Summary:

- American Tower has strong business fundamentals and highly recurring revenue, earnings, and cash flows.

- Its leverage position needs improvement, but is not a threat to its dividend.

- The company offers a sustainable income stream over the long term.

Bill Oxford

American Tower (NYSE:AMT) offers a sustainable dividend yield of 3.3% and good dividend growth prospects, plus its valuation is also attractive, making it quite interesting for long-term investors.

Company Overview

American Tower is a real estate investment trust [REIT] that owns and operates telecommunications infrastructure, namely towers related to wireless and broadcast communications. Its main business is to lease antenna sites on multi-tenant towers, being one of the main companies in this industry worldwide. Its current market value is about $90 billion and trades on the New York Stock Exchange.

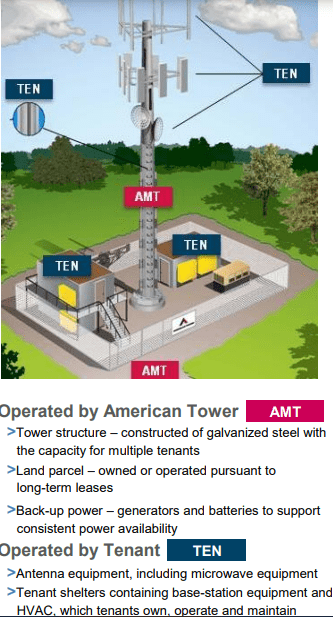

At the end of last March, it had a portfolio of more than 226,000 communication sites, including more than 43,000 properties in the U.S. and Canada, plus over 182,000 properties in the rest of the world. Its business model is to own the real estate and tower structure, while its tenants usually own the remaining tower equipment, as illustrated below.

Tower (American Tower)

Its business provides relatively predictable and growing revenue, earnings, and cash flows over the long term, due to some specific characteristics, including long-term leases with contractual rental escalators, high renewal rates, and relatively low maintenance expenditures.

Indeed, most of its tenant leases with wireless carriers have initial periods of five to ten years, with multiple renewal terms, plus provisions that lead to rent increases on an annual basis, linked to inflation or fixed escalation. Given the current inflationary environment across the world, American Tower’s business is quite well protected due to these types of leases, thus its operating performance may even improve due to inflation, if it can maintain a good cost control and its operating expenses increase at a lower growth rate than rents.

Beyond having a good hedge against inflation, its business also enjoys positive operating leverage, given that when the company establish a property and a tower, the costs of adding additional tenants are quite low and therefore when it’s able to add tenants to an existing site, most of incremental revenue flows directly to its operating profit.

Geographically, American Tower has a good diversification profile due to its global reach, which also gives it good growth prospects over the long term. In the most recent quarter, some 55% of its revenue was generated in the U.S. and Canada, while international markets accounted for the rest. Within foreign operations, its most important region is Latin America (accounting for some 17% of total revenue), followed by Africa (11.7%), Asia-Pacific (9.3%), and Europe (7.1%).

On the other hand, from a tenant perspective, it has much more concentration, especially in the U.S. Indeed, its three largest tenants are T-Mobile US (TMUS), AT&T (T), and Verizon (VZ), which together account for some 45% of total revenue. Other important tenants are also Airtel Africa (OTCPK:AARTY) and Telefonica (TEF), which one accounting for about 10% of total revenue, which means its top five tenants represent about 65% of the company’s revenue.

While historically tenants have high renewal rates and finding alternatives is not easy, if a major tenant decides to move to another tower provider, it can have a significant impact on American Tower’s revenue, which may not be easy to replace as the number of large wireless operators is limited, especially in the U.S.

Regarding growth, American Tower has relatively good growth prospects supported by industry trends such as increasing data usage, which should continue to drive telecom operators’ investment in wireless networks and lead to more leasing activity for tower operators.

Additionally, it also has historically sought external growth through acquisitions, of which the most important in the past few years was its $10 billion acquisition of CoreSite Realty, which diversified its business by adding data centers to its business portfolio. While its current strategy is to prioritize balance sheet deleveraging, American Tower is likely to pursue acquisitions in the future if the opportunity arises.

Moreover, its exposure to some developing markets also gives it good organic growth prospects in the coming years, as smartphones penetration is lower than compared to its domestic market and other developed regions, thus it’s expected solid wireless data demand for years to come.

