Summary:

- American Tower reported solid Q3 results and raised its property revenue outlook.

- However, the REIT indicated it will not increase its dividend in 2024.

- With 5G spending having peaked and high interest rates, AMT is not attractively valued despite trading below recent historical levels.

Ivelin Denev

Back in April, I placed a “Hold” rating on American Tower (NYSE:AMT), writing that while it had a nice, predictable business model that the stock looked richly valued and was facing some headwinds in the form of higher interest rates, elevated international churn, and customer collection issues. The stock has returned about -12% since then versus a nearly 3% gain in the S&P. Let’s take a closer look at the company after its recent earnings report.

Company Profile

As a refresher, AMT is tower REIT (real estate investment trust). The company owns tower structures and ground interests that it then leases to communication companies who place their equipment on its towers. The towers are able to support multiple tenants, and rent is based on a variety of factors including the weight of the equipment, the space the equipment takes up, and the location.

The company also owns distributed antenna system (DAS) networks, which can improve wireless coverage, and well as on-site back-up generators. AMT is also in the data center space through its majority ownership of CoreSite Realty.

Mixed Q3 Results

Last week, AMT reported solid Q3 results, with revenue rising 5.5%, or 6.4% in constant currencies, to $2.819 billion, topping analyst estimates by $60 million. Property revenue climbed 7.0%, or 8.0% in constant currencies, to $2.792 billion.

Total tenant billings grew by $134 million, or 7.3%, while organic tenant billings growth was $116 million, or 6.3%.

Net income attributable to common shareholders fell -30.0% to $587 million.

Adjusted EBITDA rose 10.4% to $1.814 billion, while adjusted EBITDA margin improved 290 basis points to 64.4%.

AFFO rose 9.5% to $1.206 billion, or $2.58 per share. AFFO per share beat the consensus of $2.51.

Cash flow from operations came in at $1.301 billion, with free cash flow of $892 million.

Turning to the balance sheet, the company ended the quarter with net debt of $35.5 billion. That equates to leverage of 5.0x. During the quarter, the company raised $1.5 billion in senior unsecured notes at an average weighted interest rate of 5.9%. That reduced its floating rate debt down to about $4 billion, or under 11% of its total.

Looking ahead, the REIT changed its full-year outlook. It now expects property revenue of between $10.895-10.985 billion, representing 4.5% growth at the midpoint. That’s up from a prior outlook of $10.790-10.970 billion

It projected net income attributable to common shareholders of $1.755-1.815 billion, an increase of 1.1% at the midpoint. That is down from its previous forecast of $1.845-1.905 billion.

Adjusted EBITDA is projected to rise 6.1% at the midpoint to $7.010-7.090 billion, up from prior guidance of $6.950-7.030 billion. And AFFO per share is project to rise 0.3% at the midpoint to $9.72-9.85, up from a previous forecast of $9.61-9.79.

Discussing its outlook for 5G investments moving forward on its Q3 earnings call, CEO Thomas Bartlett said:

“Just as we saw with the 3G and 4G rollouts, we expect the 5G investment cycle to play out in 3 phases that represent discrete business cases for the carriers and these 3 phases will drive 2 peak periods of spend that are bridged by a temporary phase of more moderate activity. The first phase is coverage-driven and aimed at upgrading existing infrastructure with new spectrum bands and radio technology, its competition to provide broad nationwide coverage with the new G ramps up. … As the cadence of initial coverage investments begin to moderate from record spend of over $40 billion in 2022, the first peak of the 5G cycle, we retain a high degree of conviction that there’s a long tail of network investment to come. … Today, Phase 1 of the 5G rollout is winding down, and we’re heading into a second phase. We expect Phase 2 to be characterized by carriers beginning to harvest the network efficiency benefits of their initial investments while moderating spend from the record levels of 2022 and to roughly $35 billion in 2023, which is $5 billion in excess of 4G averages, representing the second-highest level of annual spend on record. In this next phase, we will begin to see a seeping in of 5G technology across the wireless and enterprise landscape.”

