Summary:

- Apple Inc. is the world’s favorite company and apparently (judging from his actions) Warren Buffett’s as well. Apple is now my favorite company, too.

- That’s because Apple has evolved from a tech company into a full-blown aspirational luxury brand.

- Apple recently scored two $1 billion luxury product launches, proving it can sell almost anything to steadily richer Millennials, Gen Z, and Gen Alpha consumers.

- Services, smart watches, smart speakers, payments, and smartphones… Apple has rapidly come to dominate nearly every product segment it targets.

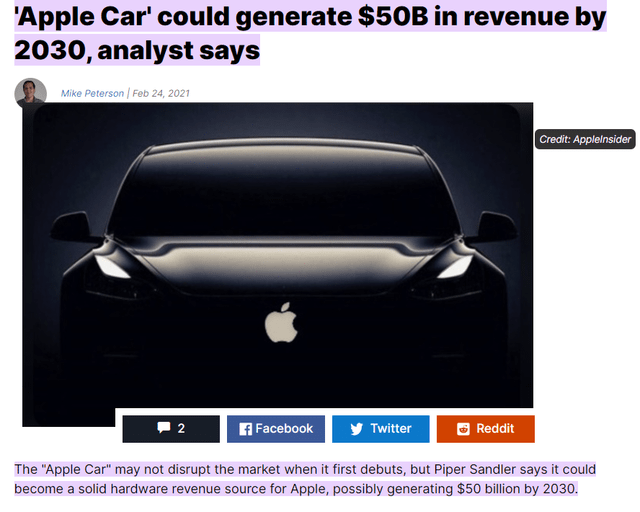

- Apple could hit $50 billion in sales by 2030 with the Apple Car currently in-development, and then rapidly grow that into the hundreds of billions as it challenges Tesla for the ultimate aspirational auto brand. Luxury brands like LVMH have survived and thrived for over 100 years (up to 430 years). Apple’s 10% growth rate could last for decades, and it is the ultimate buy and hold forever Ultra SWAN.

0shi/iStock via Getty Images

This article was published on Dividend Kings on Wed, May 10th.

—————————————————————————————

Apple Inc. (NASDAQ:AAPL) is the world’s favorite company, the most valuable company on earth.

It’s also Buffett’s favorite company…by far.

It makes up almost 40% of Berkshire’s $300 billion portfolio.

Our criteria for Apple was different than the other businesses we own —It just happens to be better business than we own.” – Warren Buffett.

Why is a man who dislikes tech stocks willing to invest $116 billion of Berkshire’s money into Apple?

Buffett had a long-standing bias against technology investments, which he felt had no margin of safety.” – Washington Post.

Because Apple isn’t a tech stock, let me show you how its latest game-changing move proves it’s transformed into an aspirational luxury brand on par with LVMH Moët Hennessy (OTCPK:LVMHF, LVMHY).

One that has a bright future selling new products and services that we can only begin to imagine. For proof, I offer not one but two recent $1 billion luxury product launches for Apple.

$1 Billion In High-Yield Deposits In 4 Days Proves Apple Has Changed The Game

Apple recently launched a new high-yield savings account service tied to its credit card. Goldman Sachs is running the backend, and Apple is just the face of this new financial product.

In the first day, Apple’s high-yield account, which pays 4.15% interest, brought in $400 million in deposits. In the first four days, it brought in $1 billion.

How amazing is this? Here’s some context.

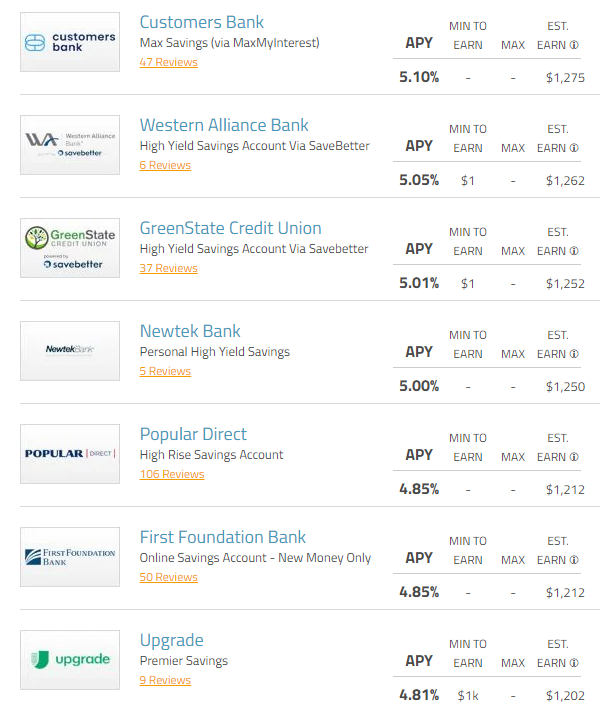

4.15% is a decent yield, but far from the best you can find in an FDIC-insured risk-free account.

