Summary:

- American Tower’s shares have underperformed, losing -18% for a total return over the last three years, compared to a +32% gain in the S&P 500 index.

- AMT has declined from a clear overvaluation set up in the middle of 2020 to a normalized or even undervalued position in July 2023.

- Despite a compelling valuation argument and a 3.3% dividend yield, growth rates for the company are expected to remain subpar.

- I am upgrading my rating from Sell to Hold, with further price weakness potentially opening a buy opportunity later in the year.

xijian

The only full-length article on American Tower Corporation (NYSE:AMT) I have written was a bearish call in August 2020 here. Of course, after years of up-up and away for the share price, commenters lambasted any hint of trouble for investors. In the end, AMT’s extended valuation ran into slowing growth to knock price down a notch. Over the last three years, shares have lost -18% for a total return, while “underperforming” the equivalent S&P 500 index gain by a rather substantial -50%, including dividends.

Seeking Alpha – Paul Franke AMT Article, August 26th, 2020

And, I have not been able to change my view until lately. Today, American Tower has a relatively compelling valuation and decent 3.3% dividend yield. The problem is growth rates should remain subpar. Taking all the investment ingredients together, I do not believe liquidating shares at $189 is necessarily the best decision for existing owners. The only fair rating for AMT in my view is a Hold or Neutral setting. If you will allow me, I now project the stock to be a “market performer” over the next several years.

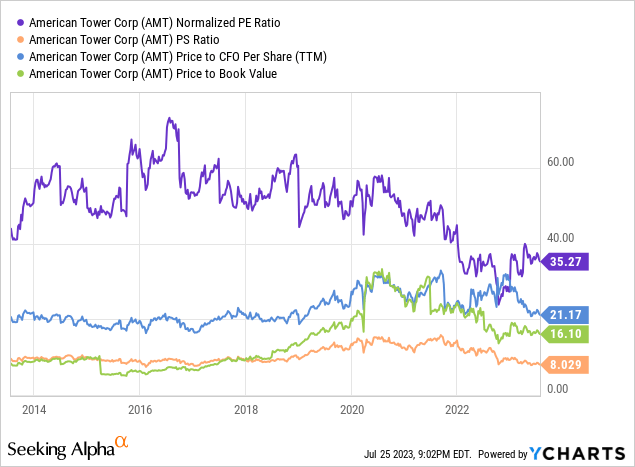

Valuation Changes

The focus of this article is a valuation review. 2020-21 proved perhaps the highest valuation on underlying business results since just after the company became publicly traded in 1998. Looking at price to trailing earnings, sales, cash flow, and book value, suggesting long-term investors liquidate shares was not popular, but also not rocket science for a contrarian thinker.

Today, valuations on these fundamental metrics are back to 10-year averages, if not below. In fact, price to normalized earnings and sales are not far off 10-year lows.

