedy is what Warren Buffett said and I’ve been taking that advice seriously in the last year. Like I mentioned in a previous article, I don’t see things as problems, but as opportunities. That’s how a lot of the wealthy, well, make their living. By taking advantage of opportunities. In my opinion, now is not the time to run. I’ve tried timing the market in the past and it is not fun nor sustainable. And I prefer not to take out all my money and place it into T-bills while waiting for the market to stabilize. In short I’m going shopping, positioning my portfolio to live off my dividends faster because of the opportunity it’s presenting right now. And one opportunity I see as a buy is American Tower (NYSE:AMT).

Overview

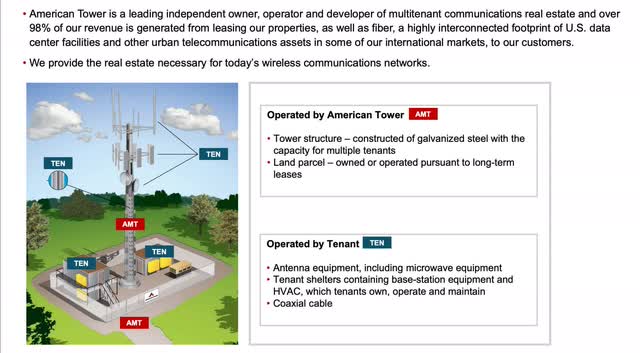

AMT is a global provider of wireless communications infrastructure. They offer services and solutions to support wireless networks in 25 countries located on six continents. They also have over 226,000 global sites with 2700+ in the United States. And although they are based in the U.S., the REIT actually has most of its towers outside of the U.S. One thing I like about this company is that most of their towers are located in India, Mexico, and Brazil.

India has 12000+ towers, Mexico has 8600+ towers while Brazil has 6900+. Why is this so important? These three just so happen to be in the top 10 most populous countries in the world. What does that mean? More people, more connections, more towers needed. Like the saying goes “Location, location, location,” right? This is something I look for when investing in a business, especially a REIT. AMT buys and builds towers, then leases these same towers to large telecom giants like AT&T (T) and Verizon (VZ) who uses them to build out their networks. So now that we know what they do, let’s talk about why they’re a buy right now.

Attractive Valuation

AMT is trading near its 52-week low of $163. In the last month many REITs have sold off. One reason for this is their low yields. And although AMT is yielding almost 4%, that’s still lower than the current average T-bill. They have a 5-year average of less than 2% so the stock is trading at an attractive valuation. Since the last FED meeting, I think investors are now starting to factor in a higher for longer environment. So many are pulling their money out of the market and placing it into safer investments that yield more. The average treasury bonds now yield over 5% compared to tower REITs who have a 5-year average of just 2%.

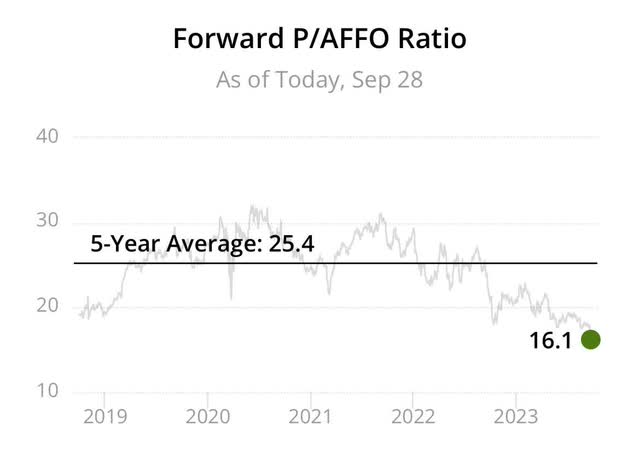

Investors want more bang for their buck and T-bills are currently offering that. Why keep money in a lower yielding investment that can drop in price when I can get a 5% return on a safer one? Because of that thought process, this caused REITs to sell-off and I think this will continue in the near-term. AMT’s P/AFFO ratio is sitting significantly lower than its 5-year average which is something that doesn’t happen that often. This is an opportunity that didn’t even present itself during the flash crash of 2020, which saw many stocks drop quickly. AMT never reached below $175 during that time. Another reason to buy it at a discount. The stock currently offers more than 40% upside to its price target of nearly $232 at time of writing.

