American Tower: There’s Still Time To Buy This Wonderful REIT

Summary:

- American Tower’s share price has soared 40% off its 52-week low in recent months.

- The company’s total revenue and AFFO per share climbed higher in the third quarter.

- American Tower holds a BBB- credit rating from S&P on a stable outlook.

- Shares of the communications infrastructure REIT could be trading at a 20%+ discount to fair value.

- American Tower could have what it takes to triple the S&P through 2025 and over the coming 10 years.

A 5G cell tower in a rural setting. Thurtell/iStock via Getty Images

In the fast and furious world of the stock market, it can be difficult to keep up. Fundamentals rarely receive the entirety of the focus that they deserve from markets over the short term. When facts fall out of focus, emotions take center stage and narratives begin to form. Thus, how the market can seemingly swing from fear to greed or vice versa overnight.

I don’t have a crystal ball to predict market movements in the near term. That’s precisely why I prefer to focus on buying great businesses and tuning the noise out.

Up 40% from its 52-week low set last October, American Tower (NYSE:AMT), is one such business that I own in my portfolio. Despite this massive pop in the share price, I believe the company remains compelling enough to be a buy. For the first time since May 2021, I will reexamine American Tower’s fundamentals and valuation to explain why.

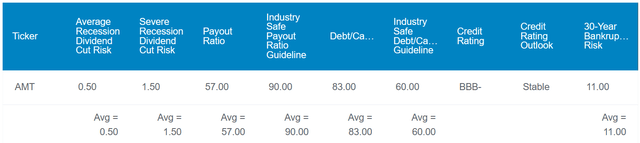

Dividend Kings Zen Research Terminal

American Tower’s 3.1% dividend yield clocks in at twice as much as the 1.5% yield of the S&P 500 index (SP500). Yet, this dividend appears to be rather sustainable.

The company’s 57% AFFO payout ratio comes in well below the 90% AFFO payout ratio that rating agencies prefer from REITs. This compensates for an 83% debt-to-capital ratio, which is somewhat elevated versus the 60% debt-to-capital ratio that rating agencies want to see from REITs. That’s why S&P rates American Tower’s debt a BBB- on a stable outlook. This implies the risk of the REIT defaulting on debt over the next 30 years is 11%.

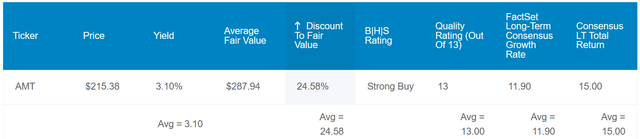

Dividend Kings Zen Research Terminal

Even after American Tower’s sharp rally in the last two months and change, shares look to remain attractively valued. Based on its historical dividend yield and P/AFFO ratio, shares of the REIT could be worth $288 a piece. Relative to the $215 share price, this suggests shares are trading 25% below fair value.

If American Tower matches the analyst growth consensus and returns to fair value, here are what total returns could look like in the next 10 years:

- 3.1% yield + 11.9% FactSet Research annual growth consensus + 2.8% annual valuation multiple expansion = 17.8% annual total return potential or a 415% 10-year cumulative total return versus the 8.6% annual total return potential of the S&P or a 128% 10-year cumulative total return

A Third Quarter That Outperformed Expectations

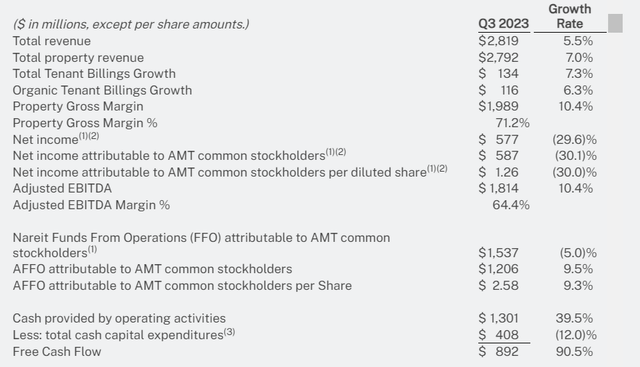

American Tower Q3 2023 Earnings Press Release

American Tower’s results for the third quarter ended September 30 were an all-around display of strength. The company’s total revenue edged 5.5% higher over the year-ago period to $2.8 billion. For perspective, that surpassed the analyst consensus by $60 million.

This healthy topline growth rate was fueled by 7% total property revenue growth during the third quarter. According to CFO Rod Smith’s opening remarks during the Q3 2023 earnings call, American Tower’s organic tenant billings growth was over 6% in the tower business. The 9% organic net revenue growth within the data center business also contributed to the company’s overall growth in the quarter.