DirectSavings

Apple’s savings account offers about 1% less than the highest accounts in the country, but the power of Goldman Sachs (GS) backs it, and many people probably assume Apple and its $167 billion cash pile.

Apple has almost certainly continued to attract more deposits, but let’s go with $1 billion for now.

If Apple were a bank (it doesn’t want to be for regulatory reasons), it would be around the 800th bank in the country and likely the fastest growing.

Why am I so excited about Apple’s $1 billion in deposits in a high-yield savings account? It’s not because this is going to make Apple a lot of money.

This move is purely to make Apple Pay a stickier part of customers’ lives. It’s about building Apple’s ecosystem and making its brand even stronger.

There is nothing more important to most corporate customers than their money. Being willing to park your cash in a savings account is an act of pure trust, especially in a regional banking crisis that is likely just entering phase 2 of 3.

Phases of the banking crisis:

- Bank runs (deposit flight)

- Negative profitability due to high funding costs (what is killing PACW)

- Loan losses in the recession (commercial real estate biggest threat).

Well, consumers trust Apple, and its brand has never been stronger.

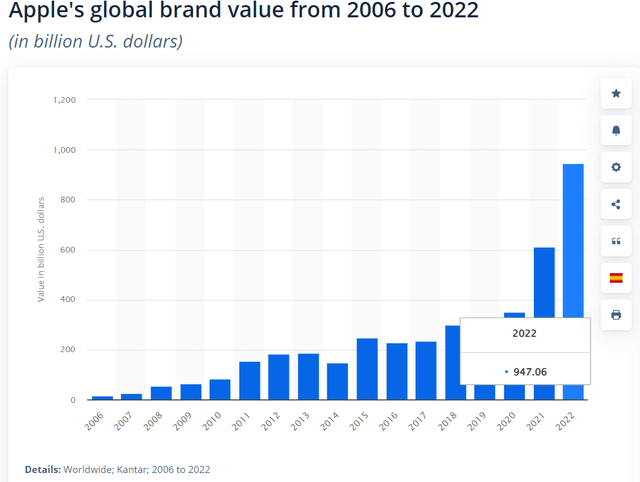

That’s a brand that Statista estimates is worth almost $1 trillion all on its own.

If the Apple brand were a separate company, it would be the 6th most valuable on earth, ahead of Nvidia Corporation (NVDA) and right behind Amazon.com, Inc. (AMZN).

What does all this mean? How does the blowout success of a single new financial product change the game for Apple?

Apple Has Proven It’s A Luxury Lifestyle Brand

Apple has proven all bears and doubters wrong when it comes to new products and services.

