Summary:

- A.O. Smith has a market cap of more than $10 billion and an annual CAGR of more than 18% since 2010.

- The Company is a Dividend Aristocrat and Champion, but the dividend growth has slowed in recent years.

- My current valuation suggests AOS is trading for a slightly premium, and thus, investors may need to wait for decent pullback before adding to or initiating a position.

Monty Rakusen

Company Description

A.O. Smith Corporation (NYSE:AOS) designs, manufactures and sells gas and electric water heaters, pumps and filtration products for residential and commercial clients. The company reports revenues for two segments, North America and the Rest of the World, which mainly consists of China, but also includes some other countries. The company employs approximately 12,000 people and sports a current market cap of about $10.5B. Since 2010 the company has a total return of more than 1,100%, resulting in a compound annual growth rate of more than 18%.

Quality

In my opinion, there are three quantitative characteristics all high-quality businesses should possess. They are an increasing revenue stream, and stable gross profit margin and a healthy return on invested capital.

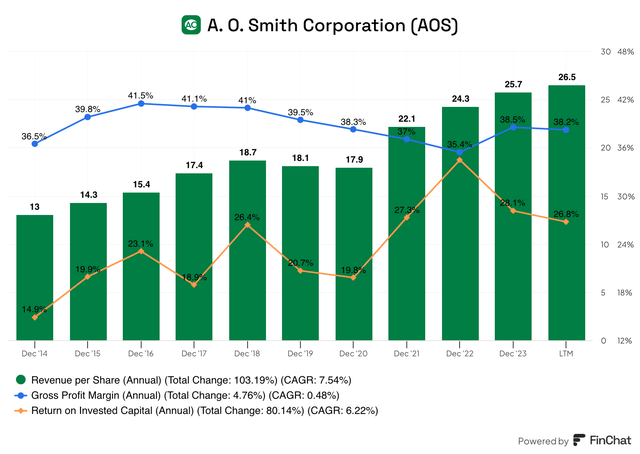

The revenue per share figure has grown at a modest 7.5% over the past decade. This metric was increasing steadily before a slight drop in 2019 and another small blip in 2020, thanks to the pandemic. Following the height of the pandemic the company recovered nicely in 2021 and has grown their revenue per share every year since.

A.O. Smith’s gross profit margin has fluctuated only a few percentage points over the past decade, in both directions. AOS was able to expand this metric at a healthy rate from 2014 to 2016, before dipping a little each year up to and including 2022. Last year the GPM rebounded nicely to 38.5% and this year it appears to be in-line with 2023, barring some drastic shift in Q4.

The company’s return on invested capital began the past decade near 15%. In FY 2015 and 2016, this metric climbed approximately 33% and 15%, respectively. The ROIC slipped briefly in FY17 before rising again in 2018 to more than 26%. The pandemic caused another decrease in 2019 and 2020 but the company was still able to maintain a nearly 20% ROIC in both years. Since then this metric surged in 2021 by 38% and by 30% in 2022 ending at more than 35%. In the most recent FY the company was able to achieve a robust 28% ROIC, well above my target of 20%.

Clearly, these metrics are quite impressive with company’s revenue rising at a decent rate for a relatively mature company, the gross profit margin has channeled some but remains around 40% and the return on invested capital has been trending upward for an extended period time. Personally, I believe A.O. Smith is a very high-quality business and worthy of consideration from any dividend investor.

FinChat.io

Dividend

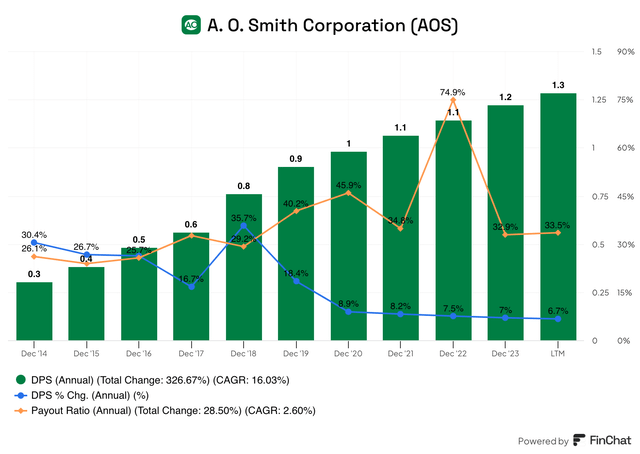

A.O. Smith is part of the S&P 500 index and has raised its dividend for more than 25 years (32 to be exact), making it a dividend aristocrat and dividend champion. In early October the company raised its dividend 6.3% which was slightly below its 3 and 5-year dividend growth rates which both sit above 7%, and well below its 10-year DGR which is more than 16%. The dividend growth has clearly slowed, as indicated by the below line on the chart below, with the company not raising its dividend more than 9% since 2019. Additionally, the payout ratio has been trending upwards but is still at a safe level to allow for future dividend growth. Hopefully, the company will reward shareholders with dividend increase north of 10% in the coming years.

