American Tower: The Bullish Case Remains Intact

Summary:

- American Tower Corporation is the second largest publicly traded REIT and has outperformed the S&P 500 with a 23.1% increase in share price since last year.

- The company reported strong revenue growth, particularly in its Asia Pacific operations, but net profits fell due to higher interest expenses and impairments.

- Management has announced the sale of its struggling business in India for up to $2.5 billion, which will be used to further reduce debt.

bjdlzx

As far as real estate investment trusts, or REITs, go, you don’t get much larger than American Tower Corporation (NYSE:AMT), currently the second largest publicly traded REIT on the planet. In the past, I have written favorably about the company. The last article that I published dedicated to it was published in August of last year. In that article, I compared the company to rival Crown Castle (CCI), ultimately concluding that, while American Tower certain advantages and a better, in summer specs, operational history of hand its rival, Crown Castle made for the better prospect. In a more general article that I recently published, where I was covering three niche REITs, I reiterated that statement.

But just because I view one particular prospect is better than another does not mean that the second-choice candidate is a bad opportunity. Far from it. In my article from August of last year, I ended up rating American Tower a ‘buy’ to reflect my view that the stock should outperform the broader market for the foreseeable future. And sure enough, that is exactly what came to pass. Shares have seen upside of 23.1% since then, a return that dwarfs the 5.9% rise seen by the S&P 500 over the same window of time. Given this nice increase in price, as well as some other developments that have occurred since then, I figured it would be a good time to update my thesis. Truth be told, I would make the case that while shares have risen materially, American Tower still offers enough potential to warrant a ‘buy’ rating at this time.

Performance keeps chugging along

Since my last article dedicated to American Tower, we have seen additional data come out. That data includes results for the third quarter of the company’s 2023 fiscal year. For the most part, that quarter was a strong showing for the company. Revenue, for instance, came in at $2.82 billion. That represents an increase of 5.5% over the $2.67 billion generated one year earlier. Some of the company’s strongest growth came from its Asia Pacific operations, with revenue spiking 21.3% from $249.2 million to $302.3 million. That increase was driven mostly by higher pass-through revenue and other revenue that was driven by a decrease in revenue reserves because of reserves that were taken the prior year. In the US and Canada, meanwhile, revenue grew a much more modest 5.2%. But that $65.3 million increase it resulted in is rather significant. And most of that was driven by a $59.8 million rise in tenant billings that management attributed largely to the leasing of additional space at its sites.

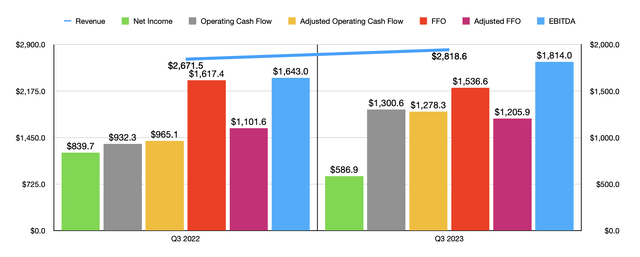

With a rise in revenue, you would expect to see an improvement in earnings. But there were multiple issues that the company contended with that prevented this from being the case. For starters, higher interest rates led to interest expense rising from $294 million last year to $359.2 million this year. The company also booked a $322 million impairment associated with its operations in India. And lastly, in the third quarter of the 2022 fiscal year, the company had “other income” of $478.5 million. This year, that figure was $297.8 million. Most of the “other income” generated during these windows of time was attributed to foreign currency gains that the company benefited from. As a result of all of this, as well as other factors, net profits fell from $839.7 million to $586.9 million.

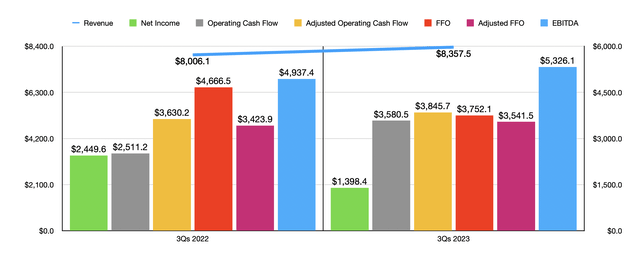

Of course, there are other profitability metrics that investors should be paying attention to. And for the most part, these came in strong. Operating cash flow is one example. It jumped from $932.3 million to $1.30 billion. If we adjust for changes in working capital, the rise was only slightly smaller from $965.1 million to $1.28 billion. The only weakness was when it came to FFO, or funds from operations. This metric managed to drop from $1.62 billion to $1.54 billion. But on an adjusted basis, it increased from $1.10 billion to $1.21 billion. And lastly, there was EBITDA. It grew from $1.64 billion in the third quarter of 2022 to $1.81 billion the same time of the 2023 fiscal year. As you can see in the chart above, results for the first nine months of 2023 relative to the same time of 2022 show that this is not a trend. All of the same metrics posted the same trajectories year over year.

