Summary:

- Microsoft’s Q4 FY 2024 earnings report showed solid performance, but investor concerns over AI infrastructure investments and declining cloud growth led to a stock price dip.

- Despite short-term challenges, the company’s long-term potential in AI and cloud computing remains immense.

- Valuation metrics suggest Microsoft’s stock may be overvalued, but its strong balance sheet and potential AI-driven growth justify holding the stock for long-term gains.

HJBC

I last wrote about Microsoft (NASDAQ:MSFT) on April 30, 2024. I gave it a Hold recommendation, primarily based on valuation concerns and the risks of its strategy not panning out. At the time, I gave it a fair value of $406. After reviewing the company’s fourth-quarter fiscal year (“FY”) 2024 earnings report, I still believe the stock’s fair value is around the low $400s.

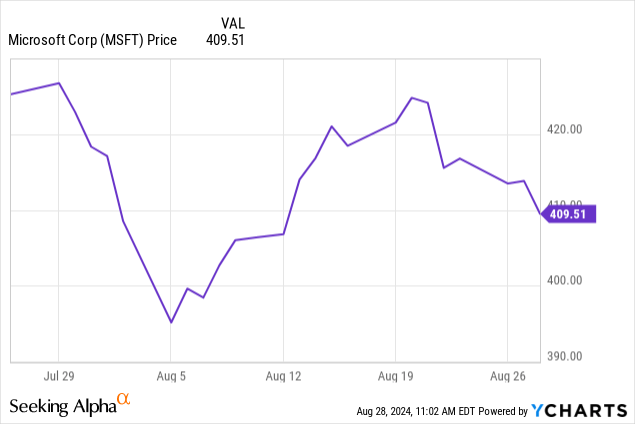

Microsoft delivered a solid fourth-quarter report on July 30, 2024. With a market cap of $3.07 trillion, it’s the world’s third-largest company. Yet it produced fundamentals that some smaller companies envy. Despite the solid performance, investors were lukewarm about the report. Nearly a month after the report, the stock is down a few percentage points from its July 30 closing price of $422.16.

There are multiple reasons why investors have become hesitant about buying the stock. The company failed to meet expectations for cloud growth and gross margins, creating investor anxiety over when investments in Artificial Intelligence (“AI”) infrastructure will pay off. Additionally, the company invested even more in capital expenditure (“CapEx”) during the quarter. It didn’t go over well with some investors when they failed to see enough bang for the buck from AI infrastructure investments in the near term. Analysts asked multiple questions on the earnings call about when the company’s AI investments will pay off. Considering the recent lack of enthusiasm for the stock price, the market didn’t get the answers it sought.

However, investors should keep this company on a watch list if they have not bought the stock. The potential long-term upside in AI and cloud computing is immense. Few companies will benefit from the proliferation of AI and cloud computing more than Microsoft. Although hardware companies like NVIDIA (NVDA) seem more exciting today than Microsoft, NVIDIA relies more on one-time sales of its GPUs (Graphics Processing Units) to generate revenue. In comparison, Microsoft has become more of a recurring revenue subscription business, meaning it may have a more stable financial foundation over the long term compared to the one-time sales of GPUs.

This article will discuss the risk of overinvesting in AI infrastructure, Microsoft’s upside potential from AI, and the company’s fundamentals. It will also examine the company’s valuation and why my recommendation remains a hold.

The significant risk of overinvesting in AI infrastructure

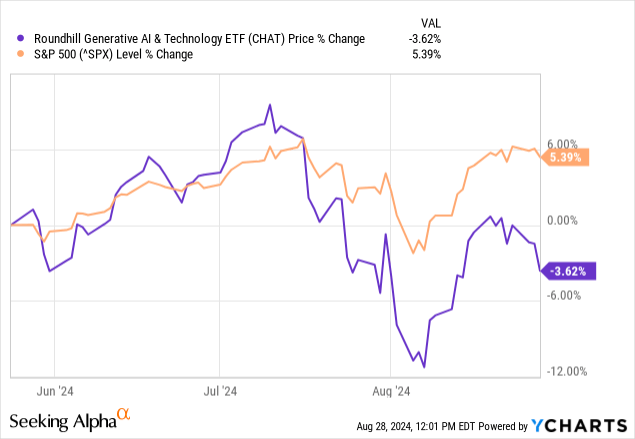

The stock returns of AI infrastructure companies have stalled over the last several months. The following chart shows Roundhill Generative AI & Technology ETF (CHAT) has declined 3.62% over the previous three months compared to the S&P 500’s (SPX) 5.39% rise.

