Summary:

- PayPal’s recent earnings call strengthens the bull thesis and the company’s imbalanced risk/reward at its current valuation.

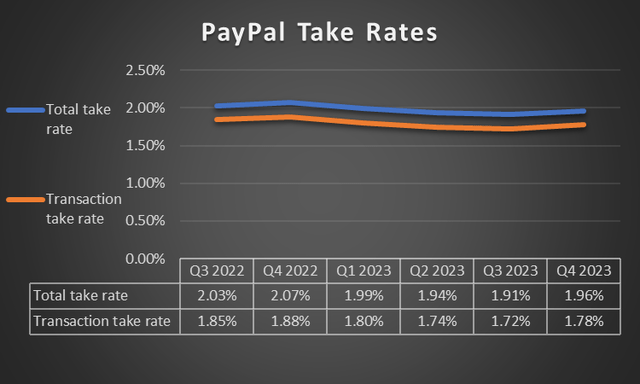

- The erosion of PayPal’s take rates has been a key concern, but the recent earnings call showed an inflection.

- First Look featured solid innovation, albeit PayPal is still playing “catch-up” to competitors.

- I rate PayPal’s moat a ‘C’ and valuation an ‘A’, and reiterate my Strong Buy rating.

NurPhoto/NurPhoto via Getty Images

Overview

I initiated coverage of PayPal (NASDAQ:PYPL) in late December with a Strong Buy rating. My thesis was that PayPal represents a very imbalanced risk/reward at its current valuation. There are many legitimate aspects to the PayPal bear case, but these are overshadowed by the extremely compelling valuation and reasonable growth outlook. You can read more about the bull and the bear case here.

In this article, I’d like to present the reasons why I believe PayPal’s recent earnings call strengthened my thesis, provide an overview of “First Look” innovations, and present an analysis of PayPal’s competitive advantage.

The primary component of the PayPal bear argument since 2021 has been a consistent erosion of the margin profile. This is a nuanced discussion.

For one, we can look at the GAAP margin profile, as I do below, to analyze how PayPal’s competitive advantage has changed over time. On the other hand, we can evaluate what is called the take rate. In other words, the amount of money that PayPal makes when money flows through its network. These figures represent the percentage of TPV (total payment volume) that PayPal captures.

Let’s start here.

Earnings Review

In all, the recent earnings call was just short of great. Every key metric showed a positive trend except MAU (monthly active user) growth, but this is because of management’s focus on higher-value accounts. They have been letting lower value / less active accounts attrite for months.

They beat EPS and revenue guidance, but the market was displeased. The displeasure was driven by abysmal guidance, without a full-year revenue target and guiding for flat EPS growth. Considering the major buyback program that’s active, flat EPS in 2024 means shrinking net income. The market reacted accordingly and punished PayPal during the call. As for the call itself, management was composed and scripted. It was quite uneventful.

By far the most positive metric to come out of the recent earnings report though was the take rate trend. Declining take rates were a primary component of what I referred to as the “crumbling” bear case. These take rates inflected, signaling management is committed to defending its margin profile and leaning on its brand strength and innovation to increase pricing power.

The market was unenthused largely because of lackluster guidance despite strong performance. Further, new CEO Alex Chriss went on CNBC a few weeks before the earnings call and the quote “we will shock the world” started rippling throughout the investment community.

Let’s discuss this, and “First Look” now.

The Importance of Context and Expectations

First Look was a widely marketed event by Chriss and the PayPal team where they would highlight six innovations that are coming to the PayPal network.

The six innovations were:

- Accelerated Checkout Process:

- Biometric authentication on PayPal branded transactions – leads to a 50% latency reduction.

- 2x faster checkout without sacrificing trust or security

- Fastlane: Guest Checkout Experience

- Save your information with Fastlane, and you can check out with a PayPal button without an account with that merchant.

- The pilot is ongoing, and Chriss is “astounded with early results”

- 40% Checkout time reduction and 70% conversion increase

- Smart Receipts:

- AI-powered predictive analytics of ‘next best item’ purchase.

- ~45% of PYPL customers open email receipts each day.

- Businesses can offer other products and cashback opportunities in receipts.

- This will help generate repeat customers

- Advanced Offers Platform – “Revolutionize commerce advertising”

- This gives merchants the ability to advertise to customers based on what they’ve actually bought, down to the individual SKU.

- Enhanced merchant customization allows merchants to pay for performance, not impressions.

