Summary:

- T has performed well, delivering a total return of 43% since August 2023, outpacing the market.

- AT&T added 349,000 postpaid phone subscribers in Q1 2024, significantly outpacing Verizon, and shows continued strength in its fiber broadband segment with 252,000 net additions.

- AT&T reduced its debt to $128.7 billion from $134.7 billion, targeting a net debt to adjusted EBITDA ratio of 2.5x by mid-2025, supported by a strong balance sheet.

- Trading at 8.6 times 2024 earnings with a near 6% dividend yield, AT&T’s stock is undervalued, bolstered by growth in its 5G and fiber broadband segments.

- Analysts expect AT&T to report Q2 earnings of $0.58 per share and revenues of $30 billion, maintaining performance despite economic headwinds and flat handset sales.

jetcityimage

Investment Thesis

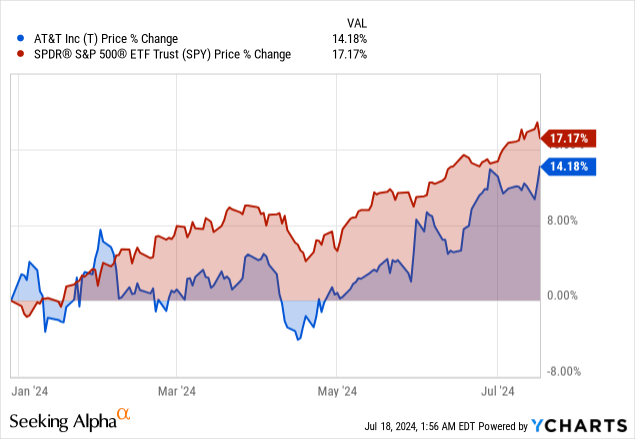

Since our initial bullish investment thesis on AT&T (NYSE:T) was published on August 2, 2023, the stock has performed remarkably well. It has delivered a total return of 43%, including dividends, significantly outpacing the broader market’s return.

AT&T has strengthened its wireless and Fiber offerings, boosting shareholder returns and outpacing competitors with steady growth in its mobility services. The company’s strong free cash flow is reducing debt and supporting dividend distributions, with shares undervalued at 8.6 times projected earnings, indicating additional growth potential. Despite past entertainment sector obligations, AT&T’s fiber and mobile operations expansion improves cash flow and financial health, making it a reliable source of long-term returns.

While the stock is up by about 14% for the year, underperforming the index, it has only recouped the more its losses accrued last year. Since the pandemic, the stock has shed more than 50% in market value and only started to bottom out in 2023. Thus, our bullish investment thesis remains intact for the stock premised upon AT&T’s robust wireless and fiber growth, strong earnings potential in light of the earnings season, and strong cash flow, which makes it a compelling buy.

AT&T’s Wireline Woes: Fierce Competition from T-Mobile and Verizon Takes a Toll

Fierce competition has proved to be the biggest threat to AT&T’s core wireline business. The landline industry has faced considerable strain because of competition from T-Mobile US, Inc. (TMUS) and Verizon Communications Inc. (VZ), rendering the company’s shares susceptible to market downturns.

For instance, the Business Wireline division saw a 7.8% decline in profits in the first quarter of 2024, primarily because of diminished income from conventional voice and data services as the company faced intense competition. Last year alone, the Business Wireline segment posted a 10.3% year-over-year revenue decline to $5.1 billion, attributed to lower demand for legacy voice and data services.

AT&T’s Bright Future: Focus on Fiber and 5G Sets Stage for Telecom Dominance

Nevertheless, the future is looking increasingly bright as the company looks into the future with its focus on Fiber and 5G technologies. Following the divestiture of its media businesses last year, AT&T is now a pure telecommunication company focused on emerging technologies.

AT&T’s shift from the entertainment industry was crucial to saving funds and materials. Creating a 5G mobile network demanded AT&T to spend billions. Last year alone, it spent nearly $23.6 billion on 5G and fiber broadband infrastructure.

By returning to its core telecommunications business, AT&T is in a solid position to keep its top spot as the most prominent US mobile network provider according to the number of wireless plans. Hence, the company is positioning itself for a future where connectivity and customer satisfaction will be at the heart of its core operations.

