Summary:

- As markets are in turmoil, driven by the recession and banking fears, investors get to benefit from attractive entry prices.

- American Tower is one of these companies. The world’s largest operator of communication towers offers an attractive dividend yield backed by high and consistent dividend growth.

- Moreover, the company has strong secular tailwinds and the ability to capitalize on rapidly accelerating 5G and IoT demand.

BackyardProduction

Introduction

Markets are in turmoil. Volatility in all asset classes is spiking, negative banking headlines are causing people to fear for their money, and recession indicators aren’t doing us any favors either. While it isn’t fun that markets are falling, it is great that we get to buy some high-quality stocks at fantastic prices. And, as buying great stocks at great prices is the core of any successful strategy, I’m embracing the opportunities we get. One of them is the American Tower Corporation (NYSE:AMT), a stock I haven’t covered in the past. In this article, I will change that, as I not only like the qualities this company brings to the table, I even put it in one of my model portfolios and on my watchlist, to be eventually put in my dividend growth portfolio.

So, without further ado, allow me to make the case for a high-quality dividend growth REIT with a spectacular business model.

American Tower – High-Quality Real Estate

I’m allergic to high-yield companies that fail to deliver satisfying total returns. That’s why I am so picky when it comes to sectors that usually contain these types of stocks. Real estate is one of these sectors.

However, there are some fantastic REITs on the market. I recently added to a REIT investment, which I will discuss in the near-term future.

One of the stocks that I have never discussed (shame on me) is American Tower. This company has it all. It comes with a 3.0% dividend yield, consistent dividend growth, a 66% (forward) AFFO (adjusted funds from operations) payout ratio, and a bulletproof business model that comes with growth.

AMT was founded in 1995. As its name already suggests, the company has something to do with towers. The company is one of the world’s largest owners of wireless towers.

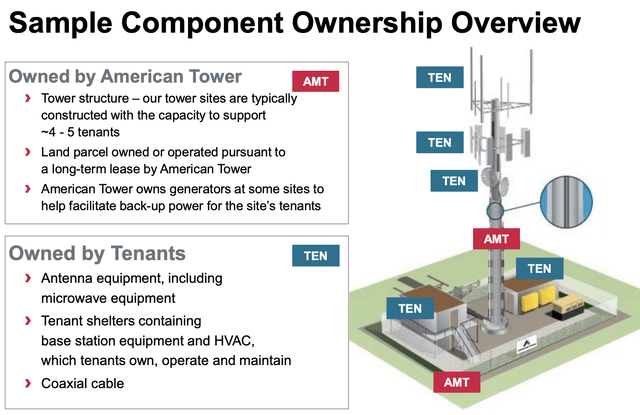

Their primary business is leasing space on communications sites to a variety of tenants, including wireless service providers, radio and television broadcasters, and government agencies.

They also offer tower-related services in the US, including site application, zoning and permitting, and construction management, primarily supporting their site leasing business.

American Tower’s portfolio mainly consists of towers they own and operate under long-term lease arrangements. Contract terms generally include an initial term of five to ten years with multiple renewal terms. Annual lease escalators in the United States are typically fixed at an average of roughly 3%. Escalations in international markets are usually based on local inflation rates.

Note that the US and Canada account for roughly half of the company’s revenue.

What this means is that the company’s main business suffers a bit in case inflation accelerates above 3%. That is currently the case and the reason why the stock price is down. But more on that later.

Moreover, they hold a portfolio of interconnected data center facilities and related assets in the US, which they lease to enterprises, network operators, cloud providers, and supporting service providers.

With that said, the company’s costs are largely fixed. Costs include ground rent (the ground towers are placed on), real estate taxes, site maintenance, insurance, and monitoring.

Similar to its own contracts, the average lease escalator on land in the US is 3%. So, the company mainly benefits when it can provide multiple clients with services from existing towers. This easily leverages existing operating costs.

