Summary:

- A.O. Smith Corporation’s stock has returned about 20.5% in the past six months, matching the S&P 500’s return.

- The author believes that 10 Year Treasury Notes offer superior risk-adjusted returns compared to investing in A.O. Smith’s stock.

- The author suggests that the stock would need to drop to $42 per share for its cash flows to match those of the Treasury Note.

Serg_Velusceac/iStock via Getty Images

It’s been over six months since I published my latest article on A.O. Smith Corporation (NYSE:AOS), and in that article, I suggested that Treasuries were more attractive than the stock. Since then, shares have returned about 20.5%, pretty much matching the return of the S&P 500 over the same time period. The yield on the 10 Year Note has dropped 23 basis points since the article was published. Today I want to return to the stock to see if it makes sense to buy at current prices, to see if the enterprise is 20% better than it was half a year ago. I’ll make that determination by looking at the latest financials, the valuation, and by comparing this investment to alternatives available.

Welcome to the “thesis statement” portion of the article. This is where I give you the “gist” of my thinking in a summary paragraph that is “punchy” and relatively quick to read. I do this because I understand wading through an entire one of my articles can be “a bit much.” I like A.O. Smith a great deal. I think the business is doing very well, and I think the dividend is very well covered. The problem, from my perspective, is that in the domain of investing, everything is relative. As investors, we are constantly searching for the best risk adjusted returns, and I think 10 Year Treasury Notes offer a superior combination of risk and return at the moment. For instance, in order for an investor to receive the same cash flows as the Treasury Note holder, the dividend will have to grow at a CAGR north of 22% over the next decade. This compares to the ___ that it actually grew over the past decade. Additionally, I think there’s going to be a rise in the price of the Treasury Note over the next decade as interest rates inevitably drop from current levels. Given all of this, the quality of A.O. Smith as a franchise is less relevant than the fact that an investor can earn superior risk adjusted returns from a Treasury Note. I like this dividend aristocrat a very great deal, but I like earning superior risk adjusted returns even more, and for that reason, I’m going to eschew this stock unless and until it drops to about $42 per share. At that price, holding all else equal, I’ll at least receive as much cash from this investment as I would from a Treasury Note. One of the readers can, and likely will, complain that my continued reticence has cost me a nice capital gain. To that rhetorically convenient critic I would impolitely suggest that what the market can giveth, the market can very quickly taketh awayeth.

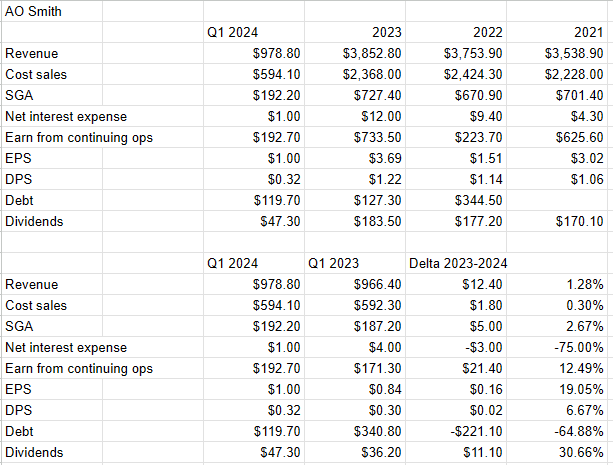

Financial Snapshot

The most recent quarter has been reasonably good in my view, with revenue and net income up by 1.3% and 12.5% respectively. Earnings per share is up an even more impressive 19% as a result of recent buyback activity. I’m particularly pleased to see that debt is about 65% lower in the most recent quarter than it was the same time last year.

Dividend Sustainability

I’m as much of a fan of accrual accounting as the next semi sane person, but when it comes to dividends and their sustainability, I like to focus on cash. In particular, I want to compare the current and likely future sources of cash to the schedule of contractual obligations that a firm has, as well as the investments that must be made in the business. The greater the delta between the level of cash, and the future uses of cash, the more comfortable I am.

As of the most recent filing, the company has about $363.4 million cash on the balance sheet. Additionally, over the past three years, they’ve earned about $567 million in cash from operations and spent about $73 million on average on the business. Please note that these figures are net of the effects of divestitures and other one time items. So, I’m assuming that the company has the capacity to generate a net positive $494 million in cash annually.

