Summary:

- Apple Inc. is reportedly developing its own AI chip with Broadcom, potentially disrupting the AI chip market if sold externally.

- Apple’s strong silicon expertise, TSMC partnership, and ability to scale production position it as a formidable competitor in the AI chip space.

- Nvidia’s high margins on datacenter GPUs are at risk if Apple enters the market with competitive pricing and performance.

- Given the potential of AAPL’s AI chip, we shift our recommendation from “Sell” to “Hold” despite uncertainties about its external availability.

Tom Werner/DigitalVision via Getty Images

Apple Inc. (NASDAQ:AAPL) is reportedly teaming up with Broadcom (AVGO) to launch its own artificial intelligence chip. The details of this chip are unknown at this time, however, given Apple’s strong silicon leadership, this should be a major concern to the AI chip creators. This is especially true if the company starts selling the chip outwards.

Apple, TSMC, and Software

Apple is no stranger to creating its own silicon, with the company’s shift to Apple Silicon across the Mac line and decade+ experience on its phones. The company is a powerhouse in the field. The company’s size and scale enabled it to reserve all of TSMC’s 3nm nodes for its phones in 2023. The rumors are that the company has 1st in line preference for TSMC’s upcoming 2nm node.

Apple is TSMC’s largest customer, accounting for more than 20% of revenue. That positioning is key to get leading silicon. Given that N2 is estimated at 10-15% faster than N3, simply being on the cutting-edge node is an obvious efficiency and performance boost. At the same time, the company also has a massive public development organization of people developing for its silicon.

That’s true with the company’s Metal API, which has been optimized heavily for its existing products. That software development organization will enable new software for its artificial intelligence chip.

Another aspect here is a ramp. Apple already ships 100s of millions of pieces of silicon per year in its various products. Given that Nvidia (NVDA), Advanced Micro Devices (AMD), and other companies have all said that they’re supply-constrained, Apple has a proven ability to ramp up the manufacturing of silicon for products.

The company hypothetically producing this GPU on N3 when its other products move away could be a great way to allocate spare capacity. However, it means the company can quickly ramp up competition for a successful product.

