Summary:

- A. O. Smith Corporation’s shares have returned 24% in the past seven months, outperforming the S&P 500.

- The company’s financial results show a decline in revenue for the first six months of the year, raising concerns about slowing growth.

- The stock is trading at high valuations and the dividend yield has collapsed, making it unattractive compared to risk-free government bonds.

onurdongel

It’s been just under seven months since I turned neutral on A. O. Smith Corporation (NYSE:AOS), and in that time, the shares have returned about 24% against a gain of 19.5% for the S&P 500. I neither added to, nor did I sell my position earlier, and it’s time to review the business once again to see if it makes sense to add, sell, or continue to maintain my position size. I’ll make that determination by looking at the most recent financial results, announced this morning, and the current valuation. It seems that after an initial rush of enthusiasm, the shares have dropped in value, so it seems that the capricious market decided that it liked what it saw, and then reversed itself after “thinking” about it for 45 minutes.

I put a “thesis statement” at the beginning of each of my articles because I want to try to save my very busy readers some time. You’re welcome. I’m of the view that an investor just coming to this investment should avoid this stock at the moment for a few reasons. First, although I’m happy with the financial results, there’s a risk that growth is slowing, as evidenced by the fact that revenue for the first six months of the current year is actually down compared to the same period a year ago. In spite of this, the shares are trading at either moderately high valuations, or are downright expensive. In my view, the game of investing involves choosing the investment that will offer the best risk-adjusted return. At a time when an investor can earn an extra 270 basis points in a risk-free government note, they would be wise to put capital to work there instead. If rates remain elevated, the investor will earn a decent, predictable return over the next decade. If rates fall from here, the investor will earn that nice predictable return along with a nice capital gain. Thankfully, there very much is an alternative to stocks. Given that, why would you risk capital here?

Financial Snapshot

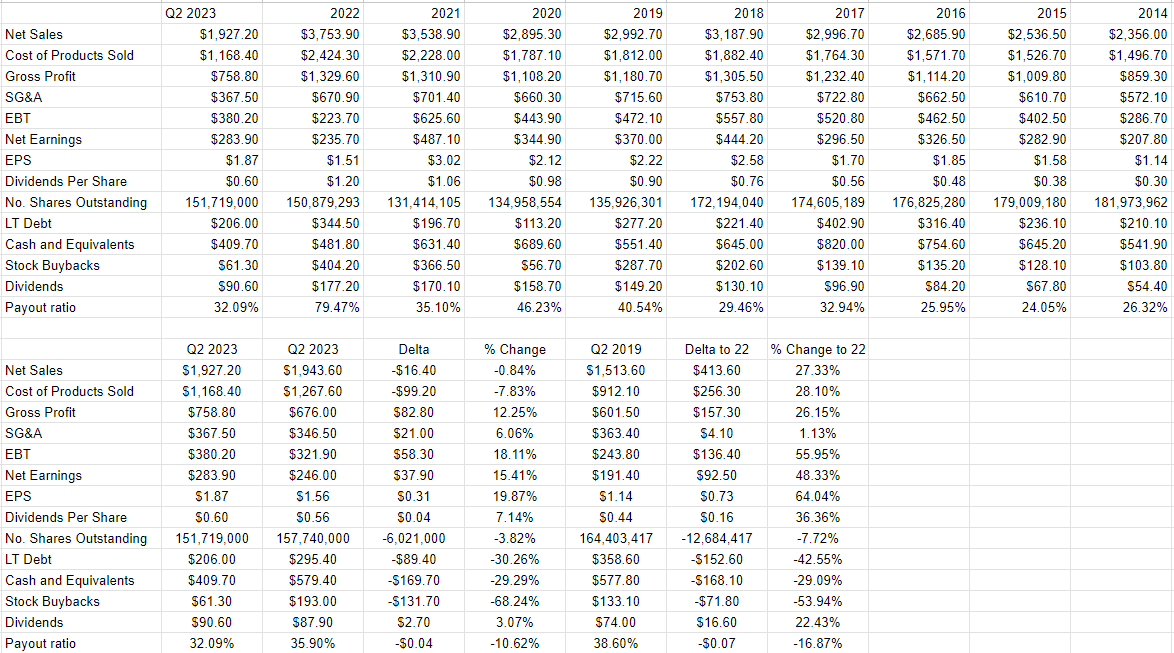

The following financial results are hot off the virtual presses this morning, as the company has just announced results that I consider to be fairly good. Although the top line was down relative to the same time last year by about 0.8%, net income rose by $37.9 million, or 15.4%. Now, this result was goosed by $13 million of “other income”, but I don’t think we could deny that the results were quite good. Additionally, the capital structure has cleaned up pretty significantly, with long-term debt down by about $89 million, or 30%. I like the fact that the company has de-risked massively over the past four quarters a great deal.

When we compare the latest results to the same period in 2019, things look even better. Relative to the same period in 2019, revenue, gross profit, and net income are up by 27.3%, 26%, and 48% respectively. The company continues to impress. I was happy with the financial results previously, and nothing’s changed to alter my view. This is a wonderful business, and I’d be happy to buy more at the right price.

