Summary:

- Apple’s recent share price weakness presents a potential opportunity for investors to consider a long position.

- After a weak 2023, the consumer electronics industry may be ripe for a recovery.

- Apple’s Services business is growing rapidly, offsetting weakness in hardware sales, but hardware still dominates its revenue mix.

- With a pro-cyclical hardware business, a recovery in device shipments would likely benefit Apple’s business and its shares.

Nikada/iStock Unreleased via Getty Images

Weakness in the share price of Apple (NASDAQ:AAPL) may be a new opportunity for investors to consider a long position in the iconic consumer electronics company. Apple has been hit by a downgrade lately which pointed to Apple’s iPhone weakness as a reason and a potential obstacle to Apple’s valuation growth. However, research firm Gartner recently suggested that chip demand is expected to rise strongly this year which could indicate a recovery in the consumer electronics industry as well. Since Apple still generates nearly 80% of its revenues from hardware-related revenues, a recovery in device shipments could be a major catalyst for Apple’s growth. With 2024 potentially becoming a rebound year in terms of device shipments, I actually think that the industry as a whole, including Apple, is facing potentially strong consumer spending-driven tailwinds!

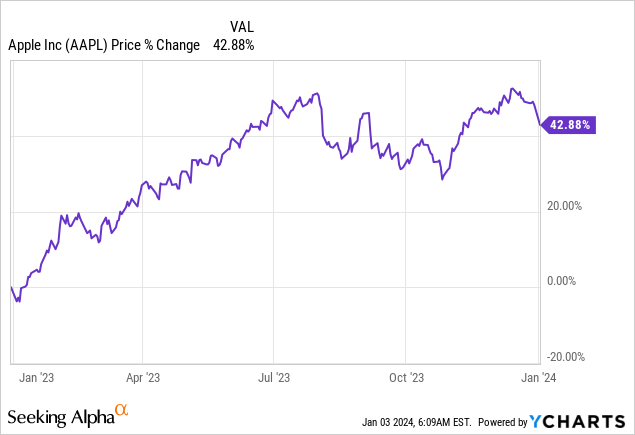

Previous rating

I rated shares of Apple as a hold last summer due to weakness in iPhones, Mac and iPad growth which reflected broader weakness in a slowing consumer electronics market. Apple’s share price has been volatile since then and shares increased approximately 3% then. However, 2024 could see a rebound in demand for consumer electronics products which in turn could reinvigorate revenue growth for Apple’s hardware product categories.

Hardware vs. Services

Apple’s Services business is by far the fastest-growing segment within Apple and it has been able to offset some of the weakness in Apple’s hardware segment in the last two years. The Services segment includes revenues derived from App Store, Apple Pay, Apple Card, Apple TV+, Apple Music, Apple Arcade, iCloud, advertising and Google payments.

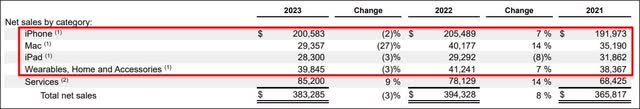

While revenues across hardware-related categories slumped in FY 2023, with the largest drop-off occurring in the Mac business, Services has been a bright spot for Apple for a while. In the fourth-quarter, Services reached an all-time revenue high of $22.3B. Apple’s broader business trajectory clearly shows that hardware-related revenues are facing challenges, ranging from fierce competition in the device market as well as overall saturation.

Although Services revenues increased 9% year over year in FY 2023 to a record $85.2B, the only product category by the way that saw positive top line growth on a full-year basis, hardware still makes up the overwhelming majority of Apple’s revenue mix: in FY 2023, non-Services revenue streams accounted for 78% of all revenues compared to 80% in FY 2022. Services is growing, but Apple’s business will continue to be driven chiefly by its core hardware product categories.

Why 2024 could be a rebound year for device shipments

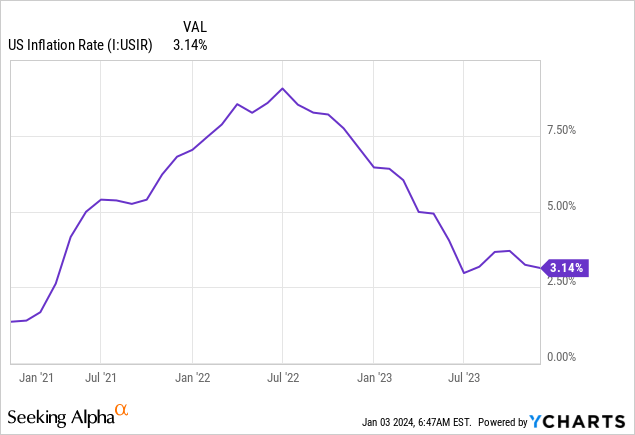

The device market overall suffered from negative growth in 2023 and the downturn in device sales has been a primary reason for me to stay on the sidelines (and miss out on upside). For obvious reasons, FY 2023 was a difficult year for Apple as consumers suffered from price inflation which in turn translated to a decline in device sales. Sales of PCs, laptops and mobile phones slumped throughout the year since a lot of consumers already upgraded their IT equipment during the pandemic.

