Summary:

- American Tower is a top-tier business that continues to benefit from heavy investments in 5G deployments by the top wireless carriers.

- AMT has a long growth runway ahead as wireless demand continues to grow at an accelerating pace.

- Recent share price weakness gives long-term dividend growth investors an excellent opportunity to layer into the stock.

turk_stock_photographer

There are some in the finance industry such as the late founder of Vanguard, who would have you believe that you can’t time the market. I believe this comes from a place of arrogance, as they think most retail investors are incapable of making their own investment decisions, and are better off plopping X percentage of their paycheck every month to an index fund without care for pricing.

Even Warren Buffett recommends the S&P 500 (SPY) for others while he himself has all the fun of picking his own stocks to buy.

I don’t subscribe to that notion, as stocks go through periods of under and overvaluation all the time, and while you don’t always have to sell your winners, money is often made by buying the right stocks at the right time and holding tight, especially when the generate a growing dividend stream.

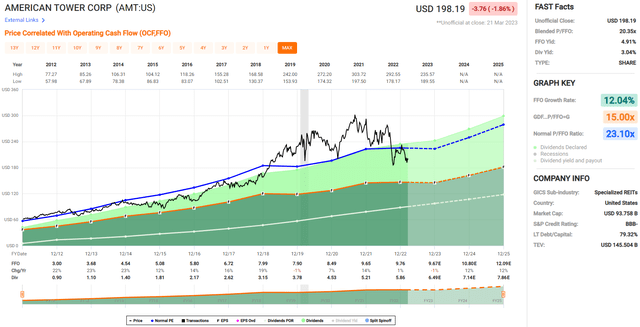

Such may be the case with American Tower (NYSE:AMT), which as shown below, is now again trading near the lows achieved in the Fall of last year. Let’s explore why now may be a great time to layer into AMT while market sentiment is working against it.

Why AMT?

American Tower Corporation is a leading REIT that owns and operates a global portfolio of communication towers, rooftop sites, and other infrastructure used by wireless carriers, broadcasters, and other tenants.

The company has a strong track record of growth and profitability, and its business is well-positioned to benefit from the ongoing expansion of mobile and broadband networks around the world. At present, it operates on six continents and its asset portfolio contains 225,000 communications sites.

Impressive, AMT has maintained a strong track record of growth over a long period of time. This includes the latest fiscal year 2022, during which AMT saw 18% FX-neutral revenue growth, and 13% FX-neutral adjusted EBITDA growth. Importantly, growth is also translating to the bottom line for shareholders, as AFFO peers share growth.

Admittedly, organic growth was roughly flat for AMT last year, but that was due primarily to Sprint (now part of T-Mobile (TMUS)) churn. However, AMT is well-positioned going forward, as most of Sprint churn is behind them while its peers still have most of their Sprint churn ahead of them.

Looking forward, it may seem that AMT’s best days are behind it, based on widespread mobile adoption that’s already taken place. However, wireless adoption shouldn’t be confused with demand, as its increasing wireless demand that is a key growth driver for AMT.

This is reflected by continued heavy investments by the top wireless carriers such as AT&T (T), Verizon (VZ), and T-Mobile into their networks, which benefits AMT. This includes the expected $60 to $70 billion in network spend this year to deploy the $150 billion in collective spectrum spend over the past few years by the top wireless carriers.

This also fits well with AMT’s data center capabilities which enables interconnection with 5G, as highlighted by management during the recent Citi (C) conference:

We also acquired a significant large data center company in the United States a number of years ago, which was really underwritten just by the cash flows that the business generates.

But the opportunity, we think, from interconnection perspective of mirroring their capability, their customer base with our tower capabilities, we think will really create a significant amount of value as the Edge develops and as 5G becomes more ubiquitous throughout the world.

Meanwhile, AMT carries a strong balance sheet with a net debt to EBITDA ratio of 5.4x and a staggering $7.1 billion in liquidity. 78% of AMT’s debt is fixed rate and has a weighted average remaining term of 5.6 years.

Admittedly, AMT’s dividend growth rate is expected to slow from the 17.5% 5-year CAGR to 10% growth this year. However, I believe this is a prudent move as AMT seeks to balance investments with the current higher interest rate environment. Importantly, the 3.1% dividend yield is well-protected by a 64% AFFO payout ratio (based on 2022 AFFO per share of $9.76)

Lastly, while AMT stock isn’t screaming cheap at $198, with a forward P/FFO of 20.2, I do find it to be reasonably attractive with this valuation sitting comfortably below its normal P/FFO of 23.1. This is considering the moat-worthy nature of the enterprise and long-term expectations of high single digit annual FFO per share growth for the foreseeable future.

Analysts have a consensus Buy rating with an average price target of $247, which equates to a potential 28% total return over the next 12 months.

Investor Takeaway

American Tower is a top-tier business that continues to benefit from the heavy investments in 5G deployments by the top wireless carriers. It has a long growth runway ahead as wireless demand continues to grow at an accelerating pace.

Meanwhile, AMT carries a reasonably strong balance sheet and aims to continue robust dividend growth. While AMT doesn’t scream cheap, it’s reasonably attractive after the recent drop in price for its moat-worthy characteristics and high quality income stream.

Disclosure: I/we have a beneficial long position in the shares of AMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!