Summary:

- A. O. Smith is the leading manufacturer of Water Heaters in the US.

- The company has a disciplined capital allocation and invests for the long term.

- The founding family owns the majority of the votes.

- Even though growth is just modest, the valuation suggests that the stock is still at a fair price.

demaerre/iStock via Getty Images

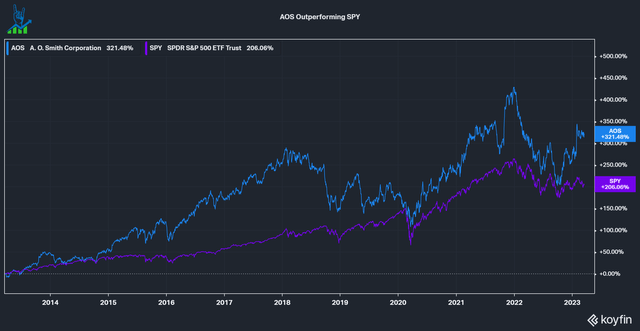

Water is the essence of life and an essential topic in the move towards a more sustainable society. A. O. Smith (NYSE:AOS) has a rich tradition of servicing the water heater, boiler and treatment industry for residential and commercial users. Over the last decade, the stock significantly outperformed the S&P 500 with a total return of over 320%. Let’s see if we can expect a similar outperformance as we advance.

AOS Outperforming SPY (Koyfin)

Riding the megatrend wave

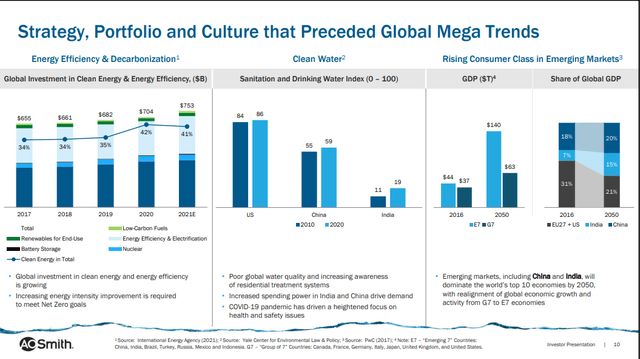

AOS is strategically positioned to benefit from several global megatrends. The world is desperately trying to reduce its energy consumption where possible. Energy-efficient products are subsidized and sometimes even required by many governments. A great example is the HVAC industry, where 2023 introduced a new SEER standard (newly sold units need an increasing energy efficiency); you can read more in my Watsco (WSO) article. AOS benefits from similar tailwinds; water boilers and heaters consume much energy, so any improvement makes a significant impact. This can also be observed in the investments going toward energy-efficient products. Another trend is Water quality, a global problem, especially in emerging markets. Although this is a smaller segment (8%) for AOS, it is growing well.

Global Mega Trends (AOS Investor Presentation)

Attractive replacement dynamics

The U.S. Water Heater market is similar to the HVAC industry: Many installed base units need replacement with just ~10% of new construction each year. This means that most of AOS’ core business is recurring (heaters eventually break down and need repairs). A significant difference to the HVAC industry is the amount of consolidation that already has taken place: While Watsco has a high single digits market share as the leader in the HVAC industry, the Water Heater market is much more consolidated with AOS and privately held Rheem Manufacturing and Bradford White making up around 90% of the industry. I prefer fragmented markets and at least AOS’ core market is very consolidated.

Management incentives

AOS is a company with a long tradition and is still controlled by the Smith family. It has two share classes: Class A has higher voting rights and the Smith Family Voting Trust owns 96% of these shares. The fund also owns 27% of the total shares outstanding.

Executives in the company receive short-term and long-term compensation packages, where short-term incentives are tied to EBIT growth (80%) and sales growth (20%). This is a significant change from ROE and performance objectives, as it was in 2021.

The long-term compensation is tied to the stock’s performance together with a multiplier based on the ROIC the company generates. The minimum threshold is 100% of the cost of capital, with the target being close to 400% cost of capital. I like these incentives; it is a good mix of profitable growth (short-term incentives based on growth) and efficiency (long-term incentives based on ROIC). Furthermore, we have significant skin in the game by the founding family.

