Summary:

- American Tower Corporation is a good investment opportunity due to the increasing demand for 5G networks and its vast communication network infrastructure.

- AMT’s extensive portfolio of communication sites and interconnected footprint position it as a key player in the industry.

- The company’s growth potential in the data center segment and solid financial performance make it an attractive investment option.

Kinwun

Investment Rundown

Demand for 5G networks continues, and one of the best ways to benefit from this is by investing in a company like American Tower Corporation (NYSE:AMT) right now. It operates a vast set of communication networks across the US and has come down quite a lot in price as well over the last 12 months, down around 26%. It offers a near 3.5% yield right now and is in my opinion in the buy zone as the technical chart seems to suggest a bottom is being found, and a rebound upwards is imminent.

I like the asset base of the business and the tailwinds are only building which is bringing more and more value to the business and shareholders. Increasing data usage is making 4G and 5G more broadly established. For a steady dividend income play right now, I think that AMT is certainly one, and I will give them a buy rating.

Company Segments

AMT, a prominent global Real Estate Investment Trust (REIT), stands as a key player in the realm of multitenant communications real estate. With an extensive portfolio comprising close to 226,000 communications sites, the company holds a significant presence in the industry. Moreover, AMT boasts a highly interconnected footprint, including a network of data center facilities across the United States. This strategic positioning underscores the company’s pivotal role as an independent owner, operator, and developer in the field of communications infrastructure.

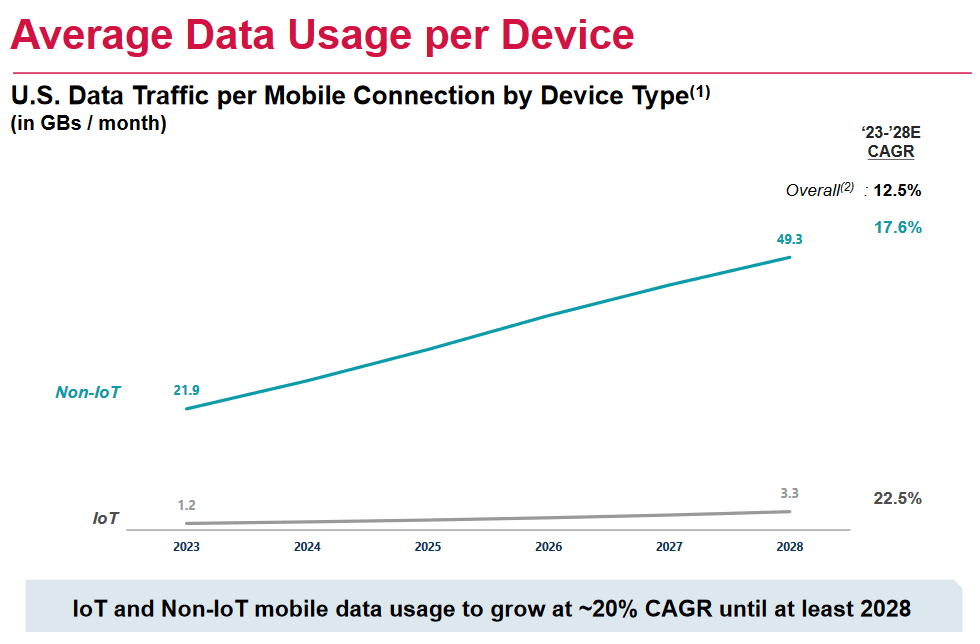

Data Growth (Investor Presentation)

One of the leading momentum builders for AMT right now is the increased usage of data traffic per mobile user. This is expected to grow at a CAGR of 12.5% up until 2028 as seen in the chart above. Tailwinds such as these are why I remain so bullish on the company and the prospects of raising the dividend even further. The data center segment for the company saw solid leasing growth in the last quarter, so AMT is firing on all cylinders right now in terms of growth I think.