After growing its dividend 10% this year, AMT expects it to be relatively flat in 2024. It said this will be to more align it with REIT taxable income. It then expects to grow the dividend in 2025.

The company also announced that Steve Vondran will become Global Chief Operating Officer and take over as CEO in February. Vondran has served as EVP and President of AMT’s U.S. Tower Division since August 2018, so there shouldn’t be a big change in philosophy with the leadership change.

Overall, it was a pretty solid quarter from AMT. It was able to nicely grow its property revenue, and raise its guidance. The company was also able to reduce its variable debt and get a pretty good rate, which is a nice move. Increased interest expense, however, continues to be a headwind.

Moving forward, it does look like 5G spending has peaked and while investments will continue, 5G driven growth will slow down from a pretty robust rate this year. The company has faced a number of headwinds this year with increased interest expense, currency headwinds, Sprint churn, and collection issues in its Indian business that have kept AFFO pretty flat despite its solid revenue growth. Luckily, Sprint churn has peaked, and it looks like it may sell its Indian business.

Valuation

AMT trades at 19.4x EBITDA based on 2023 analyst estimates of $7.04 billion. Based on the 2024 consensus of $7.19 billion, the stock trades at a 19.0x multiple.

Based on a 2023 AFFO forecast of $9.81, it trades at 18.7x price-to-AFFO ratio and 17.7x the 2024 consensus of $10.36.

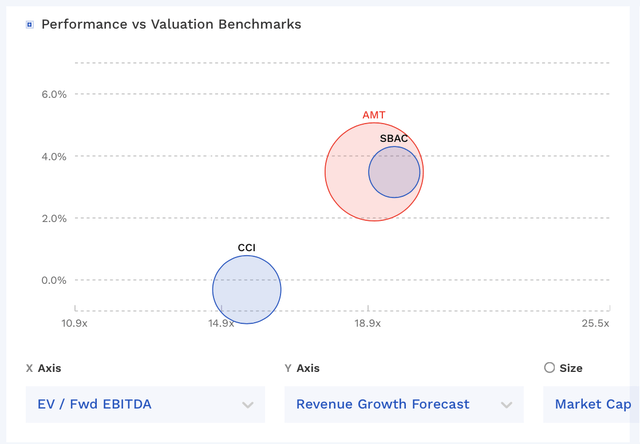

The stock trades in between the value of its two closest peers, Crown Castle (CCI) and SBA Communications (SBAC). CCI has a future revenue cliff from Sprint churn, which is why it trades at a discount to the other two.

AMT Valuation Vs Peers (FinBox)

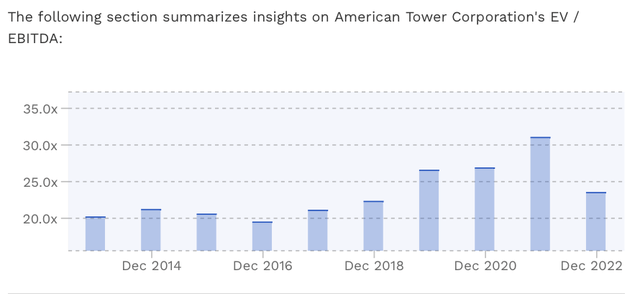

The stock has typically traded at an EV/EBITDA multiple of over 20x.

AMT Historical Valuation (FinBox)

Conclusion

With AMT trading at below the average 26x EV/EBITDA historical multiple it has traded at the past several years, the argument can be made that the stock is cheap. However, interest rates have moved up dramatically over the past year and a half, which clearly impacts a REIT with high leverage. In addition, the 5G cycle has peaked, and it doesn’t look like AMT will see a dividend increase next year. As such, I think the stock deserves a lower multiple compared to where it has traded in the past.

AMT is still a solid company, but it’s a slow grower, with about a 3.6% yield. There are better income-oriented investment opportunities out there in my opinion, particularly in the mid-stream space.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.