Summary:

- Exxon Mobil Corporation is acquiring Pioneer Natural Resources Company in an all-stock transaction, with Pioneer shareholders receiving 2.3234 shares of Exxon stock per Pioneer share.

- The deal is expected to close in the first half of 2024, offering a 2.56% upside for Pioneer shareholders over 5.5 months.

- The transaction is 100% stock, allowing investors to short Exxon and go long Pioneer with minimal capital, but there is a risk of the deal falling apart.

Michael M. Santiago

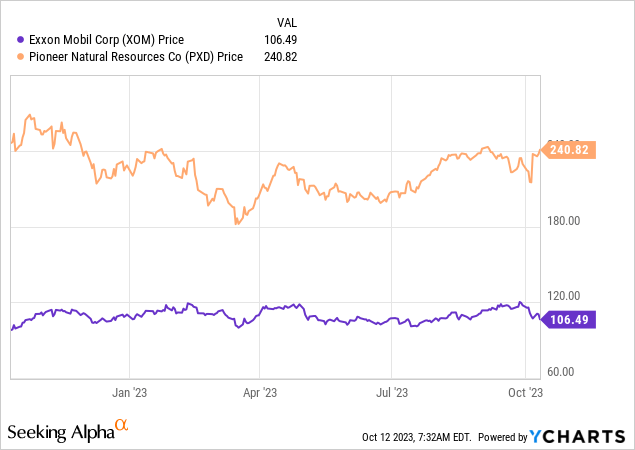

Exxon Mobil Corporation (NYSE:XOM) is taking over Pioneer Natural Resources Company (NYSE:PXD) in an all-stock transaction. PXD shareholders get 2.3234 shares of Exxon per share if the transaction closes.

As I write this article, this represents $247 per share in value to PXD shareholders. That’s only 2.56% upside, which isn’t a lot. Then again, there are good reasons for a narrow spread.

For starters, the transaction is expected to close in the first half of 2024. It is possible it closes around the end of Q1. 2.56% in 5 1/2 months isn’t great, but it’s not negligible.

The most important reason is that this is a 100% stock deal. This allows investors to short the acquirer and go long the target, which ties up very little capital. The return is thus generated on very little capital. The additional risk of these sorts of transactions (over normal M&A risks) is that the deal can fall apart because the acquirer becomes a target. If and when that happens, you often suffer a big loss because the initial target drops a lot as it won’t be bought anymore, AND the acquirer’s share price jumps up a lot. Meanwhile, the merger arbitrageur is long the original target and short the original acquirer.

In this case, the latter risk isn’t as pronounced because Exxon is a $400 billion+ company. There are very few companies that could buy it. I doubt these deals would be deemed likely enough to pass regulatory objections.

On the flipside, I think there is almost zero chance of an overbid materializing here. There are likely enough other companies with Permian exposure where competitors wouldn’t need to top the premium Exxon has already laid out.

From the deal call, I gather the companies expect a billion in synergies short-term and then a sustained rate of $2 billion in synergies.

Synergies are approximately $1 billion beginning in the second year post closing, growing substantially over the next five years and averaging about $2 billion per year over the next decade. At a high level, this can be broken down to about two thirds from improved resource recovery and one third from CapEx and OpEx efficiencies. We expect the transaction to be immediately accretive to our earnings per share, cash flow and free cash flow. 00:05:02 Pioneer offers peer leading asset margins and immediately adds $5 billion in annual free cash flow. The transaction is more accretive in the mid to long term at synergies build and it offers a long cash flow runway. With synergies, we expect incremental free cash flow of $6 billion in the second full year post- closing growing to more than $10 billion by the end of the decade. 00:05:30 The strong balance sheet and incremental cash flows generated post-closing will provide even more opportunities to enhance shareholder distributions. So you can see that it’s a powerful combination that drives value for all shareholders.

The deal would also be immediately accretive, which is a positive when ascertaining whether a deal is likely to close.

There was one specifically interesting exchange on the call, which I think is quite negative for Exxon. The analyst first complimented the CEO due to Exxon always investing countercyclical and not buying assets at the top. He then contrasted this situation where they’re doing a big deal and oil prices (CL1:COM) aren’t exactly low. Basically, the answer boiled down to this (I removed a lot of fluff around it and put in the emphasis):

…We think a stock transaction actually helps insulate us from the particular part of the commodity cycle that you’re in, both pioneer stock and our stock moves with commodity cycles. We all know that. And therefore, as the commodity cycle rises, so does our stock. And therefore, we kind of thought about it from the standpoint of the transaction. Currency grows with the commodity cycle and declines as commodity cycle comes off and therefore we’ve got some insulation from that exposure. And while we were comfortable doing an all stock transaction. I think too we felt like the value of our stock given the plans that we have in place, the projects that we’re bringing online, the strategy that we have in place, the markets beginning to recognize the value proposition we bring and that also contributes. So if you look at where our stock is, we think we trade on the day of October 5, about I don’t know 9% off of our high. So we felt like the market was reflecting one, the commodity environment we were in. But two, some of the strategic things we’ve been working on and they’re felt like – felt like it was a good time to transact with that currency…

I think Exxon is right about the all-stock deal, insulating the expected value of the deal against commodity swings. More importantly, I think this is a clear signal they see their own stock as fully valued or even overvalued. This could be true, and that makes it a better deal, but also indicates the Exxon price is too high. If I were an Exxon shareholder, it would make me take a good look at my valuation model. It also makes it even less desirable to have this merger arb on unhedged. Or if I was a PXD shareholder who got lucky, I would strongly consider hedging some of the risk by shorting Exxon stock (please fully understand the risks of shorting before engaging in any short transactions, which risks are detailed here).