SimplySafeDividends

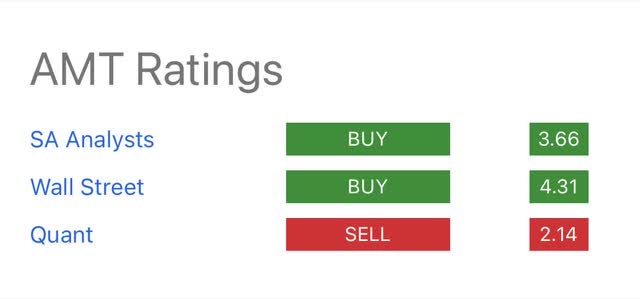

Why Quant Rates It A Sell

According to Quant, AMT is at a high risk of performing badly and has characteristics which have been historically associated with poor future stock performance. They currently have a 1YR price performance of -30.51% compared to the Real Estate sector of -13.02% over the same period. Cell tower REITs have experienced a much steeper drop compared to peers in the sector such as Realty Income (O) and Agree Realty (ADC). While these two are both down double digits at 15% and 18% respectively, AMT and its peers Crown Castle (CCI) and SBA Communications (SBAC), are all down over 30%.

The big reason for this is their lower yield. All three have an average yield of roughly 2%. So you can understand why there has been a big sell-off not only in the sector, but specifically in cell tower REITs. Because of this, now is the best time to buy in my opinion. Investors should be greedy while others are being fearful right now. Some people are saying rates won’t come down until 2025 but my guess is the FED will lower rates before the end of 2024.

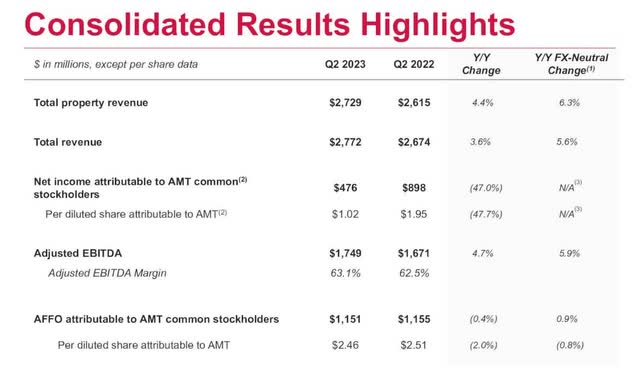

Earnings Disappointment

Another potential reason for AMT’s price drop is the decrease in FFO per share quarter-over quarter. During Q2 earnings the company reported FFO of $2.46 per share, a 3% drop from Q1, and a 2% drop from $2.51 a year prior. Despite all of this AMT still managed to grow total revenue by roughly 4%, and total property revenue by 4.4% year-over-year. Not eye-popping, but decent growth considering the current macro environment. The drop in net income was attributable to financing cost headwinds of 7% and 9% against attributable AFFO & AFFO per share growth, which was driven by high interest rates. Taken all of this into consideration, management still raised AFFO per share guidance for the full year from $9.53-$9.76 to $9.61-$9.79 and rewarded shareholders with a dividend increase of 3.2% for a forward yield of 3.65%.

Balance Sheet

Even though at the end of 2021 AMT made a $10.1 billion acquisition of CoreSite increasing the company’s debt load from $33 billion to $43 billion, the balance sheet remains strong. “CoreSite provides colocation services enabling enterprises, networks providers, and digital platforms to build and deploy custom hybrid IT strategies that monetize and future-proof businesses.” So, while this did increase the company’s debt, this has proved to be a great move for the cell tower REIT as they saw 9% growth in both revenue and operating profit for the first six months of 2023.

And the company expects this to continue as they see demand for data centers outstripping supply in their initial underwriting expectations, elevated pre-leasing, and an extended opportunity for increasingly profitable growth. As you can see below, the company has been making a concerted effort to pay down its debt which has decreased by 10% since last year. One way the company plans to continue this is by capital raised through the pricing of senior notes.

Earlier this month, the company raised approximately $1.5 billion in senior notes and plans to use the proceeds to repay existing debt. Additionally, AMT reduced their exposure to floating rate debt to approximately $6 billion, less than 15% of their total debt outstanding at the end of Q2. Net leverage was also down to just 5.3x and the company plans to continue deleveraging towards its target of 3 to 5x. At quarter end, AMT had more than $2 billion cash on hand.

