Summary:

- A. O. Smith Corporation’s shares have returned a negative 2.5% since the previous article was published.

- The company’s financials show improvements in revenue, gross profit, and net income, as well as a cleaner capital structure.

- Despite these positive factors, the relative valuation of the stock and the low dividend yield make it a less attractive investment compared to other alternatives.

champc

It’s been a little over 3 months since I suggested that there is an alternative to buying A. O. Smith Corporation (NYSE:AOS) in an article with the monumentally original title “A. O. Smith: There is an Alternative.” Since then, the shares have returned a negative 2.5% against a loss of about 3.5% for the S&P 500. The company has announced earnings yet again, so I thought I’d review the name once more to see if it makes sense to buy or not. I’ll make this determination by looking at the latest financials to try to glean some clues about the financial robustness of the firm, and I’ll compare those to the current valuation. Additionally, since I think everything in investing is relative, I want to compare these shares to much less risky alternatives.

I know my writing can be tiresome for many of my readers, which is one more reason why I’m surprised that there are so many of you. My stupefaction aside, I like to give my readers the opportunity to get into my articles and quickly get the gist of my thinking before they’re exposed to too much “Doyle mojo” and proper spelling. This gives them the opportunity to flee before things get “too much.” You’re welcome. I think this is a fine business, and I think the dividend is very well covered. I particularly like the improvements we’ve seen in the capital structure over the past year. What I don’t like is the relative valuation. I’ve written it, spoken it, shouted it many times, and will likely continue on my crusade: investors don’t seek “returns.” Investors seek “risk adjusted” returns. Given that as background, buying this stock makes little sense to me in light of the alternatives available to investors. Put another way, if an investor can deploy their capital in a perfectly predictable, risk-free manner, why would they buy this stock with its paltry dividend yield? Too much hope is placed on capital gains coming to the rescue, and I don’t think that makes sense given that valuations aren’t particularly compelling. For that reason, I’m going to continue to eschew these shares in favor of less risky alternatives.

Financial Snapshot

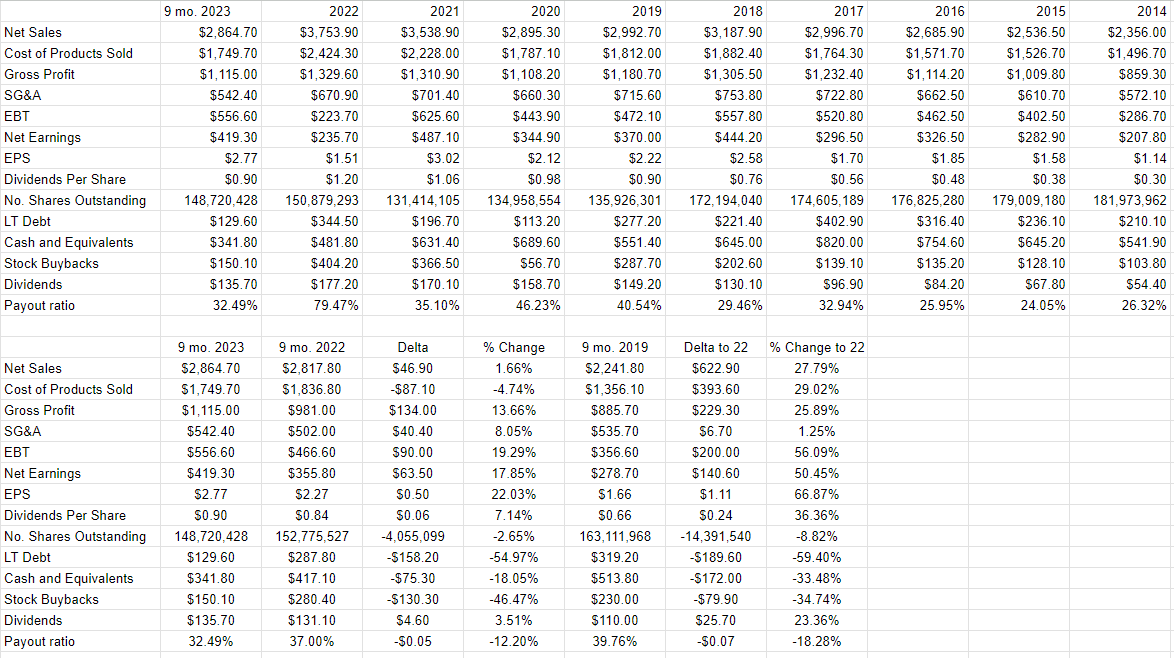

In my previous article on the name, I suggested that 2023 has so far been quite good for the firm, and nothing’s happened in the meantime to change my mind on this. Although revenue during the first nine months of 2023 was higher by only 1.7% relative to the same period in 2022, gross profit and net income were higher by 13.7%, and 17.9% respectively. This is obviously the result of the company’s heroic efforts at cost control, which sets it apart from so many others lately.

