American Tower: This Rally Is Too Hot To Handle

Summary:

- The generative AI hype has invaded the Data Center REIT space, with AMT similarly rallying by +31% since the recent October 2023 bottom.

- On the one hand, we are highly encouraged by AMT’s growing profitability, long-term leases, and future tailwinds, attributed to the growing data consumption.

- Combined with its relatively healthy balance sheet, it is apparent that the REIT is highly positioned for success, with the Fed pivot likely to further boost its prospects.

- On the other hand, with AMT pulling forward most of its near-term upside potential, we believe that there is a minimal margin of safety at these inflated levels.

- For now, existing investors may continue subscribing to their DRIP program, allowing them to regularly accumulate additional shares on a quarterly basis, thanks to the rich annualized FQ3’23 dividend payout per share of $6.48.

xxwp

We previously discussed American Tower (NYSE:AMT) in September 2023, discussing its mixed prospects then, with the elevated interest rate environment triggering a drastic sell-off for most REIT stocks, AMT included. This was attributed to the dilutive/debt-laden nature of the business model.

Then again, we had opportunistically rated the stock as a Buy at $150s, given the raised forward guidance and healthy balance sheet, with the recommended entry point likely to unlock an expanded forward dividend yield of 4.32%.

It appears that our thesis has turned out as expected, with the AMT stock well supported at those levels before rallying tremendously afterward, as the October 2023 CPI implies a cooling inflation and an unlikely rate hike ahead.

Combined with its expanding profit margins and growing tailwinds from the 5G/ Generative AI transition, we are unsurprised by the immense optimism embedded in the REIT’s stock valuations.

However, with most of its near-term upside potential already pulled forward, we prefer to rerate the AMT stock as a Hold here, with these inflated levels offering investors with a minimal margin of safety.

The AMT Long-Term Investment Thesis Remains Robust, Albeit Inflated Now

For now, AMT has reported an exemplary FQ3’23 earnings call, with property revenues of $2.79B (+2.5% QoQ/ +6.8% YoY) and AFFO per share of $2.58 (+4.8% QoQ/ +5.3% YoY).

Based on the management’s raised FY2023 AFFO per share guidance range to $9.72-$9.85 (+0.2% YoY at the midpoint), compared to the previous range of $9.61-$9.79 (-0.6% YoY at the midpoint), it is apparent that 5G/ Data Center demand is outstripping supply.

This has triggered the recovery of AMT’s property gross margins to 71.2% (+0.9 points QoQ/ +2.2 YoY) and adj EBITDA margins to 64.4% (+1.3 points QoQ/ +2.9 YoY) by the latest quarter, finally nearing the FY2019 average of 71.4% and 63%, respectively.

Combined with its drastically richer Free Cash Flow generation of $892M (+12.6% QoQ/ +90.5% YoY) and FCF margins of 31.9% (+2.9 points QoQ/ +14 YoY), it is unsurprising that the REIT is on a roll over the past few quarters.

This has directly translated to AMT’s improved profitability metrics with TTM Interest Coverage Ratio of 2.63x, TTM AFFO Payout Ratio of 62.85%, and TTM Dividend Growth Rate of +10.9%, compared to the sector median of 1.77x, 74.55%, and +3.74%, respectively.

Its long-term prospects appear to be bright as well, thanks to the 5G and generative AI-Data Center tailwinds. Thanks to the sustained cord cutting and remote work trend, more consumers have been increasing their data/ broadband consumption.

The same has been highlighted by two of AMT’s largest tenants, including AT&T (T) and Verizon (VZ) in their latest earnings call, with “demand for better and faster broadband connectivity growing exponentially,” despite “the recent increase in prices by $10.”

This corroborates with the statistic, where the global mobile data traffic grew to 126 exabytes by Q1’23 (+6.5% QoQ/ +35.8% YoY), expanding at an aggressive CAGR of +44.35% over the past four years.

As a result, we believe that the management’s long-term projections are not overly ambitious, with the monthly data usage per smartphone expected to grow at a CAGR of +18% through 2028, further cementing the importance of wireless/ broadcast communications infrastructure REITs, such as AMT.

Most importantly, aside from the notable churn from T-Mobile (TMUS) through 2025, we believe that the REIT’s long-term prospects remain robust, based on its elongated lease term through 2031 for T and 2043 for VZ.

While the data center segment only comprises $211.9M (+3.4% QoQ/ +9.3% YoY), or the equivalent of 7.5% of AMT’s top-line in the latest quarter (+0.2 points QoQ/ +0.3 YoY), we are already seeing a YoY expansion in its gross margins to 57.4% (+0.7 points YoY) and operating margins to 49% (+0.4 points YoY).

