Summary:

- I appreciate the steady income growth that Dividend Aristocrats provide for my portfolio.

- A. O. Smith’s net sales and adjusted EPS moved higher in the fourth quarter.

- The company boasts a net cash position on its balance sheet.

- A. O. Smith appears to be slightly overvalued at the current share price.

- The company may outperform the S&P in the next 10 years, but I would like to see a 10% pullback before upgrading back to a buy.

Growing stacks of coins symbolizing the power of compounding. LdF

Since the time I was 12 years old, I took an interest in the stock market. Readers who know me well may already know my story. But for those who are less familiar with me, I was fascinated by the dividend growth investing strategy from the start. The thought of my share of a company’s earnings and my passive income via dividends consistently growing was one with which I immediately fell in love.

That is why when I began investing at age 20 (just over six years ago), I chose dividend growth investing as my predominant strategy. Over that time, I have added numerous Dividend Aristocrats to my portfolio. My thought process is that a company that has upped its dividend as long or longer than I have been alive is probably a darn good business.

After all, such a feat isn’t possible without strong operating results year after year. Now, there are exceptions to my buying Dividend Aristocrats. If fundamentals have deteriorated in recent years, I’m likely not going to be interested in such a Dividend Aristocrat.

One Dividend Aristocrat whose fundamentals I believe remain healthy is the water treatment, water heater, and water boiler company, A. O. Smith (NYSE:AOS). Since I last covered the company in October, shares have rallied 19%. For context, that’s better than the 16% gains that the S&P 500 (SP500) posted during that time.

As I will address in this article, I still very much think A. O. Smith’s fundamentals are encouraging. But the rally in the last four months appears to have overextended shares to the point that I am downgrading the stock from a buy to a hold. With that in mind, let’s dive into a discussion of A. O. Smith’s fundamentals and valuation.

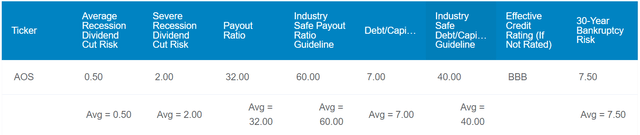

Dividend Kings Zen Research Terminal

At a glance, A. O. Smith’s 1.6% dividend yield doesn’t stand out compared to the 1.4% yield of the S&P 500. However, the company could have plenty of flexibility to keep hiking its dividend for the foreseeable future.

For one, A. O. Smith’s 32% EPS payout ratio is approximately half of the 60% EPS payout ratio that rating agencies prefer from the industry. Secondly, the company’s 7% debt-to-capital ratio is comfortably less than the 40% industry-safe guideline per rating agencies.

A. O. Smith’s debt isn’t rated by credit rating agencies. But if it was rated, Dividend Kings estimates that the company’s favorable payout ratio and debt-to-capital ratio would earn it a BBB rating. That means the probability of A. O. Smith not remaining a going concern in 30 years is 7.5%.

Considering these variables, Dividend Kings also projects that the probability of the company cutting its dividend in the next average recession is just 0.5%. For perspective, that’s the minimum allowed probability. Even in a severe recession, that probability climbs to just 2% – – not materially above the 1% floor set by Dividend Kings.

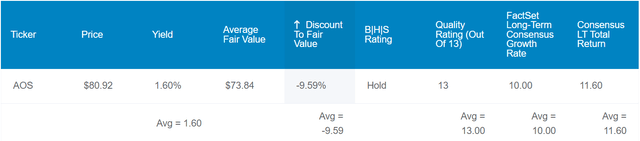

Dividend Kings Zen Research Terminal

A. O. Smith’s valuation is where the company arguably diverges from fundamentals. Factoring in its 10-year and 25-year dividend yields and P/E ratios, shares are worth $74 each. Contrasted to the $78 share price (as of January 30, 2024), this equates to a 6% premium to fair value.

If A. O. Smith can match the growth consensus and revert to its mean valuation, here are the total returns that it could produce over the next 10 years:

- 1.6% yield + 10% FactSet Research annual growth consensus – 0.6% annual valuation multiple downside = 11% annual total return potential or a 184% 10-year cumulative total return versus the 9.8% annual total return potential of the S&P or a 155% 10-year cumulative total return.