Financial Overview

Regarding its financial performance, American Tower has a good track record, reporting growing revenue and strong business margins over the past few years. In 2022, due to the acquisition of CoreSite, some 7% of its revenue was generated by data centers, while the rest came almost all from its tower segment.

Its annual revenues in the last year amounted to $10.7 billion, up by 14% YoY, of which 6.9% was related to tenants billing growth. Its adjusted EBITDA was $6.6 billion, representing an EBITDA margin of 62%. The company’s net income was $1.7 billion, and its adjusted funds from operations (AFFO) were nearly $4.7 billion, an increase of 7% YoY.

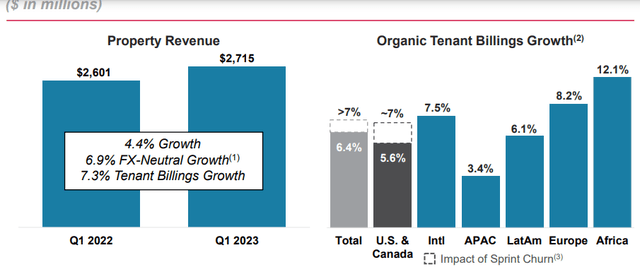

During the first three months of 2023, American Tower maintained a positive operating momentum, with total revenue increasing by 4% YoY to $2.77 billion, boosted by organic tenant billing growth of 6.4%, while on the other hand forex was a headwind. Its data center segment reported revenue growth of 10%, showing that is also enjoying strong momentum.

Regarding its profitability, American Tower reported an adjusted EBITDA of $1.7 billion in Q1 (margin of 63.7%), due to strong cost control that is allowing some margin expansion. Its AFFO was close to $1.2 billion, a small increase compared to the previous year.

For the full year, American Tower’s guidance is to achieve property revenue of about $10.7 billion, up by around 3% YoY, supported by rental growth while forex is expected to impact negatively revenue growth. Its EBITDA should be above $6.9 billion, or a 62.9% margin, while its AFFO is expected to be some $4.5 billion.

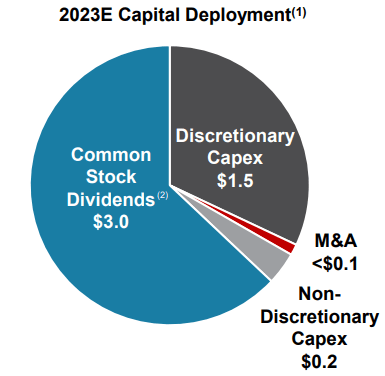

While American Tower has a recurrent and highly cash generative business, its financial leverage is somewhat high, as the company increased its debt position following the acquisition of CoreSite. At the end of last March, its net debt-to-EBITDA ratio was 5.2x, lower than 6.1x at the end of 2021, but still above its long-term target of between 3-5x. Therefore, American Tower’s goal in the short term is to deleveraging its balance sheet, which means most of its organic cash flow should be allocated to shareholder remuneration and capex, while large acquisitions are not expected until it reduces financial leverage to an acceptable level.

Taking this background into consideration, the company’s capital deployment plan for 2023 is to distribute some $3 billion to shareholders through dividends, representing an annual increase of about 10%, allocate some $1.7 billion to capex and a very small amount to M&A.

Capital plan (American Tower)

Regarding its dividend, American Tower has a very good history, delivering a rising dividend over the past few years. Its last quarterly dividend was set at $1.56 per share, or $6.24 per share annually, which at its current share price leads to a dividend yield of about 3.3%.

Given that its dividend is covered by AFFO and the company’s business model is highly recurrent and predictable, plus has a good cash flow generation capacity, American Tower’s dividend is clearly sustainable and is likely to maintain a growing trend in the near future.

Indeed, according to analysts’ estimates, its dividend is expected to grow to about $6.45 per share this year, and increase to about $7.82 per share by 2025, showing that American Tower’s dividend growth prospects are quite good supported by the company’s strong fundamentals.

Conclusion

American Tower is a company with a solid profile, due to its recurring revenue, earnings and cash flows stream, being a strong support for a sustainable dividend over the long term. While its relatively high financial leverage is the main weak factor of its investment case, I don’t see this being a threat to income investors as the company’s priority is to reduce balance sheet leverage rather than seeking further acquisitions.

Regarding its valuation, it’s currently trading at some 19x FFO, at a discount to its historical average of about 25x over the past five years. Thus, American Tower has a sustainable dividend and also offers an attractive valuation compared to its history, being therefore a good income investment right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.