There is an offsetting dynamic that argues against hedging out some risk by shorting Exxon. There is a complicated dynamic going on here where both parties have strong free cash flow and strong capital return policies. Both companies will continue these policies until the deal closes, to a lesser or greater extent. From the merger agreement(see 6.01 C), I understand PXD is continuing their regular dividends and their special dividends to a lesser extent. My reading is shareholders will still get roughly 75% of free cash flow in Q4, 50% in Q1 2024, and a maximum of $1.25 per quarter after Q1. The latter represents around 2% on an annualized basis. On the call, it is explained like this:

You know, kind of on both sides of this transaction, either ExxonMobil or Pioneer. With regard to Pioneer, they obviously have an existing shareholder distribution framework in place, you know, where they’re looking to pay out 75% of their prior quarter, I’ll call it free cash flow first, doing that through their base and then doing the Remainder of that through variable dividend and or some level of buybacks. So their results occur as a result of the transaction. Or as you think about, I’ll call it the free cash flow that comes from their third quarter. That ultimately would be triggering a payout for the fourth quarter. That variable part of the dividend and only the variable part of the dividend would be restricted by 75%. So their base dividend will continue to be 75%. Their base dividend would continue.

And then if you think about the free cash flow that would be generated in the fourth quarter, which would get paid out in the first quarter of 2024, that would be restricted by 50%. And so those are the restrictions on the pioneer side.

And again, their base dividend would continue if it takes us longer than the end of the first quarter to close. 00:34:20 On the Exxon Mobil side, our only restriction would be to some kind of extraordinary dividend, which we would not anticipate.

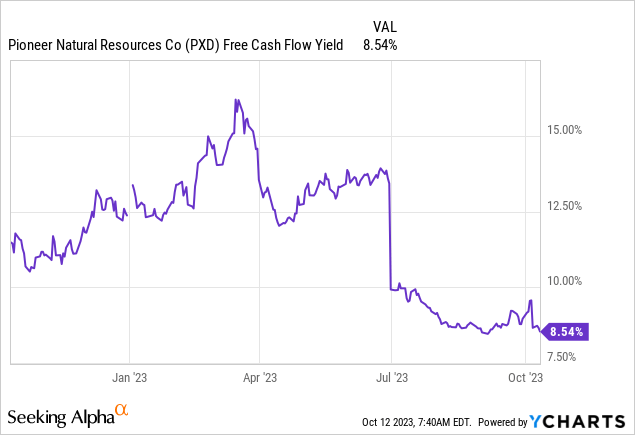

The dividend clauses in this deal are favorable to PXD shareholders if the deal closes in Q4, Q1 or even Q2 (PXD trades at a 8.5% free cash flow yield). However, the longer it is dragged out, the worse it becomes, as the $1.25 per quarter is below the cost of carry on the hedge.

Then on share repurchases:

And then you didn’t ask this, but I’ll just address this because we get a lot of questions about this, our overall program with regard to share repurchases. 00:35:31 you know, I would describe as it’s on autopilot underneath a 10b5-1 plan. Right. And it anticipates that ExxonMobil could have entered into public type M&A transactions that would cause us to have to be out of the market during the period of the solicitation of those transactions. But it automatically contemplates that so that we’re able to still execute, you know, what we have guided to. So we continue to expect to repurchase 17.5 billion worth of our shares this year as an example. And similarly, as we would go into next year, you know, we have guided to up to an additional 17.5 billion of share repurchases next year. That is all already contemplated in the 10b5-1 plan that we have filed.

My guess (based on slide 10 of the Q3 presentation) is Exxon still needs to do roughly $4 billion of repurchases this year and still plans to do $17.5 billion net year. As it is put into a 10b5-1 plan, these purchases are likely distributed through the year. Often these plans accelerate purchases if Exxon starts trading below some moving average. This is a dynamic that could offset some of the pressure on Exxon’s share price, and it could also offset some of the downside because of: 1) a perceived bad deal; or 2) slumping oil prices. This upward force isn’t present on the PXD side of the deal. Roughly $20 billion in buybacks are insignificant to a $400 billion market cap company, and it is one argument for not heading the XOM exposure.

Conclusion

Closing the loop on the Exxon Mobil and Pioneer Natural Resources deal, the upside for PXD shareholders is a modest 2.56% lift. It could be a little more if the deal closes quickly. The annualized return will decrease a lot if the deal is dragged out. That’s not my expectation, but if it happens, it’s bad.

The PXD dividend will likely no longer fully offset the XOM dividend. Because it is a 100% stock transaction, this is still quite favorable because the cost of capital is very low if properly hedged. The fact that Exxon will continue its substantial buyback program argues against hedging out the Exxon leg. However, Exxon signals its stock is possibly overvalued by using 100% stock as well as laying it out on the call.

In any case, the risk/return profile is much better when hedged because the volatility of the position decreases so much. For investors that utilize margin accounts and can short the acquirer, I think it is an interesting enough deal. If I held PXD and couldn’t short XOM, I’d seriously consider whether moving my money to another shale company is more productive.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PXD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

short XOM

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out the Special Situation Investing report if you are interested in uncorrelated returns. We look at special situations like spin-offs, share repurchases, rights offerings and M&A. Ideas like this are especially interesting in the current late stages of the economic cycle.