Some investors have turned lukewarm on AI infrastructure stocks because they perceive them as in a bubble. David Cahn of venture capital company Sequoia wrote an article on June 24, 2024, titled AI’s $600B Question, which outlines a valid thesis on why companies like Microsoft may have over-invested in AI infrastructure. David Cahn wrote:

In September 2023, I published AI’s $200B Question. The goal of the piece was to ask the question: “Where is all the revenue?” At that time, I noticed a big gap between the revenue expectations implied by the AI infrastructure build-out, and actual revenue growth in the AI ecosystem, which is also a proxy for end-user value. I described this as a “$125B hole that needs to be filled for each year of CapEx at today’s levels.” This week, Nvidia completed its ascent to become the most valuable company in the world. In the weeks leading up to this, I’ve received numerous requests for the updated math behind my analysis. Has AI’s $200B question been solved, or exacerbated? If you run this analysis again today, here are the results you get: AI’s $200B question is now AI’s $600B question.

In other words, many companies investing in AI infrastructure may need more ROI (return on investment) to justify investing in the stock. Microsoft is no exception. The company has spent significant sums to build AI infrastructure, with no guarantee that it will generate enough revenue from AI services to justify the cost. If demand for AI services doesn’t grow as fast as expected, Microsoft could be stuck with many unused hardware parts. The company may have to write down the unused inventory, which may result in substantial losses.

One counterpoint that Microsoft will bring up when someone points out that the company overspends on AI infrastructure is that it is a “long-lived asset” that the company plans to monetize for an extended period. However, there is a danger in thinking of AI infrastructure as a long-lived asset similar to other physical infrastructure assets. David Cahn’s article points out the issue with that line of thinking when he compares the difference between AI infrastructure, such as data centers, and train infrastructure, such as railroad tracks. Cahn’s article also stated:

In the case of physical infrastructure build outs, there is some intrinsic value associated with the infrastructure you are building. If you own the tracks between San Francisco and Los Angeles, you likely have some kind of monopolistic pricing power, because there can only be so many tracks laid between place A and place B. In the case of GPU data centers, there is much less pricing power. GPU [graphics processing unit] computing is increasingly turning into a commodity, metered per hour. Unlike the CPU [Central Processing Unit] cloud, which became an oligopoly, new entrants building dedicated AI clouds continue to flood the market. Without a monopoly or oligopoly, high fixed cost + low marginal cost businesses almost always see prices competed down to marginal cost (e.g., airlines).

When Cahn refers to “GPU-based computing,” he means computing where multiple processors work in parallel to solve several problems simultaneously. This type of computing enables generative AI. CPU-based computing is traditional computing where one processor handles all the computational tasks of a system. The CPU cloud oligopoly that he refers to is Amazon’s (AMZN) AWS, Microsoft’s cloud unit, and Alphabet’s (GOOGL)(GOOG) cloud unit. Suppose Cahn’s assessment is accurate, and GPU-based computing becomes commoditized. In that case, Microsoft may be unable to charge a premium for its generative AI services, making it harder to recoup its investment.

Another huge problem that all AI-focused platform companies face, such as Alphabet, Meta Platforms (META), Amazon, and Microsoft, is that companies like NVIDIA (NVDA), Broadcom (AVGO), and Advanced Micro Devices (AMD) are constantly developing even more powerful AI hardware which could make these company’s current AI hardware investments obsolete more rapidly than expected, resulting in rapid depreciation of equipment. The massive downside of AI infrastructure depreciating too quickly is the potential negative impact on the company’s balance sheet, income statement, and cash flow.