Geographically, international organic tenant billings growth of 7.9% led the way for the company (slide 5 of 33 of American Tower’s Q3 2023 Earnings Presentation). This was led by 12.8% growth in Africa and 8.2% growth in Europe. That made up for the 5.3% growth rate in the U.S. and Canada (around 6.5% excluding Sprint churn).

American Tower’s AFFO per share surged 9.3% higher year-over-year to $2.58 for the third quarter. That exceeded the analyst consensus by $0.07. Aside from the higher revenue base, this was driven by a 150 basis point expansion in AFFO margin to 42.8% during the quarter.

Moving to the balance sheet, American Tower continued to improve its financial health. The company’s net leverage ratio has dipped from 5.4 heading into 2023 to 5 as of September 30, 2023. American Tower has also boosted its liquidity during that time from $7.1 billion to $9.7 billion. Lastly, the company has further hedged against floating rate debt: American Tower’s share of fixed rate debt has increased from 77.5% as of December 31, 2022, to 89.1% as of September 30, 2023 (slide 11 of 33 of American Tower’s Q3 2023 Earnings Presentation).

2024 Will Be A Temporary Pause In Dividend Growth

American Tower has been an exceptional dividend grower: In just the past five years, the company’s annualized dividends per share have compounded by nearly 105% to $6.45 in 2023. Management has made it clear that it will be delivering little to no dividend growth in 2024, however.

On its face, this may seem discouraging. But this development isn’t because management is deprioritizing shareholders. On the contrary, American Tower is simply prioritizing shareholders differently. The company believes that it can best deliver value to shareholders in 2024 by focusing even more on reducing its leverage below 5 times per, CEO Tom Bartlett. But beyond that point, American Tower seems committed to returning to strong dividend growth.

Risks To Consider

American Tower is a high-quality REIT, but it still has pertinent risks that are worth considering.

First, the company’s annualized base rents are concentrated among relatively few customers. This concentration risk could become a problem if customers were to experience financial difficulties. Additionally, industry consolidation as of late like the T-Mobile (TMUS) and Sprint merger could lead to increased churn. That could weigh on American Tower’s growth prospects.

The company’s extensive international presence also leaves it vulnerable to regulatory risks. Complying with differing regulations in various markets requires dedicating substantial resources to compliance. Any substantive legislation in major markets could force the company to boost compliance spending. That could pressure American Tower’s growth as well.

Unfavorable foreign currency translation is another possible risk stemming from its international operations. However, foreign currency translation tends to even out over time because it swings both ways.

Summary: A Top-Notch REIT To Own

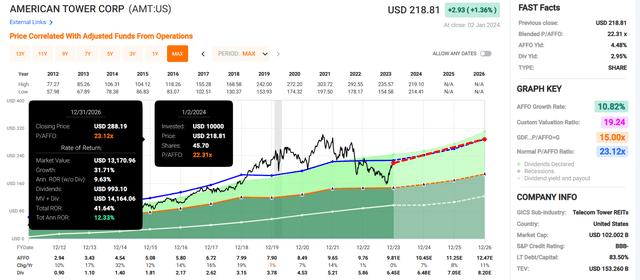

FAST Graphs, FactSet FAST Graphs, FactSet

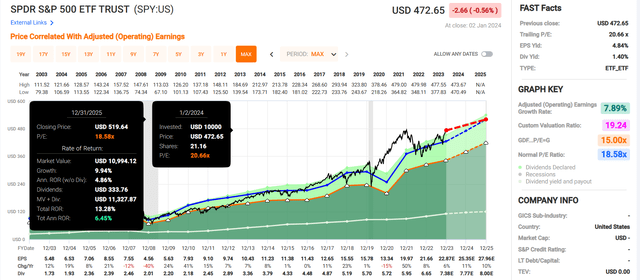

For a stock that has soared lately, American Tower isn’t as expensive as one would expect. Shares are trading at a P/AFFO ratio of 22.3, which is below the normal P/AFFO ratio of 23.1 per FAST Graphs. Assuming American Tower returns to that multiple and respectively grows 11% and 10% in 2024 and 2025, it could deliver 42% cumulative total returns through 2025. Compared to the current consensus of 13% total returns through 2025 for the SPDR S&P 500 ETF Trust (SPY), this would be enough to 3X the broader market. American Tower’s vigorous total return potential is what has led me to reiterate my buy rating now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.