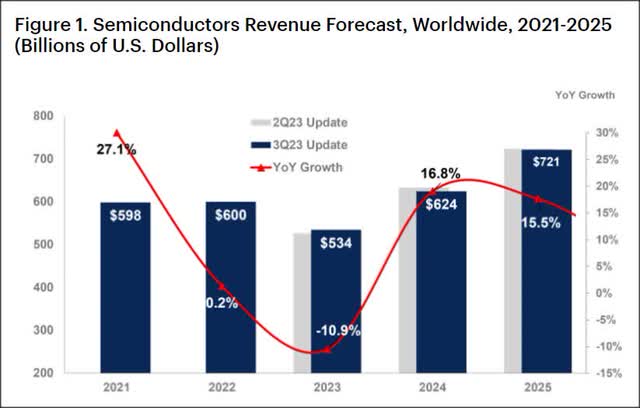

While 2023 was obviously not a great year for Apple and other electronics manufacturers, 2024 could shape up to be a rebound year where consumers are more willing to spend on PCs and smartphones. According to Gartner, the research firm projects a healthy recovery in semiconductor revenues which are projected to grow 17% in FY 2024 to $624B. Actual numbers for FY 2023 have not yet been reported, but the research firm expects FY 2023 global revenues in the semiconductor industry to have dropped ~11%.

Broadly speaking, a rebound in semiconductor revenue growth would also bode well for the consumer electronics industry which may benefit from improving fundamentals in the economy. The slow disappearance of inflation is definitely a big plus that is helping consumers and may result in a strong rebound year in terms of device sales.

Apple’s valuation, EPS upside revision potential

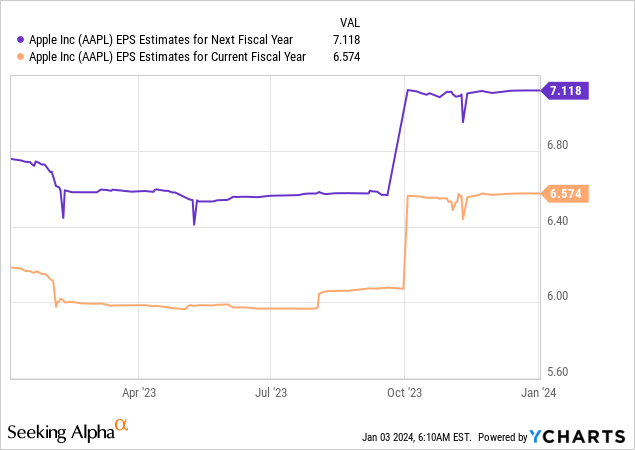

Apple is currently expected to generate $6.57 per-share in earnings in FY 2024 and $7.12 per-share in FY 2025, implying an earnings growth rate of 8%, but I actually believe Apple now has a good chance to see broad EPS estimate revisions to the upside, especially if the thesis plays out as expected. In FY 2023, Apple’s growth potential was clearly suppressed, due to headwinds in the device market which negatively affected iPhone, Mac and tablet sales: Apple earned $6.13 on a diluted per-share basis in its last financial year, showing just 0.3% year over year growth. The EPS revision trend is also positive and could indicate potential for EPS estimate upside corrections.

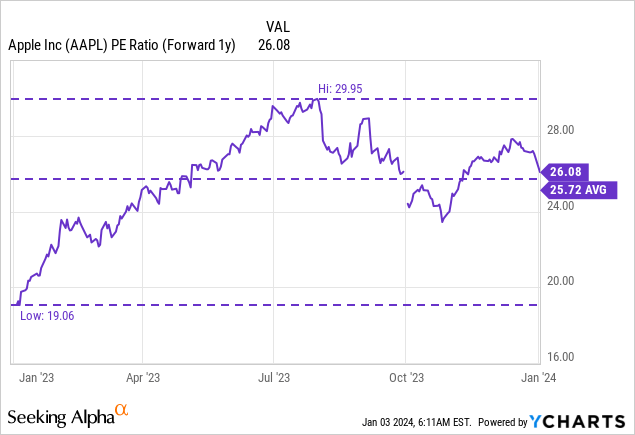

Apple’s shares are currently valued at a price-to-earnings ratio of 26.1X which is slightly above the 1-year average P/E ratio of 25.7X. In the longer term I can see Apple trade at 30X P/E, under the condition that the device market rebounds and consumer sentiment improves. A 30X P/E ratio calculates to a fair value of ~$214.

Risks to my Apple thesis

A recession was projected to drag down the U.S. economy in 2023 which ultimately did not happen. A survey from the National Association for Business Economics indicated that three in four respondents believe there is a 50%-or-lower probability for a recession in 2024.

The Federal Reserve has guided for a lower federal fund rate in 2024 which could indicate a soft landing. In other words, the economic context is favorable and supportive of a recovery in the consumer electronics market. However, should this view be proven false throughout the year, then Apple as a major consumer spending-dependent consumer electronics company could face more severe headwinds in terms of top line growth and EPS upward revisions may also not materialize.

Closing thoughts

2024 could indeed be a breakout year for Apple if consumer spending holds up and the U.S. manages to avoid a recession. Hardware-related segments could finally face a positive catalyst for growth as consumers spend more money on new consumer electronics and make vital upgrades to their IT equipment. With inflation also coming down, consumers should further experience budget relief which could free up cash for consumer purchases. The Federal Reserve is also set to be accommodative and Gartner’s projections also indicate that the device market (PCs, laptops, mobile phones) is ripe for a strong recovery in 2024, following a disappointing 2023. I believe Apple, due to its heavy reliance on hardware-related revenues, would be a prime beneficiary of a rebound in device sales in 2024!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.