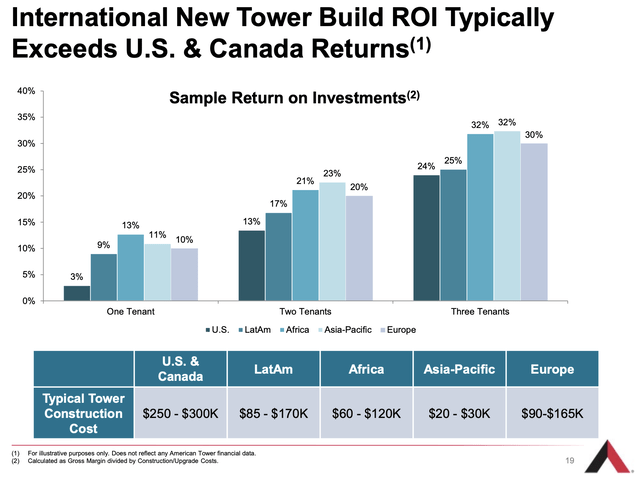

For example, let’s say the company has one tower and one tenant. On average, this would result in a 3% return on investment. That’s not a lot, as it comes with high construction costs. Please note that this is just an example based on its US operations.

By adding a tenant, the company boosts that ROI to 13%. By adding another client, that number jumps to 24%. In this example, construction costs are $275,000 for one tenant. By adding another tenant, nothing changes to that number. It’s the initial cost to build a tower. Even operating expenses can be leveraged. One tenant requires roughly $12,000 in operating expenses like ground rent, property taxes, and others. By adding one new tenant, that number rises to just $13,000. Adding another tenant pushes that number to $14,000. Meanwhile, revenue increases by $20,000 to $30,000 per tenant.

Hence, it is even better news that the company generates even higher returns overseas. For example, in Africa and Asia, the company achieves double-digit returns with just one tenant per tower. Leveraging these businesses is what drives fast international growth.

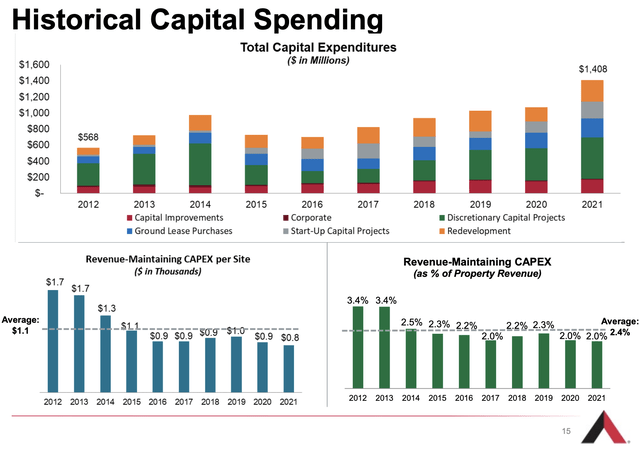

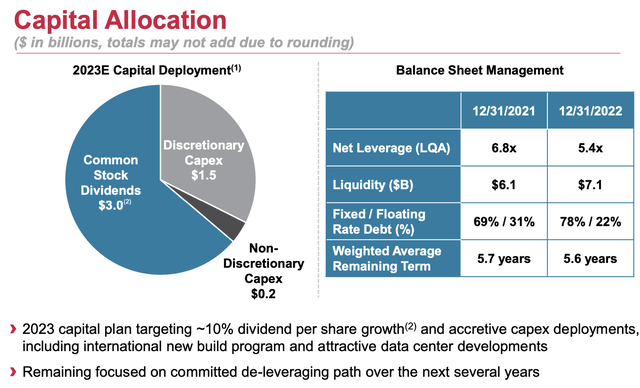

Moreover, capital expenditures are subdued. On average, the company spends 2.4% on maintaining CapEx. The biggest driver of higher CapEx in recent years was discretionary CapEx to boost the company’s asset base. That’s growth CapEx, not sustaining maintenance CapEx.

With that said, the AMT CEO was asked during Citi’s 2023 Global Property CEO Conference why investors should buy AMT stock. He gave investors three reasons. Allow me to summarize his response.

