A. O. Smith: An Excellent Long-Term Dividend Grower, But Wait For Better Prices

Summary:

- A. O. Smith Corporation is a high-quality dividend growth stock with a 30-year dividend growth streak.

- The company has a resilient business model, strong financials, a healthy balance sheet, and promising growth prospects in emerging markets and their water treatment business segment.

- Based on my own discounted cash flow analysis, the fair value of AOS stock is $66.18 per share, which is 19.6% overvalued compared to the current share price.

- Uncertainty in the Chinese real estate sector, volatile steel prices, and a relatively high beta are factors that must be taken into account before investing in AOS.

vovan13

Introduction

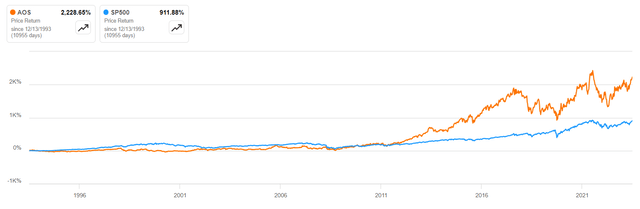

A. O. Smith Corporation (NYSE:AOS) is a stock that could function as a cornerstone in a dividend growth investment portfolio. I think AOS is a perfect example of a boring high-quality stock and if you’re a long-term dividend growth investor I highly encourage you to put it on your watch list. The company has proved that a boring company can easily beat the market over longer periods of time.

Long-term total returns (Seeking Alpha)

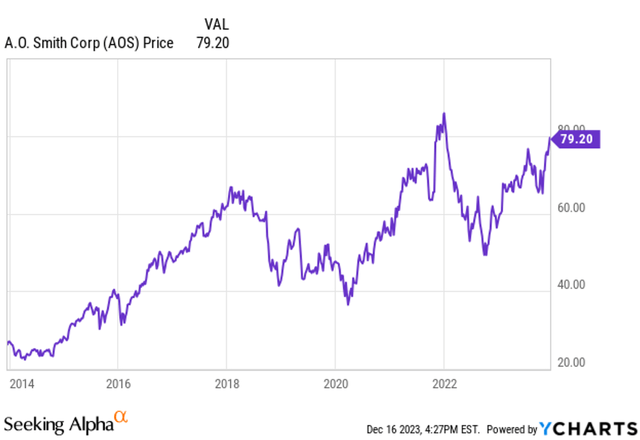

This year the share price does an excellent job with a +35% year to date. AOS is also a dividend aristocrat with a 30Y dividend growth streak. I also expect the company is well positioned to become a future dividend king. AOS has often a premium valuation, but high-quality has its price.

In this article, I want to update my investment thesis to determine if AOS is attractive at current prices.

Why AOS?

For those who don’t know, AOS is a global leader in manufacturing water heaters, boilers, and commercial water treatment products for residential and commercial applications.

I want to give you a few reasons why I think AOS is worth considering.

Business model and catalysts

The business model of AOS can be called resilient and they have a strong track record when it comes to their financial results.

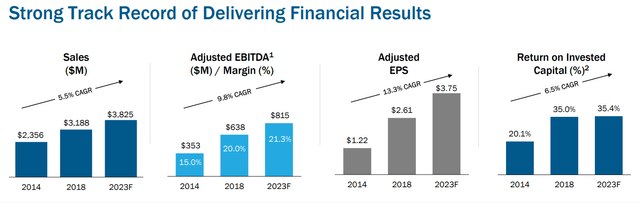

AOS financial results (2023 Investor Day)

At first glance a 5.5% 10Y sales CAGR isn’t that impressive, but if we look further into the profitability ratios things are getting more interesting. From a bottom-line point of view, the company delivers great results. With a 10-year adjusted EPS CAGR of 13.3%, they show their true compounding potential. Their core business is located in the US, where they earn 75% of their total revenue and is by far the most profitable part of the business. From that percentage, 80-85% of sales is derived from the replacement of existing products which creates a safety cushion in their earnings.