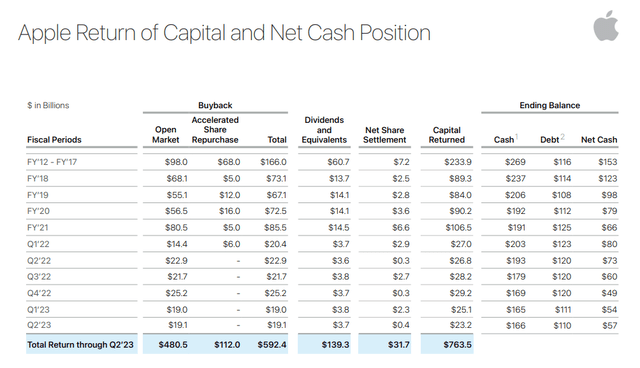

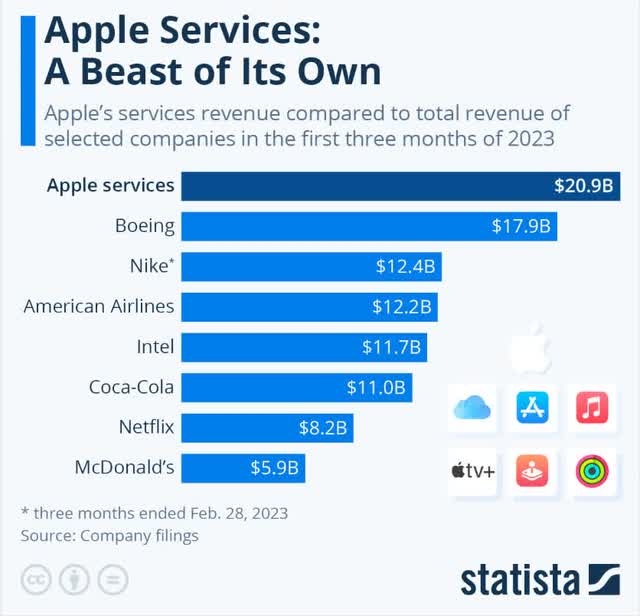

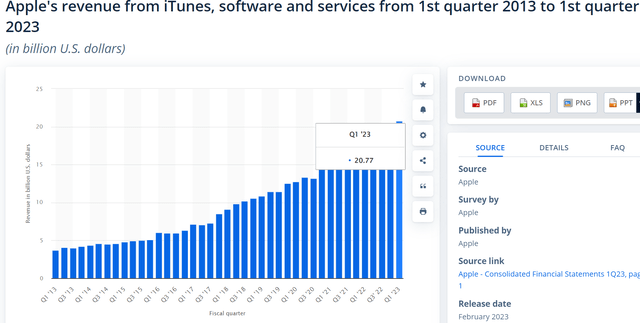

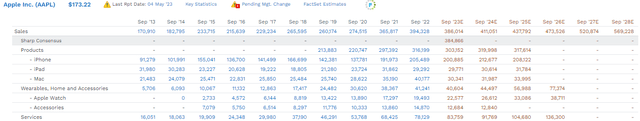

When iTunes was launched, few thought it would lead to a subscription services business that is now $21 billion in a single quarter. That’s an annual revenue of $84 billion for a business that didn’t exist a few years ago.

Apple’s services business alone is larger than the sales of Coke (KO) and Netflix (NFLX) combined.

Services had gross margins of 71% in Q1 and are more stable than hardware sales.

And it’s now 21% of company sales and has been growing at 22% annually since 2013.

Apple services are expected to grow to a $136 billion annual business by 2028, a 15% annual growth rate.

- 29% of company sales.

When AirPods were announced, I never imagined it could be a needle mover for Apple.

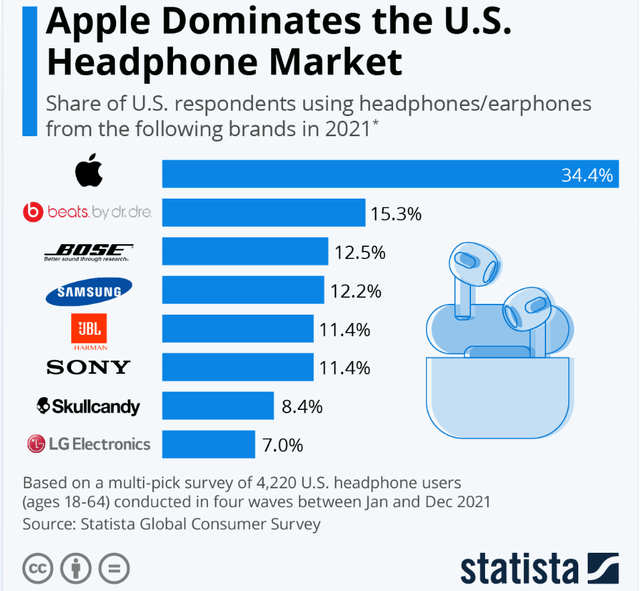

Apple controls 50% of the headphone market (it downs beats). The largest acquisition in Apple’s history was buying Beats for $3 billion in 2014.

These are expensive in-ear headphones costing $129 to $249. The AirPods Pro 2, which is $249, sold 4 million units in their first week.

- $1 billion in sales of a single product in one week

- almost as good as its high-yield savings account.

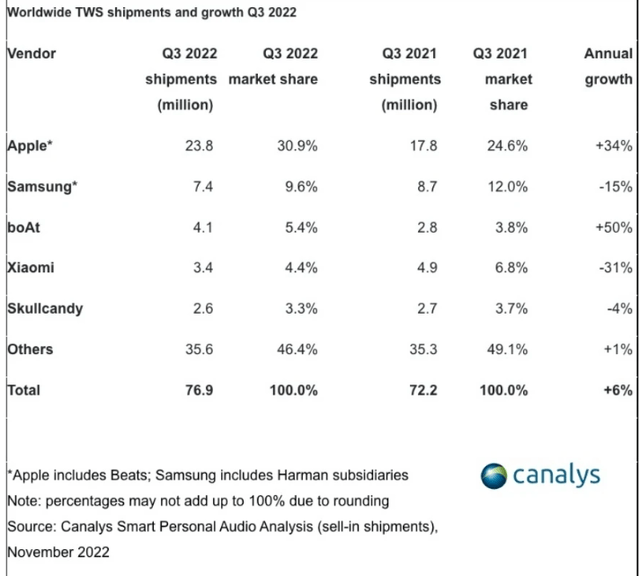

In Christmas 2022, Apple once more dominated the headphone space with 24 million units sold, 34% growth, and its market share grew 6%.