Additionally, the capital structure is much cleaner now than it was this time last year, with long-term debt down by about $158.2 million, and cash down by only about $75 million compared to 2022. That obviously reduces the risk and makes the dividend more secure in my view. This is yet another reason why this business is a rarity at the moment, as so many other corporations are virtually choking on debt. Given the drop in payout ratio from 37% to about 32.5%, the dividend is even more secure in my view. All of the above leads me to conclude that I’d be very happy to buy this stock at the right price.

A. O. Smith Financials (A. O. Smith investor relations)

The Stock

If you subject yourself to my stuff on a regular basis, you know that I like to buy shares when they are as cheap as possible. This is for the very simple reason that cheaper shares possess a great combination of lower risk and higher return potential. They’re lower risk because any bad news is already “priced in.” This means that if a stock that the market is pessimistic about issues some new bit of bad news, no one pays much attention as the company has simply met expectations. In this case, the shares don’t drop too much in price. If, on the other hand, the heretofore “dog” offers the good news that beats expectations in a positive way, here’s what I call a “prodigal son” effect, which often drives the shares higher. I like “lower risk, higher return” potentials, so I want to buy shares when they’re cheap.

My regulars also know that I measure “cheap” in a few ways ranging from the simple to the more complex. On the simple side, I look at ratios, and I like to see a stock trading at a discount to both its own history and the overall market.