Management has not come out with a firm date regarding fourth quarter earnings. We do know that prior guidance provided by management calls for net profits for 2023 in its entirety of between $1.76 billion and $1.82 billion. Adjusted FFO is believed to be between $4.54 billion and $4.60 billion, while EBITDA is likely to be between $7.01 billion and $7.09 billion. Assuming all of these come to fruition, we should see FFO of around $5.34 billion and adjusted operating cash flow of roughly $5.64 billion.

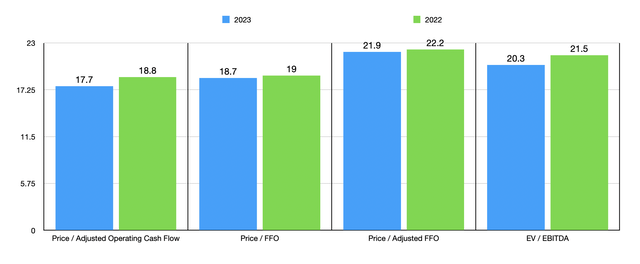

Using these figures, I was able to value the company as shown in the chart above. For a high quality company with generally stable cash flows, the stock is not cheap, but I wouldn’t call it expensive either. Sometimes, you have to pay for quality. And that is what a firm like American Tower brings to the table. You can also see that American Tower is not the most expensive of the group either. In the table below, you can see how shares are priced compared to Crown Castle and SBA Communications (SBAC).

| Company | Price / Operating Cash Flow | EV / EBITDA |

| American Tower | 17.7 | 20.3 |

| Crown Castle | 16.0 | 17.5 |

| SBA Communications | 19.5 | 23.0 |

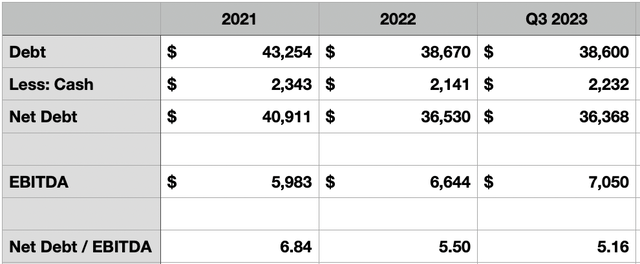

Outside evaluation, there are some other things that we should take into consideration. First and foremost is that management has been doing a very fine job of reducing leverage. At the end of 2021, for instance, the company had net debt of $40.91 billion. But for that year, EBITDA was only $5.98 billion. That translated to a net leverage ratio of 6.84. By 2022, a $4.38 billion reduction in net debt and an increase in EBITDA to $6.64 billion brought the net leverage ratio down to 5.50. And assuming that management has not decreased debt any further for the fourth quarter, the net leverage ratio for 2023 should end up being around 5.16.

For a company that has forecasted around $1.65 billion and $1.76 billion toward capital expenditures for 2023, with most of that being focused on growth initiatives, while simultaneously allocating $2.19 billion toward common stock distributions in the first nine months of 2023, this kind of improvement in net leverage is impressive.

But this brings us to another development, which was just announced on January 4th. As I mentioned earlier in this article, the firm took a $322 million impairment on its operations in India. For some time now, American Tower has been struggling with that business. In fact, in its third quarter earnings release, management made clear that they were reviewing strategic alternatives, including taking indications of interest from other parties, that may result in a sale of those assets. Well, on January 4th, the company announced that it was selling off its business in India in exchange for up to $2.5 billion if we assume that current exchange rates remain unchanged.

The $2.5 billion figure is based on $2 billion at closing, with a ticking fee that started accruing from October 1st of 2023. If we assume that management gets the full $2.5 billion, then that will translate to about seven times the annual EBITDA of $355 million associated with those assets. That in and of itself is fairly awful. The good news is that management intends to use the proceeds to reduce debt even further. More likely than not, the firm will allocate at least some of this toward paying down its debt in India. It has one term loan there in the amount of $120.7 million. But my hope is that whatever decision management makes will involve a reduction of some of its higher rate debt. Allocating $2.5 billion toward debt that has a weighted average interest rate of, say, 5.5%, would save the company $137.5 million in interest expense annually. That would improve the EV to EBITDA multiple of the transaction slightly to 11.5. But of course, we will have to wait and see what all transpires.

Takeaway

At this time, I believe that American Tower is a solid prospect for long-term investors who don’t mind paying a bit of a premium for a high-quality business. Management continues to do well to grow the firm, but they are mindful to sell off assets when they believe it appropriate. In the long run, I fully expect that the company will go on to create significant value for shareholders. And because of that, I have no problem keeping it rated a soft “buy” at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!