In terms of contractual obligations, the company is “on the hook” (as the young kids say) for $68 million in 2025 and 2026, $59 million in 2027-28, and just under $20 million the year after that.

Given that the company spends about $185 million on dividends annually, this is a rather healthy buffer in my view. Thus, I consider this to be an exceedingly well covered dividend. I’d be happy to buy back in at the right price.

A.O. Smith Financials (A.O. Smith investor relations)

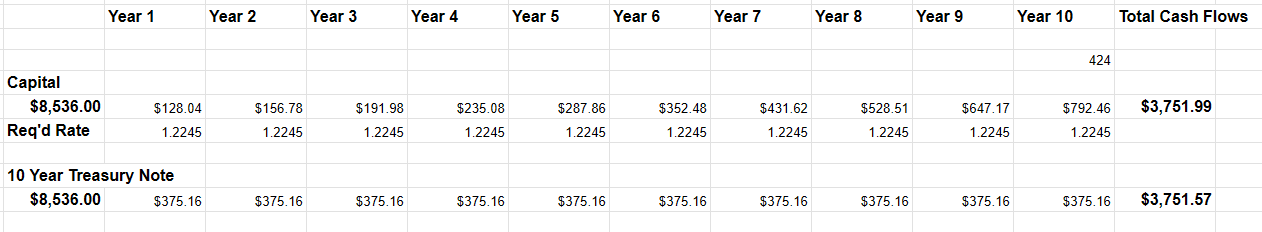

The Stock v The Treasury Note

In my view, investors aren’t seeking “returns”, they’re seeking “risk-adjusted returns.” Given that, I think it reasonable to judge every investment against the least risky investments available to them to see if investors are being adequately compensated for taking on the risk of owning stock in a market that one could argue is, uh, “richly priced.” In aid of this effort, I’m going to compare the dividend an investor receives from A.O. Smith to the cash flows they can receive in Treasuries. Note that the yield on Treasuries is sitting around 4.4% at the moment.

I think it reasonable to assume that AO Smith will continue to grow its dividend from here. That’s not the issue for me. My issue, as I often repeat, is the idea that everything in the domain of investing is relative, and that investors should always seek the highest risk-adjusted return available to them. To that end, I want to answer two questions here. The first, “by what amount will AO Smith need to grow its dividend to match the cash flows earned on the 10-Year Treasury Note over the next decade?” The second, “if we assume that the dividend grows at the same rate over the next decade than it has over the previous decade (i.e. CAGR of 7.9%), at what price does these shares match the cash flows of the Treasury Note?”

The answer to the first question is 22.45%. To simply match the cash flows received by the Treasury Note holder, the dividend will need to grow at a CAGR of 22.45% over the next decade. That is, as the young kids say, a “spicy meatball.”

To the second question, if we assume that the past decade of dividend growth matches the past decade of dividend growth, the stock would need to fall to about $42 for the cash flows from the dividend to match the cash flows from the Treasury. In other words, a person buying this stock at $42 today would earn the same cash flows as the Treasury Holder over the next decade, assuming dividend growth continues apace. That is troublesome in my view.

Given that I’m a relativist (where investing is concerned, anyway), I think it makes more sense to buy the 10-Year Treasury Note than to buy this stock. This view is based on the idea that the investor in the risk-free instrument ends up receiving much more cash than does the investor in the riskier stock. That makes no sense to me. Additionally, for those who clutch their pearls and say that there’s no upside in Treasury Notes at the moment, I would counter that rates will likely come down over the next decade, and such a move will create a decent capital gain in Treasury Notes.

A.O. Smith Stock v Treasuries (Author calculations)

Conclusion

I think this is a wonderful business, and I think there’s very little risk of the dividend being cut. I think it reasonable to assume that the dividend can keep growing at the same 7.9% clip, for the next few years at least. That’s not my problem with this investment. My problem with this investment is that it would be made in the context of a world where I can earn much more cash in a much more risk-free manner. I value sleep much more than I value “potential further upside”, and predictability enables sleep much more than does the many unknowns associated with investing in a stock. For that reason, I’m going to continue to eschew the shares and will buy more Treasuries. For those who need reminding, what the market giveth, the market can very quickly taketh awayeth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.