AI may have a huge potential upside for Microsoft

Cahn did not write his assessment in stone. Although AI is very competitive, with seemingly a new entity offering another Large Language Model (“LLM”) daily, some companies believe they can differentiate their solutions. One such company is Microsoft. Management believes investing heavily in AI infrastructure is worth the risk because generative AI has the potential to change the world. In a Seeking Alpha Investing Summit, Wedbush Security Dan Ives said:

[I have been] covering tech since late ’90s, there have been some themes that were ultimately hype. And we could go back throughout the last 20-years. This is the fourth industrial revolution, I’ve never seen anything like it in tech, maybe call it start of the internet mid-90s, 1995 would be the only thing similar, but not a 1999 moment. And what I see traveling the world, we’re in the first inning. I mean, I believe it’s 9:00 p.m. at a party in Vegas, and this is going to a 4:00 a.m. Now I think part of the problem is, from a Wall Street perspective, you don’t find AI in the 10th floor of your office building, in your spreadsheets or on Metro North or Jersey Transit. You got to travel the globe. And that’s why I believe this is a tech bull market that’s going for the next two, three years. I think it’s a game changer. And I think it’s just started.

Microsoft shapes its investment in AI-based products according to where management sees customer demand. One prime area where the company saw demand for generative AI was adding it to existing products with large user bases. Microsoft’s productivity suite is one of the most popular software/cloud products worldwide. The company may have created a new hit product by adding its generative AI-based CoPilot to Microsoft 365, which combines Office productivity apps (Word, Excel, PowerPoint, and Outlook) with cloud-based services such as Exchange, SharePoint, and OneDrive. Chief Executive Officer (“CEO”) Satya Nadella said on the company’s fourth-quarter earnings call, “When I think about what’s happening with M365 Copilot as perhaps the best Office 365 or M365 suite we have had, the fact that we’re getting recurring customers, so our customers coming back buying more seats.” In other words, adding Copilot to Microsoft 365 raised the value proposition for customers. Its clients are now contractually expanding the number of employees accessing that service under the licensing terms. The more a customer adds users, the more revenue it generates for Microsoft. CEO Nadella said later on the earnings call:

At the end of the day, GenAI [generative AI] is just software. So it is really translating into fundamentally growth on what has been our M365 SaaS offering with a newer offering that is the Copilot SaaS offering, which today is on a growth rate that’s faster than any other previous generation of software we launched as a suite in M365. That’s, I think, the best way to describe it. I mean the numbers I think we shared even this quarter are indicative of this, Mark. So if you look at it, we have both the landing of the seats itself quarter-over-quarter that is growing 60%, right? That’s a pretty good healthy sign.

Only a few companies have a popular product that has been around for decades to add on a generative AI solution. The original Microsoft Office suite has existed since 1988 and has a massive user base. Integrating AI into its core products (like Microsoft 365) differentiates its AI usage from competitors, potentially giving it a competitive advantage and some pricing power.

When Morgan Stanley analyst Keith Weiss essentially asked Microsoft management how long it would take for the company to see a return from its AI infrastructure investment on the fourth quarter FY 2024 earnings call, Chief Financial Officer (“CFO”) Amy Hood gave the following answer:

Being able to maybe share a little more about that when we talked about roughly half of FY2024’s total capital expense as well as half of Q4’s expense, it’s really on land and build and finance leases, and those things really will be monetized over 15 years and beyond. And they’re incredibly flexible because we’ve built a consistent architecture first with the Commercial Cloud and second with the Azure stack for AI, regardless of whether the demand at the platform layer or at the app layer or through third parties and partners or, frankly, our first-party SaaS, it uses the same infrastructure. So it’s long-lived flexible assets.

Translation: A significant portion of Microsoft’s investment is in acquiring land, constructing data centers, and securing long-term leases for the computing facilities. Management doesn’t blindly invest in hardware. It only invests in hardware (like servers) when there’s sufficient demand for its AI services.

The company has built a standardized computing architecture in its data centers for its PaaS (Platform as a Service) products, applications, third-party solutions, and its own SaaS (Software as a Service) products. Management believes that for at least the next 15 years, it can adapt this architecture to meet the changing demand for various AI services and monetize it in different ways.

CFO Hood indicated that it initially built this standardized computing infrastructure for its Commercial Cloud products, such as Dynamics 365, Microsoft 365/Office 365, and more. Later, it started building a standard computing infrastructure for Azure stack for AI, a hybrid cloud solution that brings Azure’s AI services to on-premises and edge environments. Microsoft’s PaaS, apps, third-party and first-party SaaS can use this same computing infrastructure today. Although the initial costs were high for building this infrastructure, the company expects to generate revenue from it for 15 years or more, regardless of where the demand for AI services comes from.