YCharts – American Tower, Price to Basic Trailing Fundamentals, 10 Years

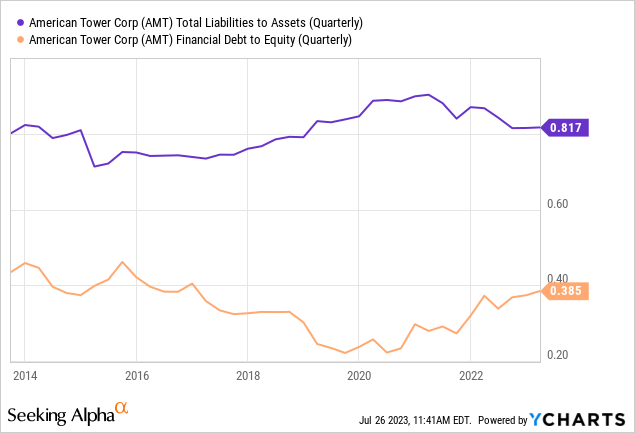

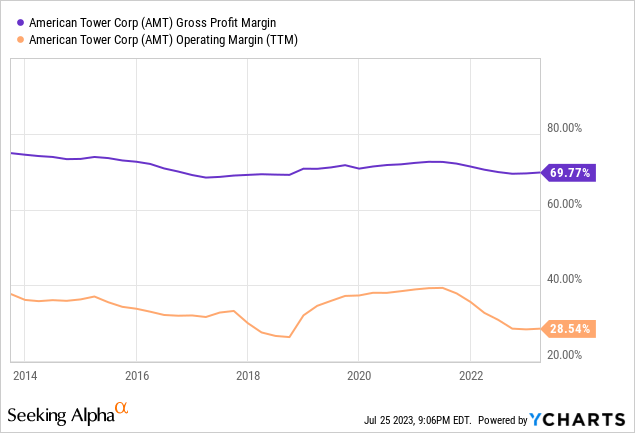

The company has continued to expand through wireless tower acquisitions, with debt ratios rising slightly. Integration issues, a stronger U.S. dollar currency, and a very competitive tower landscape have hurt margins over the last couple of years, something bulls never thought possible three years ago.

YCharts – American Tower, Debt and Liability Ratios, 10 Years YCharts – American Tower, Profit Margins, 10 Years

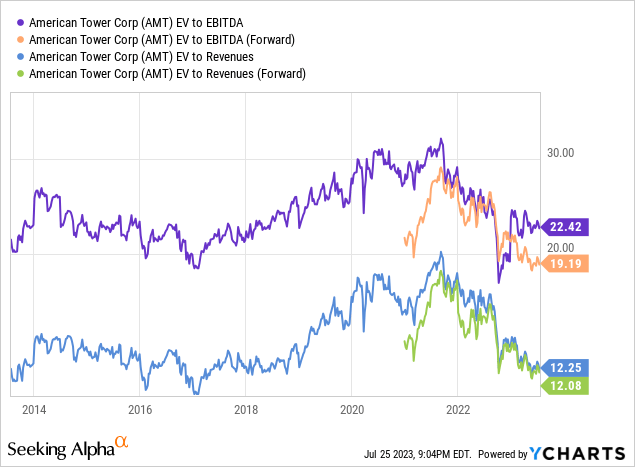

Yet, even when we include debt with equity market capitalization, the enterprise valuation today looks just as inexpensive for new investment. EV multiples on basic cash EBITDA and revenues are approaching decade lows, when using Wall Street analyst forecasts for all of 2023 or 2024.

YCharts – American Tower, Enterprise Value to EBITDA & Sales, 10 Years

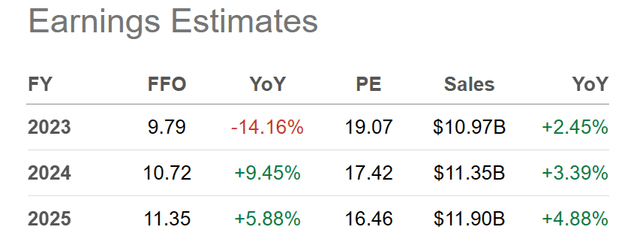

It’s entirely possible the company’s operating numbers will grow from today, even if at a slower than usual pace. Analysts are projecting this outcome in their forecasts for FFO and sales into 2025.

Seeking Alpha Table – American Tower, Analyst Estimates for 2023-25, Made July 25th, 2023