Samsung, the world’s 2nd biggest headphone company, has 1/3rd of Apple’s market share.

How about the Apple HomePod? I think smart speakers are nice but hardly “must-have” devices.

- My Amazon Echo only turns my lights on and off.

HomePod was introduced in 2018 and immediately gained a 6% global market share.

- Tied with Xiaomi (OTCPK:XIACF, OTCPK:XIACY) for 3rd.

By Q1 2022, Apple’s smart speaker global market share was 13%, second to Amazon’s 28% and Google’s 17%.

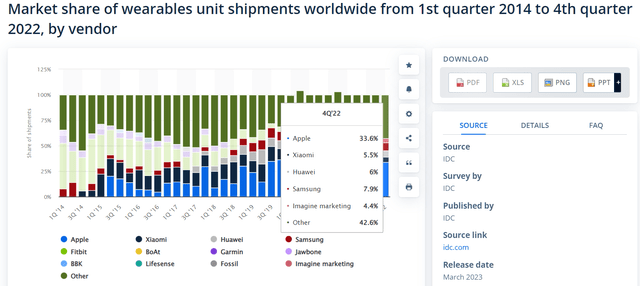

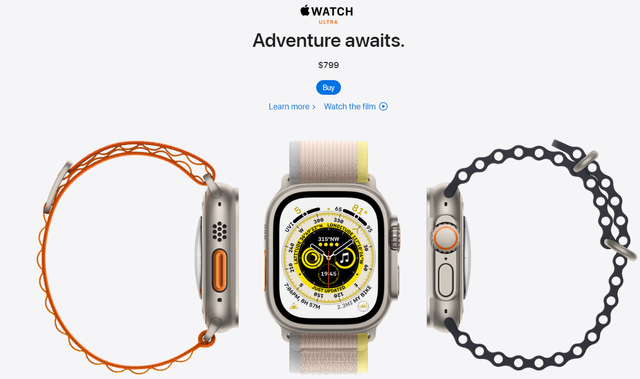

How about smartwatches? I own a Fitbit and personally think a computer on my wrist is overkill.

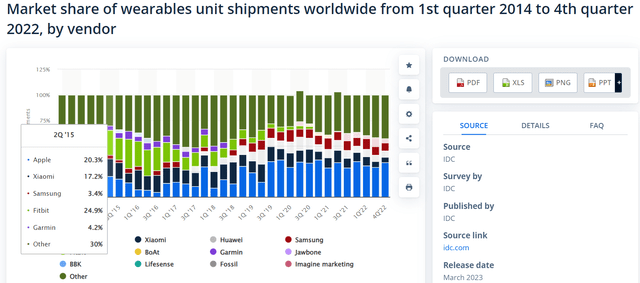

Mid-2015, Apple launches the Apple Watch. Skeptics don’t think it will move the needle. The company immediately captures a 20% market share and is #2 behind Fitbit.

Q4 2022 Apple commands 34% global smartwatch market share, 4X more than its nearest rival, Samsung Electronics Co., Ltd. (OTCPK:SSNLF).

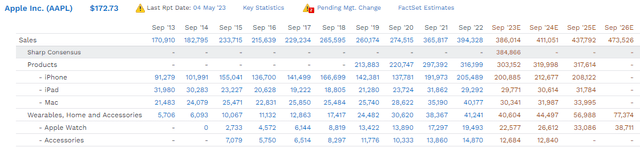

OK, so Apple has a habit of steadily growing market share and coming to dominate every product category it enters. But how much is it actually selling of these overpriced watches?

Apple started out in 2013 with $6 billion in smartwatch sales.

Last year they sold $41 billion, a growth rate of 38% annually.

By 2026 analysts expect Apple to sell $77 billion worth of watches, a 17% annual growth rate.