Unlike its cloud computing buildout, which gradually expanded from region to region, Microsoft’s AI infrastructure buildout is rolling out globally in one fell swoop. The company has strong demand from large customers in every geographic region. It is moving as quickly as possible to establish market leadership and a robust AI presence in the first inning of this new, exciting market. Management has likely concluded that the danger of underspending and allowing competitors to take leadership in the AI market vastly outweighs the risk of overspending on AI architecture.

Company fundamentals

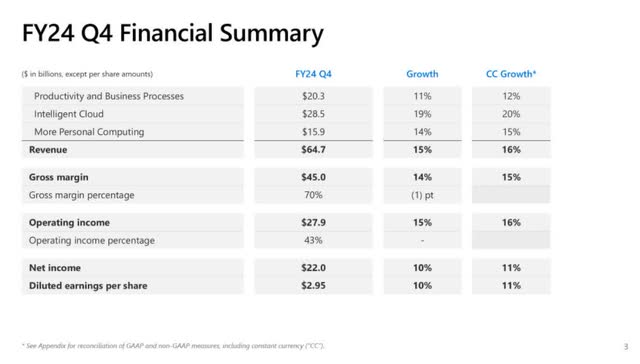

Some people find Microsoft a confusing company to analyze because it has so many products in different areas. To make things simple, it organized all its products under three revenue reporting segments: Product and Business Processes (traditional software like Office, Windows, and server products), Intelligent Cloud (cloud-based services like Azure, Dynamics 365, and Power Platform), and More Personal Computing (primarily consumer-facing products, such as Xbox and Surface devices).

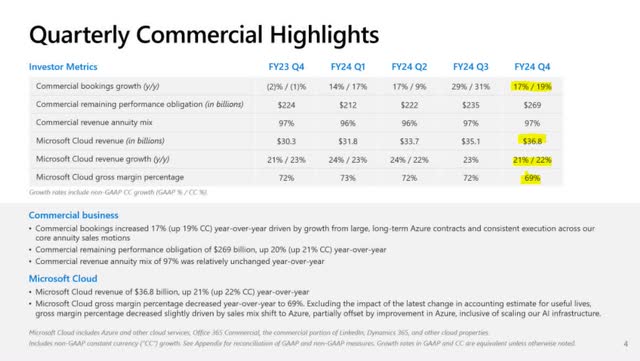

Microsoft emphasizes its Commercial business in its investor slide presentation because it is its most significant growth driver. Microsoft’s Commercial business combines the fundamentals of its Product and Business Process segment, and Intelligent Cloud segment. The numbers highlighted in yellow were the most significant contributors to investor disappointment with the company’s fourth-quarter results.

Microsoft Fourth Quarter FY 2024 Earnings Slides

The good news is that the company’s fourth-quarter Commercial remaining performance obligations displayed excellent growth. CFO Amy Hood said on the fourth quarter earnings call:

Commercial remaining performance obligation increased 20% and 21% in constant currency to $269 billion. Roughly 40% will be recognized in revenue in the next 12 months, up 18% year-over-year. The remaining portion, recognized beyond the next 12 months, increased 21%.

These numbers mean the company is growing its backlog and effectively converting it into revenue. The bad news is the company’s lackluster bookings growth in the fourth quarter. The company’s sequential decline in fourth-quarter commercial bookings from 29% to 17% means it signed fewer new business deals than it did in the third quarter.

Wall Street is also laser-focused on Microsoft’s cloud revenue growth, a key growth driver of the company’s revenue. The company’s AI growth should show up mostly in cloud revenue. Its cloud revenue declined from 24% in the first quarter of 2024 (calendar September 2023) to 21% in the fourth quarter of 2024 (calendar June 2024), which is disappointing since this quarter is traditionally the largest quarter of the year. In contrast, Alphabet’s cloud unit revenue growth accelerated from 22.46% in its September 2023 quarter to 28.83% in its June 2024 quarter. Amazon’s AWS showed similar acceleration, growing revenue from 12% year over year in its September 2023 quarter to 19% year-over-year in its June 2024 quarter. Microsoft’s deceleration in cloud revenue growth, while its competitors accelerated cloud growth, alarmed its investors.