We also want to highlight that its operating margins are notably improved compared to its Data Center REIT peers, such as Digital Realty Trust (DLR) at 4.1% (-9.1 points YoY) and Equinix (EQIX) at 18.4% (+0.4 points YoY) in the latest quarter.

Nonetheless, AMT investors may also want to temper their dividend expectations, attributed to the management’s choice to consistently “strengthen and de-risk our balance sheet,” naturally triggering the guidance of flattish dividend per share growth in 2024.

For now, the REIT has already strategically reduced its net leverage ratio to 4.89x by FQ3’23, down from 5.08x in FQ2’23 and 5.36x in FQ3’22. This is based on the annualized FQ3’23 adj EBITDA of $7.24B (+4% QoQ/ +10.3% YoY) and its long-term debts of $35.44B (inline QoQ/ YoY).

With $3.02B of debts maturing in 2024, we can understand why the AMT management has strategically focused on its intermediate term financial flexibility indeed.

This is especially since it is uncertain when we may see a normalized economy, despite the prediction of a Fed pivot by Q1’24.

So, Is AMT Stock A Buy, Sell, or Hold?

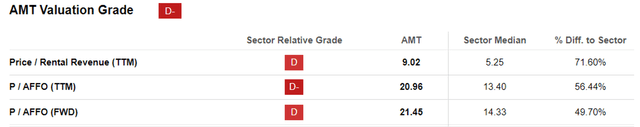

AMT Valuations

For now, AMT’s FWD Price/ AFFO valuation of 21.45x appears to be relatively rich, compared to September 2023 levels of 17.30x, 3Y pre-pandemic mean of 18.70x, and the sector median of 14.33x.

It may be noteworthy to highlight that the same premium is also observed in multiple data center REITs, such as DLR at 22.95x, EQIX at 25.73x, and Iron Mountain (IRM) at 16.54x.

This is thanks to the robust demand for cloud computing and generative AI services, consequently boosting the significance of 5G/ IoT/ data center REITs.

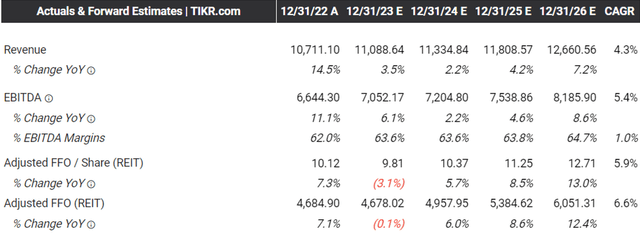

The Consensus Forward Estimates

However, we also want to highlight that the consensus estimates that AMT may only generate a top and bottom line expansion at a CAGR of +4.3% and +5.9% through FY2026, compared to its historical trend of +10.8% and +9.7% between FY2016 and FY2022, respectively.

As a result of the notable deceleration in its top/ bottom line growth, we believe that the stock is trading above its fair value of $182.80, based on the management’s FY2023 AFFO per share guidance of $9.78 at the midpoint and its normalized Price/ AFFO valuation of 18.7x.

There appears to be a reduced margin of safety to our long-term price target of $237.60 as well, based on the consensus FY2026 AFFO estimates of $12.71.

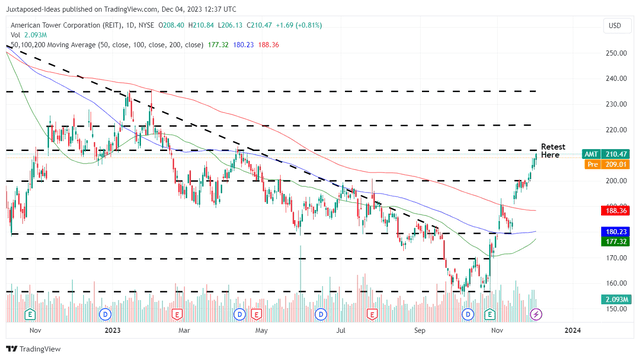

AMT 1Y Stock Price

Combined with the succession break out from its 50/ 100/ 200 days moving averages over the past few weeks, it appears that AMT may sustain its upward momentum to retest the upcoming resistance level of $212.

However, here is where we prefer to caution investors, since we believe that the rally has been overly fast and furious, with most of its upside potential already pulled forward.

As a result, we prefer to rate the AMT stock as a Hold (Neutral) here.

For now, existing investors may continue subscribing to their DRIP program, allowing them to regularly accumulate additional shares on a quarterly basis, thanks to the rich annualized FQ3’23 dividend payout per share of $6.48 and decent FWD dividend yield of 3.08%.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.