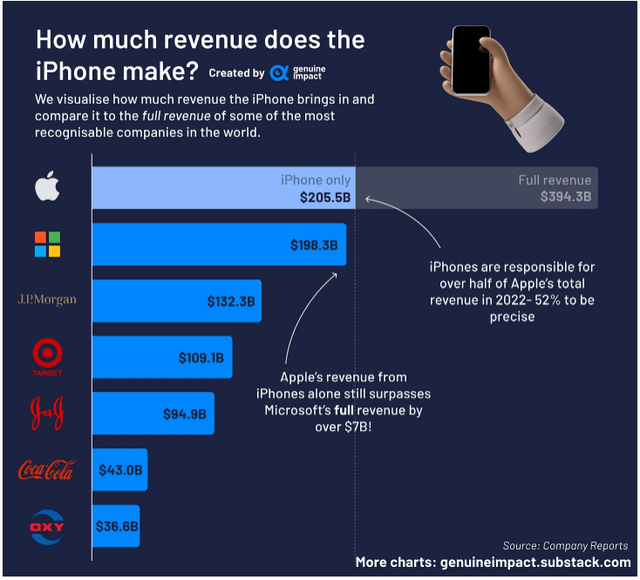

And let’s not forget the most important business of all, the iPhone, which perfected the modern smartphone.

All on its own, iPhone sells more than all of Microsoft. In fact, it sells more than JPMorgan and Coke combined!

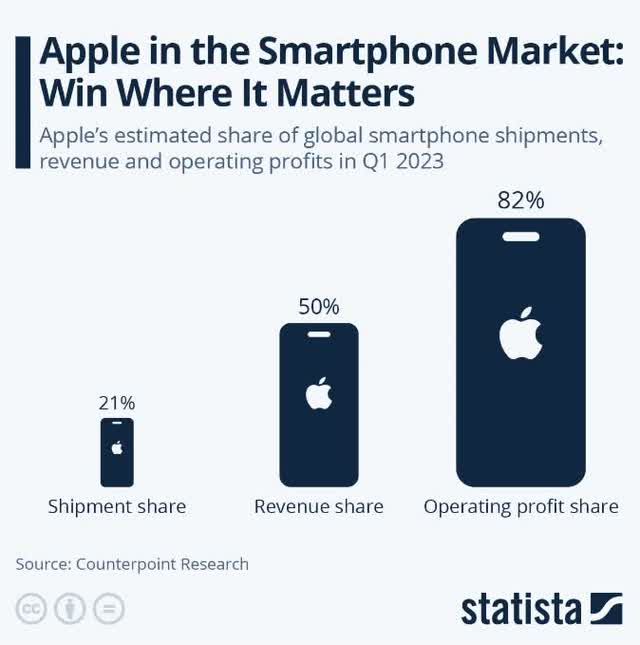

And thanks to its luxury lifestyle brand, fanatically loyal customers (94% of customers plan to stick with iOS), and an installed base of over 2 billion devices worldwide, Apple is the king of the only kind of phone share that matters, profit share.

Apple earns 82% of smartphone operating profits and even more of its net profit.

Apple = The LVMH Of Young People

I have no interest in a Rolex, and most Millennials, Gen Z, and Gen Alphas don’t.

But Apple watches? Young people can’t get enough of these things!

Apple Watches start at $249, and the new Ultra is $799.

If I become a billionaire, I will never buy a Rolex, but I will probably buy an Apple Watch Ultra.

That’s what I mean by the LVMH of my generation.

This is our Tiffany’s diamonds; this is our Bentley.

When young people “make it to the big show” we show we’ve arrived by buying Apple products.

I will never buy a Rolls Royce or a Bentley, but a Tesla? That calls to me as it does to many young people.

Ferrari? Lamborghini? Porsche? Sure, a few of us, the crypto billionaires especially, are into that.

But for most young people? If we ever become ludicrously wealthy, this is what our dream supercar looks like to us—the Tesla Roadster 2.

- 248 MPH top speed

- 0-60 in 1.9 seconds

- and a 620-mile range.

That’s what today’s young person’s Ferrari looks like.

And this is where I get excited, because guess what Apple is planning?

Apple Car: The Next Big Thing From Apple

There isn’t a single product category that Apple has entered that it hasn’t come to dominate, either in outright volume market share or profit share.

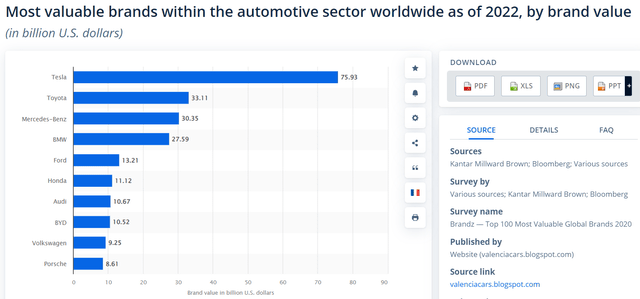

Tesla, Inc. (TSLA) is 20 years old and has managed to build the most valuable car brand on earth. In fact, its brand is worth more than Toyota (TM), Mercedes (OTCPK:MBGAF), and Ford (F) combined.