Microsoft’s cloud gross margin dropped three points from the previous quarter to 69%. This drop in gross margins also worried investors because one concern with an AI business is that it could cause gross margins to deteriorate due to the high costs of delivering AI services. As for the first quarter FY 2025 guidance for cloud gross margin, CFO Hood said, “[First quarter] Microsoft Cloud gross margin percentage should be roughly 70%, down year-over-year driven by the impact of scaling our AI infrastructure.”

Microsoft Fourth Quarter FY 2024 Earnings Slides

Microsoft’s total revenue increased by 15% over the previous year’s comparable quarter to $64.7 billion, beating analysts’ forecasts by $287.80 million. Fourth-quarter FY 2024 gross margins dropped one point, likely due to the deterioration in cloud gross margins.

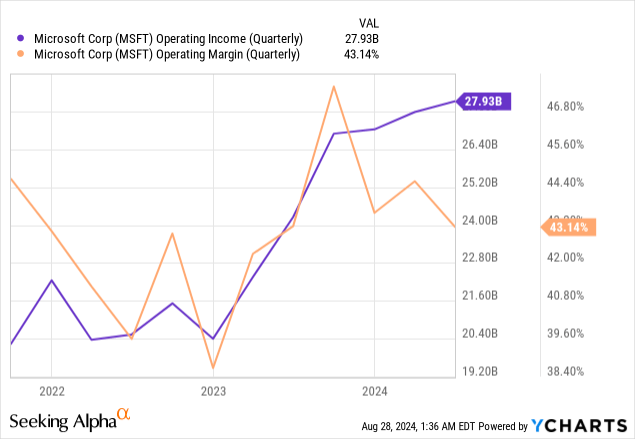

Operating margins were flat year over year and down 145 basis points sequentially to 43.14%. Operating income was $27.83 billion, up 15% year over year.

The company’s diluted earnings-per-share (“EPS”) grew 10% over the previous year’s comparable quarter to $2.95, beating analysts’ estimates by $0.02.

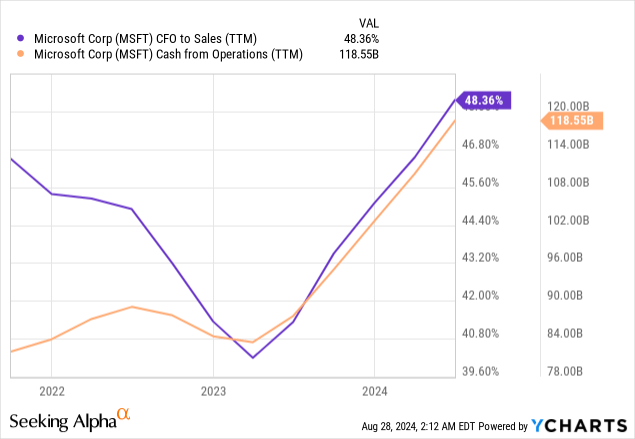

The following chart shows that since early 2023 (right after OpenAI released ChatGPT), Microsoft’s cash flow from operations (“CFO”) to sales has increased by over eight points to 48.36%, which means that for every dollar of sales, the company generates $0.48 in cash flow. CFO also rose sharply to $118.58 billion, supported by robust cloud billings and collections.

The company paid $13.9 billion in the fourth quarter for property and equipment. If you include finance leases, Microsoft spent $19 billion in CapEx in the fourth quarter to support its AI infrastructure initiatives. It grew annual FY 2024 CapEx by 75% from the previous year’s comparable quarter to $55.7 billion. The company expects to spend even more next year. CFO Hood said on the fourth quarter earnings call:

To meet the growing demand signal for our AI and cloud products, we will scale our infrastructure investments with FY2025 capital expenditures expected to be higher than FY2024. As a reminder, these expenditures are dependent on demand signals and adoption of our services that will be managed through the year.

