Summary:

- American Tower has a nice, predictable business model that provides investors with nice visibility.

- The company should continue to grow as the use of mobile data continues to rise.

- However, the company is seeing some headwinds in the form of higher interest rates, elevated international churn, and customer collection issues.

Ivelin Denev

American Tower (NYSE:AMT) has been an investment darling riding some nice secular trends for a long time, but the stock’s valuation is too rich for my blood given the recent headwinds it has been facing.

Company Profile

AMT is real estate investment trust (REIT) that leases space on communications sites to wireless service providers, radio and television broadcast companies, wireless data providers, government agencies, and municipalities, among others. Its portfolio primarily consists of towers that it owns or operates through long-term lease agreements. It also owns distributed antenna system (DAS) networks that help deliver coverage in certain in-building and outdoor wireless environments.

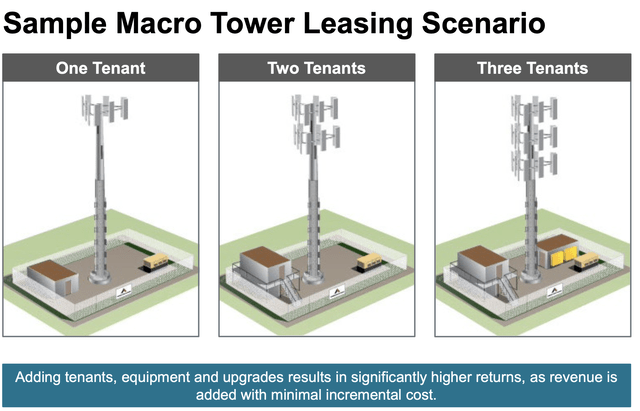

A tower is vertical structure built on a parcel of land designed to handle the equipment of multiple tenants. AMT owns the tower structure and ground interest, while its tenants own and operate their equipment, such as antennas, antenna arrays, coaxial cables, and bases stations, along with equipment shelters. AMT also owns generators at some sites to provide back-up power.

AMT leases the vertical space on the tower and the land underneath to multiple tenants for their communications equipment. Rent is based on the property location, the amount of leased vertical square footage on the tower, and the weight of the equipment placed on the tower.

The company also derives about 2-3% of its revenue from tower-related services. This includes things such as site application, zoning and permitting; structural analysis; and construction management services.

AMT also got into the data center space through its December 2021 acquisition of CoreSite Realty, which it bought for $10.4 billion. It later sold a stake in this business, and now owns 72% of it, or 64% on a fully converted basis, after issuing equity and convertible preferreds to the buyer Stonepeak.

Opportunities and Risks

AMT’s contracts are generally for 5-10 years with multiple renewal options. The contracts are usually non-cancellable, and have lease escalators of around 3% in the U.S. and based on local inflation in international markets. Power and fuel costs are usually passed onto its customers as well.

As such, AMT’s business model provides a lot of visibility. With long-term, non-cancelable contracts that have annual lease escalators, the REIT has a nice steady revenue stream. In addition, churn is typically very low, historically in the 1-2% range.

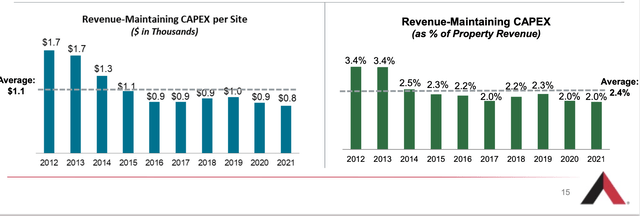

Maintenance CapEx is also generally light. It typically spends $1,200-1,700 a year per tower in the U.S. and $500-800 in international markets. The company has done a good job over the years of leveraging maintenance CapEx per site and as a percentage of revenue as its moved more international markets.

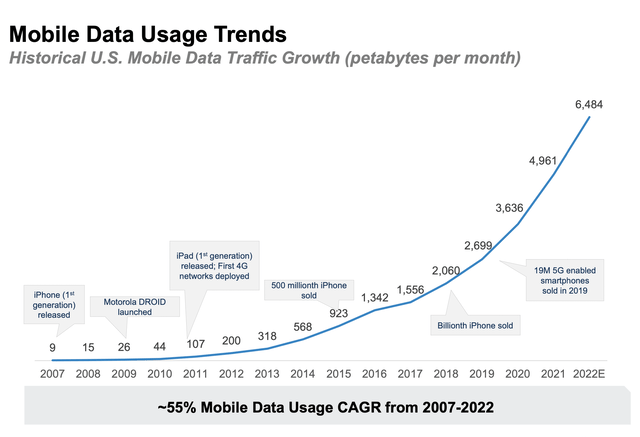

The biggest trend the AMT is riding in mobile data usage expansion. With everyone always glued to their smartphones surfing the internet, watching videos, and interacting on social media, it’s no surprise that mobile data usage just continues to increase. And as speeds continue to increase through the advent of new technology standards such as 5G, mobile data is growing even more.

And with growing mobile data and new technology standards comes increased network spending. And with increased spending comes the need for more tower space. The big wireless carriers typically build out coverage when a new technology standard is introduced, then they add capacity as adoption increases and demand grows.