Growth Outlook

AMT is expected to post significant growth in the coming years thanks to its business model. One way for this is expected mobile data usage growth in the U.S., Europe, and Latin America. Total mobile-connected devices and total U.S. mobile data are expected to grow by 7% from 632 million in 2023 to 881 million in 2028. Furthermore, total U.S. mobile data traffic growth is expected to grow nearly 20% during the same period.

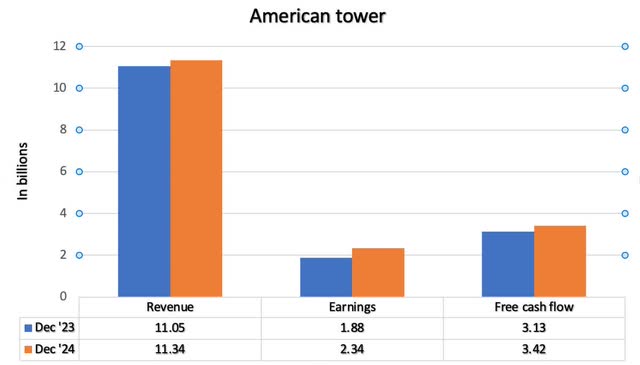

Revenue & FCF are expected to grow in the single digits to $11.34 billion or almost 3% by 2024 and from $3.13 billion to $3.42 billion, or 9.2%. Earnings are expected to grow by double-digits roughly 25% from $1.88 billion to $2.34 billion during the same period. I think analysts are taking the current state of the economy into account. If rates do indeed decline in 2024, I expect AMT to exceed expectations and post low, double-digit growth in 2025 and beyond.

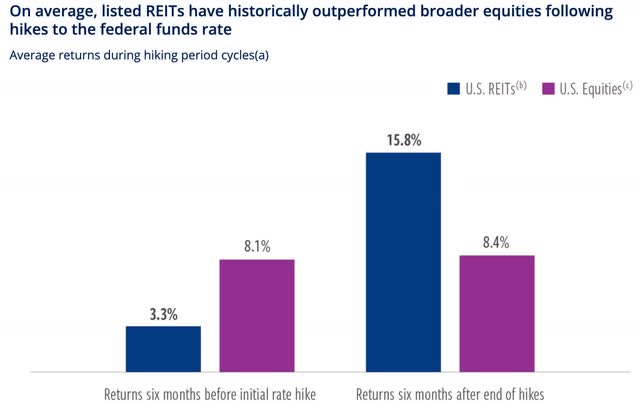

REIT Performance Post Rate Hikes

As previously mentioned, I search for opportunities during times of panic & chaos. That’s when the greatest transfer of wealth usually happens. Although oil prices are surging and inflation is more persistent in Europe and other markets, inflation seems to be backing off in the U.S., although it is still above the Fed’s targeted 2%. So as rate hikes slowly decline in the coming months, I believe REITs will return to their prior performance. Below shows REIT performances six months before rate hikes and six months after (rate hikes). As you can see their performance triples in the six months after. And I think the case will be no different this time around. All that being said, many stocks are offering great sales right now, and trying to time the market after could cause investors to lose out on some good gains in the sector.

Cohen & Steers, Bloomberg, Federal Reserve

Risks

AMT’s largest risk right now are high interest rates. Because rates are to remain in a higher state, I suspect AMT’s price will continue to suffer in the near-term. Because investors are looking elsewhere for higher-yielding, safer investments, this will provide investors who don’t mind taking risks an opportunity to continue dollar cost-averaging into this stellar REIT. Even though the door is still open for a potential rate hike next meeting, I suspect we are closer to the first rate cut, happening sometime in 2024. More so in the mid-year.

As rates continue to be a headwind, especially for REITs in the short to medium-term, AMT management seems to agree the worst of the rate hikes appear to be over. This was apparent by their raised AFFO guidance for the year and the dividend raise announced last week. This is a testament to the company’s financial strength and growth initiatives for the foreseeable future.

Conclusion

Although their yield is below what investors can get currently in T-bills, American Tower is a stellar REIT that normally trades at a P/AFFO ratio of 25x. The stock is currently trading significantly lower indicating it may be undervalued. Additionally, it offers more than 40% upside to its current price target. Investors with a long-term outlook and a tolerance for short-term pain have a chance to pick up a once in a lifetime opportunity with AMT. As more uncertainty travels through the economy in the coming months, I suspect REITs will fall further offering investors more opportunities to dollar cost average as they search for higher-yielding investments. AMT’s growth outlook looks good and think the stock is a buy for long-term investors right now

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.