Summary:

- American Tower Corporation posted ho-hum Q2 earnings yesterday.

- AMT stock attempted a breakout from a bearish pattern but failed.

- I don’t see anything to like here, and American Tower stock is a strong sell.

temizyurek

The epic rally we’ve seen in U.S. equities this year has created many winners. However, strength doesn’t extend to every sector, even in raging bull markets. One such sector that has been weak – and, in my view, will remain as such – is real estate investment trusts, or REITs. The sector is naturally defensive and income-oriented, which is exactly the wrong place to be in a bull market. Stocks in this sector generally will underperform the S&P 500 (SP500) during bull runs, and in this article, we’ll review one such stock.

American Tower Corporation (NYSE:AMT) posted Q2 results yesterday, and results were once again, shall we say, uninspiring. The REIT is buried under an ever-expanding mountain of debt that is becoming increasingly expensive to service, all while margins deteriorate with little revenue growth. I’m slapping a strong sell on AMT after the earnings report, and below, I’ll explain why.

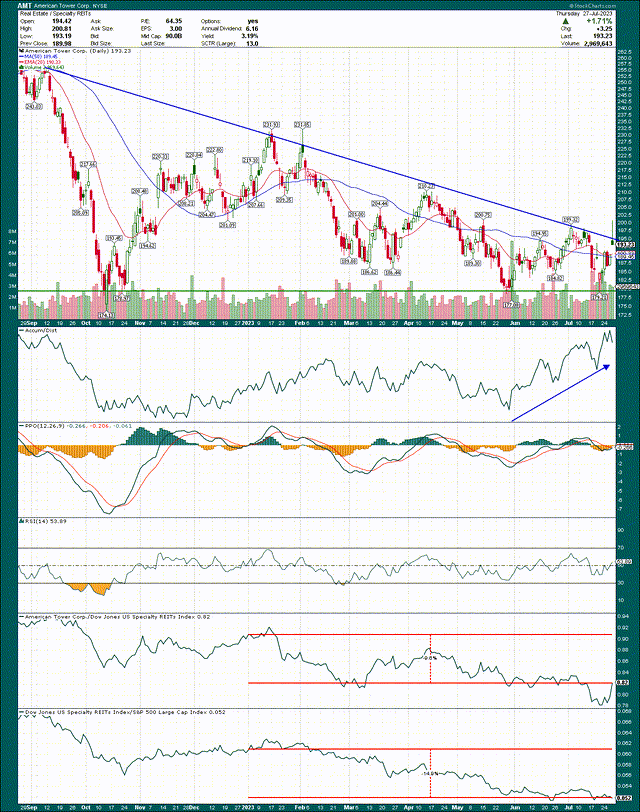

American Tower stock – A potentially damaging pattern is near completion

We’ll begin with a look at the technicals. In this case, I don’t see a lot to like. There’s a massive, long-term descending triangle that is close to completion, and if you’re long, this should terrify you. Descending triangles generally break to the downside after a series of lower highs. That’s exactly what we have here, and it signifies an increasing unwillingness of the bulls to defend a stock. It is my view that we’re going to eventually see a breakdown under $175, and after that, look out below.

We can see the stock actually tried to break out of the pattern yesterday but was swiftly rejected. That’s not a good sign for the bulls. Of course, like with any pattern, the stock could break out to the upside and invalidate it. That’s not what the odds suggest right now, but if you end up shorting, for instance, you’ll still want to use stops.

We have a stock that is underperforming its peers, which are also weak, so we have a weak stock in a weak group. No thanks.

The bottom line on the chart is that unless that downtrend line is broken, and we see a higher high over $200/$201, I like AMT to eventually test and break the bottom end of this descending triangle.

The fundamentals support a price breakdown in AMT

Sometimes, when I look at the fundamentals of a company and the price chart, I see different things. For instance, I may like the fundamentals but see a weak chart. In the case of AMT, the fundamentals support my view of weakness on the chart, as I simply don’t see any reason why your capital should be deployed here.

We’ll start with the Q2 report review, which showed total revenue rising 3.6% year-over-year, or +4.4% when isolating to rental revenue only. That’s fine, and AMT’s model builds in these kinds of modest increases over time. Adjusted EBITDA margins were roughly flat, so adjusted EBITDA rose on a dollar basis by 4.7%. However, the problem is that adjusted FFO (fund from operations) was down fractionally, and after AFFO peaked last year, shareholders are looking at a pretty sizable decline in 2023.

AMT did boost guidance for this year, bringing the bottom end of its AFFO per-share range up by eight cents. Guidance is still below that of consensus estimates, however, so we’re looking at a very small boost to guidance, and only on the bottom end. AMT is focused on reducing operating expenses to support margins, with that number falling from $1.99 billion in Q1 to $1.90 billion in Q2. However, as we can see below, AMT needs much more than that to salvage a bull case.