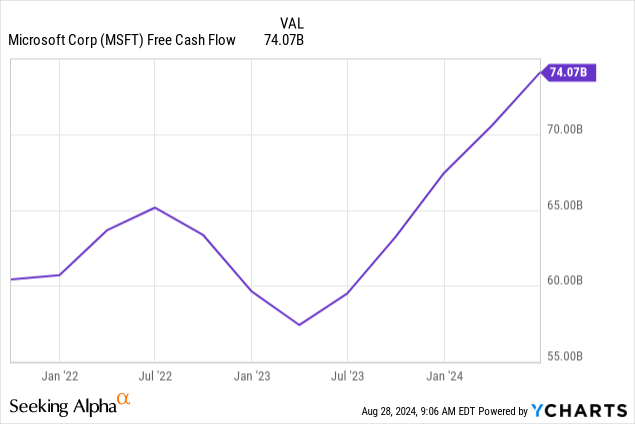

High CapEx spending subtracts from cash flow, reduces FCF margin, and slows FCF growth. As long as Microsoft spends heavily on CapEx for its AI infrastructure buildout, it could negatively impact valuations based on FCF. It could also negatively impact shareholder yield, which measures how much value the company returns to investors in debt reduction, stock repurchases, and cash dividends. The following chart shows the company’s annual FY 2024 FCF was $74.07 billion.

The company has $75.53 in cash and marketable securities against $42.69 billion in long-term debt. Its debt-to-EBITDA ratio is 0.49, and its debt-to-equity ratio is 0.25, a sign of a solid balance sheet.

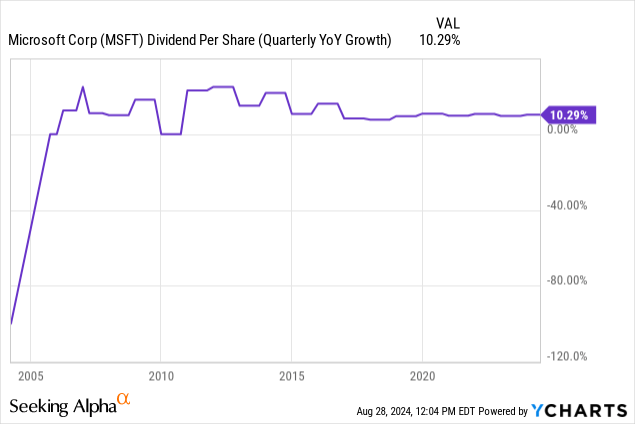

The following chart shows that Microsoft has maintained a dividend-per-share ratio of around 10% over the last decade, a positive sign for investors.

The company’s first-quarter revenue guidance of $63.8 billion to $64.8 billion was more tepid than analysts would have liked. Analysts had called for $65.07 billion in the first quarter. On the positive side, management expects revenue growth to increase later in FY 2025.

Valuation

The following table compares Microsoft’s price-to-earnings (P/E) to several cloud and AI peers. Microsoft has the second-highest P/E at 35 but the lowest diluted EPS growth rate in the June quarter. Its P/E ratio is also above the sector median of 29.79, which might lead some to conclude that the market overvalues the stock.

| Company name | TTM P/E | Quarterly TTM diluted EPS growth |

| Amazon | 41.56 | 93.85% |

| Microsoft | 35 | 9.67% |

| Apple (AAPL) | 34.67 | 11.11% |

| Meta Platforms (META) | 26.6 | 73.15% |

| Alphabet | 23.85 | 31.25% |

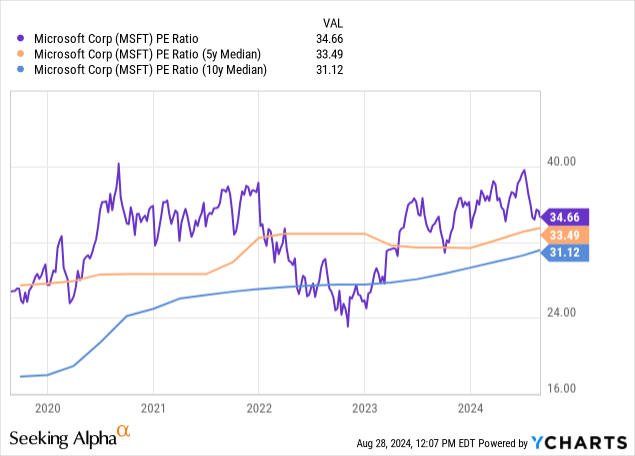

Microsoft’s TTM P/E also trades above its five- and ten-year median, suggesting slight overvaluation. The following chart shows the ideal time to purchase the stock was from the fall of 2022 to the spring of 2023.

