Summary:

- Apple stock is expensive. The company has a high valuation, which means it doesn’t have the free cash flow to generate strong returns.

- Apple Watch’s success, in our view, was based on a new category (healthcare). That category is yet to be apparent for Vision Pro.

- Even if the Vision Pro succeeds, a global slowdown in demand, combined with the company’s valuation, makes Apple stock a poor investment in our view.

Daniel de la Hoz/iStock via Getty Images

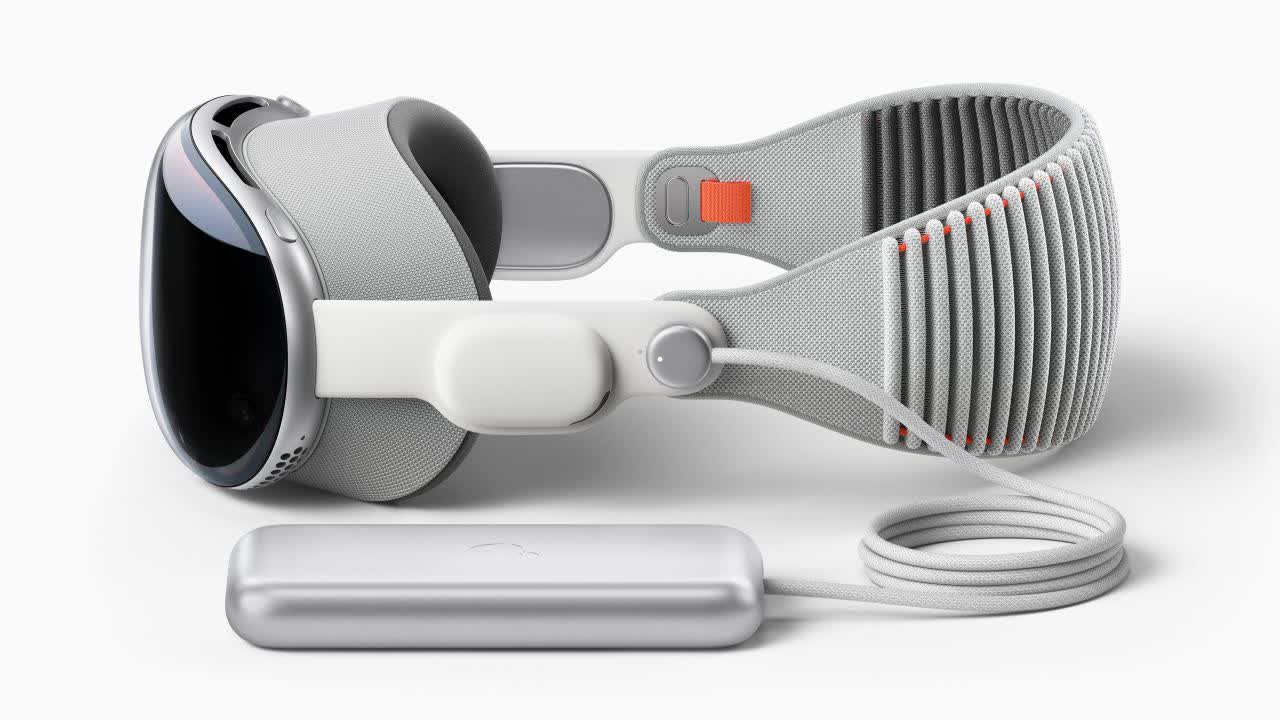

Apple Inc. (NASDAQ:AAPL) has announced its Vision Pro, the company’s first new announced product category since the Apple Watch. The category has done incredibly well as a new wearables category for the company. However, we’d argue that was due to the health benefits. As we’ll see throughout this article, we don’t expect the Vision Pro to outperform, but even if it does, it won’t justify Apple’s valuation.

Vision Pro

The Vision Pro is a major announcement for the company. Of course, the announcement was muted by the $3500 sale price and the lack of availability until next year. For us, the announcement was nothing special. The vast majority of the applications shown were comparable apps we’ve used on the Oculus, but with the improvements expected for 10x the price.

Vision Pro

There are some potentially ground-breaking applications, but as of now, there’s no true indication that the software exists. Given that Apple relies on developers to traditionally populate its app store, that’s a massive risk. The Oculus has been around for a while, without the same ground-breaking software.

Could the same developers change that with Apple hardware?

Unfortunately, there’s another dynamic here. The company is massive and it’s hitting the law of large numbers. The massively successful iPad only makes up 10% of its revenue. The iPhone is in a category of its own. That means even if the Vision Pro becomes another iPad or wearable, it won’t move the needle enough to justify the company’s valuation.

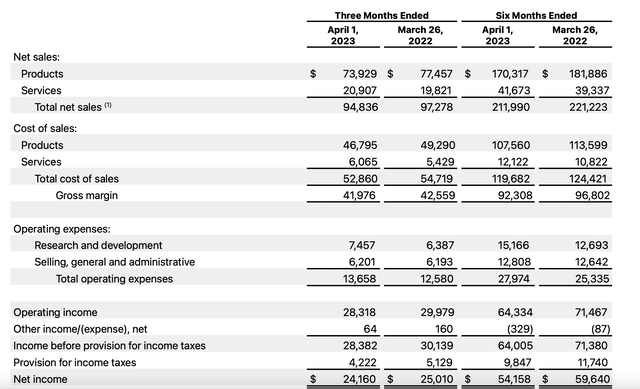

Apple Financial Results

The company’s financial results show continued weakness, despite a strong portfolio.

The company had $94.8 billion in total net sales, down YoY. For the 6-month period, the company’s net sales dropped almost 5%. The company’s cost of sales helped partially with the decline in revenue, but the net result was a decrease in gross margins for the company. That was especially more evident for the 6-month period.

The company’s operating expenses also increased due to a substantial increase in research and development expenses. That’s not too surprising, but it does mean the company’s net income has dropped roughly 4%. That continued weakness at a 30+ P/E is a tough position for the company to be inside.

Apple Forecast

There are warnings for a continued decline in revenue. Apple set a new record last year at $97 billion in the 2Q, which was up 9% YoY. However, for the upcoming quarter, the company expects a continued negative impact from forex along with massive weakness in the Mac and iPad division.

The company thinks that the weakness won’t necessarily continue, but at its valuation, it needs more than stagnation, it needs growth.

Thesis Risk

The largest risk to our thesis is an accomplishment that Apple did earlier this week. The company hit a new all-time record for its share price, but the company’s market cap was more than $100 billion below where it was the last time. How did it do it? Share repurchases. Apple is a slow and steady stock that’s been repurchasing shares, and chugging along.

Reliable growth with increasing margins can lead to a steady share price increase as its valuation is ignored in light of its reliability.

Conclusion

Apple is a great company. But it’s a great company at too high of a price. The company’s free cash flow (“FCF”) is 3% and income growth is stagnating. For the year, it’s likely to turn negative. In a world where short-duration treasuries are yielding well past 5%, it’s a tough sell given the higher risk that’s present across the world in equities.

Apple has been a volatile stock in the past and there’s been plenty of interesting opportunities to invest. But at its current valuation, despite the impact of share repurchases, with its FCF, it’s just not cutting it. As a result, we recommend against investing in the company at the present time. Let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.