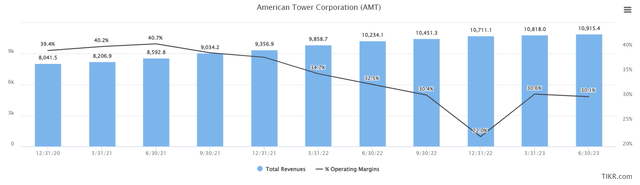

This is a look at trailing-twelve-months revenue and operating margins going back to 2020, and it’s not pretty.

AMT has managed to boost the topline pretty consistently, but it’s not translating to profitability growth. Operating margins for the past four quarters are about 30% of revenue, miles away from the 40%+ it achieved in the 2020/2021 period. Anytime I see sustained margin deterioration of this magnitude, a bull case is pretty difficult to make. Cutting operating expenses, like we saw in the Q2 report, is a decent start, but that only goes so far. There comes a point for any entity that it cannot cut any longer, so I don’t see that as a long-term solution.

The other problem is that AMT has been proven to be pretty poor at using leverage for the benefit of shareholders. AMT has a lot of debt, but that’s expected given the nature of its business. The amount of debt is not necessarily the problem. The problem arises in that, to my eye, AMT’s use of leverage is actually destroying value for shareholders, and that it’s becoming increasingly expensive to service at a time when margins are already contracting.

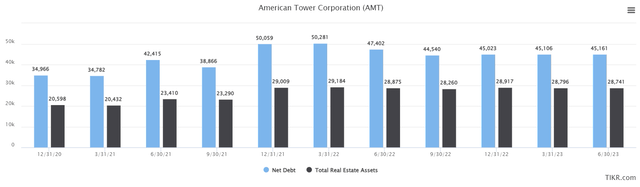

Here’s a look at the REIT’s real estate assets (which ignores the ~$30 billion of goodwill and intangibles on the balance sheet) against net debt.

The value of the REIT’s earning assets has been steadily declining while debt has stayed roughly the same at ~$29 billion. That indicates to me that the investments the REIT is making aren’t generating sufficient value for shareholders. And yes, I understand AMT’s assets get depreciated over time. However, other REITs manage to grow their book values despite this factor, so I don’t give AMT a pass.

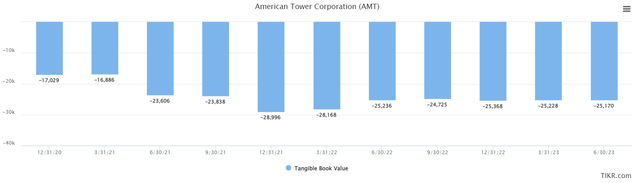

In fact, if we isolate tangible book value, this doesn’t look anything like a stock I want to own.

Value is being destroyed nearly all the time on this measure, and given the weakening margin picture, I have no idea when or if this may improve.

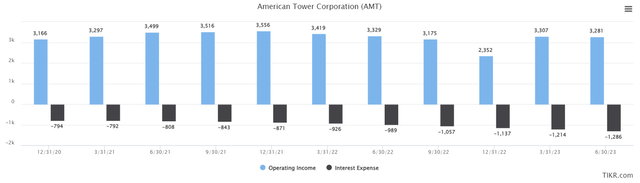

Further, because of weakening margins and rising debt costs, the amount of operating income that AMT must use to service its debt is moving sharply higher. Below is TTM operating income and interest expense for the past three years.

For instance, in 2020, about 25% of operating income was used to pay interest expenses. That’s high, but in the most recent four quarters, it’s 39%. This is unsustainable, and any further deterioration in margins will exacerbate the issue. This has implications for FFO, obviously, but also on the REIT’s ability to ever get out of this cycle of debt. Its model is slow and steady growth, and while that’s fine, I don’t see how AMT is going to grow its way out of this issue.

The bottom line

If we wrap all of this together, I see a weak chart on the verge of a major price breakdown, a REIT with modest growth prospects due to perpetually weak margins, a mountain of debt that is being used imprudently, and ever-increasing debt servicing costs. In a world where there are better REITs to be had, and more importantly, better sectors of the market to be invested in, AMT is a hard pass for me.

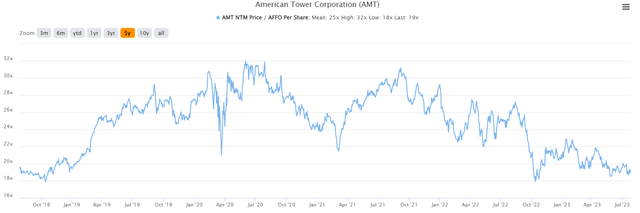

The one thing the stock has going for it is that it’s cheap.

P/AFFO on a forward basis is about 19X today, which is well under the average in the past five years of ~25X. However, it is my view American Tower Corporation stock is cheap for a reason, and this alone is not enough to persuade me off of my bearish stance. I’m siding with the Quant Rating on this one and suggesting you look elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.