Apple ANE and GPU Performance

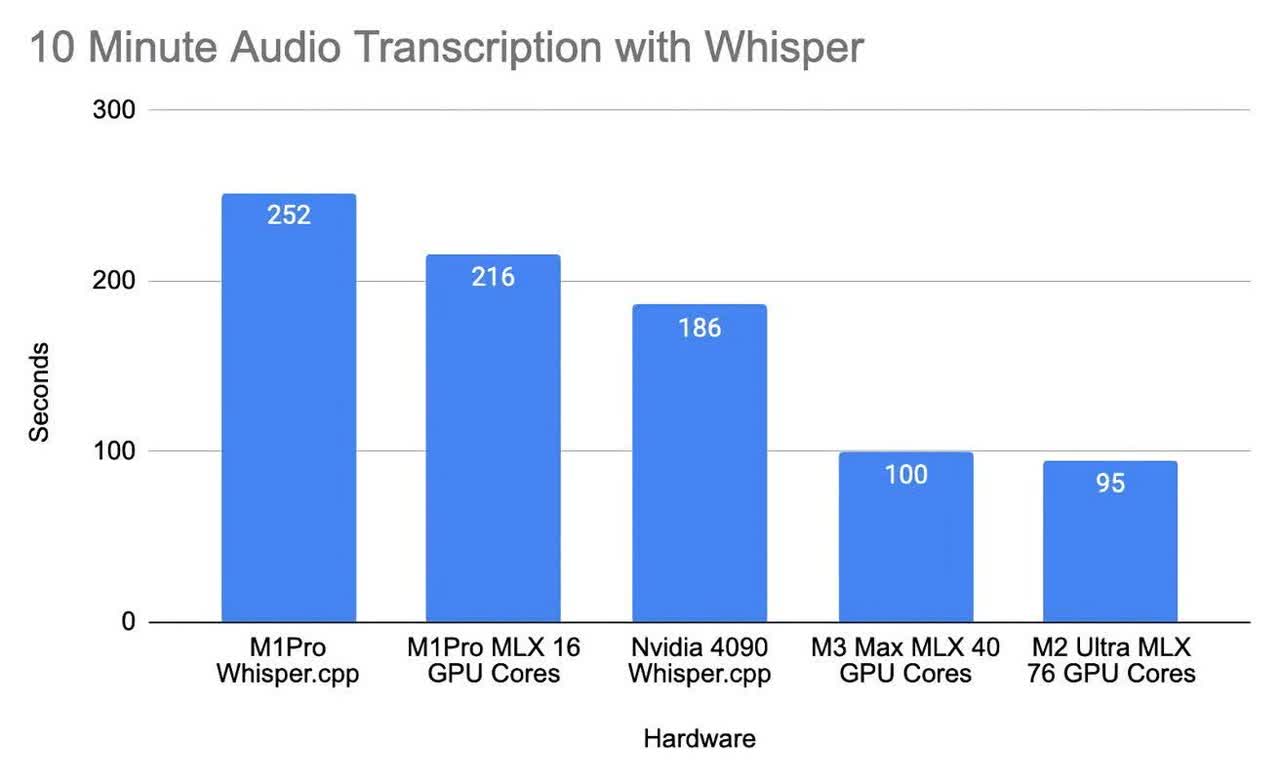

At the same time, we think Apple has the chops to be a strong competitor. While we don’t know the details of its current chips, the company’s existing chips are very competitive.

Apple’s existing silicon can fairly consistently beat Nvidia’s latest hardware in various ML-related benchmarks. Now, the 4090 is not an ML GPU, but neither is Apple’s standard laptop chip. Benchmarking the cost of an M3 Max chip is difficult, but the die size is ~650 mm^2, and at $20K/300 mm wafer from TSMC, (71K mm^2) that implies ~$200 per chip. Adding in a 60% yield and that’s $330/chip.

A 4090 is at 610 mm^2 so using similar math on a similar TSMC manufacturing process, we get a similar cost. However, the M3 Max also excels at power efficiency at just under 80W, versus 5x that for a 4090. Again, we don’t have an idea of the specifications of Apple’s purported dedicated chip but the company’s other silicon stacks very well against consumer silicon.

Combining that with the company’s strong relation to TSMC as their largest customer, it’s clear to us they could make a threatening product.

Nvidia Margin Risk

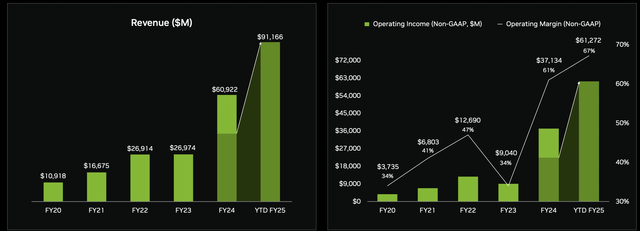

Nvidia’s valuation lives and breathes in their current margins. We discuss the risks facing the company in more detail here, but the risk to margins is substantial.

The massive growth in demand for datacenter GPUs that the company has seen has pushed its margins up to almost 70%. For perspective, before the AI craze, the company’s margins were <40%. While revenue has increased 5-6x, that means that the margins on datacenter GPUs are even higher to supplant lower margins on other products.

The key aspect here is that the GPU that takes Nvidia $1000 to produce is getting sold for $3000. That leaves a lot of margin for a company like Apple to step in with its own GPUs. Even if Apple needs to spend $1200 to make a GPU that’s competitive with Nvidia because it’s hypothetically behind, it can still threaten Nvidia’s margins.

Thesis Risk

The largest risk to our thesis is Apple’s prioritization. So far, we have no data on whether the company will use this for external customers or internal AI only, and what the long-term goals are. There are many scenarios where it could turn out that this new silicon is simply a way to reduce the costs of Apple Intelligence, rather than being a needle mover of any sort.

Conclusion

In our most recent article on Apple, we discussed how the company’s earnings justified Berkshire Hathaway’s sales. Since then, Apple has gone up almost 12% versus 6% for the S&P 500. Clearly, at least in the immediate term, the timing was off some. Part of our view on the downside is that the company has minimal additional catalysts.

The Vision Pro seems to be dead on arrival, the company is expanding existing products, but they’ve already hit mass market appeal. However, selling GPUs at scale could be a catalyst here that makes the company a more valuable investment. As a result, we’re shifting our recommendation on the company from “Sell” to “Hold.”

Please let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.