- Customers can opt in or out – “Your privacy, your choice”

- PayPal Consumer App Reinvention – “PayPal CashPass”

- Starting this quarter, the PayPal App will give consumers hundreds of deals for businesses. When you shop with a participating merchant, the deal is automatically applied.

- Some participating merchants: McDonald’s, Uber, Ticketmaster, Best Buy, Walmart, eBay, and Priceline

- No limit to cashback

- When you pay with PayPal ‘Cashback’ Mastercard, you get an additional 3% on every purchase. In addition to CashPass cashback offers.

- Venmo Enhanced Business Profiles

- Venmo is mentioned every 9 seconds on social media

- 90 million active accounts, 3 million merchants

- It’s a community-based app

- They are adding a “Venmo Subscribe” option. People can subscribe to merchants

- Merchants can offer subscribers cashback offers

- Nationwide rollout in 2024

The market was expecting a “shock the world” announcement and was unimpressed with the six innovations that were announced. The shock the world comment was taken largely out of context from Chriss’s CNBC interview, but the narrative ran away and many began calling First Look the “shock the world” event.

I believe Chriss was taking a more long-term perspective with that comment. He was inferring that, despite various analyst downgrades, PayPal is a bellwether of e-commerce that the bearish undertones and abysmal 3-year stock performance are not reflective of.

Overall, these announcements underpin some solid innovation in PayPal’s products, and I believe they add value to merchants and consumers alike. The goal here is clearly to offer more value to consumers through cashback offers and relevant advertising, while leveraging PayPal’s trusted brand to boost conversion for merchants. Remember, more transactions mean more revenue. Better ads, more cashback, and better conversion rates mean more transactions.

In e-commerce, conversion is everything. An ad with a 1% conversion rate that gets 1 million impressions is much worse than an ad with a 10% conversion rate on 500,000 impressions. While this seems intuitive, digital marketers often value raw impression volume over CTRs (click-through rates). The CTR, and specifically the unique customer CTR, is everything. That’s exactly what PayPal is targeting here.

They are leveraging AI to get the right ads in front of the right eyes. Of course, execution is everything, but this is a good step in the right direction.

Another major trend we see specifically in social media commerce (which PayPal has a healthy 20% market share in) is that any additional latency significantly reduces conversion.

PayPal forcefully addresses this with biometric authentication in branded checkout and Fastlane. Consumers won’t need to set up a merchant account to purchase, they just need to use their PayPal Fastlane info to buy anything, anywhere, from anyone. That’s bullish.

Innovations 3-5 are mostly consumer-focused. They focus on cashback offers and relevant ads for consumers. While this could signal some future margin pressures for PayPal, they have a massive cash pile and benefit from ongoing growth in transactions per active account (“TPAA”). These 3 innovations will bolster TPAA and will derive more value from existing users.

The final innovation is a strike at monetizing Venmo. PayPal is seeking to monetize merchant accounts, which I believe is the right strategy. P2P payments are nearly impossible to monetize, and PYPL would drastically reduce its user base if it attempted to earn money from Venmo P2P payments.

So they opted to leverage Venmo’s social nature (the Venmo feed shows your friends and anyone’s transactions if they aren’t set to private) and will allow users to subscribe to businesses.

This will help merchants advertise through Venmo, which will allow PayPal to deepen and monetize merchant relationships.

Some analysts were expecting an outright combination of the PayPal and Venmo mobile apps. I believe keeping them separate is a better strategy, at least for now. Venmo is a deeply entrenched brand name. It’s a verb. People say “I’ll venmo you” when their friend pays for something. The brand value is immense, and losing that at this point would be a net negative.

Overall, PayPal is seeking to deepen existing relationships with this announcement. They are leveraging their wealth of data and massive user base to offer better advertising capabilities, more cash back, and better e-commerce conversion rates.

While this was a sell-the-news event because it didn’t “shock the world”, I believe it was an overwhelmingly positive announcement for the company itself. First Look made me more bullish on PayPal.