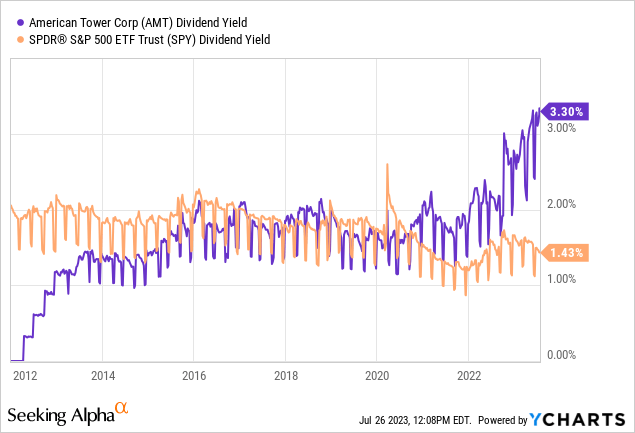

A final valuation stat to ponder is the dividend yield. Relative to the S&P 500, American Tower’s stock price is now generating the greatest positive spread in cash distribution yield of 3.3% vs. the equivalent S&P 500 index rate of 1.4% ever (the company started paying a dividend in 2012).

YCharts – American Tower vs. S&P 500 ETF, Dividend Yield, Since 2012

Technical Trading Chart

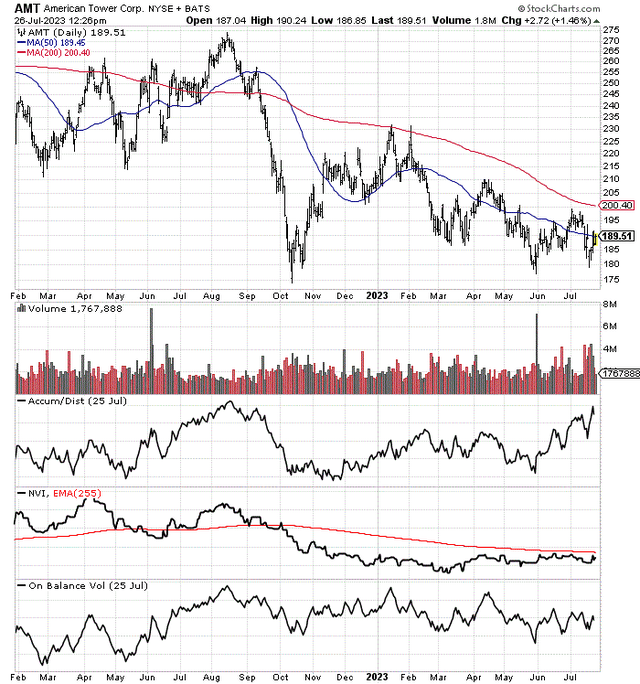

More good news. American Tower’s trading momentum has not been overly bearish, particularly in 2023. I have graphed below the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume calculation, some of my favorite indicators. Each is about unchanged on the year, despite a -20% slide in price.

My readout is the quote has been falling (-30% in price over 12 months) from temporary operational issues in the headlines, and an unsustainable position of overvaluation a year ago. Serious and heavy selling has not been the problem. Once better operating results are reported, the stock is in stronger valuation shape during July-August to benefit from positive change vs. many alternative equities, inside and out of the REIT space.

StockCharts.com – American Tower, 18 Months of Daily Price & Volume Changes

Final Thoughts

I am honestly close to issuing a buy rating on American Tower. However, I can find rising earnings/sales growth in many stocks with far lower valuation multiples. For me to turn bullish, another -10% to -20% decline in price is necessary into the autumn. If I can capture a rough 4% dividend yield, with price to FFO approaching 14x to 15x, a smarter risk/reward setup would start to grab my attention.

For now, I am upgrading my view to Hold/Neutral on AMT. If you already own it, I would not be in a hurry to sell this company. Even with a lowballed +5% to +10% in annual compounded gains over the next five years, such may be the same or slightly better for a total return vs. a flattish S&P 500 (given its still extreme overvaluation on macro stats like the Shiller P/E or total market capitalization to GDP ratio).

What could go wrong? At this stage of wireless demand and popularity, and sitting at a normalized valuation, I am thinking a worst-case scenario for the share price would be rising interest rates. Climbing interest expense over time would eat into margins. Plus, Wall Street may put reduced valuation multiples on the business for acceptable rates of investment return.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.