I have very little doubt that the Apple car could, within a few years, have a brand more valuable than everyone other than Tesla. And if it does a great job of design and convenience, Apple might become Earth’s most valuable car brand.

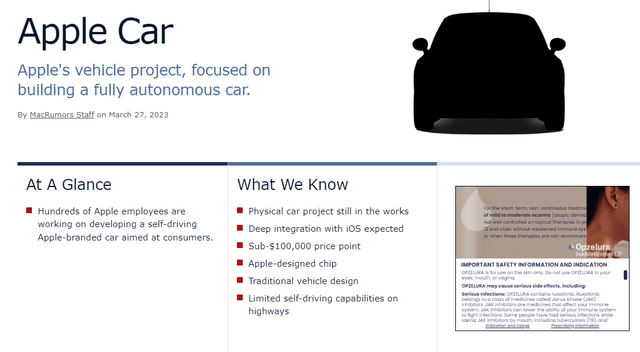

Apple is targeting the upper end of the market just like Tesla started out doing.

The Apple Car has been described as Apple’s “next star product” with Apple able to offer “better integration of hardware, software and services” than potential competitors in the automotive market. The Apple Car is likely to be marketed as a high-end vehicle rather than a standard electric vehicle, but Apple is aiming for a price point under $100,000.” -Apple.

Where Tesla perfected the electric vehicle (“EV”) and made electric cars the new hotness, Apple plans to take it to another level by turning rolling supercomputers into rolling Apple supercomputers, with full integration with the Apple ecosystem.

Apple is considering partnering with Hyundai or Nissan for the manufacturing to ramp up quickly to try to topple Tesla as the king of cool aspirational luxury cars.

In December 2020, Apple hired Manfred Harrer, a Porsche executive with expertise in chassis design. Harrer was considered one of the best engineers in the Volkswagen Group, serving as the head of chassis development at Porsche prior to overseeing the Cayenne product line.

A former top Volkswagen manager told Business Insider that Mr. Harrer was a “hidden champion,” and the “measure of all things in his field.” Prior to working on chassis development at Porsche, Harrer worked for BMW and Audi.- MacRumors

Apple is hiring top engineers from Porsche and BMW.

Apple, in June 2021, hired former BMW senior executive and self-driving vehicle startup founder Ulrich Kranz for its car project. Kranz founded Canoo, a self-driving car startup he left earlier this year. Before creating Canoo, Kranz helped develop the i3 and i8 vehicles at BMW, where he was employed for 30 years.” – MacRumors.

Apple has also poached top engineers and designed from Mercedes and Ford.

What kind of designs might we expect from an Apple Car?

Here is what Dall-E, open AI’s image creation software, thinks the Apple car might look like.

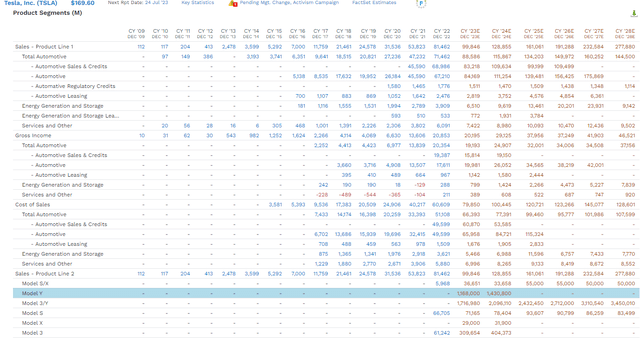

What kind of sales potential would an Apple Car potentially have? Let’s consider the expected sales of Tesla, today’s king of cool cars, and what young people aspire to drive.

Tesla is expected to sell $278 billion in 2028.

What about Apple?

At the rate Tesla is growing, by 2030, it could be selling $400 billion worth of cars.

Is the $50 billion per year in Apple cars from Piper Sandler outrageous? I would say, given Apple’s track record of quickly becoming #1 or #2 in its industry, it might be conservative. In fact, Piper Sandler is modeling 1% market share for Apple by 2030.

I wouldn’t be surprised if Apple eventually achieves 50% to 150% of Tesla’s sales.

It will take time to ramp up production. But I think the demand will be there for the Apple faithful to eventually make Apple the #1 or #2 automaker on earth.

Ok, so maybe Apple Car is an exciting and sexy chance for Apple to take its brand to a whole new level. But car makers aren’t exactly known for making money.