Although these are results from the past, there are plenty of reasons to be optimistic about the future. The company is in a good position to further expand their business in emerging markets like China and especially India, which can be seen as a catalyst for future growth.

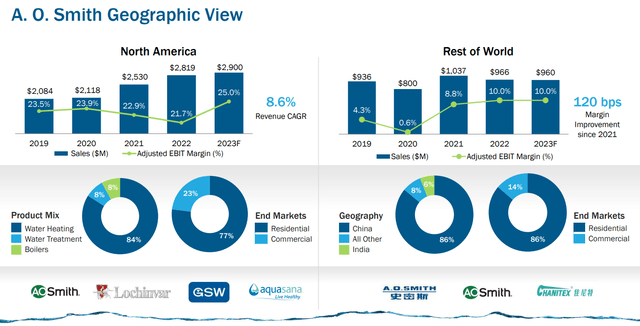

Sales distribution (2023 Investor Day)

Also, trends like energy efficiency and climate change will be further stimulated by the government, because this is a part of the Green deal. This means that buildings need to be upgraded so they can achieve, for example, maximum energy/water efficiency and durability. As one of the market leaders in North America in the residential and commercial market in water heaters and high-efficiency boilers, AOS can benefit from these trends.

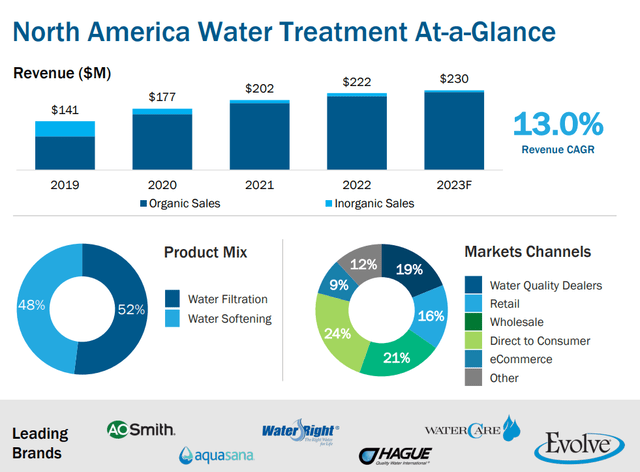

AOS has also expanded its product portfolio in recent years with water treatment products.

AOS water treatment segment (2023 Investor Day)

Despite the fact that these products are still a small part of their sales, high growth rates can be expected compared to their water heaters and boilers. For example, in the North America segment, they expect revenue growth of around 15-17% for the coming 5 years. This also includes 5% from acquisitions.

Capital allocation

Their capital allocation strategy is very clear, and in my opinion, they are doing things right. From FY 2014 they managed to increase their ROIC from 20.1% to around 35.4% this year. This underlines the ability of AOS to successfully use capital to create shareholder value.

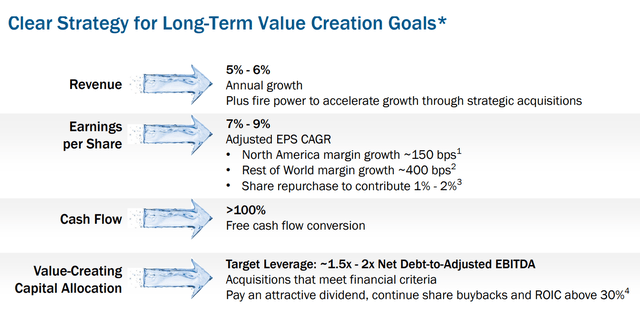

They also have concrete financial goals for the period 2024-2028.