A. O. Smith Financials (A. O. Smith investor relations)

The Stock

I’ve written it before, and I’m absolutely certain that I’ll write it again. I may risk boring my readers, but if it isn’t obvious to you by now, that’s very obviously a risk I’m willing to take. The more you pay for $1 of future gains, the lower will be your subsequent returns. This is why I try my best to buy shares when they are cheaply priced.

In case you’re still of the view that “we don’t buy stocks, we buy businesses”, then please consider the following idea. An investor who bought these shares about eight days ago is down about 3% this morning. An investor who bought virtually identical shares 21 days ago is up about 5% as of this morning. Given that earnings were just released this morning, a very strong argument could be made to suggest that these two investors acted with identical knowledge. The 8% variance in returns in such a short period of time comes down to the price paid for the shares. The person who bought more cheaply did better.

With that sermonizing out of the way, I should point out that I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I like to look at ratios of price to some measure of economic value, like earnings, free cash, book value, and the like. I like to see shares trading at a discount to both their own history and the overall market.

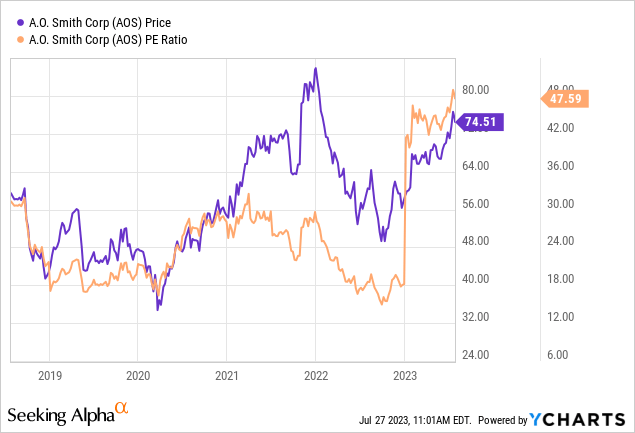

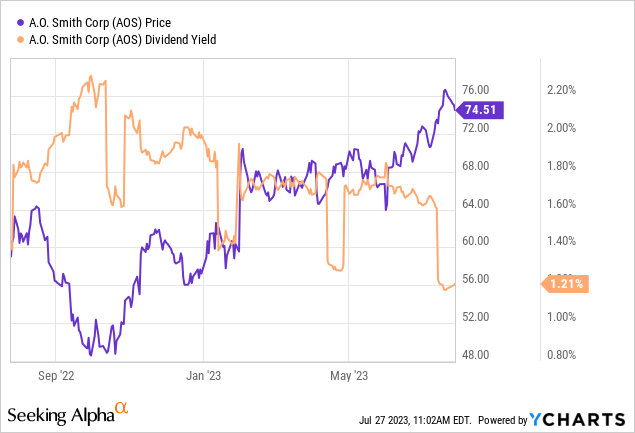

When I last revisited this name, I was neither excited nor disappointed by the valuation of these shares, given that they were trading at a PE of about 18.7 times, and the dividend yield was sitting around 1.93%. Please note that at the time, the 10-year Treasury Note was yielding about 3.7%.

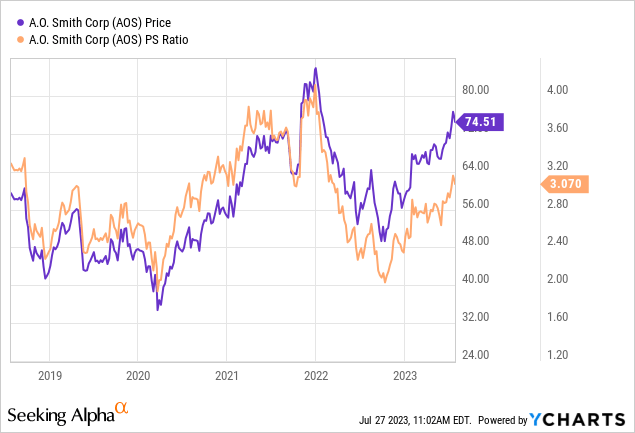

Fast-forward to the present, and the 10-year Note has drifted about 20 basis points higher, while the dividend yield has collapsed by about 36%. Additionally, PE is now well over twice what it was previously. By that measure, the shares are trading at a multi-year-high. Finally, the price to sales ratio isn’t the highest it’s ever been, but it’s certainly not cheap. So, it seems that investors are paying more for the stock than they did previously, and they’re getting less dividend income from it. That’s never a great combination, in my view.

In addition to looking at simple ratios, I want to try to understand what the market is currently “thinking” about a given company’s future. In order to do this, I turn to the work outlined in books like Penman’s “Accounting for Value” and Mauboussin and Rappaport’s “Expectations Investing.” The idea expressed by these books is that the stock price itself has some interesting information embedded within it, including the market’s “thoughts” about a given company’s future. The greater the expectations, the more risky the investment. According to the approach outlined by Penman’s work, the market currently “thinks” that A. O. Smith will grow at a rate of about 6.5% from current levels. I consider that to be a bit rich.

Given the above, and given the alternatives available, I’m not going to add to my position, and I would caution other investors from buying at current levels. An investor can receive an extra 270 basis points risk-free in a government instrument. If interest rates remain elevated, the investor will receive a relatively good, predictable return over time. If interest rates fall from current levels, the investor may also enjoy a nice capital gain on their risk-free Note. In my view, this is the wisest use of new capital at the moment, as it represents the best risk-reward combination.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.