FinChat.io

Q3 Earnings & Looking Ahead Full-Year 2024

AOS released 2024 Q3 earnings in mid-October with Non-GAAP earnings per share of $0.82 which was in-line with analyst expectations, on revenue of $903M which missed estimates by more than $50M and was a 3.7% decrease from the same time period a year ago.

The North America segment of the business saw revenue of $703M, which was a slight decline from Q3 2023 as a result of lower residential and commercial water heater volumes. Furthermore, segment earnings for the quarter were $162.5M, giving this portion of the business a margin of 23.1%, down 80 bps from 2023.

Revenue for the Rest of World part of the business was $210.3M, which was quite poor when compared to the prior year when sales were $233.4M, a 10% drop. The main drivers here were lower sales in China, offset by a modest increase in sales in India. The margin for this segment was a weak 6.5% compared to 9.9% in 2023, which occurred again because of lower volumes.

In addition to the release of Q3 numbers, full-year 2024 projections were provided by management. Revenue is expected to be in the range of $3.8 to $3.9 billion, comparing that range to 2023 actual revenue of $3.85B, management essentially expects flat sales, with the possibility for a minor increase or decrease. Additionally, diluted EPS is expected in the range of $3.70 to $3.85, which would result in either being flat or increasing about 3%.

The CEO, Kevin Wheeler, explained in the earnings release, “Because we expect consumer demand to remain challenged in China through the end of the year and we are cautious about N.A. residential and commercial water heater end-market demand, we announced on October 11, and reaffirm today, that we lowered our sales outlook for 2024 to be approximately flat to last year.”

The full earnings call be read/listened to here.

Valuation

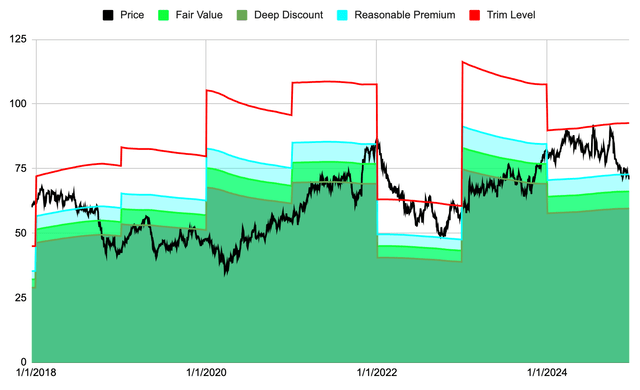

The final piece of this puzzle is to determine if AOS is a good investment at its current level, and to do so, we’ll look at it from a free cash flow perspective.

Created by Author

The valuation model points to A.O. Smith trading for a small premium to its fair value, about 7% above. The free cash flow was initially trending higher for the period of 2018 through 2021. In 2022, there was a more than 40% drop in FCF, but this metric rebounded nicely in 2023, nearly doubling from $2.07 per share to just shy of $4/share. Since the release of its Q3 earnings, the stock has struggled, down about 10%, and the valuation model shows the stock has potentially been overvalued for most of the year, the market may finally be catching up to the value of AOS.

The valuation model rates A.O. Smith as a HOLD; however, it’s worth taking into account the weak demand mentioned during their Q3 earnings release, I believe this is something investors should monitor to see when/if it picks back up.

Lastly, the long-term expected rate of return for A.O. Smith is currently 10.56%, slightly above my target of 10%. This estimate is comprised of a 1.92% dividend yield, -1.36% return to fair value factor and an estimated 10% earnings growth rate. While I believe the potential is there for AOS to provide investors with good returns given their financial metrics and the health of their dividend, the concerns regarding product demand, coupled with a slightly unfavorable valuation, lead me to believe I should wait for a better entry point in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.