A Double Beat To Conclude 2023

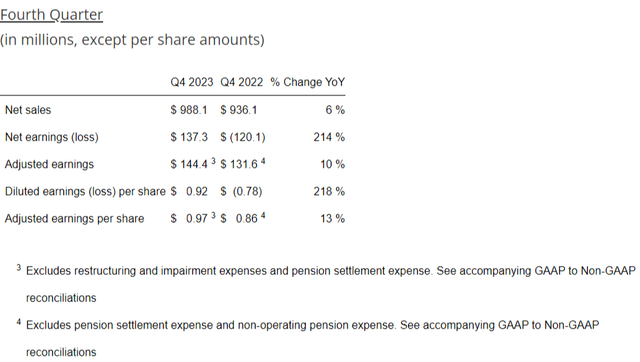

A. O. Smith Q4 2023 Earnings Press Release

A. O. Smith performed well in the fourth quarter that ended December 31. The company posted $988.1 million in net sales during the quarter, which was up 5.6% over the year-ago period. For more color, this came in $2.6 million ahead of the analyst consensus for net sales.

These results were largely driven by momentum in the North America segment. Robust demand for water heater products more than offset unfavorable boiler pricing and volumes. This is what propelled the segment’s net sales higher by 6.6% year-over-year to $738 million for the fourth quarter.

The Rest of World segment was the other contributing factor to A. O. Smith’s healthy topline growth in the fourth quarter. The segment’s net sales grew by 4.2% over the year-ago period to $260.2 million. Newly launched kitchen products in China and double-digit (11%) net sales growth in India were the elements that powered this growth.

I’d also note that net sales don’t perfectly foot because of $10.1 million in inter-segment sales that were subtracted from the company’s results during the quarter.

Moving to the bottom line, A. O. Smith’s adjusted EPS climbed 12.8% year-over-year to $0.97 for the fourth quarter. That was $0.01 better than the analyst consensus for adjusted EPS per Seeking Alpha. Aside from the higher net sales base, A. O. Smith’s non-GAAP net margin expanded by approximately 55 basis points to 14.6% in the quarter. Alongside a lower share count, this is what led adjusted EPS growth to far outpace net sales growth during the quarter.

Looking toward 2024, A. O. Smith anticipates that its momentum will largely continue. The company is guiding for $4.01 billion in midpoint net sales for the year, which would represent 4.1% year-over-year growth. Additionally, A. O. Smith projects that its midpoint adjusted EPS will rise to $4.025. This would be equivalent to a 5.6% growth at the midpoint over the $3.81 adjusted EPS base for 2023.

Given the company’s momentum in closing out 2023, I think this guidance from management is reasonable. Overall, based on data from Seeking Alpha, analysts tend to agree. The analyst consensus is that A. O. Smith will put up $3.99 billion in net sales in 2024 and generate $4.05 in adjusted EPS.

The company also remains financially well. This is evidenced by A. O. Smith’s $236.1 million net cash balance as of December 31 (unless otherwise noted or linked, all details were sourced from A. O. Smith’s Q4 2023 Earnings Press Release).

Ample Free Cash Flow To Support Dividend Growth And Share Repurchases

Hiking its quarterly dividend per share cumulatively by 45.5% in the past five years to the current rate of $0.32, A. O. Smith has been a decent dividend grower. I wouldn’t be surprised if similar growth materialized in the years to come.

That is because the company generated $597.7 million in free cash flow in 2023. Against the $183.5 million in dividends paid during the year, that is a 30.7% free cash flow payout ratio (info also according to A. O. Smith’s Q4 2023 Earnings Press Release). Such a modest payout ratio should allow A. O. Smith to grow the dividend at a high- single-digit rate annually, improve its financial position further, and repurchase shares.

Risks To Consider

A. O. Smith is a quality business, but there are still risks associated with the company.

As I alluded to in my previous article, one of the more significant risks to the company is its concentration within China. In 2022, 22% of A. O. Smith’s net sales and 5,200 of 12,000 employees were based in the country (page 9 of 81 of A. O. Smith’s 10-K Filing). If geopolitical tensions were to worsen between the U.S. and China, that could negatively impact A. O. Smith, just as it did in 2019, when adjusted EPS dipped by 15% per FAST Graphs.

Speaking on the subject of concentration risk, roughly 39% of the company’s net sales in 2022 were to just five customers (also page 9 of 81 of A. O. Smith’s 10-K Filing). If any of these customers experienced financial difficulties, that could hurt A. O. Smith’s financial results.

Finally, the company could be vulnerable to product liability litigation. If A. O. Smith was found liable in major lawsuits and current insurance coverage proved to be inadequate, that could eat away at the net cash balance on the balance sheet.

Summary: Waiting For $70 To Upgrade

A. O. Smith is a business that I would like to own more of in the future. But right now, I just don’t view the valuation as compelling enough to add here. In my view, I believe fundamentals are about as strong as they have been throughout their history. This is why I firmly believe that mid-$70s is fair value for this business.

Because I also like to build a margin of safety into my purchases, I would think about buying more A. O. Smith around $70 or below. That’s because I believe such a combination of starting yield, growth potential, and multiple expansion would lead to a high probability of the 10%+ annual total returns that I target as an investor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.