Summary:

- I rate Alpha Metallurgical Resources as a strong buy due to its undervalued stock price, despite missing earnings expectations and macroeconomic headwinds.

- AMR has managed cash flows and liquidity well, improving FCF to $158M and reducing CapEx by 36% YoY.

- Management is making tough decisions like idling mines to save costs and expects $10/short ton savings in 2025.

- AMR’s balance sheet remains strong with over $485M in cash and minimal debt, focusing on liquidity during the market downturn.

Monty Rakusen

I still rate Alpha Metallurgical Resources (NYSE:AMR) as a strong buy, with a price target of $348.44 due to the undervalued stock price that is occurring because of macro factors outside of management’s control.

In my initial thesis, I stated AMR was undervalued due to the current uncertainty around macroeconomic and geopolitical conditions. This uncertainty, along with a glut of Chinese steel in the global markets, has led to a decline in metallurgical coal purchases by steel producers. I argue these headwinds are only temporary, and AMR is a company with a superior management team (with skin in the game) and a strong balance sheet that will help them handle this current market downcycle.

You can read my initial article here.

What happened in the Q

Despite the continuing headwinds, AMR has done well to manage cash flows and liquidity, enabling them to handle the current market downturn.

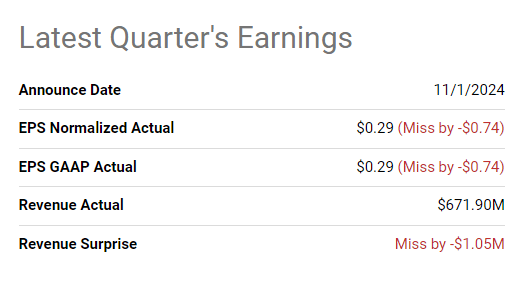

On November 1, 2024, AMR reported quarterly earnings, and while the results were not stellar, missing analysts’ expectations, the stock is up 16% from that day’s close as of the time I am writing this article.

Seeking Alpha

The results of the U.S. presidential election have undoubtedly contributed to this near-term optimism.

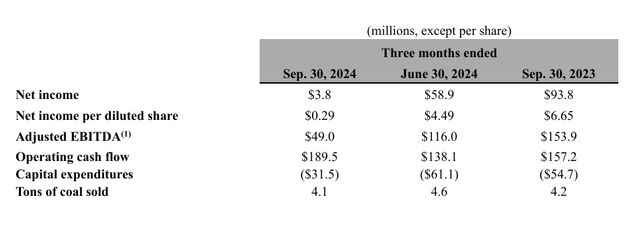

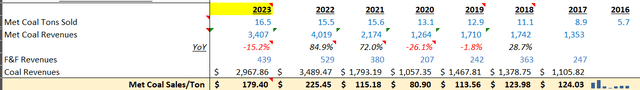

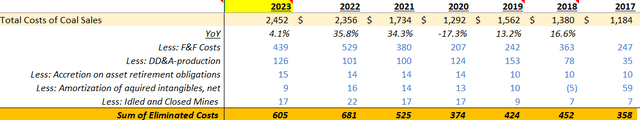

In Q3 2024 AMR sold 4.1mt of coal, roughly in line with Q32023. However, net income and adj. EBITDA were down 96% and 68% YoY, respectively. The $4.1M tax benefit AMR had in the Q was the only reason net income was positive. Despite these poor numbers, OPCF improved 21% YoY due to working capital realizations in A/R and less inventory. On top of that, Andy Eidson and the crew have done a good job on managing CapEx and costs in general as CapEx has come down 36% YoY to $32M improving FCF to $158M in the Q.

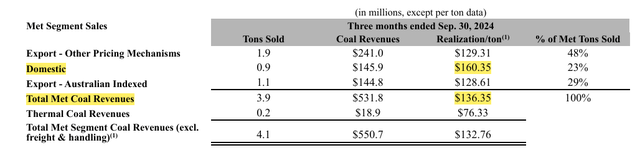

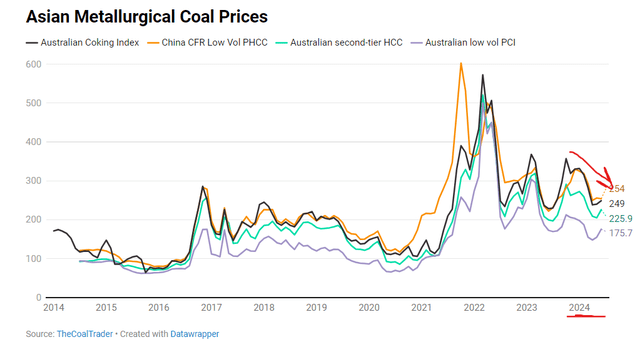

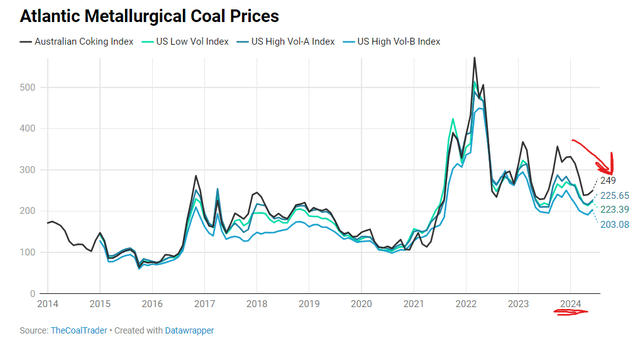

The majority of coal sold in the Q still went to the export markets (3.0mt), but realization prices on their coal have decreased because of sustained weakness in the global steel markets in Q3. This weakness in steel demand has hurt index pricing for coal, as can be seen below.