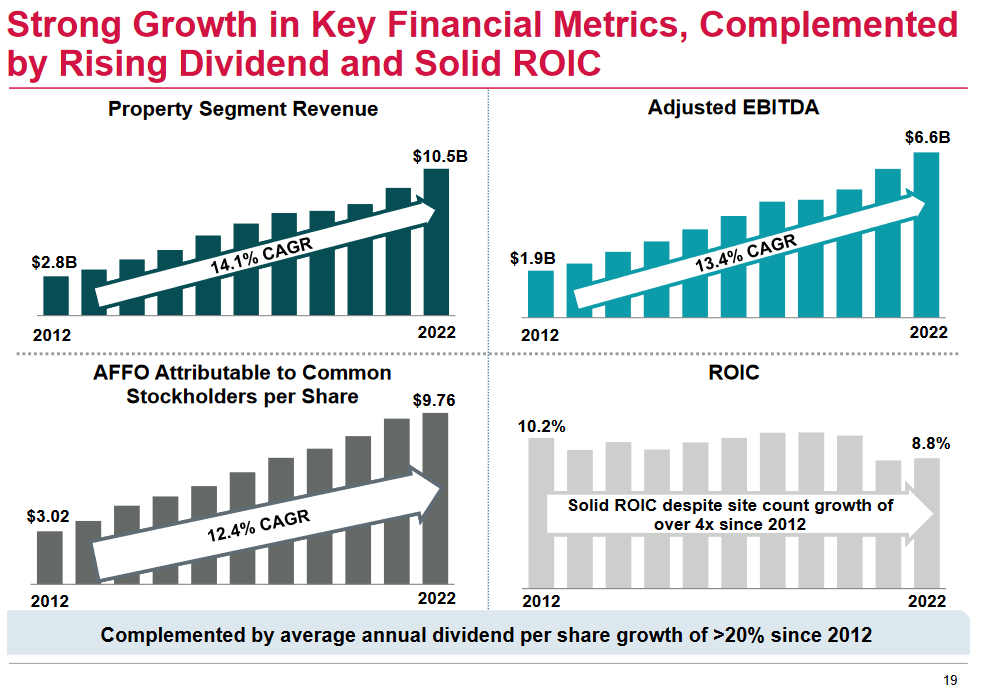

Company Demand (Investor Presentation)

Historically, the company has managed to have very solid growth for both the top and bottom lines of the business. It has done so by continuously investing and expanding, which has built up the debt levels significantly, but also yielded a strong investor return. Most recently, AMT has been venturing into the data center segment over the past few years, with ambitious plans to further grow its data center portfolio. Although this currently represents approximately 8% of its total revenue, the company is actively pursuing expansion in this area. This strategic move positions AMT as a direct competitor to industry players like EQIX, DLR, and IRM. What sets AMT apart is that it combines the stability of a tower REIT with the growth potential typically associated with data center REITs. If its data center revenue experiences rapid growth, it could lead to a substantial increase in the company’s overall value, offering investors an attractive proposition.

Valuation

AMT is currently trading in close proximity to its 52-week low, with shares priced at around $163. This recent downturn aligns with a broader trend in the REIT sector, where many companies have experienced declines in their stock prices. One primary contributing factor to this trend is the relatively low yields offered by REITs, and while AMT boasts an attractive yield of nearly 4%, it still falls short of the current average yield for Treasury bills.

Moreover, AMT’s P/AFFO ratio is currently trading significantly below its five-year average. This presents an uncommon opportunity for investors, as such deviations from the historical norm are relatively infrequent and can indicate substantial potential for upside in the stock.

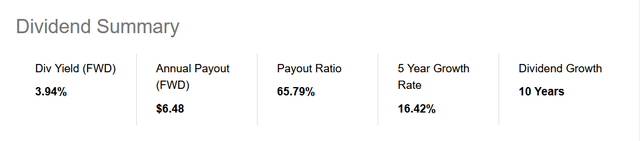

Dividend Summary (Seeking Alpha)

Looking at the dividend summary for AMT, I find it rather appealing as the payout ratio is not abnormally high at 65%. A high payout ratio would be along the lines of 90 – 95% instead. This leaves room for AMT to raise the dividend in times when the earnings may stagnate or not grow as fast. I am still bullish on the earnings prospects of AMT, but what I find further reassuring about the company is the cushion that investors get, knowing AMT could raise the dividends without jeopardizing their earnings distribution strategy too much. By this, I mean they can afford to have a higher payout ratio for a short amount of time and still deliver on their already 10-year consecutive run of raising the dividend.

Risks

The remarkable surge witnessed in U.S. equities throughout this year has undeniably resulted in numerous success stories. Yet, it’s important to note that not every sector has enjoyed this strength. One sector that has faced challenges amid this rally is real estate investment trusts, often referred to as REITs. This sector typically exhibits a defensive and income-oriented nature, making it less appealing during a bull market. As such, REITs have encountered headwinds in the current market climate.