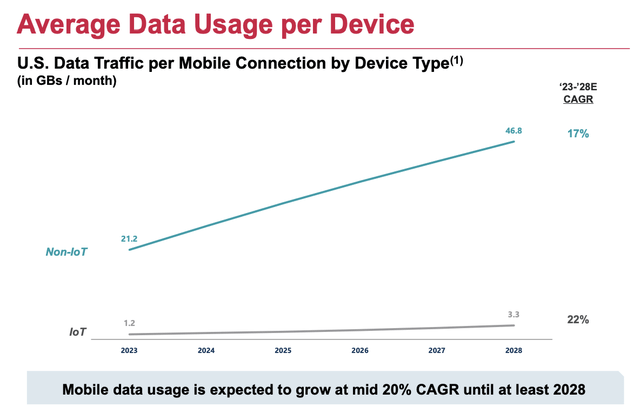

- Demand: The demand for American Tower’s services is driven by the increasing need for broadband wireless, which is a global phenomenon. Large wireless providers invest in their networks to meet this demand, which requires more space on American Tower’s sites. This ongoing demand creates a steady source of revenue. Moreover, it allows the company to use its operating leverage. Demand growth includes expanding 4G in certain areas, advancing 5G in more developed nations and areas, and preparing for what the Internet of Things might look like, where we take connectivity to a next level. Not only are these trends expected to rapidly boost data demand, but we can also assume that it will require more hardware on towers, not less.

Here are two CEO comments from its February earnings call that highlight these trends:

I still think we’re in the early innings really with 5G. Our customers on average are probably on about half of our sites.

Moreover:

On the operational front, we’ve signed comprehensive master lease agreements with T-Mobile, AT&T, DISH and most recently, Verizon in the United States. These agreements represent a commitment to a mutually beneficial, predictable growth path and strategic alignment between American Tower and its customers, while also demonstrating the value and criticality of our nationwide 43,000-plus site portfolio to support 4G, 5G and future network generations.

- Business model: The tower model is considered one of the best business models in the world. American Tower enters into long-term agreements with customers with escalators that take the space on its sites. The company has a large pass-through revenue that comes from revenue down to EBITDA. The tower model provides a significant barrier to entry for competitors. In other words, this is what we just discussed. The CEO added the wide-moat element.

-

Execution: American Tower has a history of delivering strong financial metrics. The company is a leader in ESG, power, and fuel, which is critical for decarbonization globally. The company has also acquired a large data center company in the United States, which creates opportunities for value creation as the edge develops and as 5G becomes more ubiquitous throughout the world.

So there’s an incredible demand, as you well know, as we’ve heard from other competitors in the market for interconnection hubs. And that’s what I really refer to as core side. It’s not a co-location facility. It’s an interconnection hub creating opportunities for new logos. We added over hundred logos last year. And we’re really excited about the opportunity and the demand that we see in the market for activity relative to our data center business in the United States.

Dividends & Balance Sheet

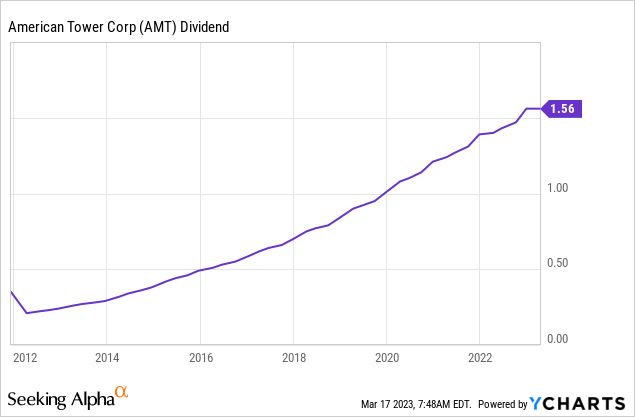

With that said, the company yields 3.1%. It has had ten consecutive years of dividend growth and an average annual dividend growth rate of 15.7% over the past three years. The company usually hikes multiple times per year. The most recent hike was announced in December 2022, when management hiked by 6.1%. On a full-year basis, the company aims to boost its dividend by 10%. That’s a big deal, as we’re dealing with a 3.1% yielding stock. These hikes add up over time.