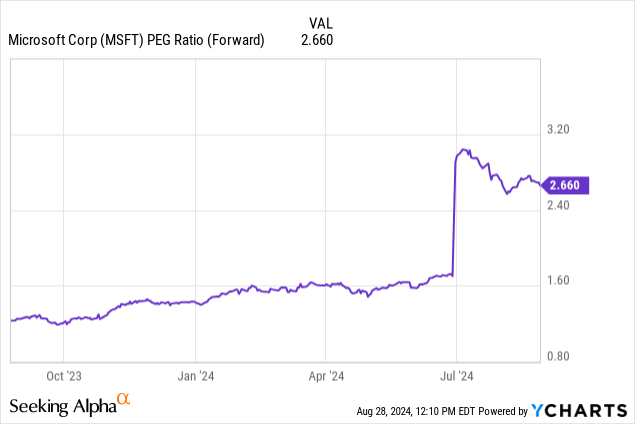

However, the TTM P/E is backward-looking. Using the forward price to earnings to growth (“PEG”), let’s compare the forward P/E to the company’s estimated EPS growth rate. One rule of thumb that some growth investors use is that a forward PEG ratio above two is a sign the market may overvalue the stock. Value investors may consider a forward PEG above one as overvalued. Therefore, some value and growth investors may consider Microsoft’s PEG ratio of 2.68 a sign of overvaluation.

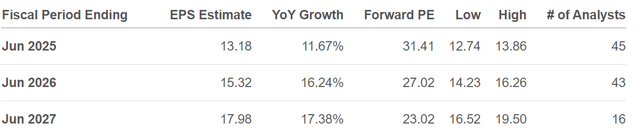

The following table shows that the company’s forward P/E is 31.41, and its estimated EPS growth rate is 11.67%. Dividing 31.41 by 11.67 equals the company’s forward PEG ratio of 2.69. Suppose the stock trades at a forward PEG ratio of 1.0; the stock price would be $153.81.

One flaw of using the forward PEG ratio to value a stock is that it depends on analysts’ EPS growth estimates, which are sometimes wrong. Analysts are not immune to market sentiment, which could change at any moment — a potential reason that analysts constantly revise future estimates. Additionally, the PEG ratio shares another flaw with all valuation methods: stocks may trade well above mathematically derived valuations that fail to capture intangibles that the market believes deserve a higher valuation. For instance, the market may award a stock with a subscription business a higher valuation than a stock with mostly one-time sales, even though the companies have similar growth rates. One intangible that Microsoft has over several businesses is that its primary growth engines are cloud computing and AI, which the market views as having excellent long-term prospects and may be more willing to award a premium to mathematically derived valuation methods. Another intangible might be the company’s score in the rule of 40.

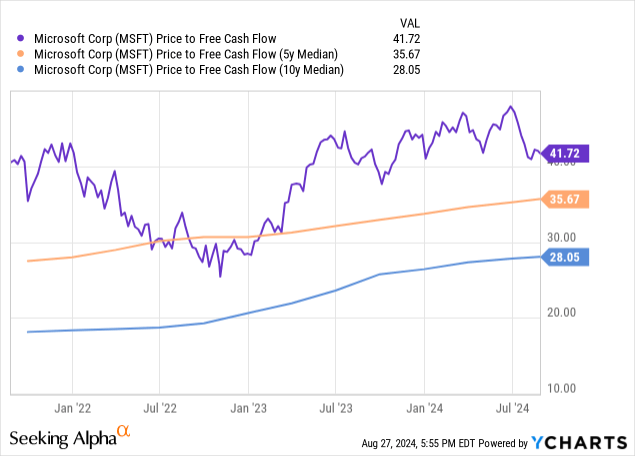

Microsoft’s price-to-FCF ratio is 41.72, higher than its peers and above the Information Technology industry average of 19.35. The following measures are all backward-looking.

| Company | Price/FCF | 12-month FCF per share growth | Five-year FCF per share growth |

| Microsoft | 41.72 | 24.60% | 13.90% |

| Amazon | 38.22 | 1317.80% | 6.50% |

| Alphabet | 34.79 | -12.70% | 20.60% |

| Apple | 33.94 | 6.00% | 14.60% |

| Meta Platforms | 27.56 | 104.20% | 26.90% |

The following chart shows Microsoft’s price-to-FCF is also higher than its five- and ten-year median, suggesting overvaluation. If the stock trades at its five-year median, its price would be $353.84.