Long-term financial goals (2023 Investor Day)

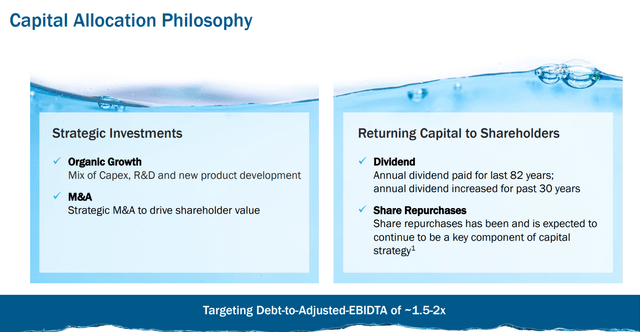

AOS prioritizes growing its business above anything else, which is the most important thing from a dividend growth investment point of view. They seek ways to invest in organic business growth and in growth via M&A. M&A is mainly to expand and/or grow its core business and to maintain an active pipeline.

Capital allocation (2023 Investor Day)

On top of that the company is doing share buybacks and is paying a growing dividend.

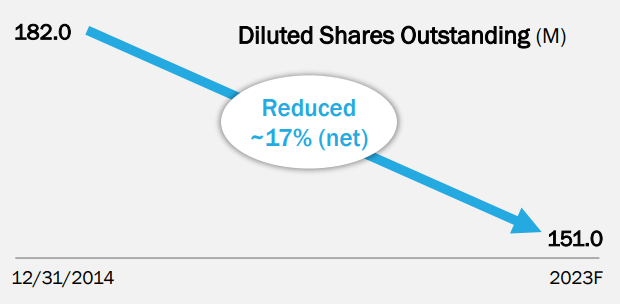

Share buybacks (2023 Investor Day)

Looking at the last 10 years, AOS has bought back a lot of shares, which comes down to an annual CAGR of -1.8%.

High-quality balance sheet

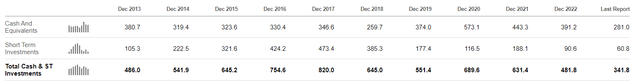

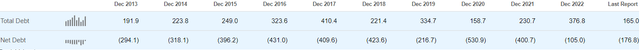

The company is in a healthy financial position when it comes to their balance sheet. AOS has a total of $341.8 million in cash and short-term investments and a total debt of $165.0 million. This is in my opinion a big plus, this creates a lot of financial flexibility to execute their capital allocation strategy. Over the past 10 years, AOS has also managed to keep its net debt negative, which is in my opinion a sign of quality.

Cash and investments (Seeking Alpha) Debt development (Seeking Alpha)

Dividend growth track record

Last but not least, the company has a rock-solid dividend policy with the main goal of offering a growing and sustainable dividend.

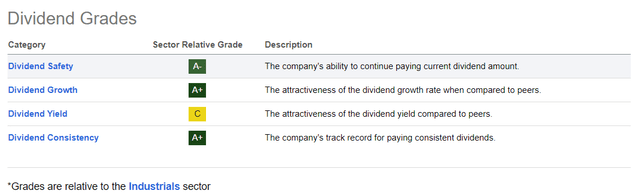

Dividend grades (Seeking Alpha)

Looking at the dividend grades from the Seeking Alpha website all grades are A- or higher, except the dividend yield.

A dividend yield of 1.62% isn’t that high, but this will be compensated with attractive and safe dividend growth.

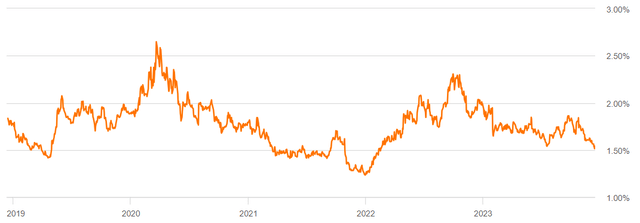

Yield development (Seeking Alpha)

The 10Y compound annual dividend growth rate of 18.16% can be called impressive. I expect the future dividend growth won’t be as high as the 10Y CAGR, but it will be more in line with its 3Y (7.57%) and 5Y CAGR (9.93%). On the 9th of October, the company had announced a 7% dividend increase in the quarterly cash dividend, which is more on the lower side of the spectrum.