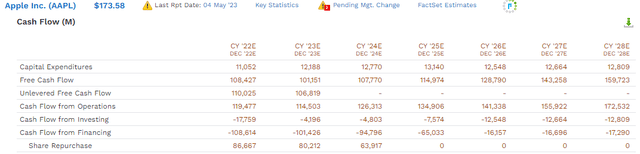

What kind of cash flow can a luxury EV make for Apple?

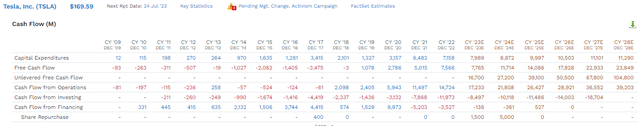

In 2028 Tesla is expected to grow its free cash flow from $12 billion to $24 billion.

How does that compare to its biggest peers?

- Tesla’s free cash flow: $23.6 billion

- VW (OTCPK:VWAGY): $12.9 billion

- Stellantis (STLA, old Chrysler): $12.3 billion

- Toyota: $7.7 billion

- General Motors (GM): $6.6 billion

- Ford: $3.4 billion.

What about Apple? If Apple eventually gains the same manufacturing capacity and margins, what would $24 billion in free cash flow mean for it?

$24 billion in free cash flow per year would be a meaningful boost to Apple’s $100 billion per year. And eventually, that might grow into $50 or even $100 billion.

But wait a minute, if it takes Apple 20 years to generate $50 or even $100 billion in free cash flow, would that not really boost the growth rate much?

After all, even doubling Apple’s free cash flow from $100 billion today to $200 billion via Apple car is only a 3.5% annual growth boost if it takes 20 years.

The Hidden Genius Of Apple’s Aspirational Luxury Brand

Apple started out with cool computer, the iMac, pioneered by Steve Jobs upon his return to the company he co-founded.

Unlike all other PCs that commanded 90% of the market share, he built the Apple brand around being different.

Then he perfected the MP3 player with the iPod and dominated that industry through sheer coolness.

Then the iPhone wiped out Nokia and BlackBerry within a few years by being so much better and cooler.

Then tablets, then smartwatches, and now smart speakers.

Next up, electric luxury cars.

What’s after cars? I don’t know, but if I were to guess, I would say Apple Homes.

The Potential $1 Million Apple Home

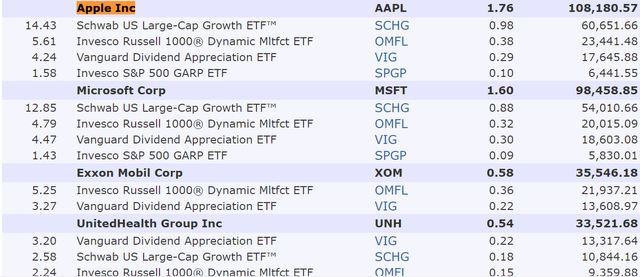

Why have I never been more excited about Apple and the $6200 position my family hedge fund owns?

- the plan is to take that to $33,000 by the end of the year via exchange-traded funds, or ETFs.

Let me put it this way. What is the #1 fear any company has? Losing its moat.

What is the #1 thing that cool brands like Tesla or Apple have? Losing their “cool” status.

What brands are timeless and seldom worry about losing their moats or aspirational status?

- Yves Saint Laurent was founded in 1961 (62 years old)

- Christian Dior was founded in 1946 (76 years old)

- Fendi 1925 (98 years old)

- Gucci 1921 (102 years old)

- Balenciaga 1919 (104 years old)

- Prada 1913 (110)

- Chanel 1910 (113 years old)

- Rolex 1905 (118 years old)

- Tiffany 1837 (136 years old)

- Burberry 1857 (166 years old)

- Louis Vuitton 1854 (169 years old)

- Hermes 1836 (186 years old)

- Château d’Yquem (oldest LVMH brand) 1593 (430 years old) – $240 to $3000 bottles of wine.

Luxury brands are timeless! They don’t just last for years or decades, they can last for centuries.

That’s what Apple is striving for and succeeding at right now.

The kids who grew up being rebels with iMacs and then trendsetters with iPhones are now growing up and making a lot of money.

They know Apple, love Apple and trust Apple with their savings accounts!

And now Apple is coming out with the ultimate status symbol, a sporty sexy car. There is nothing more American than that and nothing more aspirational…other than a luxury home.

From home speakers all the way up to luxury EVs and possibly one day million-dollar fully integrated Apple Homes, the Apple luxury brand is alive and well.