Fiber and 5G Growth Fuel Strong Revenue Despite Equipment Decline

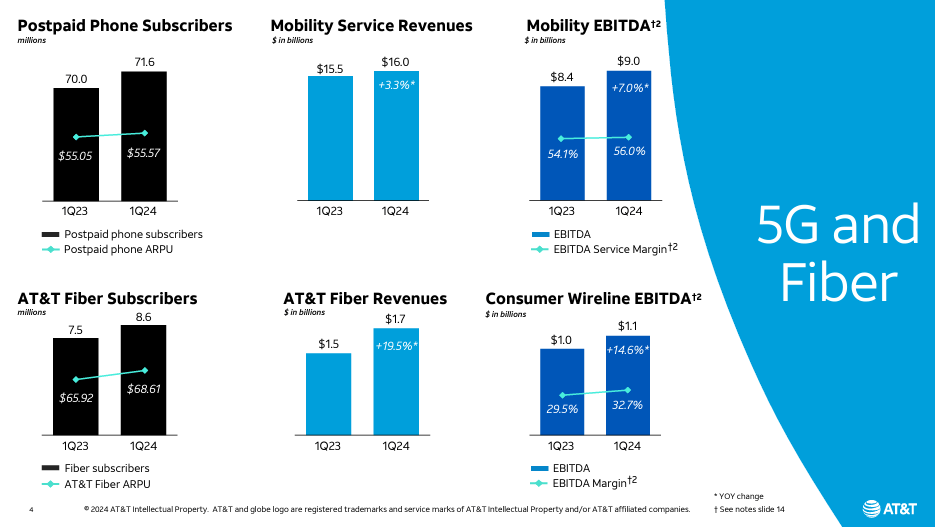

In the first quarter of 2024, the company delivered results that underlined substantial customer additions on its fiber connection and profitable growth as it benefited from revenue increase in Mobility service and broadband.

Total revenue totaled $30 billion compared to $30.1 billion delivered a year ago. The slight drop was due to a decline in Mobility equipment revenues. However, the decline was offset by solid growth in service revenues, up by 3.3%, as Mobility revenues increased by 0.1%. Net income attributable to shareholders was $3.4 billion, compared to $4.2 billion a year ago in the same quarter. Adjusted EBITDA was $11 billion, compared to $10.6 billion a year ago in the same quarter. Additionally, its margins increased by 6% to 36.8%.

The telecom behemoth is making great success in the Fibre and 5G sectors, which are anticipated to be crucial to future development, even as it keeps moving forward and aims to quicken growth in sales and profits. The company covers over 300 million people in over 24,000 cities and towns across the US, making it one of the largest mid-band 5G portfolios. One of the quickest networks, 5G and Fiber, is making up for a slowdown in the wireline segment. Compared to last year’s quarter, the segment saw a 1.6 million rise in postpaid phone subscribers in the first quarter of 2024. Similarly, the segment’s income from mobility services increased by 3.3% to $16 billion.

AT&T

AT&T Fiber subscribers were up by 1.1 million year over year in the quarter to 8.6 million as AT&T Fiber revenues increased 19.5% to $1.7 billion, becoming the fastest-growing business. The double-digit revenue growth has everything to do with the growth in user count.

To speed up its expansion into fiber services, AT&T has partnered with BlackRock (BLK). Additionally, the company is using its expanding 5G network to provide wireless internet access in areas with fewer people. Customers can enroll and install this service on their own in just a few minutes, which is expected to boost AT&T’s broadband service business.

The telecommunications giant is expanding its wireless phone user base and maintaining a solid relationship with them. The firm’s churn rate for postpaid phone subscribers, which measures the proportion of customers switching to AT&T, is at its lowest point in history. Moreover, customers who chose AT&T’s mobile phone plans and fiber optic internet services have shown the lowest churn rates of just 0.72% and the highest value over the customer’s lifetime.

Q2 2024 Earnings Preview: Can 5G and Fiber Fuel a Comeback?

AT&T’s stock is poised for a potential turnaround as it prepares to report its Q2 2024 earnings on July 24. The stock has performed reasonably well this year, outpacing rival Verizon’s gain. Analysts estimate that the company is about to report $0.58 per share in earnings, slightly edging over the consensus, while the revenues would be at $30 billion, remaining the same as last year.

Yet despite its historical underperformance—down sharply 35% from January 2021 to the present—AT&T’s stock shows overt signs of being undervalued. Trading at around 8 times consensus 2024 earnings and with a near 6% dividend yield, AT&T does not look bad for long-term accommodation.