The following Microsoft reverse discounted cash flow (“DCF”) uses a terminal growth rate of 3% because the company should continue steadily growing its cash flow above the market average after ten years. I use a discount rate of 10%, the opportunity cost of investing in Microsoft, to reflect an average risk level. This reverse DCF uses a levered FCF for the following analysis.

Reverse DCF

|

The fourth quarter of FY 2024 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$74,071 |

| Terminal growth rate | 3% |

| Discount Rate | 10% |

| Years 1 – 10 growth rate | 17.0% |

| Stock Price (August 26, 2024, closing price) | $413.53 |

| Terminal FCF value | $366.728 billion |

| Discounted Terminal Value | $2019.850 billion |

| FCF margin | 30.22% |

If Microsoft maintains an FCF margin of 30%, it would need to grow revenue at 17% over the next ten years to justify the August 27, 2024 closing stock price of $413.53. Since the company only grew its revenue at 10.93% annually from 2014 to 2024, that might be a difficult ask. If I assume it can expand its average FCF margin to 33% as the company’s AI investments begin paying off and it winds down CapEx spending after completing most of its infrastructure spending, it would only need to grow revenue by 15.8% annually over the next ten years.

Fortune Business Insights expects the AI market to reach $2.74 trillion, growing at a compound annual growth rate (“CAGR”) of 20.4% from 2023 to 2032. It also projects the cloud market to reach $2.29 trillion, growing at a CAGR of 16.5% from 2024 to 2032. Microsoft’s increasing revenue in line with the cloud computing and AI market over the next ten years is a feasible but aggressive assumption considering its competition with Amazon and Google for the same markets. Two companies that, by the way, grew their cloud units faster than Microsoft in the June quarter. If Microsoft grows its annual revenue from $245.1 billion in FY 2024 at a 16% CAGR over the next ten years, it will reach $1.08 trillion in annual revenue in FY 2034.

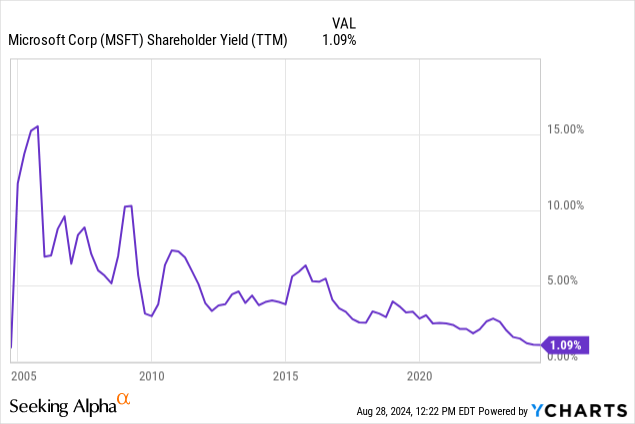

Last, let’s look at Microsoft’s shareholder yield, which decreased significantly from above 6% in late 2015 to 1.09% in August 2024. The market may overvalue the stock when shareholder yield is at the low end of its range.

I believe the ideal time to buy Microsoft is when its shareholder yield is 3% or above. From the above chart, 2015 to early 2020 was an excellent time to buy the stock for the long term. Another buying opportunity was from late 2022 to early 2023. Despite the excitement over Microsoft’s AI and cloud opportunity, if it goes significantly below a 1% shareholder yield, that may be a red flag that may make me consider giving it a sell recommendation.

Why Microsoft remains a hold

There are solid reasons to continue holding the stock. Microsoft’s AI and cloud strategies have significant potential returns if they eventually pay off as much as the company expects. If its long-term bet on AI increases revenue, profitability, and FCF, shareholder yield may increase without investors enduring significant declining stock prices. If you have bought Microsoft at better valuations, it may still be worth holding because of its potential upside in the cloud and AI market. However, if you have yet to buy it, be careful, as the company is close to reaching a level based on its shareholder yield that investors who buy today may not receive a reasonable return on their investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.