Right now, the company is still benefiting from wireless companies adding capacity for 5G. It has master lease agreements (MLA) with Verizon (VZ), T-Mobile, AT&T (T), and DISH (DISH) in the U.S. to build out its sites in order to support 4G, 5G, and future network generations. Right now, AMT said that on average its customers are only on about half its sites for 5G, so there is still a strong runway.

On its Q4 call, CEO Thomas Bartlett said:

We expect an acceleration in organic growth in 2023, representing an improvement of around 100 basis points relative to our prior 5-year average. Beginning with our U.S. and Canada segment, the benefits of our comprehensive MLAs and ongoing 5G deployments are driving an expectation for organic tenant billings growth of approximately 5% in 2023, including approximately $220 million in year-over-year colocation and amendment growth, which would be a record year for American Tower by a significant margin.”

International also remains a big opportunity for AMT, although it does come with some risks as well. The company operates sites in 26 countries, and likewise is seeing many of the same drivers as in the U.S. with more mobile data usage and 5G densification. African and India is particular are seeing a lot of growth with additional sites.

On its Q4 call, CFO Rodney Smith said:

When it comes to our build program, I mean, we’re going to build about 4,000 sites this year. That’s the expectation. The biggest chunks here really come from Africa and India in the range of 1,600, 1,700 sites each in those areas. In Europe, we’re going to drive just over 400. In Latin America, maybe just under 300 sites. So there’s an opportunity to build in all of these markets. And we get really good NOI yields in these markets kind of across the board. So it’s not just about the volume of sites. Certainly, we like the idea of increasing our footprint Europe, in particular, driving more builds there with very highly credit quality customers in really attractive economies.

So the 400 plus, 400 to 500 sites we’ll build there are very attractive to us. But as Tom talked about with scaling the core, anywhere where we have management teams and assets and customers, to the extent we can add assets through an internal CapEx program with high NOI yields, it creates a lot of value for our shareholders’ long term. It’s good for our customers as well. So we think all of these markets are attractive in terms of our ability to build new assets.”

When looking at risks, however, international markets do tend to see more churn. Latin American growth, for example, is expected to be moderate the next few years due to Telefónica churn in Mexico and Oi churn in Brazil. Telefónica has migrated its mobile traffic in Mexico to AT&T. There has also been customer consolidation in Africa impacting churn, as well as some churn in APAC.

Some international customers may also not be as strong financially. Case in point, the company has had difficulties collecting all the money owed to it by Vodafone Idea (VIL) in India. VIL is currently making partial payments, and AMT may convert $200 million of existing accounts receivable into a convertible note. This is not an ideal situation, and the company said it may look to sell a stake in its India business as a result.

ATM is also currently facing a headwind from higher interest rates. The company carries a lot of debt, and while the bulk is at fixed rates, it still has nearly $9 billon in variable-rate debt. It also has $3 billion in bonds it will have to refinance this year at higher rates.

Valuation

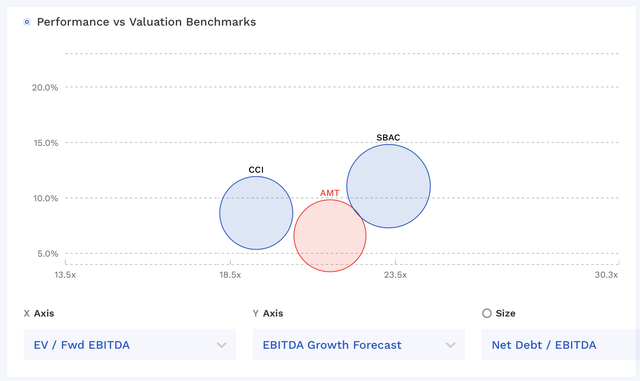

AMT trades at 21.7x EBITDA based on 2023 analyst estimates of $6.82 billion. Based on the 2024 consensus of $7.21 billion, the stock trades at a 20.5x multiple.

Based on a AFFO forecast of $9.85, it trades at 21x price-to-AFFO ratio.

The stock trades in between the value of its two closest peers, Crown Castle (CCI) and SBA Communications (SBAC).

AMT Valuation Vs Peers (FinBox)

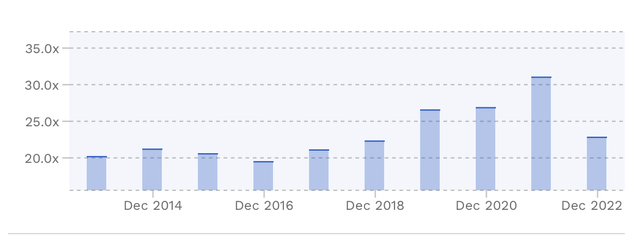

The stock has typically traded at an EB/EBITDA multiple of over 20x.

AMT Historical Valuation (FinBox)

Conclusion

AMT has always gotten a premium multiple for its steady business model. It’s not the fastest grower, but contract escalators along with the growth of mobile data and need for more wireless investments provide a lot of predictability, which investors like.

AMT has been a good long-term investment for quite a while. However, the company has recently seen some headwinds with higher interest rates, collection issues in India, and elevated international churn. With modest growth, a hefty debt load, and only about a 3% yield, the valuation is too rich for my blood in this environment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.