Summary:

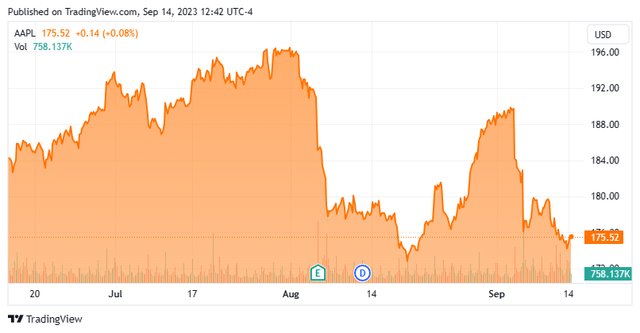

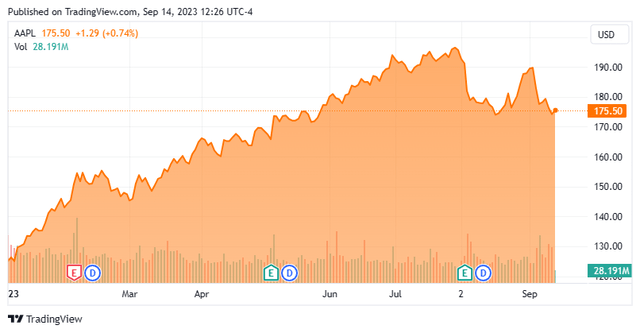

- The shares of Apple Inc. are down nearly 9% since I highlighted my bearish position in the stock in early July.

- The stock is near short-term technical support levels, and if they don’t hold, further declines are likely ahead for the stock of this tech giant.

- How I am currently positioned in the shares of Apple and my game plan for the weeks ahead are outlined below.

Andrey Sayfutdinov

It’s hard to walk away from a winning streak, even harder to leave the table when you’re on a losing one.”― Cara Bertoia.

On July 5th, I posted my first article on Apple Inc. (NASDAQ:AAPL) in many, many years here on Seeking Alpha. In that piece, I outlined why I thought the stock of this Cupertino tech giant was significantly overvalued and how I planned to take advantage of any pullback in these overbought shares via out of the money bear put spreads.

That has been a good call to this point, as the shares are down approximately nine percent since that article was first posted on Seeking Alpha. I still think the direction of the stock is down from here for several reasons. However, first the equity will need to break through short-term technical support near current trading levels.

I have taken some of my initial bet against Apple off the table to ensure I break even in a worst-case scenario. Whether I make a much bigger profit should be determined over the next week or so depending on whether the stock can hold the approximate $173 – $175 level.

There are several reasons that I believe if Apple stock fails to hold this support level and manages to close in the $170 – $172 a share level, my original projection the stock falls to $160 will be fulfilled.

Valuation:

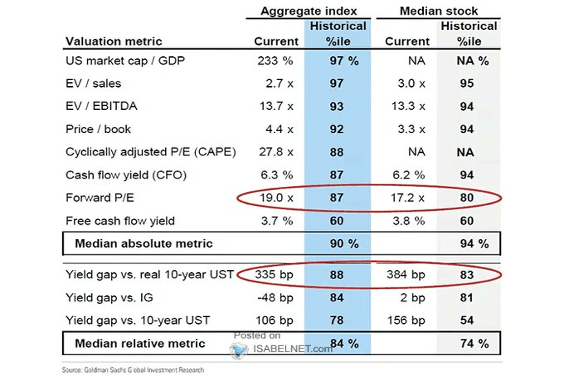

If technical supports cannot hold, some investors will be forced to re-evaluate the stock based on valuation. It is very hard to make a case that the shares of Apple are undervalued here trading at just under 29 times trailing earnings and nearly seven times trailing sales.

This is especially true as both earnings per share and sales are projected to fall here in FY2023. Apple made $6.11 a share in profit in FY2022 on just over $394 billion in sales. The current analyst firm consensus has profits falling to $5.64 a share as revenues fall to just over $365 billion.

Real Money Pro

Now, I also believe the overall market is overbought given the recession I believe the country will experience sometime in the first half of 2024 and the fact that both short term treasuries and the Fed Funds rate are up near 5.5%. And Apple is trading to a considerable premium to the S&P 500 based on P/E, P/S and a variety of other valuation metrics, especially given Apple will have both sales and earnings declines here in FY2023.

Momentum Trading/Profit Taking:

The majority of trading volume these days is driven by algorithmic trading programs. A lot of them based on momentum and increasingly so by AI. If AAPL breaks technical support in a meaningful way, these programs could drive the shares down even further. The shares are already significantly under their simple moving average.

In addition, despite the recent decline in the stock recently, investors are still sitting on an approximate 40% return so far in 2023. It is not hard to see how additional profit taking will occur from these investors should support levels not hold.

iPhone 15 Launch Was Flat:

One of the most important events in Apple’s production cycle is always the launch of a new version of its iconic iPhone franchise. This happened Tuesday morning of this week. The event did not invoke the buzz of past launches and the stock fell an additional three percent Tuesday and Wednesday. The new version of the iPhone has hardly received rave reviews, and investors hoping this much-anticipated event would improve recent trading sentiment on Apple shares have to be disappointed.

My game plan is to hold my remaining bear put spreads in AAPL until the end of next week to see if they break through the key short-term $173-$175 support level meaningfully. If I get a daily close in the $170-$172 range over that time, I will ride my original bet. If support holds, I will take the remaining profits in this position given it expires on October 20th. If AAPL shares manage to trade back into the high $180s/low $190s, I would look to reset my position again.

One last thing. If Apple doesn’t hold these support levels, it could trigger some marginal additional headwinds for the overall market as the stock has the largest market capitalization of any equity. Further weakness in the shares would be a negative for major indexes.

The gambling known as business looks with austere disfavor upon the business known as gambling.”― Ambrose Bierce.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.