Summary:

- American Tower Corporation stock has declined by over 40% from its 2021 highs, shocking income investors who expected stability and lower volatility.

- AMT is a well-diversified global wireless and broadcast communications infrastructure provider with significant competitive advantages.

- Management remains confident of delivering stable AFFO per share growth over time, allaying the fears of investors who remained.

- American Tower is scheduled to release its second-quarter earnings on July 27. With the recent pessimism, I assessed that the bar has been lowered for AMT to outperform.

- Investors with a high conviction of AMT turning it around with the economy likely heading toward a soft landing should find the current levels attractive.

temizyurek

Investors of leading multitenant communications operator American Tower Corporation (NYSE:AMT) have suffered, and that’s likely an understatement. On a price-performance basis, AMT was down more than 40% from its 2021 highs at its recent July lows. Income investors who relished stability and lower volatility have likely been stunned by AMT’s decline.

Despite that, AMT’s total return profile remains constructive. It posted a 5Y and 10Y total return of 7.8% and 12.2%, respectively. Based on its 10Y average forward dividend yield of 2.1%, it should be clear that price performance is a critical driver of its stock price, income less so. In other words, AMT is likely priced for growth in the real estate space, and thus, corroborated by Seeking Alpha Quant’s “A-” valuation grade.

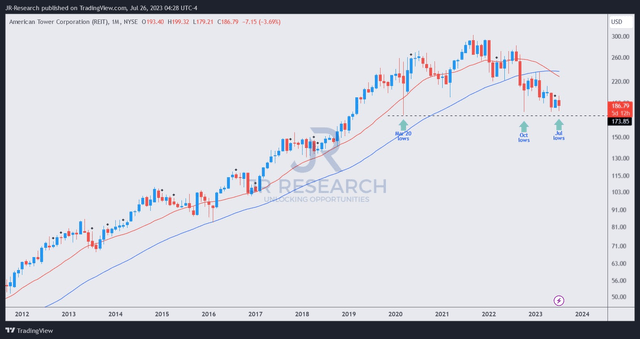

Although management offered assurances to investors that the company’s well-diversified business model globally offers robust visibility into earnings and AFFO, providing security for its dividends. Moreover, American Tower’s scale as one of the largest REITs makes it a formidable player against its smaller rivals. Coupled with its narrow economic moat predicated mainly on its massive scale and customers’ switching costs, investors are likely baffled why AMT remains close to lows last seen in March 2020 and October 2022.

Notably, the initial recovery from its 2022 lows has faltered as investors reflected a wider discount against its 10Y average valuation. Despite the market pessimism, the revised analysts’ estimates suggest American Tower’s AFFO per share should bottom out in FY23 before it’s expected to stage a much-needed inflection from FY24.

Investors will likely parse the company’s impending second quarter or FQ2 earnings release on July 27 (pre-market) on whether there could be a revision to its full-year guidance. The recent hammering in the telco space that ensnared AT&T (T) and Verizon (VZ) likely contributed to risk-off sentiments on AMT’s buying momentum.

Despite that, investors should note that AMT is not directly exposed to the cyclicality of the telco industry. Yet, it’s plugged into the secular drivers of expanding data communications, wireless networks, and continued 5G rollout. In addition, its growing international exposure is expected to continue driving potential upside, with Morningstar projecting US revenue contribution falling to 44% by 2027 (down from FY21’s 53%).

Notwithstanding its business resilience with built-in cost escalators and triple net-lease structure, its leverage could remain challenging in the current high-interest rate environment. American Tower is expected to post a net debt-to-adjusted EBITDA ratio of 5.31x in FY23, down slightly from last year’s 5.51x.

Furthermore, management alluded to a potential near-term impact at a June conference. CEO Tom Bartlett articulated that American Tower’s “AFFO per share growth may be impacted by interest rates.” However, the company is focused on driving “multi-year growth expectations,” with an AFFO per share growth expectations “in the high single digits over time.”

I assessed that the market is right in reflecting a significant discount in its valuation, given its leverage and relatively low forward dividend yields (3.5%). However, an improving macro outlook suggesting a soft landing is increasingly likely should bolster the recent bottoming process of AMT.

In other words, as AMT dip buyers have been robustly holding the March 2020 support level, it should provide confidence to more buyers that pessimism is appropriately reflected. Therefore, high-conviction investors with patience should find the current levels reasonably attractive as they anticipate the actualization of the soft landing outlook, leading more buyers to return.

AMT price chart (monthly) (TradingView)

According to AMT’s long-term price chart, I gleaned that its March 2020 support level remains well-supported. With its AFFO per share multiple falling to 18.9x (well below its 10Y average of 21.8x), it’s relatively attractive.

However, AMT is priced for growth and thus priced at a premium relative to its peers (Seeking Alpha Quant’s valuation grade of “D-“). As such, management must deliver sufficient confidence that its AFFO and adjusted EBITDA could bottom this year to entice growth investors back into the fray.

Given the tepid buying sentiments reflected in AMT’s recent price action, I assessed that optimism doesn’t seem high, lowering the bar for management to outperform the market’s expectations at its earnings release tomorrow.

Rating: Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!