Summary:

- American Tower is a large-multinational REIT with a focus on telecommunications.

- The company’s presence in Europe has grown remarkably in recent years, spurred on by a major acquisition.

- The economics of the region, combined with favorable demographic data, offers the company with attractive opportunities in the long run.

Jaiz Anuar

As measured by market capitalization, American Tower (NYSE:AMT) is the second-largest REIT in the world, with a market value of $93.8 billion. Although it may seem difficult to imagine because of its size, the company has done quite well to grow in recent years. And the fact of the matter is that some parts of the business are growing more rapidly than others. One opportunity that I think investors should really be zeroed in on involves the firm’s operations throughout Europe. Over the prior three years, revenue and cash flow growth from that continent has exceeded any of the company’s other core activities. From what data is available today, it looks as though further growth in this market could await the business in the years to come. So while this portion of the business is still fairly small in the grand scheme of things, it should be viewed as a catalyst to further propel growth for investors.

A global REIT

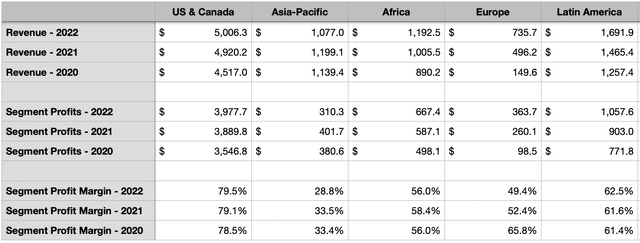

From my experience, most REITs tend to be focused on a particular country or region. Some operate exclusively in very small areas. But this approach to doing business does not apply to American Tower. Despite its name, the company has its hands all across the globe. During its 2022 fiscal year, for instance, only 47% of its sales came from the US and Canada combined. 16% came from Latin America, 11% came from Africa, 10% came from the Asia Pacific region, and 7% came from each of its European operations and its new Data Centers business.

When it comes to the portions of the business that focus on communications sites, the cash cow has undoubtedly been the US and Canada. Despite accounting for only 51.6% of all communications-related revenue, the business represented 62.4% of communications site profits. The overall segment profit margin for this portion of the company is an impressive 79.5%. That dwarfs the other portions of the business, especially the operations that are located in the Asia Pacific region.

It’s important to keep in mind, however, that both the US and Canada are mature markets where the company has a large market share. Europe is also mature, but the firm has a much smaller presence there. A quick glance at the firm’s annual report might make you think otherwise. After all, American Tower currently owns 27,634 towers across the US and Canada. By comparison, the number owned in Europe, split between France, Germany, Poland, and Spain, is even higher at 30,409. But towers are not all the same. For instance, in metropolitan areas across not only Europe, but also throughout the Asia Pacific region, Africa, and Latin America, rooftop towers tend to be more common because of a lack of space for larger towers. These typically range in height from 10 feet to 100 feet. By comparison, guyed towers can stand up to 2,000 feet high.

Author – SEC EDGAR Data

In all actuality, the company’s presence in Europe is quite small. In 2022, the region accounted for only $735.7 million of the firm’s sales. However, that was up significantly from the $149.6 million reported two years earlier. Much of this growth, it should be said, was driven by the firm’s massive acquisition of the European and Latin American tower divisions from Telxius Telecom, a deal that was completed in 2021 in exchange for $9.4 billion. This included 24,000 communications sites between Germany and Spain that was ultimately split between two separate transactions. In order to complete the deal, the company did have to sell off 48% of its ownership in ATC Europe in exchange for $3.1 billion. But that still allowed the company to retain 52% ownership over the assets in question.