With its strategy back to core telecommunications, combined with its fiber broadband segment growth and firmly falling churn rates, AT&T has already proven to be a solid foundation for future profitability. As the expensive 5G plan builds to the bottom and margins rise from higher-value 5G plans, AT&T sets itself up to surf the tide and rise with the increased revenues.

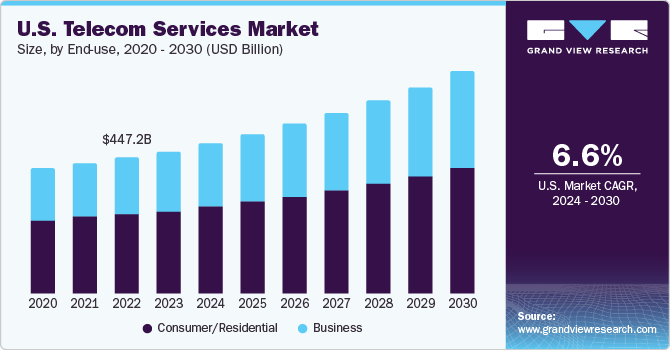

In fact, given the lower relative risk right now for bottomed-out earnings, the imperatives of wireless and telecom services are a buffer from significant financial impact — and AT&T is poised to participate in an all-firm economywide recovery with plateauing or moderately stable long-term returns, supported by the industry’s 6.6% CAGR.

www.grandviewresearch.com

AT&T’s Turnaround: Strategic Debt Reduction and Fiber Growth Propel Financial Stability

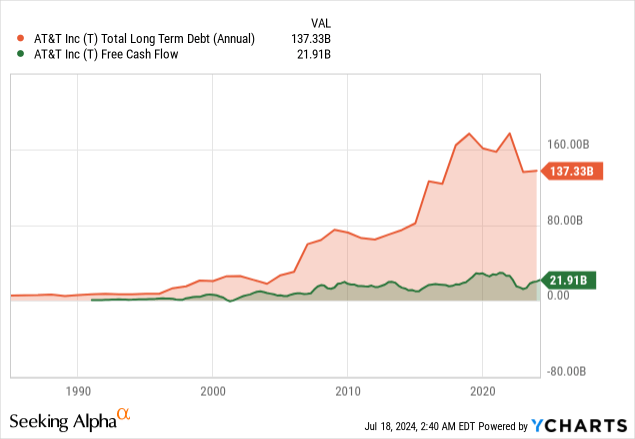

Over the past few years, the stock’s poor performance had everything to do with poor execution, especially in the wireline business. Capital management was also a big problem that saw the company invest massively in acquisitions that needed to generate significant value, resulting in a significant debt load. Fast forward, things are changing thanks to an efficient capital allocation strategy focusing on reducing the debt load.

Additionally, growth in the fiber business was one reason the company generated $7.5 billion in cash from operating activities, representing a $0.9 billion yearly increase. The increase came despite the company spending $4.6 billion in capital investments and ended the quarter with $3.1 billion in free cash flow.

The company’s ability to maintain dividend payments is mainly due to its strong financial situation, highlighting its commitment to giving investors returns. Furthermore, it has restated its goal to spend $21.5 billion in 2024. It is projected to retain roughly $17.5 billion in free cash flow, translating into a 15% free cash flow yield.

As evidence of the strength of its core business, AT&T projects its yearly free cash flow to be between $17 billion and $18 billion. Less than 40% of its free cash flow, or about $8 billion, is allocated to dividends, underscoring the significant amount of free cash flow the company will still have available to reinvest in its shareholders.

The company has reiterated its commitment to continue reducing its debt load. It has already dropped to $132.8 billion. The strong balance sheet should support the debt reduction, as the wireless carrier remains on track to reach a net debt to adjusted EBITDA of 2.5x by the first half of 2025. The huge debt load does not pose a significant risk, given that 95% is fixed, with an average maturity of 16 years.

Bottom Line

AT&T has enhanced its wireless and Fiber offerings, strengthening its capacity to generate shareholder returns. Consequently, It’s no longer on the decline, with its mobility services sector showing steady expansion, allowing it to surpass its competitors with a robust and dependable service.

The carrier’s debt load is loosening due to strong free cash flow, which should enable it to keep distributing dividends and providing returns to investors. Despite facing financial obligations from its purchases in the entertainment sector, AT&T is moving forward positively.

Finally, the firm’s accomplishments in expanding its Fiber and mobile operations contribute to cash flow growth that is not tied to expenses, indicating that AT&T’s financial situation is expected to improve in the following quarters.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.