The Coal Trader The Coal Trader

China’s Baowu, the largest producer of steel in the world, also came out in Q3 stating the Chinese domestic steel industry is in for a harsh winter, and they are going to be focusing on cash over profits. This was bad news for met coal producers because Chinese demand has already been in question due to the property blowup going on there. For the year, Chinese steel production is down 6% according to the World Steel Organization. These were the major reasons met indexes were down, and the best AMR can do under these conditions is manage their costs.

One way AMR is managing their costs is by idling mines. On October 7, 2024, AMR’s subsidiary Elk Run Coal Company, LLC issued a 60-day notice to employees of plans to idle the Checkmate Powellton mine as of December 6, 2024, or within the 14-day period starting on that date. This is a relatively new mine, and management deemed the startup costs did not make sense in the current economic environment. This shows me that management is willing to make the hard but right decisions for the long-term viability of the business.

I believe it is important to note that AMR did not just let these miners go. AMR tried to shift these workers into open positions so they can retain some of this talent during the downturn. This loyalty to their workers, especially after some have been impacted by the hurricane that hit Appalachia, will breed loyalty among this workforce. Attitudes like this breed successful businesses over long periods of time. That is an intangible asset that can’t be measured on a balance sheet.

Going forward, management discussed on their call how they expect to have a $10/short ton in savings in 2025 from cost-saving initiatives such as the idled mines, lower production output, and lower fuel costs. This is good to hear because we do not know when met markets will rebound, but AMR will be around when they do.

Review of B/S and Liquidity

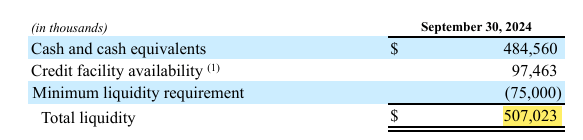

AMR 10-Q

AMR had over $485M in cash and cash equivalents, with a total liquidity level of over $507M. Management stated on the call how the current focus is on liquidity and being able to maintain the current market downturn. On top of this war chest, the company only had a paltry $3.5M in LT debt

The balance sheet of AMR is still a fortress.

That being said, management did not purchase any stock in Q3 and will begin repurchasing when it is appropriate. This cautious tone to me makes me feel like management is still uncomfortable with the uncertainty in the met markets; more pain could be ahead.

FY 2025 Guidance

Management offered guidance for FY 2025 in Q3. While this level of clarity typically is seen as good news, when we listen to the call, management expects 2025 to be like Q32024, with no material upside scenarios they foresee.

Alpha expects to ship between 15.0M-16.0M tons in 2025 as well as another 1.0-1.4M tons of incidental thermal coal, bringing total 2025 shipment expectations to a range of 16.0M-17.4M tons for the year. At 16.0M tons, that would be a 500K ton drop in sales from FY 2023 production levels.

Idling expenses for mines are expected to range from $18-$28 million. To put that in perspective, at $18M that would be the highest idling expense AMR has seen over the past decade.

This is concerning, but taking this supply off at this time is a natural response to this economic environment. AMR is still a cyclical play.

Domestic sales for FY 2025 are locked in at 3.7mt at $152.51/ton.

Risks

The risks to an investment in AMR have not changed materially from my initial article.

Geopolitical tensions are still the biggest risk in my opinion. Whether it is China-Taiwan, Israel-Hamas/Hezbollah, or Russia-Ukraine, none of these conflicts have had a material change since my last writing.

The glut of Chinese steel on the international markets is still an issue. This steel will eventually be used, but the timetable is uncertain. When the biggest steel producer warns of a “harsh winter” in the steel markets, investors in met coal companies should be cautious.

The proposed merger of ARCH and CEIX is likely to go through after the results of the U.S. election. The combination of these two companies will produce the largest legitimate competitor to AMR in the U.S., and with their new scale and cost structure they could start to take AMR’s market share.

Lastly, with any mine company, there are always geological and environmental risks.

To summarize…

Management has been handling the downturn in the met market well so far, fortifying their balance sheet and focusing on controlling their costs under current market conditions.

They have begun to idle mines and have forecasted lower production in FY 2025 due to an extended period of the current market environment. Until management deems it prudent, they will hold off on share repurchases and the dividend.

I believe the market is discounting AMR because of this uncertainty and management’s willingness to keep cash on the B/S instead of returning it to shareholders in the form of dividends or repurchases.

An investment in AMR is going to require patience, but I believe it will reward those patient investors handsomely.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.