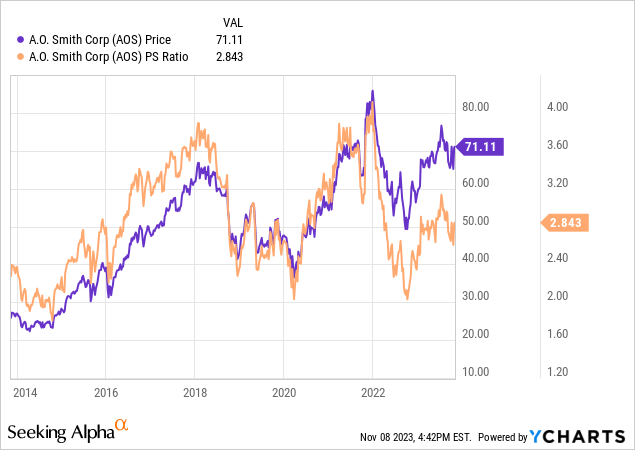

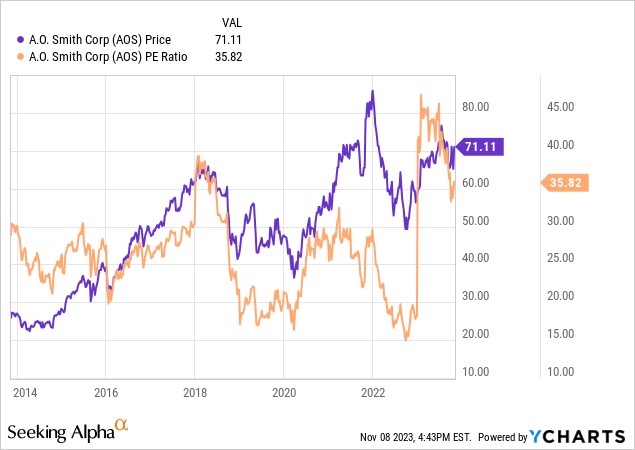

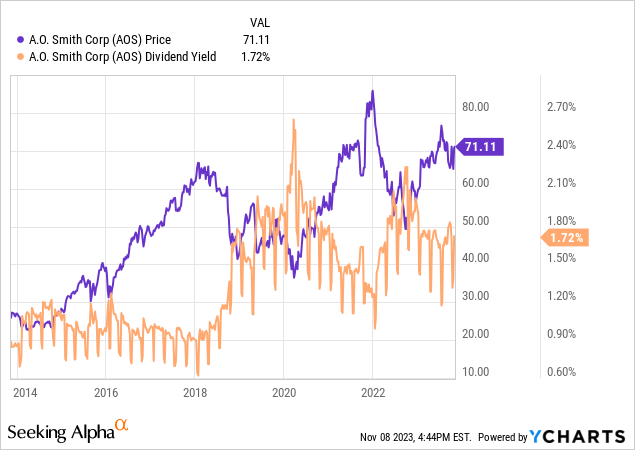

In case you don’t happen to have your “Almanac of Doyle’s Trades” handy, I balked at this stock a few months back when it was trading at a PS ratio of over 3 times, and the market was offering a PE of 47.6 times. Additionally, I didn’t love the fact that the dividend yield was hovering around 1.2% when the 10-Year Treasury Note was yielding about 3.9%. Fast forward to the present, and here’s the lay of the land.

The shares are between 7.5% and 24% cheaper, and the dividend yield has climbed by about 42%, so things are looking relatively better than they were. That written, we should note that the spread between the dividend yield and the risk-free rate has blown out to a pretty hefty 278 basis points. That means investors are receiving a large, negative risk premium for investing in this stock at the moment.

Everything’s Relative

In the domain of investing, I’m of the view that everything’s relative. When we buy “X”, we are, by definition, eschewing any number of “Y’s.” Additionally, when I decide to buy a stock that I once avoided, I’m picking between relative valuations of the same asset through time. In my view, the heart of this relativistic process involves picking the highest risk-adjusted returns among a series of alternatives available to us. So, “stock X” may be a terrible investment at the current price, but the same stock may be a wonderful investment at a much lower price, for instance. I am also of the view that all of this must be judged against the backdrop of the risk-free rate.

If an investor can receive a risk-free 4.5% return from Treasury Notes, the future of which is perfectly predictable, they should, in my view, be compensated for taking on the risks associated with every stock. The fundamental reason for this is obviously that stock returns are much more unpredictable, and the market gods are quite capricious. I think it’s also wise to remind ourselves that the dustbin of market history is filled with a great many “can’t miss”, high flyer stocks. Given all of this, I insist on a positive risk premium for investing in a stock.

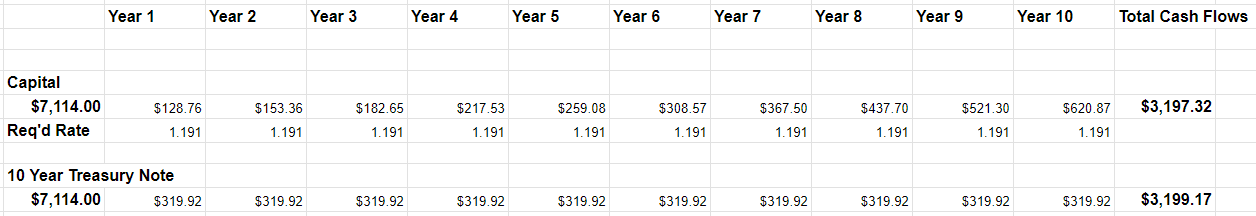

At the moment, A. O. Smith investors are receiving a negative risk premium, which I think makes no sense. Being the math nerd that I am, I like to quantify things as much as possible, so I’m going to ask the question “at what rate will dividends need to grow from their current level for shareholders of this company to earn the same cash flows as will Treasury Noteholders?” Using the math skills not so lovingly beaten into me by the good sisters at Holy Spirit School decades ago, I’ve answered that question, and offer the results below for your enjoyment and edification, in a table that I hope is simultaneously “handy” and “dandy.”

A. O. Smith v Treasury Note (author calculations)

So, in order for stockholders to receive the same cash flows as Treasury holders, the dividend would need to grow over the next decade at a CAGR of about 19.1%. That’s a “heavy lift”, as the young people say, given that over the past decade it’s grown at a (still extraordinary) rate of about 6%. So, simply to match the risk-free rate, investors are betting on continued capital gains here. That may happen, but it may be challenging given current valuations. This miasma of uncertainty drives me to continue to balk, and so I’ll stick with the fully known.

Once again, we’re not hunting “returns.” We’re hunting “risk-adjusted” returns. In my view, the risks present here are too great for the potential returns, and I think there are much better risk-adjusted returns to be had. For that reason, I’m going to continue to eschew A. O. Smith, and would recommend others do the same.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.