Analyzing PayPal’s Competitive Advantage

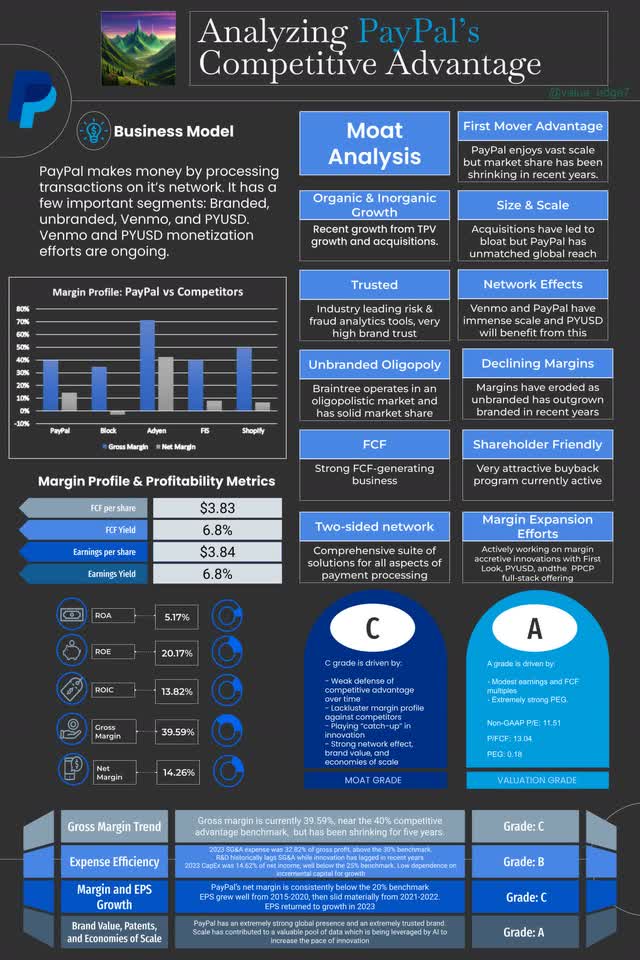

Now that we have a solid base of the recent earnings call and innovation pipeline, let’s take a look at PayPal’s moat and valuation.

I created this graphic to help guide the conversation. I won’t add redundant information in this article, just some helpful commentary.

In general, I rate PayPal’s moat a ‘C’. This is largely driven by a weak defense of its first-mover advantage. PayPal was once by far the most dominant e-commerce payment option, but this position has withered in recent years. Increasing competition from the likes of Shopify (SHOP), Block (SQ), Apple (AAPL), and others has consistently gobbled up share from PayPal.

Despite losing share over time, PayPal has still managed to consistently grow total payment volume, TPV, but recently much of this is driven by the unbranded segment.

The unbranded segment, Braintree, has a lackluster margin profile compared to branded payments. Unbranded customers are typically large enterprises that have significant negotiation power, so unbranded exhibits characteristics of “race-to-the-bottom” pricing, but it also has high switching costs.

This does not change the fact that unbranded is experiencing strong growth, leading to margin compression from the shifting revenue mix between branded and unbranded. With some mental gymnastics, many analysts believe that strong growth in unbranded signals fundamental issues for PayPal. I disagree.

Branded still enjoys an ever-expanding TAM and is the e-payments leader globally. Further, PayPal has a strong presence in social media payments, a segment of the market that is quickly growing. Social media payments growth historically has been stymied by a lack of trust and transparency from merchants, so PayPal’s strong brand recognition, trust, and extensive consumer protection programs make it the best option available. They have a long-running partnership with Meta (META), which touts two of the leading social commerce platforms in Facebook and Instagram. Temu, a fast-growing e-commerce brand out of China, features PayPal as its leading checkout option.

Overall, branded growth moving forward will be characterized by three things: 1) TAM expansion, 2) social media commerce growth, and 3) international payments growth. TAM expansion benefits all payments players, while I believe PayPal is well-positioned to benefit from points 2 and 3.

In summary, here is the logic underlying my ‘C’ grade for PayPal’s moat:

- Weak defense of competitive advantage over time, leading to loss of market share

- Unbranded exhibits “race-to-the-bottom” pricing

- Increasing competitive headwinds

- Sequential Gross Margin compression for five years

- Lackluster net margin

- Strong EPS growth over time

- Vast scale leading to a strong network effect

- Very strong brand name recognition, economies of scale, and consumer trust.

Moving on to valuation, I rate PayPal an ‘A’.

PayPal’s PE and P/FCF are both very strong, coming in at 11.51 on a non-GAAP basis and 13.04, respectively. For a tech company growing at a respectable rate, these are very modest multiples that far lag equivalent competitors.

PayPal’s PEG is by far its strongest valuation metric at 0.18 signaling deep undervaluation. The price you are paying today for the growth you will receive tomorrow is very modest.

Conclusion

My previous article on PayPal posited that PayPal presents a very compelling bull case and a crumbling bear case. This thesis was strengthened by the recent earnings call namely because of take rate inflection. While PayPal has a relatively unattractive moat currently, the attractive valuation compensates investors well.

I reiterate my Strong Buy rating and expect PayPal to significantly outperform the market in the next five years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.