In terms of consistency, the company stands out the most. AOS is an undisputed dividend aristocrat and has increased its dividend for 30 years in a row and with a cash dividend payout ratio of 32.84% it is very likely that this streak will continue at a steady pace. Combine this with its promising growth prospects and I think AOS will deliver dividend growth like clockwork and is likely to become a dividend king.

Q3 2023 results

The last quarterly results of AOS were better than expected. The results were also well received by the broader market, since the share price went up significantly (+6%).

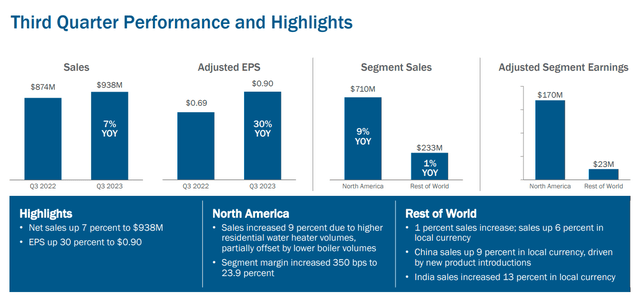

Sales were 7% up and the adjusted EPS went up 30% year-over-year. Especially, the results of the North America segment were strong. The demand for water heaters was resilient and the overall operating margins were also better than expected.

Their new products were well received in China and India, resulting in sales growth of 9% and 17%, respectively.

Performance highlights (Q3 2023 Results)

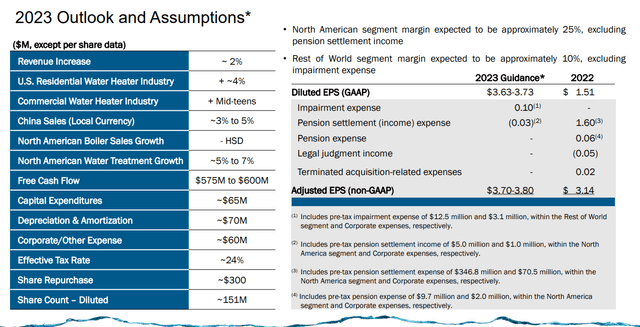

The company also increased their 2023 outlook with an expected adjusted earnings per share of $3.70 to $3.80 per share.

Their North America full-year margin guidance is around 25% based on full-year outlook and their Q4 material costs will be similar to Q3. Also, their Rest of the World margin guidance of approximately 10% remains unchanged. They also narrowed their free cash flow range ($575 million – $600 million vs $ 575 million – $625 million in Q1 2023).

In my opinion, it can be concluded that despite the difficult circumstances, AOS has achieved excellent results.

Valuation

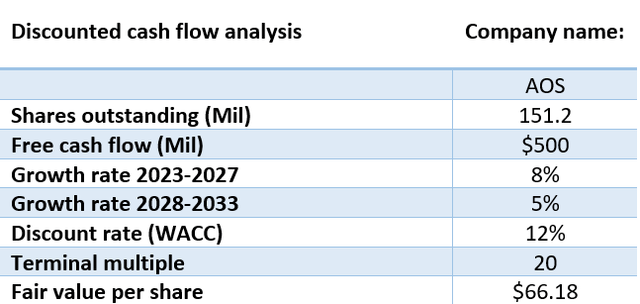

To calculate the intrinsic value of AOS I used discounted cash flow analysis. The expected free cash flow for FY 2023 should be in the $575-$600 million range and it looks like that the company is going to achieve this.

Due to the cyclical nature of the company, a constant growth of free cash flow can’t be expected. So for my calculations, I used a more conservative free cash flow of $500 million.

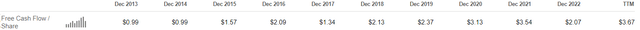

I think a 5Y free cash flow growth assumption of 8% is reasonable and 5% for the 5 years thereafter. Comparing the free cash flow per share of FY 2013 to the FY 2022 numbers we talk about a 10Y CAGR of 7.6%. But if we compare it to the TTM free cash flow per share, which can be seen in the table below, the 10Y CAGR is much higher (13.9%).