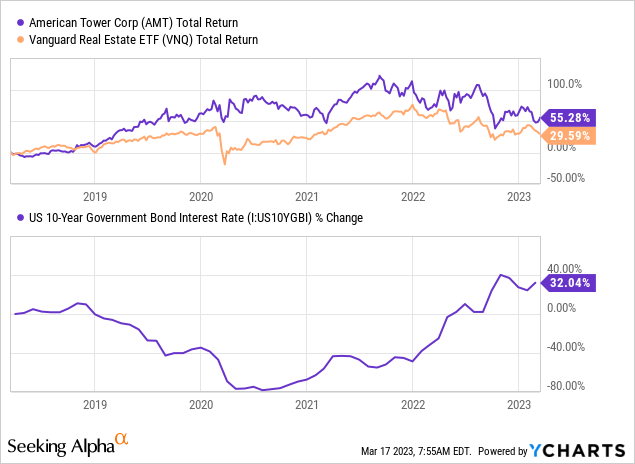

With regard to my earlier market-related comments, AMT shares have suffered, yet less than its benchmark. Over the past three years, AMT has returned 55%. This beats the Vanguard Real Estate ETF (VNQ) by roughly 25 points. This includes a 30% decline from its all-time high as a result of rising inflation, higher rates, and lower investor sentiment. Hence, I added the surge in government bond yields to illustrate the impact this had on the weakness in real estate stocks.

Moreover, with the surge in short-term bonds, investors have an alternative to risky stocks – especially when it comes to buying income.

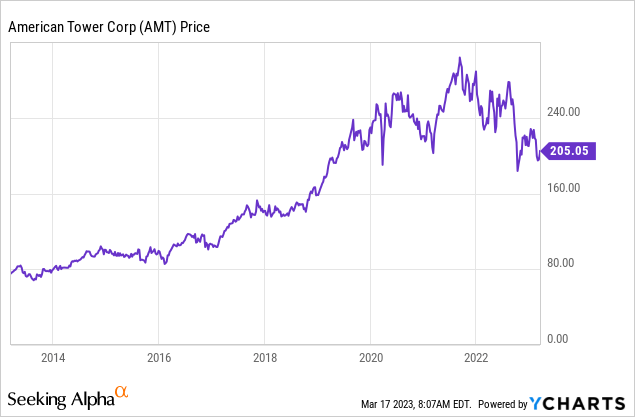

Needless to say, the decline in AMT stock prices is the reason why I’m covering the stock. I put the stock in a model portfolio of mine and made it a potential buy for my dividend growth portfolio, which holds close to 95% of my net worth.

AMT is currently trading at 20x AFFO, which I consider to be a fair value.

While I expect the stock market to remain choppy, I do like the current risk/reward of AMT and believe the stock has the potential to outperform the REIT sector by a wide margin for many years to come.

It also needs to be said that AMT has a terrific balance sheet. 78% of its debt is fixed, which protects it against the surge in interest rates. The same goes for the weighted average remaining term of its debt of 5.6 years. It’s buying the company valuable time. On top of this, the company has deleveraged its balance sheet, reducing the net leverage ratio to 5.4x. This supports its BBB- credit rating.

In both 2023 and 2024, management will focus on further reducing the net leverage ratio to 3-5x EBITDA. After that, dividend growth might even accelerate further if new deals and interest rates allow it.

Takeaway

When I started researching the company behind the AMT ticker, I thought it was a decent company worth having a second look at. When I finished my homework, I put the stock on my watchlist and in one of my model portfolios. I believe that AMT is truly one of the best REITs on the market. It has a stellar business model with a wide moat, and it can easily leverage its existing assets, backed by strong industry tailwinds.

The company has a decent dividend yield, a sustainable payout ratio, fast growth backed by high connectivity demand, a healthy balance sheet, and satisfying dividend growth.

It would make so much sense for me to add AMT, thanks to these qualities and the fact that investors get both growth and a decent yield. One isn’t sacrificing growth to get access to a steady stream of dividends. It’s also a terrific (critical) infrastructure play.

While ongoing market woes keep a lid on the stock, I believe we’re dealing with attractive entry prices.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.