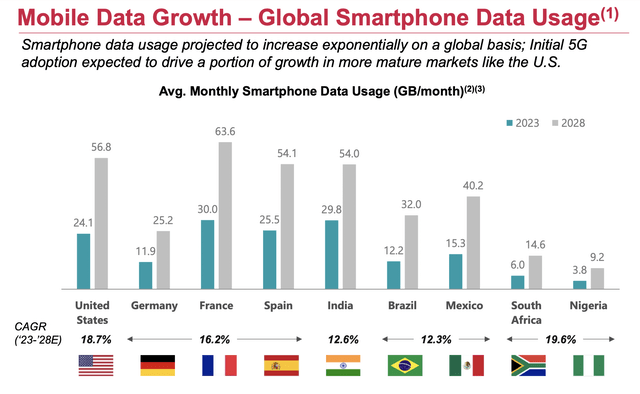

The profit margins throughout Europe are good, but not great. Over the past three years, they have actually pulled back some. But there’s reason to believe that the company has some attractive opportunities there. For starters, average monthly smartphone data use throughout the core parts of Europe that the company has exposure to is growing at a rapid pace. Between 2013 and 2028, data usage per smartphone is expected to climb by about 16.2% per annum for Germany, France, and Spain combined. This is a bit slower than the 18.7% anticipated for the US. But with the exception of that and markets like South Africa and Nigeria, which are substantially smaller by comparison, it’s some of the fastest growth the company has exposure to. In fact, average monthly smartphone data usage in Spain is expected to remain higher than in the US through at least 2028. The more usage that is required, the greater demand there will be, not only for communications sites, but also other offerings like small cells that are particularly good for dense urban areas.

American Tower

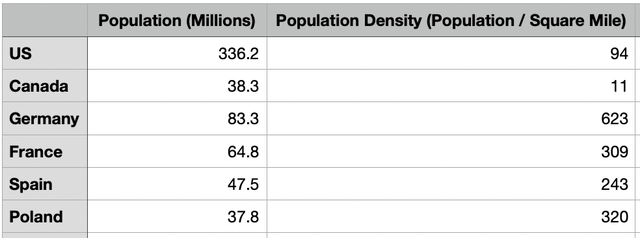

This rings especially true when you consider differences in population. The four European countries that American Tower has exposure to have a combined population of 233.4 million. By comparison, the population in the US is about 336.2 million, while in Canada it’s 38.3 million. Even though the market here at home is larger, the population density throughout Europe is much greater. In France, there are roughly 309 people per square mile. In Spain, that number is a bit lower at 243. In Poland, it’s an impressive 320. But in Germany, it stands at a robust 623. By comparison, that number for the US is only 94, while in Canada it’s a paltry 11. A higher population density does create challenges, but the small cells I mentioned, combined with other methods like the rooftop towers, are ways to circumvent that and to monetize effectively.

Author

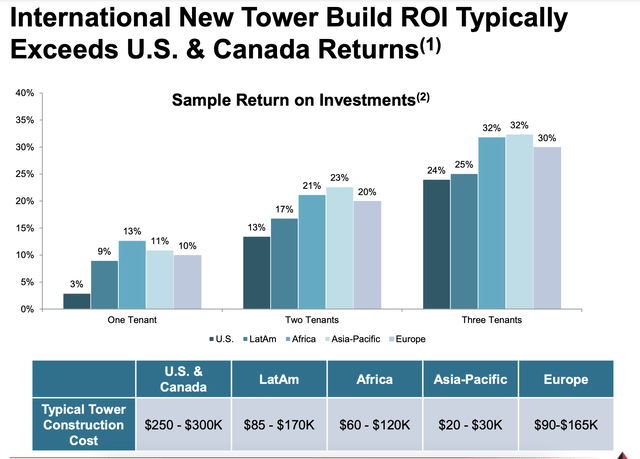

Outside of growth, there’s also the prospect of return. By return, I mean return on investment, or ROI. Between the US and Canada, a typical tower costs between $250,000 and $300,000. In Europe, that cost is between $90,000 and $165,000. With a single tenant, it’s estimated that the ROI in Europe per tower is about 10%. That dwarfs the 3% in the US and Canada. When you get up to three tenants, you still have a significant advantage, with the ROI in Europe coming in at 30% compared to the 24% seen here at home. The lower cost of producing these towers is likely one contributor to this higher return. But the benefits from population density are almost certainly another. In time, and when the appropriate opportunities arise, American Tower can also use its current European presence to leapfrog into other countries throughout Europe. If you take the eurozone, plus the UK, the total population comes out to 407.6 million. If you add Norway and Sweden to the mix, that number climbs to 423.4 million. So by continuing to grow in this market, American Tower has the opportunity to capture a dense, wealthy, and mature market that it has a relatively small presence in. In time, it wouldn’t be surprising to see margins approach what the company has achieved here at home.

American Tower

Takeaway

Based on the data provided, American Tower seems to be doing a remarkable job. This global player has done well to establish itself in key markets. Although it’s still a very small piece of the pie, I do believe that its footprint in Europe has tremendous upside. The economics make sense and the long-term benefit of having such a mature and population-dense market as a key part of its portfolio will create long-term value for its investors, even if it does come at a high price today.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!