That’s what Warren Buffett loves about Apple. Not that it’s a cash-minting machine today, but that it looks like it has a good chance to remaining so as an aspirational luxury brand for decades or even centuries to come.

Bottom Line: Buffett Loves Apple Because It Just Proved It’s The LVMH Of Tech

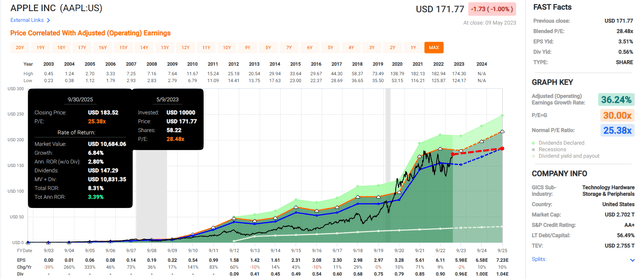

Am I saying that Apple is a great buy today? Nope.

- quality rating: 100% medium-risk 13/13 Ultra SWAN

- dividend safety: 100% (1.10% severe recession dividend cut risk)

- fair value:$160.98

- current price: $173.09

- Discount: -8%

- DK rating: hold

- Yield: 0.6%

- Long-term growth consensus: 9.8%

- Long-term total return potential: 10.4% vs 10.2% S&P.

Is Apple a fast-growing company? Nope, 9.8% long-term growth expected.

Is it undervalued? Probably not, given that it’s above its historical fair value of 25.4X earnings.

But isn’t Apple the LVMH of tech? Yes, I just spent the last 2500 words proving that.

So maybe Apple should be worth 30X earnings? 35X?

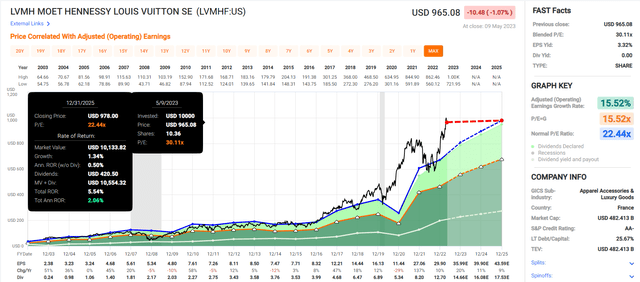

LVMH is growing at an identical rate as Apple, 10%.

LVMH’s historical fair value is 22.4X earnings, as you can see based on the average PE of the last 20 years.

LVMH’s cash-adjusted earnings are 15X vs. a historical 12.8.

Apple’s cash-adjusted PE is 21.8. Reasonable, perhaps, but it’s more speculative than I can get to say it’s a reasonable buy today.

But the point is that there is a reason that Apple is the world’s favorite company, and Buffett’s.

With its latest $1 billion wins, $1 billion in deposits in 4 days for high-yield savings, and $1 billion in AirPods Pro 2 sales in 8 days, Apple has proven it’s not a tech company; it’s the king of aspirational luxury tech brands.

Exactly the kind of world-beater brands that can keep growing at around 9% to 11% for decades, or even centuries, and deliver life-changing income and wealth.

Not just for you but your children, grandchildren, and great-grandchildren.

As someone who is interested in a philanthropic trust and donating billions to charity over time, a wide-moat business that can endure and thrive for centuries is very appealing.

And that’s why Apple is also my favorite company, though I plan to own a 2% stake in my family hedge fund via ETFs.

Dollar Amount Not To Scale (Morningstar )

Given the debt ceiling crisis could cause a 45% plunge in the market and the recession likely starting in 6 weeks, I wouldn’t advise anyone to pay 28X earnings for Apple right now.

You won’t lose money long-term. I can say that with 99.71% certainty.

- AA+ credit rating = 0.29% 30-year bankruptcy risk.

But a better valuation and higher margin of safety is likely coming because not even mighty Apple is likely immune from a recession.

But if you have owned it for years? Like Buffett and are sitting on giant gains? Don’t pay taxes on those unrealized profits because Apple is going to sail through this recession and come out stronger than ever on the other side.

How confident am I? As much as you can be about any company’s long-term growth prospects, 80%, the Marks/Templeton certainty limit, signifying “I’ll die on this hill” confidence.

If you own Apple Inc. stock today, hold, and you and I can toast our success and ownership in the world’s greatest company in 50 years.

In our Apple luxury home, which we were driven to in our autonomous Apple Car while utilizing the AI-powered by our iPhone ;).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own $6,100 worth of Apple via ETFs. By year-end, I plan to own about $33,000.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my correction watchlist

- my $2.5 million family hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.