FCF per share development (Seeking Alpha)

At the moment AOS has a PE non-GAAP of 21.35, which is still a bit below its 5Y average of 22.04. I used a PE of 20 as a terminal multiple, because AOS is a high-quality business where this relatively high multiple can be justified. Finally, I used a discount rate of 12% as a minimum rate of return.

This comes to a fair value of $66.18 per share. Comparing it to the current share price of $79.20 it is 19.6% overvalued.

Investment risks

Of course, there are also investment risks that need to be considered before investing in AOS.

Firstly, the volatility in raw material costs can hurt the profitability of the company. On the short term, the company itself expects that the material costs of Q4 2023 will be comparable to Q3. If we look at the chart below, it is clearly visible that steel prices have been rising again in recent months. This could hurt their margins; in my view, this will not put the long-term investment thesis in danger.

Steel futures (Trading Economics)

Talking about volatility, AOS share is also more volatile than the market average with a beta of 1.25. Partly due to its cyclical nature and higher beta, severe corrections in share price over the past 10 years are no exception.

With AOS, high volatility downwards can be your friend, as it allows you to pick up shares at a great price. Since timing can be hard, dollar cost averaging would be wise in these situations.

Finally, AOS also has exposure to emerging markets. One of the growth opportunities for the company lies in China. However, the development in revenue in recent years is somewhat disappointing. In addition, the revenue development in the rest of the world segment is flat in a 5Y time frame (FY 2019: $936 million vs FY 2023: $960 million).

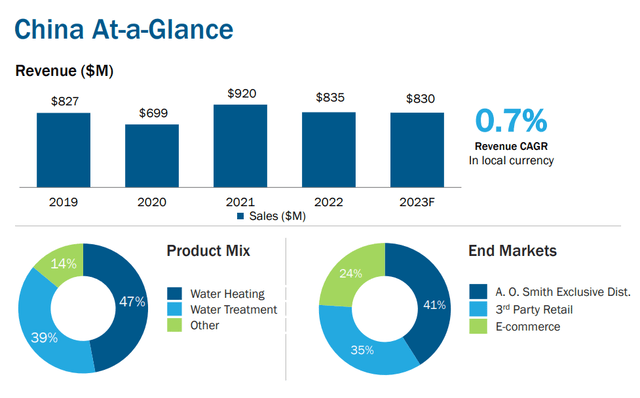

China segment (2023 Investor Day)

In China, AOS has the financial goal of achieving annual revenue growth of 5-6% and margin expansion from 11 to 15% in 5 years. I do think that the objectives are ambitious due to the difficult circumstances in the Chinese real estate sector. This makes it possible that the Chinese population will invest or spend less in their home and could potentially hurt growth in the emerging markets segment.

Conclusion

Without a doubt, AOS is a high-quality dividend growth stock. The company can benefit from various megatrends and possible growth opportunities in China and India, has a top-notch balance sheet and a clear and effective capital allocation strategy. Future returns will consist of a growing dividend, share buybacks, and capital appreciation.

However, the share price of AOS seems to be on the high side. Despite the fact that I think AOS is overvalued I have no intention of selling the shares, but I don’t want to buy them either at these levels.

Don’t expect extreme dividend growth in the coming years given the company’s further investment plans, but if you have enough time on your side the dividend should compound nicely. I expect that AOS will easily be able to increase their dividend by high single digits in the coming decade.

I also think that the combination of the current dividend yield of 1.62% and dividend growth isn’t attractive enough. The fair value of $66.18 per share corresponds to a yield of 1.93%. From the past, a starting yield of approximately 2% seems reasonable and has proven to be an excellent purchasing opportunity.

My personal plan is to closely monitor the developments regarding AOS and if the share price comes close to my calculated fair value I will slowly increase my position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.