For those that seek to capitalize from short-term momentum, then I wouldn’t suggest AMT to be a buy right now, but rather a hold. The sector it’s in may not be prone to the same rally as perhaps tech companies are, but that isn’t to say it won’t be a good long-term addition to a portfolio, that is still a view that I hold true.

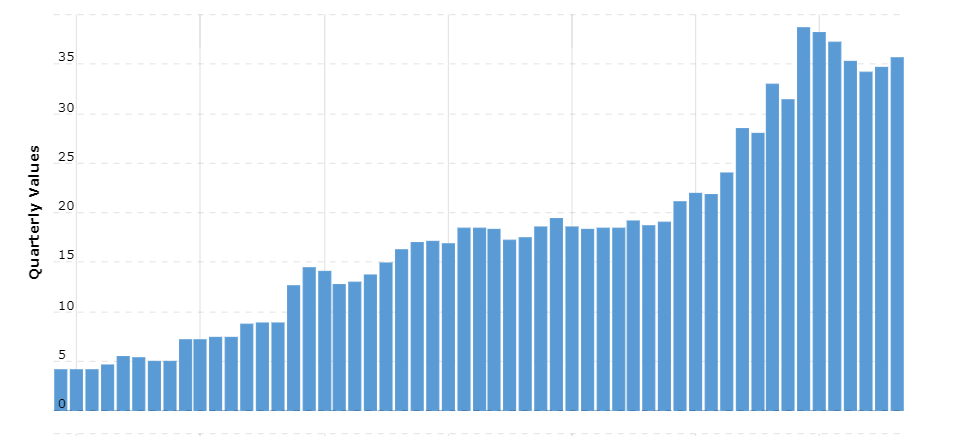

Debt Levels (Macrotrends)

AMT is currently wrestling with a mounting debt load that seems to expand relentlessly. Servicing this debt has become more costly over time, and the situation is exacerbated by deteriorating profit margins and a lack of substantial revenue growth. These challenges are placing significant pressure on the company. The hope is that the asset base that AMT holds will continue to appreciate in value and that they can leverage this into stronger earnings for business and service the debt that they have gathered up so far.

Financials

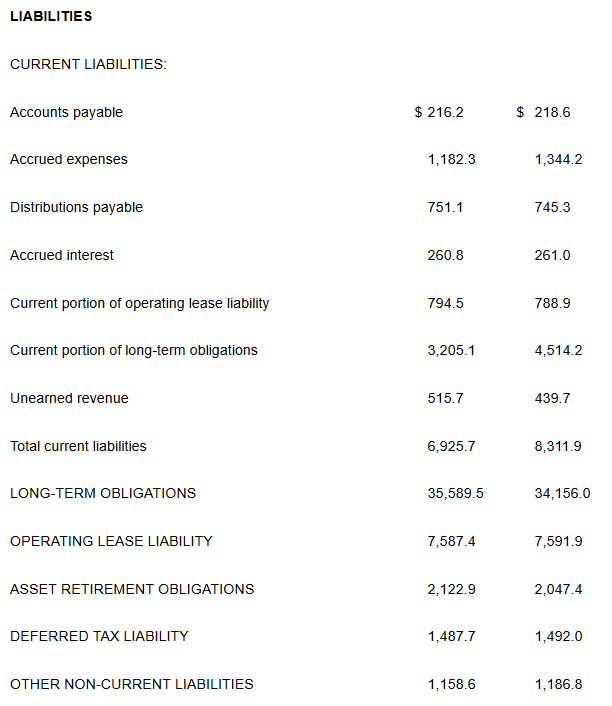

Company Liabilities (Investor Presentation)

On the liabilities side of things for AMT, I think they have some issues to attend to that could drag down the share price somewhat. The current debt obligations are over $3 billion, which is coverable by around 66% if the cash position is used. But it leaves open the risk that share dilution will be necessary to a great extent. As with a lot of REITs, this is a common practice to gather up more capital and be able to invest, but as to the extent of the dilution, the share price drop is often reflected. AMT has had a long history of high debt levels and the current market tailwinds have only made their assets in higher demand, so I wouldn’t think they are in a spot where they might default on debt, EBITDA is still quite high at TTM of $6.7 billion.

Final Words

AMT is an exciting company that is benefiting heavily from the increased data usage, as the company holds a vast amount of assets related to telecom. The company is also moving into data centers, which should add another set of growth opportunities for the business. The price has also come down around 25% in the last 12 months, and this has in my view opened up a very good buying opportunity. With a decent dividend, AMT looks like a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.