Disciplined capital allocation

AOS is a highly profitable company with an EBIT margin of around 17% and generates a lot of cash, so we have to look at its capital allocation. The company invests in organic growth via CapEx and R&D, between 2-3% of revenue in recent years. Acquisitions also play an essential role, which we’ll look at in more detail later.

Excess capital is returned to shareholders via a growing dividend with a 25-year history, making AOS a dividend aristocrat. Over the last five years, it increased by 17.2% on average but saw a deceleration to 7% growth in October. On top of that, AOS buys back a lot of shares. Over the last decade, shares outstanding declined 18.5% with an investment of $1.92 billion into buybacks and $108 million of stock-based compensation. Comparing it with the current market cap of $10 billion, we can see that the buybacks were decent.

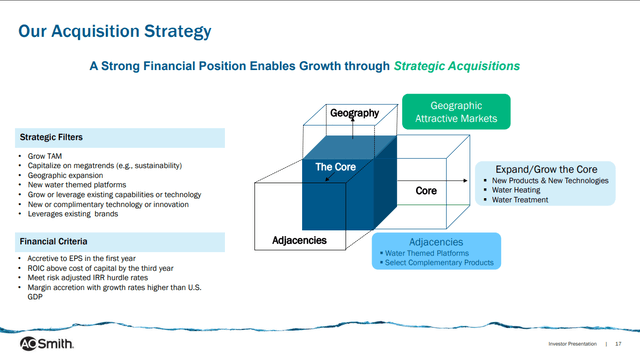

AOS has an insightful visualization for its acquisition strategy. Acquisitions can be made for three strategic reasons:

- Geographic: Entry or expansion into attractive markets.

- Core: Expanding the Core business with new products & technologies.

- Adjacencies: Enter new water-themed industries or complementary products

Fortunately, they also provide us with Financial Criteria:

- Accretive to EPS in the first year

- ROIC above the cost of capital by the third year

- Meet risk-adjusted IRR hurdle rates

- Margin accretion with growth above U.S. GDP

These criteria ensure that acquisitions have a minimal risk of destroying value if executed well. Too many companies do not set concrete Financial Criteria like this, which is a big reason why most acquisitions destroy value. While AOS isn’t a serial acquirer, they make deals occasionally and spent $460 million in the last decade on M&A.

M&A Criteria (AOS Investor Presentation)

A reasonable price to pay

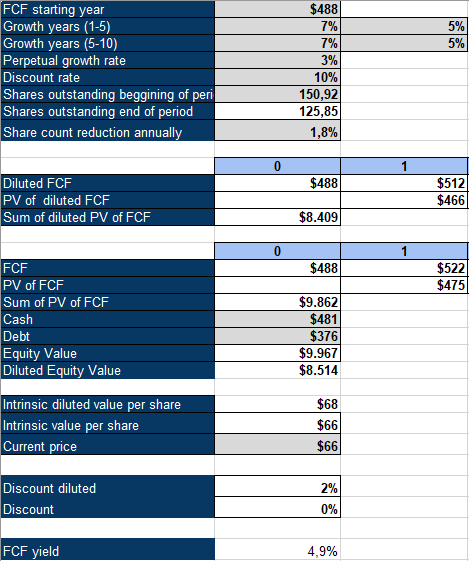

To value AOS, let’s do an inverse DCF. Due to a $417 million pension settlement expense, earnings for the company are severely compressed for F.Y. 22. AOS has a track record of achieving >100% net income/Free cash flow conversion, so I’ll use adjusted earnings at a 100% conversion rate as an approximation for FCF. This leaves us with $488 million in FCF for the model. I also assumed a 1.8% annual buyback yield, in line with the last decade. Using these assumptions, we get to growth expectations of 5%, factoring in buybacks and 7% without factoring them in. This is below analyst expectations for the following years and around the average sales growth of the company over the last decade (6.9%). To conclude, AOS is a well-run family business in an industry with tailwinds and modest growth expectations baked into the stock. I consider A. O. Smith a buy for the long term, while the short-term could always be bumpy. In case of a recession, it could suffer due to a housing slowdown where customers delay replacement and the number of new construction should decline.

AOS Inverse DCF (Authors Model)

Disclosure: I/we have a beneficial long position in the shares of WSO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice.